MPCX is a digital blockchain driven financial services platform. Our long term aim is to aggregate all crypto financial services into one place.

The platform is designed to service entities' and individual's needs in the areas of digital wealth management, cryptocurrency exchange and trading, digital banking, crypto research and ICO promotion, and crypto lending.

In the short term, MPCX will create a blockchain driven decentralized ecosystem to manage innovative investors' portfolios of crypto assets. Based on the current market situation with a huge demand for the services and very limited financial management solutions we decided to create the MPCX Platform.

The MPCX Platform will be developed in three stages :

- Jan 2017 – Dec 2018 – the digital wealth management platform

- Dec 2018 – Nov 2019 – the cryptocurrency exchange

- Dec 2019 – Jul 2020 – the digital banking and regulated wealth management platforms

The MPCX Solution

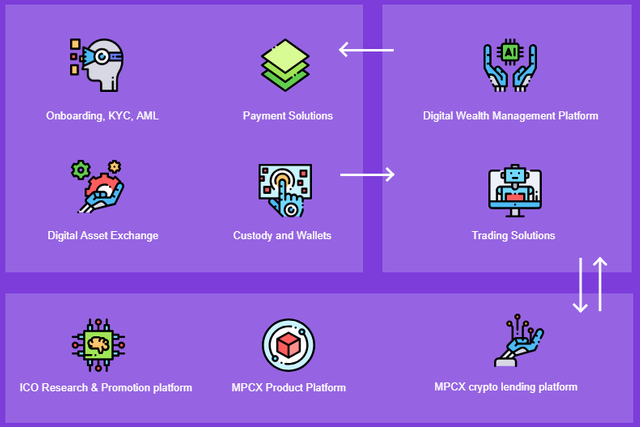

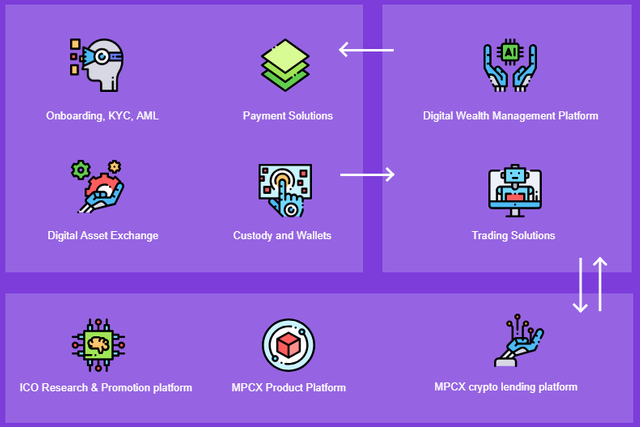

At the end of the third stage of the development of the MPC X Platform we will have implemented the following ecosystem:

The platform will bring all the following crypto services into one place :

- Fully digital client onboarding to reduce costs and provide clients' with friendly services.

- Digital cryptocurrency exchange in aggregated liquidity in the TOP 100 cryptocurrencies by market cap.

- Crypto payments, transactions and banking solutions.

- Custody and wallet solutions to provide secure safekeeping of clients' funds.

- Three crypto investable indices, crypto AI fund, crypto ETNs, ICOs.

- MPCX's Trading Solutions will give full access to the product platform and crypto exchange, arbitrage system, trading terminal and reporting.

- A Digital Wealth Management Platform will offer roboadvisory Digital Smart Investment Mandate, automatic portfolio rebalancing, crypto lending strategies and reporting.

- MPCX's ICO promotion and research platform will offer two level access to ICOs with full industry coverage.

- MPCX's crypto lending platform will include borrower scoring and match loans with lenders potential.

The XDMC token

The XDMC token will be the functional tool on the MPCX Platform and offer unique opportunities to participate in the platform development.

XDMC Tokens will be used to pay for the services inside the platform. Once the XDMC Token becomes liquid and popular, it will be used as the internal currency for our banking services. At MPCX we believe that crowd wisdom is a part of a new reality where each individual can contribute to the mutual wellbeing of a community and be rewarded for their contribution fairly.

We strongly believe that "crowd wisdom" will help us to create our platform to serve the best interests of our community. In this way XDMC Token holders will have the opportunity to participate in the development of the network.

