Bitcoin Surpasses $100 BILLION Total Value, Despite Looming Schisms

Hey Steemers, I'm releasing this new blog here before I do on my main blog, Free Keene. Can you do a fact check for me? I'm trying to communicate about what's coming in the next several weeks to the average person and what one can do to prepare. Please let me know if I've gotten anything wrong in the comments below. Here's the piece:

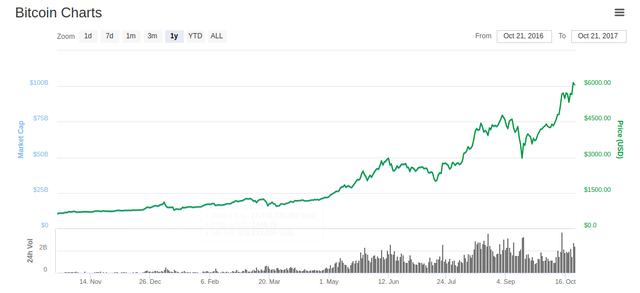

It has been a crazy last year for Bitcoin, for better or for worse. One year ago this month, Bitcoin's "market cap", the total global value of all the bitcoins in existence, was at 10 billion dollars. This week, after passing the $6,000 price per bitcoin mark for the first time ever, Bitcoin's market cap hit 100 billion dollars!

A market cap of $100 billion makes the total value of Bitcoin larger than financial behemoth Goldman Sachs (and others). This is major news and an incredible run up in price over a year. It definitely deserves celebration - bitcoin is truly a phenomenon, overall.

(Bitcoin's price and market cap over the last 12 months.)

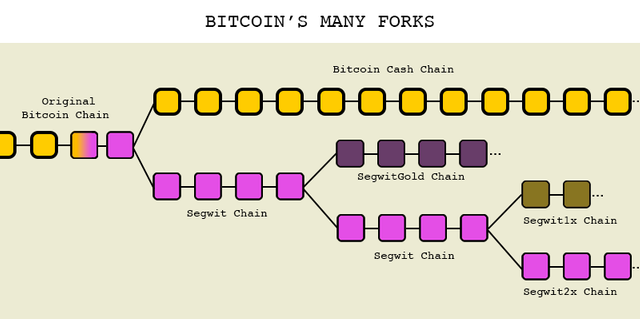

Behind the scenes, however, things have gotten ugly. The bitcoin network has been full of transactions for many months now. That's resulted in delayed transactions and wildly varying fees on the Bitcoin Core network. Despite Bitcoin's first-ever schism in August, which resulted in two competing Bitcoin networks, "Bitcoin Core" and "Bitcoin Cash", infighting within the Bitcoin community continues unabated regarding how bitcoin should scale to the increasing consumer demand.

The reason why the fighting is at a fever pitch now is because the BIG schism has still yet to come. The historic split of Bitcoin Cash in August was a relatively small one. Only about 3% of the mining power behind Bitcoin Core initially got behind Bitcoin Cash and though there's a strong argument that Bitcoin Cash is the Bitcoin that is most true to its anonymous creator's vision, the market doesn't seem to agree. The price of one Bitcoin Cash is near all-time lows at about $320, or about 5% of the price of one Bitcoin Core, which is over $6,000 at the time of this writing.

(It's not so civil.)

As was recommended on this blog at the time, everyone who held their bitcoin through the August schism came out on top. Bitcoin Core's price held steady then went up and Bitcoin Cash created billions of dollars worth of new value in the marketplace in an instant. It was really quite a success. However, Bitcoin Cash was a minor schism compared to what is coming up in November.

In less than a month, in mid-November according to current estimates, part two of the "Segwit2x" agreement goes into effect. As I explained in greater detail in an article published here at Free Keene this summer, "Segwit2x" is the compromise deal cut in New York back in May where dozens of stakeholders in the Bitcoin community came together and agreed to implement both of the proposed changes to allow bitcoin to scale that the community had been squabbling over for years prior. First, the controversial "Segregated Witness" or "Segwit" went into effect, per the agreement, back in August. Part two is the hard fork implementation of the 2x part, which is a doubling of the "block size" from 1 MB to 2 MB. (Blocks are where the transactions are stored on the blockchain - the distributed, decentralized, public ledger that is the guts of Bitcoin.) Though the compromise deal was supported by dozens of major bitcoin-related companies and more importantly, 83% of the mining power on the Bitcoin Core network, there are still many people who do not want to see the plan completed.

(More forks ahead!)

