Bitcoin TA - summary of analysts - 5. Mar 18

Regular daily update on BTC ta analysts opinions.

Own comment:

Not too much news today. Bullish pattern stay intact. Move upwards expected.

Tone made just a view comments, @ew-and-patterns and @philakonecrypto brought no update

Tone, @haejin and @lordoftruth confirmed their outlook.

Update educational links at the bottom. Feel free to check them out.

Analysts key statements:

- Tone: He made no dedicated analysis today - he had an interesting interview with @boxmining (highly recommended). Regarding price he only mentioned the following:

Daily: cup and handle is confirmed. You have a price target of the hight of the cup which is around +5'000 USD. - @haejin: Price has risen out of consecutive wedge pattern. A likely impulse wave is on its way as part of higher degree 3 wave. This will lead us to 12'112.

He sees also the iSHS as completed which brings us to 12'306 (wave 3) and 13'157 (wave 5) and mid-term towards 17'655.

- @ew-and-patterns: - no new update -

Today he has an update about long term perspective of bitcoin. If 20k was cycle wave 1 and 6k cycle wave 2 we could see this year BTC reaching 120'000.

- @lordoftruth: Bullish outlook. The 11'750 still needs to be tested again. If we get rejected a minor correction is expected (to the range of 10.5-10.8). If we pass we will move to 12'200. Volume is still low - but probably will get higher as soon as we pass resistance. Expected trading for today is between 10'700 and 12'800.

- @philakonecrypto:- no new update - lost steemit account - still active on youtube - last video of him is from March 3rd. -

If we move over 11'200 than next level is 11'788. Possible way up is shown in chart below.

Overall sentiment: bullish

(last: bullish)

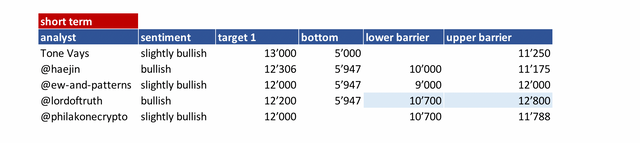

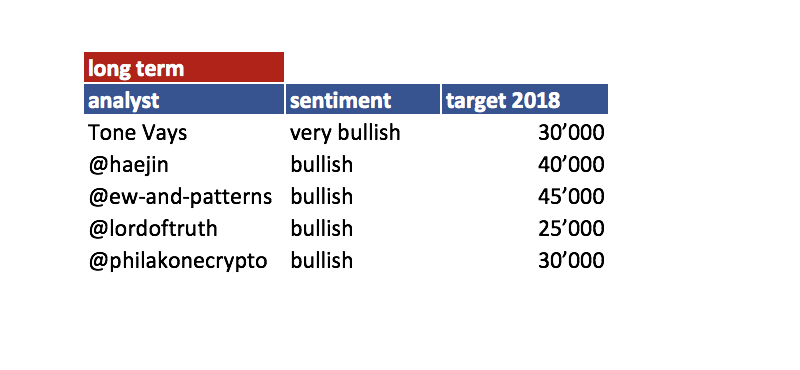

Reference table

| analyst | latest content date | link to content for details |

|---|---|---|

| Tone Vays | 5. Mar | here |

| @haejin | 5. Mar | here |

| @ew-and-patterns | 3. Mar | here |

| @lordoftruth | 5. Mar | here |

| @philakonecrypto | 3.Mar | here |

Definition

- light blue highlighted = all content that changed since last update.

- sentiment = how in general the analysts see the current situation (bearish = lower prices more likely / bullish = higher prices more likely)

- target 1 = the next price target an analysts mentions

- bottom = price target analyst mentions as bottom

Both target are probably short term (so next few days/weeks) - lower/upper barrier = Most significant barriers mentioned by the analysts. If those are breached a significant move to the upside or downside is expected. It does not mean necessary that the sentiment will change due to that (e.g. if upper resistance is breached it does not mean that we automatically turn bullish).

Further links for educational purposes:

From @ToneVays: Learning trading

From @philakonecrypto: Like in every post you find links to his amazing educational videos. For example here

From @lordoftruth: Fibonacci Retracement

From @haejin: Elliott Wave Counting Tutorial

If you like me to add other analysts or add information please let me know in the comments.

thank you for your important informatio,i'm your follower i like your all post

thanks for sharing cryptocurreny news.

i appreciate your post..

I'm interested in predictions about sbd and steem?

I know both ew and Haejin post TA on these

Thanks for the update again @famunger!

I generally scan through them quickly and most interesting to me are your own comment and the short term table.

Personally I would think it is more logical to have the 'short term' table above the analysts key statement section. Then, when I think I see something standing out from the short term table, I could scroll a bit further and check the explanation of the analyst.

Just my 2 cents :-)

Keep up the nice work!

Thank you for this informative, very important and useful for us all @famunger

I have heard from different sources that expects a big drop in mid March. Do anyone see that potentials too in any type of technical analysis?