How XDMC referendum works ?

- Hold XDMC

- Receive Votes

- Participate in a Referendum

- Be Rewarded

MPCX first stage unique products

MPCX Investable Crypto Indices.

By creating three crypto investable indices we will offer investors a solution to increase diversification, efficiency, and portfolio returns.

Our Investable Crypto Indices are :

- Crypto Large Cap Index (CLT) index holds the top ten coins by market capitalization

- Mid Cap Index (M20T) index holds the next top twenty coins by market capitalization

- Smart Beta Factor Exposure Crypto Index (SBCI)

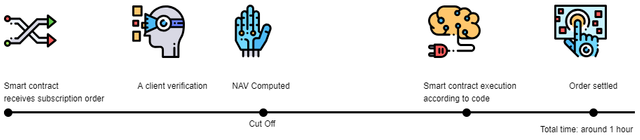

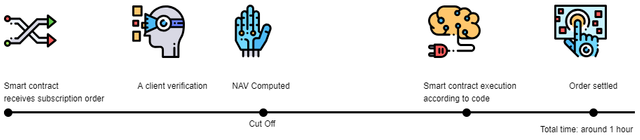

Buying and selling execution with the crypto indices will be run using smart contracts as follow :

This automation eliminates errors and the risk of data corruption, as well as significantly reducing costs.

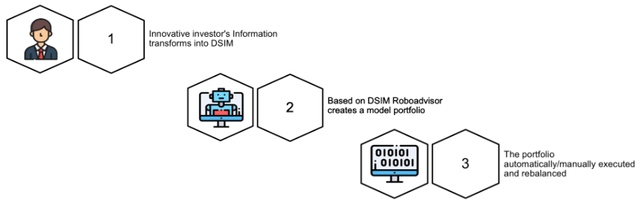

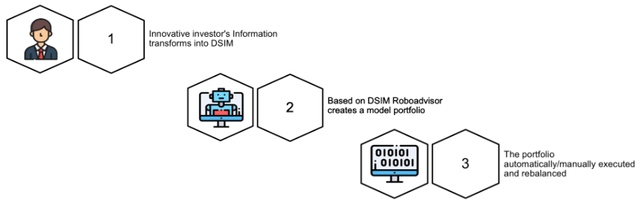

Digital Smart Investment Mandate (DSIM).

DSIM profiles the client's crypto risk tolerance, crypto investment objectives, and investment horizon, as well as crypto liquidity needs, and overall crypto wealth creation aims, as well as any unique circumstances.

Based on the DSIM roboadvisor, offer tailored portfolio solution. The portfolio can be executed automatically, or a client can make amendments and do it manually.

MPCX Financials

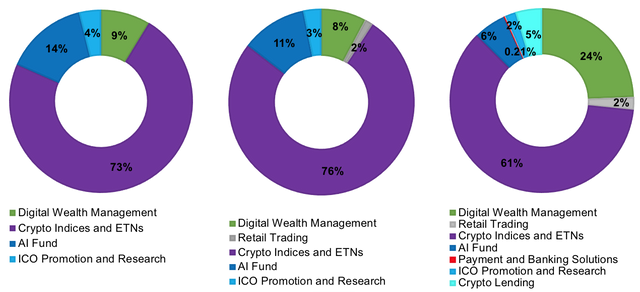

We have several main categories of revenue streams.

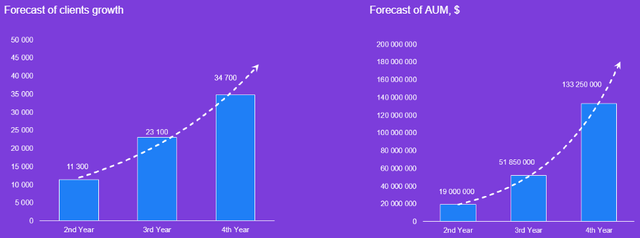

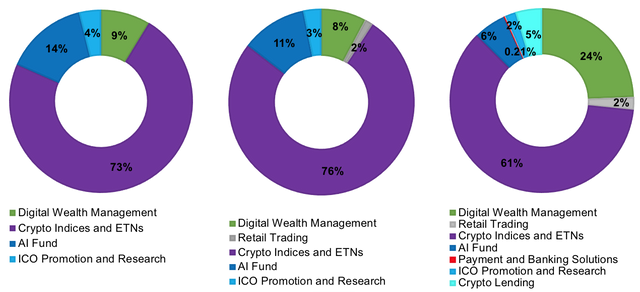

Forecasted revenue sources second, third and fourth years respectively :

