Bitcoin TA - summary of analysts - 20. June 18

Regular daily update on BTC ta analysts opinions.

**My summary - short-term (next 24h) sentiment: neutral ** (last: bullish )

Bearish scenario (preferred):

We move up towards 7'100 and than turn around.

Until 3rd of July 6'300 gets broken which moves price towards last stronghold - the low of Feb 5th - 5'945.

After breaking 5'945 we see panic and a significant drop towards new lows in the range of 4'975 and 3'100.

Bull scenario:

An iSHS pattern was formed with price target of 7'170. We reach this price target and volume is picking up bringing us even above it towards 128 MA daily.

- @haejin: He is posting bitcoin only on bitcoin live anymore. I am trying to reach out to him to see if we can have an abstract here.

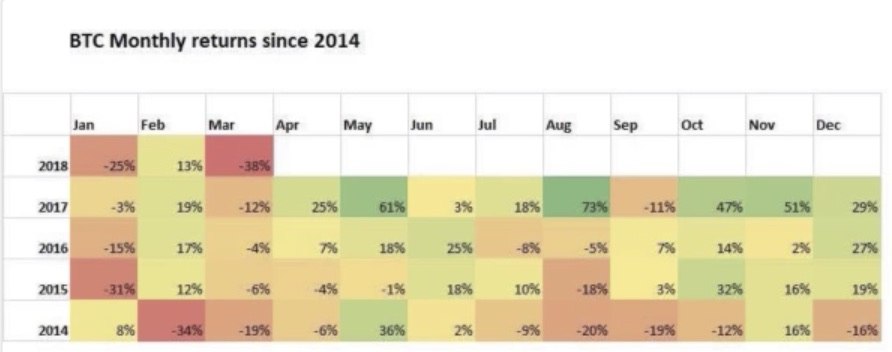

- Lets see how June plays out -usually also a bullish month. Are we going to see a compensation of May with a huge rally up?

News about the blog

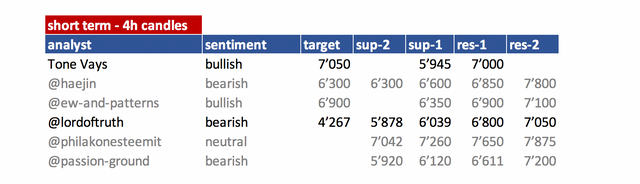

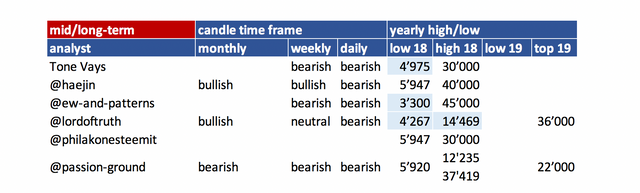

I revised my tables. Now the sentiment is split in 4 sentiments. Sentiments are based on the candle charts timeframe. So 4hr charts, daily, weekly, monthly chart sentiments are up. I haven't gathered all information from all analysts yet but will do that over time. I hope you find that additional precision useful.

To let the steemit community about this I will use promoting bots for this post.

Bounty project website launched. Are you becoming a bounty hunter? Steem-bounty website.

You find the How-To for creating a bounty at this post

Analysts key statements:

Tone:

- Weekly: We are still at the pump of yesterday - so no much news. Volume drops off - we fall out of the triangle too early so it might be a false break out. Still we have the lowest closing lows. We are on 6 of 9 and he is looking for 5'000 in first half of July.

- Daily: He expecting this bounce to last max. up to 7'050. He is not recommending any bullish trades here.

@haejin:

@haejin is moving his analysis to bitcoin live. Those of you who want to follow him directly should look into subscription. I will try to get in contact to see if I can use an abstract to post here also in the future.

Bitcoin (BTC) Short Term Update: The blue circle shows a potential pricepathway of BTC. The purple waves have been updated and it shows a scenario where purple 1,2,3 could be complete and 4 is getting its final touches. Purple 5 is still targeting the 6'300 zone or so.

@ew-and-patterns:

Are you missing the vola days as well? I certainly do. But I am 100% sure those days will come again.

This is typical behaviour in a longlasting correction. It's the calm before the storm again.

@lordoftruth:

Bitcoin price formed a support at 6'107 and for now the price fluctuate within Sideways Track, keeping stability inside the bearish channel Borderd by 6'300 - 6'900.

Most important moment here is going again Below 6'519 lows in the next days to can move Below 5'878 as a lot of stops could be accumulated and once they will be triggered, the price will accelerate lower, right to our destination at 4'300 Area / Butterfly "Buy" within 2 weeks.

Stochastic shows overbought signals, to support the chances of resuming the bear run.

MACD back in the bearish zone and RSI is moving lower towards the 60 level.

At press time, bitcoin price is around 6'600 and our Bearish Overview remain valid, conditioned by the price stability Below 7'090.

Todays trend is bearish. Trading between 6'039 and 7'090.

@philakonesteemit:

A bounce at the 7'000 level was much expected due to hitting a major trend line support established since Nov 11, 2017.

Bullish View, if we break the 7'650 range, there's a chance to hit 7'850 to 8'000 range (0.5 to 0.618 fib retracement)

Bearish View, if we break 7'161 range, we'll most likely test 7'040, which I see as failing to hold and then testing 6'500.

@passion-ground:

The move up off the recent pivot low has begun to wander sideways. Tonight we present both a bullish and bearish trade set-up for those so inclined to consider such.

We got a price target (iSHS) of 7'170 as long as 6'120 isn't broken.

Sell trigger if 6'331 is cross. Target of 400 downwards so at 5'931.

Summary of targets/support/resistance

Reference table

| analyst | latest content date | link to content for details |

|---|---|---|

| Tone Vays | 19. June | here |

| @haejin | 13. June | here |

| @ew-and-patterns | 19. June | here |

| @lordoftruth | 20. June | here |

| @philakonesteemit | 31. May | here |

| @passion-ground | 18. June | here |

Definition

- light blue highlighted = all content that changed since last update.

- sentiment = how in general the analysts see the current situation (bearish = lower prices more likely / bullish = higher prices more likely). The sentiment is based on 4hr, daily, weekly, monthly candle charts.

- target = the next (short term) price target an analysts mentions. This might be next day or in a few days. It might be that an analyst is bullish but sees a short term pull-back so giving nevertheless a lower (short term) target.

- support/res(istance) = Most significant support or resistances mentioned by the analysts. If those are breached a significant move to the upside or downside is expected.

Further links for educational purposes:

- From @ToneVays: Learning trading

- From @philakonecrypto: Like in every post you find links to his amazing educational videos. For example here

- From @lordoftruth: Fibonacci Retracement

- From @haejin: Elliott Wave Counting Tutorial

*If you like me to add other analysts or add information please let me know in the comments.

Excelente información, gracias por compartirla, @famunger.

wow this is insane TA followed! i cant upvote bcus i ran out of steempower sorry. You should post your charts on steepshot, bcus im always on that lol

It is a great job that you do every day to bring these statistics on the BTC, thanks for sharing this information with us

Sehr coole Zusammenfassung der Statistiken. Fuer mich sieht das alles immer so kompliziert aus