eCoinomic as a digital platform that provides traditional financial services to all crypto currency holders.

The launch of new blocking technology has opened the door for relatively large developments in all global sectors and still has the potential for development. The global financial sector relies heavily on blockbuster technology. This block has a digital currency called the crypto currency. Crypto currency, also called digital assets, can be used to apply various actions on different platforms; particularly activities such as purchases of goods, service payments, liquidation of assets, etc., but these crypto currencies have not received worldwide recognition and usage of their sole discretion, and therefore prevent the use of cryptothermings as a form of collateral to be provided in fiat currencies. In addition, this digital asset has several other utilities, which are not presented or implemented. One of them uses it as collateral. This is the main goal of creating eCOINOMIC.

eCoinomic provides its users with financial management services of the digital assets

- Lending

Secured and unsecured loans based on fiat money and cryptocurrencies. - Investing

Long-term and short-term investments in cryptocurrencies and fiat money. - Hedging

Mechanism of hedging the exchange rate risks for crypto assets. - Crypto exchange

Including the function of managing collateral assets. - Crypto payments

Payment agent with virtual cards issuance. Integration with the largest trading platforms (such as eBay and Amazon).

What is eCoinomic ?

eCoinomic as a platform based on communications block, designed to provide financial services to the holders of cryptocurrency. This is a platform that considers the cryptocurrency as an asset that can be used as collateral for a loan. He gives his money to his users and receives cryptocurrency as collateral; which means there's no need to sell any crypto assets before you can get a loan. eCoinomic is one of many platforms designed to ensure widespread recognition and use of digital currencies in our current reality.

eCoinomic serves as an intermediary between financial institutions that provide loans and individuals who are borrowers. It provides full financial coverage to get a loan. It plays the role of the surety, uses the borrower's cryptoactive assets and thereby removes all risks associated with the lending procedure.

In addition to the possibility of using cryptocurrency as collateral, eCoinomic also provides its users with other features, such as: investment and asset management, currency risk reduction and market vulnerability, transfers and settlements between users and partner projects, using kriptovalyutnost and fixed money to pay for goods and services traded on platforms, issuance of virtual cards using crypto currency, and more.

Users can exchange crypto licenses, which they use as collateral, on the other hand. For example, when a user uses ETH as collateral, he may exchange it with BTC during the credit period. This implies that the platform takes various cryptothermia as collateral and loans.

In order to ensure the security and transparency of the platforms using smart agreements for regulatory locking procedures, deletion or return of collateral. A smart contract will impose the fulfillment of all credit obligations. This will improve investment security for both the creditor and the intermediary acting as the guarantor. If the borrower can not make a payment, a reasonable contract will liquidate the collateral and repay the loan and interest, and when the value of the kriptoaktivnyh assets falls below 20% of the market price on the signed date, the borrower's loan agreement may make additional kriptoaktivnye assets or take partial liquidation collateral or repay all loans. The platform offers solutions for both sides of lending procedures; creditors and borrowers.

- Lending

- Successfull Loan Closure

- Unclosed Loan

Platform has no problem with scalability. It supports basic payment agents, thus offering financial transactions at a very high pace. To ensure the security of the assets used as collateral, the deposit is made directly to the user account of the platform, and if cryptoactive does not affect the current loan agreement, the owner may withdraw it from the platform at any time.

Token Details Information

- Pre-sale whitelist registration starts : 15 March 2018

- Pre-sale whitelist registration ends : 03 April 2018

- Pre-sale Development stage starts : 03 April 2018

- Pre-sale Development stage ends : 21 April 2018

- Crowdsale Development stage start : 01 Mey 2018

- Crowdsale Development stage end : 01 June 2018

- Reserve stage start : 01 June 2018

- Reserve stage end : 01 August 2018

- Total Token supply : Up to 2.100.000.000

- Tokens available for the Token Sale : Up to 1.550.000.000

- Excluded countries : the USA, People’s Republic of China, Singapore

KYC procedure is required for all participants

- Accepted currencies on Pre-Sale : ETH

- Accepted currencies on Token Sale : ETH, BTC, XRP, BCH, LTC, NEO, XMR, ZEC

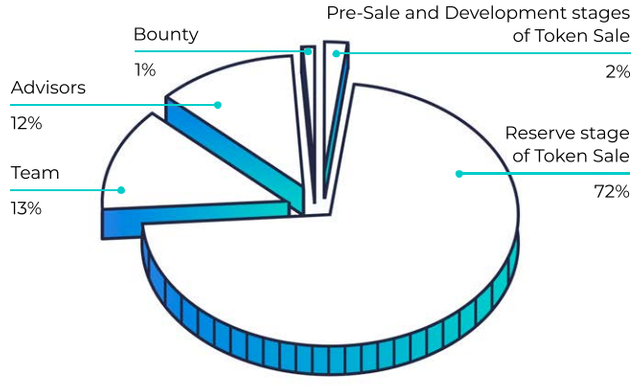

Token Distribution

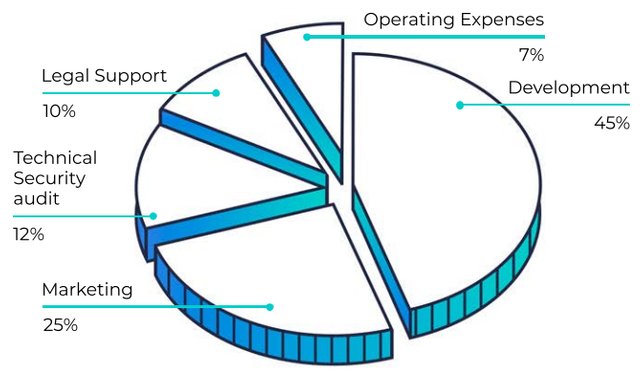

Funds gathered during the Pre-Sale stage and Development stage will be distributed as follows :