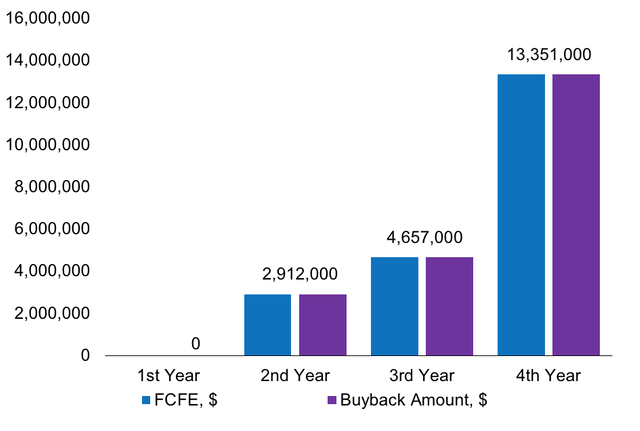

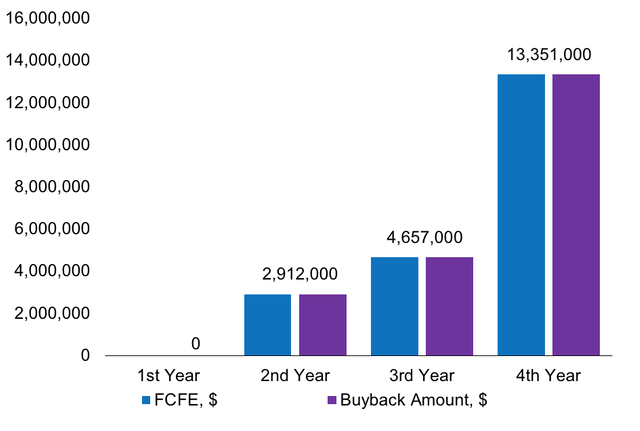

Forecasted cash flows, $

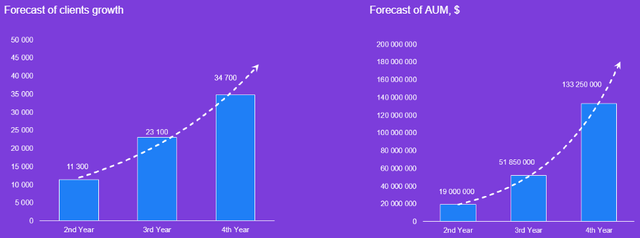

Business development

We have strong commitment to generate revenue as early as we will be possible. For these reason we are already in conversation with several large potential clients.

XDMC token sale structure

Tokenization is a process by which real or digital assets and related rights are registered on a ledger of specific blockchain. Technically a token is a unit of registered value.

Total XDMC token supply structure :

- Token Name : XDMC

- Supply Type : Fixed

- Token Type : Utility Token

- Total Supply : 999.950.416

- Pre ICO Price, XDMC = 1 ETH : 31.000

- Forecast Pre ICO upside, times : 20X

- Minimal Investment, ETH = 0.10

XMC Token distribution by stages :

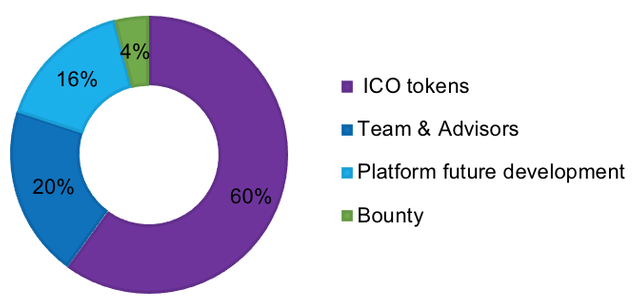

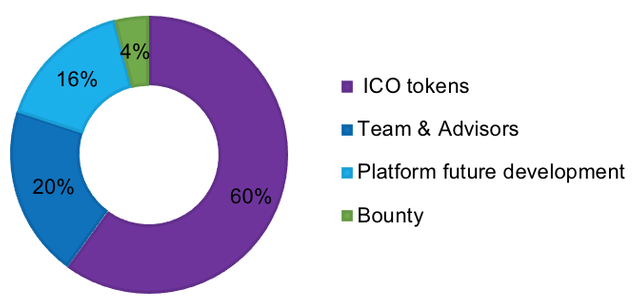

General XDMC token distribution structure :