Specifically, the holdouts are those who did not sign the "consensus" agreement, including the main programmers of the Bitcoin Core software, who for some reason do not wish to see the block size increase to two megabytes. They also include those who did sign the agreement and have now publicly reneged on their promise. They wanted Segwit implemented, and it was, so they are now breaking away prior to fulfilling the full agreement. Bitcoin Core has even publicly attacked the signers of the agreement, which includes major bitcoin-related companies like Blockchain, Coinbase, and Bitpay who collectively have millions of users on their sites.

Despite the companies who've reneged and the ongoing caterwauling of those supporting the 1x version of Bitcoin (Bitcoin Core), the Segwit2x proposal still has at least 85% of miners signaling their support for 2x. Presuming a supermajority of the miners follow through on their promise and increase to 2 MB blocks in November, Bitcoin will "hard fork", with 80+% of the mining power siding with Segwit2x, and the other miners presumably backing the 1x Bitcoin Core. Of course, there's no guarantee it will play out like this, but at the time of this writing, that seems to be the most likely to occur. However, once the fork happens, it's anyone's guess what will come next. Here are a few, but not all, possibilities, in no particular order:

- Segwit2x, (let's call it Bitcoin 2x from here out), pulls so much mining power away from Bitcoin Core (1x) that Bitcoin Core's network slows to a crawl and is no longer able to mine blocks once every ten minutes, drastically delaying transactions and shooting up the fees on the already congested Bitcoin Core network. The remaining miners on Bitcoin Core, being interested primarily in profit, not politics, jump ship and start mining the most profitable chain, Bitcoin 2x. At this point the old 1x chain is in danger of becoming useless due to super-slow blocks and the fact that the Bitcoin Core network's mining difficulty adjustment only comes once every 2,016 blocks. When blocks are found every ten minutes, the standard for Bitcoin, 2,016 blocks are found about every two weeks. If blocks are only coming once an hour or even less often, say only a few times per day, reaching that 2,016 mark could take quite a while. By that time, how many miners will have bailed out and moved to Bitcoin 2x?

(Mining doesn't actually look like this.)Faced with near-certain demise as-is, the Bitcoin Core programmers could perform a hard-fork of their own to make mining easier and who knows what else, though this would go against all the things they've said publicly about how bad an idea hard forking is. There are many potential variants just within this one possible future.

- The fork happens, but due to last-minute reneging by mining companies or individual miners in mining pools staying with Bitcoin Core (1x), a dead-heat develops between the total mining power of the competing chains, with blocks coming slower on both sides as a result. Who knows how this will turn out.

- The Bitcoin 2x camp for whatever reason ends up with a violated agreement and a minority of the mining power. Their blocks come super-slow, as described in the first example. They're stuck and may have to abandon their plan. Do they return to mine Bitcoin Core (1x), or move their mining power behind Bitcoin Cash, which already increased their block size back in August and have since then mined blocks as large as 8 MB? What about "Bitcoin Gold", another minority hard fork set to happen in the next two weeks? This is an oversimplification of the possible paths and outcomes. One thing's for sure, this is going to be a contentious schism, far more so than the mostly-successful Bitcoin Cash schism back in August. Many are expecting the same thing to happen this time, where each schism ulimately increases the total market value of all the competing Bitcoin networks. However, there are no guarantees. After all, how many more times can Bitcoin fracture and the market still respond positively?

- Check Your Keys: If you have some amount of bitcoin, make sure it's in a "non-custodial" wallet to which you hold the private key. Some examples of non-custodial wallets include Blockchain, Mycelium, Airbitz, Coinomi, Copay, Bitcoin.com, Breadwallet, Electrum, Jaxx, and Exodus. If you had to write down 12 words to back up your wallet - you have your private key. If you have the private key and Bitcoin forks, you'll come out on the other end with both types of bitcoin. If, on the other hand your bitcoin is being stored in a custodial wallet where someone else, like Coinbase, LocalBitcoins, Paxful, Backpage, Xapo, Freewallet, GDAX, Kraken, BitStamp, Poloniex, or any bitcoin exchange, has control over the private key, then you are subject to their whims regarding how they handle the fork. Maybe they'll give you access to both bitcoin, or maybe only one of them. It's best to hold your bitcoin in a wallet which gives you access to your private key, instead of giving corporations control over your key, and therefore your bitcoin.

