The Currency Crisis, and our SALVATION

During WW2, the Nazi’s had some bizarre war strategies, and “Operation Bernhard” was definitely one of the strangest. The plan was to use a bomb to make it rain trillions of counterfeit bank notes over London. Now the idea wasn’t to just “make it rain” for the citizens of London, rather it was designed to strategically destabilise the English economy through mass inflation.

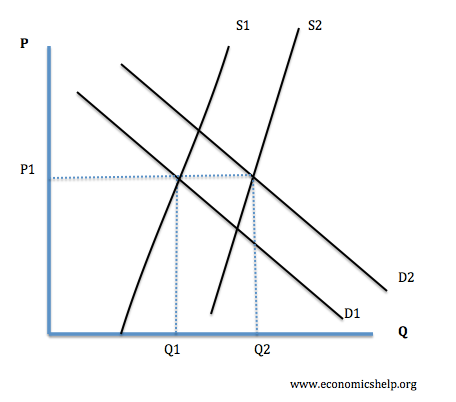

How does this relate to Bitcoin and Cryptocurrency’s in general? For one thing, someone dropping a currency bomb over us, is something crypto users will never have to worry about. But there are many indicators, that our debt-based economy is already accelerating towards insolvency. Take a look at the graph below.

This is what statisticians call a “hockey stick” curve (very scientific). Notice that debt starts to accelerate around 1970, when President Nixon debased the USD from the gold standard. For the first time, the US were fighting multiple wars at once.. and wars are expensive. However, for the most part, the economy prospered and Debt-GDP stayed relatively modest.

Ultimately, this system works if the rate at which the fed introduces new money into the economy can at least maintain pace with the interest payments on that debt.

As the world reserve currency, the US dollar has some unique luxuries. One such luxury, is the Petrodollar. This created global demand for the USD, and gave the federal reserve the power to print new money without risk of severe Inflation.

But what happens when country’s (like Iran) stop using the petrodollar and switch to the yuan, euro or ruble? Well, apart from the Trump administration threatening war, you get a large inflow of US dollars coming back into its economy. As It turns out, taking money out of the economy is a lot harder than putting money in.

I believe that within the next decade, we will experience a currency crisis unlike anything before. Whereby the Fed, and many other national banks, will be forced to default on their debt or risk spiralling into hyperinflation.

I have heard many reasons to invest in Bitcoin. However, this is what truly turned me into bitcoin fanatic. Bitcoin is not a phenomenon, it is a solution to a debt problem that is all-too-often ignored.

If you made it this far. Gold star to you. I’m not a big article writer, so I encourage constructive criticism.

Until next time,

Gayboy

Really interesting stuff. I didn't knew about the Nazi thing. I will look more into it

Thanks Sstefan. I'm going to write an article comparing Gold and BTC next. I'm sure that I'm 'beating a dead horse' at this point. But it reinforces my learning at the same time.

interessing post