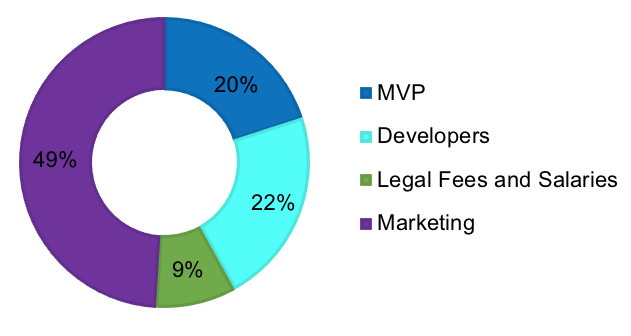

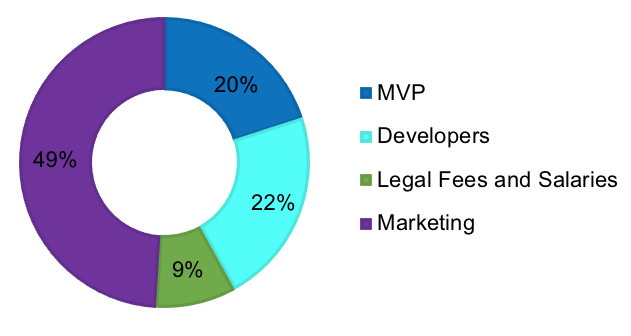

Use of Pre ICO proceeds :

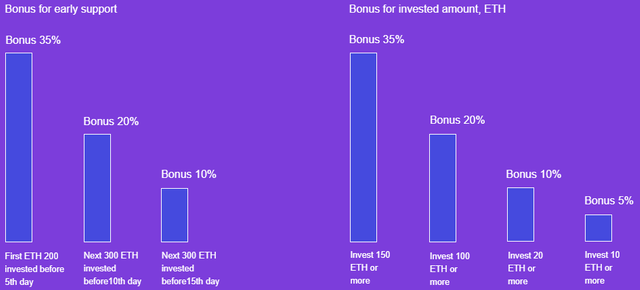

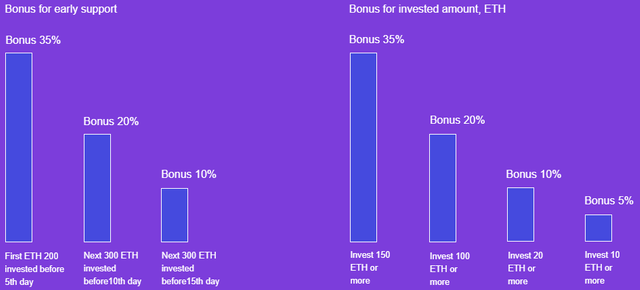

Special Pre ICO bonuses

Bonus 35%All bonuses are summed (e.g. if you back us with ETH 200 or equivalent before 5th day and your investment will be within the first ETH 200 your bonus is 70% (35% for early investment and 35% for invested amount)).

Roadmap

We have ambitious plans to disrupt and change the financial industry and we intend to realise them in three stages.