- HOLD: Once you're sure your bitcoins are in a non-custodial wallet, hold on for the ride. If Bitcoin forks for Segwit2x in mid-November, due to potential network attacks, you shouldn't spend or receive BTC if you can avoid it until the dust has settled. If you're a bitcoin-accepting merchant, lock up the point of sale device and instruct staff to politely decline any customers who want to use bitcoin to pay until the confusion no longer remains online. Stay positive! There's a good chance the bitcoin price could drop dramatically during a fork and any ensuing reorganizations. Bitcoin can survive this challenge - we've had drops in price before, dramatic ones. Watch, wait, and keep up with the latest.

- Bail Out: If you're too spooked by the possibility and uncertainty of a fork, you can always cash out for fiat currency like US Dollars or trade your bitcoin for other competing cryptocurrencies. Keene-area merchants who want to cash out should contact the Keene Bitcoin Network and we can probably help with that or any questions you might have.

- Pick a Side: If you really want to take some risk, you can try to pick a winner in the event of a fork and as soon as the two competing bitcoins appear on exchanges for trading, you can try selling your least-favorite bitcoin and buying your favorite (or other altcoins). I personally will not be taking this level of risk and will instead HOLD.

(Which is the "true" Bitcoin?)

On the positive side, schisms allow for the interested, conflicted parties to go their own way with the currency. That allows for market competition - let the best Bitcoin win. However, it also introduces confusion into a space that already has a learning curve that can be intimidating to newbies. Which Bitcoin is the "real" bitcoin? All sides say it's theirs, and after mid-November, we may have as many as four competing currencies all calling themselves Bitcoin-something: Bitcoin Core, Bitcoin Cash, Bitcoin Gold, and Bitcoin 2x (or whatever they decide to call it - the petty naming spats are a whole other level of ridiculous drama). Can the price of Bitcoin really continue to climb in such a cluttered, confusing situation?

For a Bitcoin evangelist like me, it's frustrating, especially without a clear winner between the "altcoins" (the hundreds of competitors trying to top Bitcoin) that I could promote instead of Bitcoin. Given it's impossible to know for certain what will transpire and what the market prices will do in response, I plan to hold on for the ride - historically the best strategy for handling bitcoin.

Like with the first schism in August to Bitcoin Cash, where anyone holding an amount of bitcoin prior to the fork was then in possession of that amount of Bitcoin Core and an equal amount of Bitcoin Cash, this time the same thing will be true. Anyone holding Bitcoin Core before the upcoming fork for Bitcoin Gold scheduled for October 25th will end up with an equal amount of Bitcoin Core and Bitcoin Gold (if Bitcoin Gold survives its fork - many are quite skeptical about its viability). Anyone holding Bitcoin Core prior to the Segwit2x hard fork in mid-November will then have an equal amount of Bitcoin Core (1x) and Bitcoin 2x (or whatever they end up calling it).

(Bitcoin Vending Machine at “Route 101 Local Goods” at 661 Marlboro Rd in Keene)

In one of my articles from July on these schisms, I explained why we were temporarily shutting down the Bitcoin Vending Machines in Manchester and Keene due to the concerns about certain attacks that could be possible during the turmoil. We're going to be shutting down the BVMs again for the Segwit2x fork, but not Bitcoin Gold. For updates about the machines' status, please check the Shire Crypto Vending website here.

If you have bitcoins you once again have the same options as before:

(New Hampshire's Crypto Community is Unmatched)

Regardless of what transpires in the next several weeks, cryptocurrency is here to stay. Whether Bitcoin stays on top of the crypto charts and for how long remains to be seen, but the idea created by the anonymous programmer Satoshi Nakamoto in 2009 of a decentralized, cryptographically secure currency that is useful both locally and globally is a proven success in whatever form it takes.

Speaking of local,Keene, NH is a global leader in per capita businesses accepting bitcoin and we're still strengthening that position. Portsmouth is also on the rise and attempting to take the title from Keene, with Free Keene bloggers Derrick J Freeman and Steven Zeiler at the helm out there. New Hampshire is deregulating cryptocurrency and multiple state reps and senators have bitcoin. With the ongoing NH Freedom Migration happening, cryptocurrency-loving libertarian activists are moving to New Hampshire every month, only making our crypto-activist community stronger. It's an exciting time to be involved in cryptocurrency in New Hampshire and if you love liberty and crypto, you really ought to join us and make the move to the Shire.

Stay tuned here to Free Keene for the latest on the NH cryptocurrency scene. If you'd like to connect and discuss with others in New Hampshire online about Bitcoin and other cryptos, please visit the NH crypto forums. Finally, if you're in the Keene area and want to meet area bitcoiners, please join our Meetup group. We have meetups every eight days - these are great places to ask questions, especially if you're new to cryptocurrency.

great article

yes great article thank you