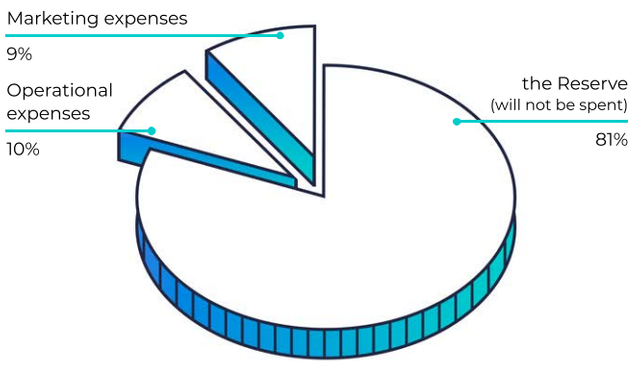

Funds gathered during the Reserve stage are to be allocated as follows :

Roadmap

- Q3-4 2020

- Conducting the IPO

- Q1-2 2020

- IPO procedure initialization

- First stage crypto bank launch (licensed in the UK and EU)

- Q3-4 2019

- Cooperation and technical connection with trading platforms

- Issue of bonds

- Procedure of crypto bank registration start

- Q1-2 2019

- Finance transfers from financial institutions and family offices

- Expansion through global partnership with local microfinance organizations

- Legal procedures for bonds issue

- Q4 2018

- Virtual cards issue

- eCoinomics.net payment agent with open API launch

- Platform launch - November for early adopters, December - public.

- Q3 2018

- Obtaining of licenses, developing solutions for different jurisdictions

- Token Sale finish

- Partnership with top global payment agents

- Signing the Letters of Intent with financial institutions and family offices

- Q2 2018

- Pilot project launch in Russian Federation

- Token Sale (Pre-sale stage)

- International platform alpha release

- Token Sale start

- Q1 2018

- First public information on the project

- Early-stage development of the platform

- 2017

- Origin of the idea

- Conducting cryptocurrency market research, technical solutions evaluation

- Working team assembly, concept development

The Team

The core team of the project consists of professionals and experts with more than 10 years experience in Fintech Industry and software development who worked in Veeam Software, Netwrix Corporation, Geekbrains, SMSchain, Cindicator and One Venture Partners.

CEO/Co-Founder

Aleksei is the CEO of the Sauber Bank that has been operating since 1992 and offers a variety of financial services to its clients.

Before joining Sauber Bank, he was an executive in the management company Saurun.

Aleksei has over 13 years of experience in senior management.

He graduated from St.Petersburg Polytechnic University and North-West Academy of Public Administration, majoring in Finance and Credits.

CTO/Co-Founder

Maksim has been a Sauber Bank board member since 2012.He is leading the Information and Communication Systems Ltd (SIIS) company offering a wide range of services with an emphasis on modern comprehensive data processing and web analytics since 2009.

Maksim has over 9 years of experience in senior management. Using his versatile experience he now combines the role of a Co-Founder and a senior Architect at eCoinomic.net.

Managing Director/Co-Founder

Vitalii is an experienced senior manager, he has been working as a CEO of different companies for over 8 years.

He has also been the head of the microfinance company «Dengi budut!» since 2013. In 2015 he became CEO of the federal chain of gold and jewelry secured loans pawnshops and later in 2016 he founded a company RapidCredit.

Investment Directo

Having graduated from Richmond, The American International University in London with a degree in International Business, Alpamys has extensive experience in project management, precisely in fintech industry. His interests include investing in software companies and blockchain technology.

He is a partner in ARMLON, Co-Founder of One Venture Partners and is responsible for Investor Relations at eCoinomic.net.

Business Development Director/Co-Founder

Maria has over 10 years of experience in senior management in different companies. She’s the CEO of the microfinance company «Dengi budut!»

Before taking this position, she also worked as a business development director in the federal chain of gold and jewelry secured loans pawnshops and was the owner of the company named Green Planet.

Maria graduated from Cass Business School (London), business school holding the gold standard of 'triple-crown' accreditation and ranking among the best business schools and programmes in the world.

Marketing Team Lead

Nataly has 15 years of marketing experience and over 4 years of experience working with fintech projects.

She knows all the subtleties of traditional offline marketing. Her professional portfolio includes developing 6 companies from different industries: providing full marketing support to launch retail chain; creating brand and corporate identities; developing ATL / BTL promotional strategies for sales departments; organizing events and exhibitions.

Nevertheless, her true passion is digital marketing. Over the last few years, she has been involved in creating and developing over 25 successful digital projects in B2B and B2C segments.

Her marketing approach fully relies on numbers: market monitoring, competitive analysis, advertising campaign performance indicators, attendance, conversion and sales statistics.

Key Account Manager

Danil is a project Advisor Relations & Key Account Manager. He has a passion for international networking and specializes in the establishment of worldwide communications with an individual approach to each stakeholder. Besides, he is also up to extensive media monitoring & activity analysis. Being a devoted member of our team, Danil takes responsibility for event management and SMM. He is interested in fintech innovations, digital privacy and new IoT & AI technologies.

For information about eConomic.net, you may join us below :

- Website : http://www.ecoinomic.net/

- Whitepaper : https://ecoinomic.net/docs/whitepaper

- Facebook : https://www.facebook.com/ecoinomic/

- Twitter : https://twitter.com/Ecoinomicnet

- Telegram : https://telegram.me/eCoinomicchatroom

- ANN Thread : https://bitcointalk.org/index.php?topic=2878954

Author by G4R3N6

My ETH : 0x69bAE764ac3D767722673eE89F44B027F7F7B97F

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://ecoinomic.net/