First Stage: Digital Wealth Management (DWM) Platform

- 1Q 2017

Research and Idea validation

- 4Q 2017

First Infrastructure solution with crypto assets

- December 2017

Began ICO preparation process

- May 2018

- Pre ICO

- Hard Cap

- ETH 1 000

- July 2018

- First ICO Round

- Hard Cap

- ETH 12 500

- MVP release before the end of Q2

- December 2018

- Digital Smart Investment Mandate

- 3 Crypto investable indices

- AI Crypto Fund

- Crypto ETNs

- Custody and Wallets

- ICOs

Second Stage: MPCX's Cryptocurrency Exchange and Trading

- December 2018

- Second ICO round hard cap ETH 25 000

- 2Q 2019

- Digital Crypto Exchange

- 4Q 2019

- MPCX Trading Terminal

Third Stage : MPCX Banking, Regulated Wealth Management and P2P Crypto lending

- December 2019

Third ICO round hard cap ETH 40.000

- 2Q 2020

Payments and Banking Solutions

- 4Q 2020

-Regulated Wealth

-Management

- 2Q 2021

- MPCX P2P

- Lending Platform

Meet MPCX’s team of highly qualified and experienced professionals.

Iurii Riabykin, CFA, MCSI is a highly qualified and experienced investment specialist and the member of several best respectable and recognizable investment societies around the Globe. He has built an incredible career in financial markets as the Equity market professional and Wealth and Portfolio Manager. Iurii started his career as an Equity Sales, continued as a Fund Manager and eventually has become an innovative investor with strong belief and passion about the future of Crypto Assets and disruptive abilities of the technology behind.

Iurii graduated from one of the most recognizable Russian financial universities where he has studied financial markets and financial engineering. During this time Iurii’s interest in complex financial products and disruptive technologies has been growing and eventually lead him to Crypto Assets.

Since October 2016, Iurii is a regular member of CFA Institute and CFA Russia. In 2017 Iurii joined CFA UK Society and as well as became a member of Chartered Institute of Securities and Investments.

Phil Millo is a highly experienced entrepreneur, financial professional, crypto structuring and portfolio construction expert, family office investor, blockchain and ICO advisor as well as public speaker with more than 25 years of successful experience.

In addition to the active role in MPCX development, Phil is the CEO of MCX, a full service crypto-structuring firm based in London and Luxembourg.

He is a recognized expert on the creation of crypto-based financial products, and is named on several patent applications relating to blockchain consensus algorithms. He is a member of the UK Government’s ‘APPG Blockchain’ community and is an advisor to a number of specialist ICOs. He has spent much of the last decade executing advanced fiat structures and advising ultra-large asset managers and sovereigns on alternative assets.

In the 90s he was a technology leader and was voted one of the top 100 most important people to have driven the first decade of the commercial internet.

Alex is a senior legal advisor and co-founder of the project. Alex started his legal career as an intellectual property lawyer, which followed 10+ years’ exposure to international natural resources sector. Recently Alex has been advising several UK start-ups in different stages of development, mostly in financial sector.

Recent boom in blockchain and cryptocurrencies shifted market interests from pure financial investments into disruptive technologies. Lack of blockchain regulation by government officials makes advising in this area more challenging, but at the same time it creates new opportunities of monitoring legal and regulatory developments at very early stages, literally as we speak. Alex believes that blockchain and cryptocurrencies are here to stay and crypto-finance is the new economic reality.

Md. Sadek is an experienced Blockchain technical expert with more than 10 years of research and development practice. In addition to active advisory position at MPCX, Sadek is currently working in a project involving identity and blockchain technology at the Imperial College Business School. Sadek was the first Technology Fellow at The UK Cabinet Office till the end of January 2018.

Before that Sadek worked in a Horizon 2020 project called SUNFISH (SECURE INFORMATION SHARING IN FEDERATED HETEROGENEOUS PRIVATE CLOUDS) at the University of Southampton, in which investigated how the blockchain technology like Ethereum could be utilised to deploy a secure monitoring infrastructure for cloud systems and worked as a Post-doctoral Research Assistant at the University of Glasgow.

Sadek completed his PhD from the School of Computing Science of the University of Glasgow and where he defended graduation thesis related to “Usercontrolled Identity Management Systems using Mobile Devices” in which he investigated how mobile devices can be used for managing different online identities.

Sadek is a very research oriented and love to face new challenges and develop novel mechanisms based on his research. His current research interests are Blockchain, Identity Management, Security Usability, Trust Management, Petname Systems, Trusted Computing and Privacy Enhancement Technologies.

For more information, you can visit us below :

Author by G4R3N6

My ETH : 0x69bAE764ac3D767722673eE89F44B027F7F7B97F