Bitcoin meteoric rise does not mean it is a bubble.

I don't know if the price of Bitcoin will go up or down from here. This is such a new technology with new ideas and new concepts popping up every day that is hard to say who the dominant players would be 5 years from now.

What I do know is that Bitcoin started it all, it has a growing user base of both users and supporters, it is build on a revolutionary technology that is changing the perception of what is possible, spurring innovation, changing the way people interact, and more importantly, enabling the path for a truly globalized world. Bitcoin and the blockchain technology is globalization 2.0.

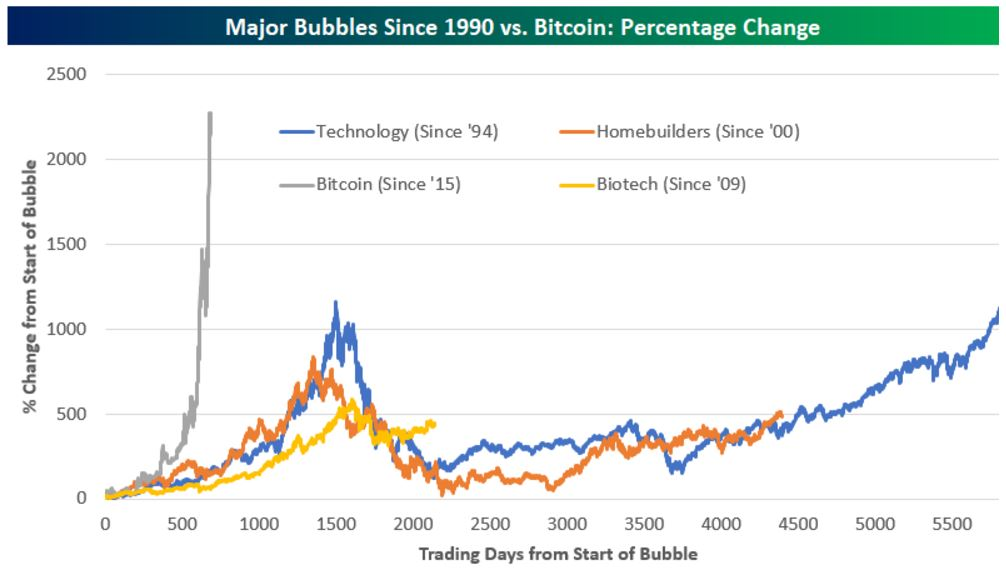

So when I hear people saying that it is a bubble and I see charts like the one below comparing Bitcoin to the Tulip bubble of the 1960's, or stock market returns over the past 10 years. I wonder if the naysayers are looking at Bitcoin and the technology behind it thru the right lenses.

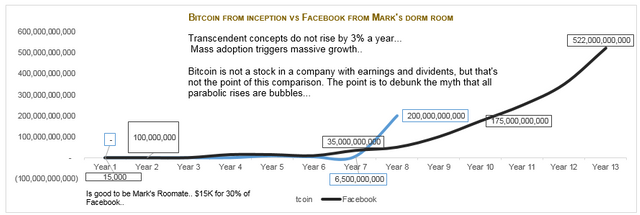

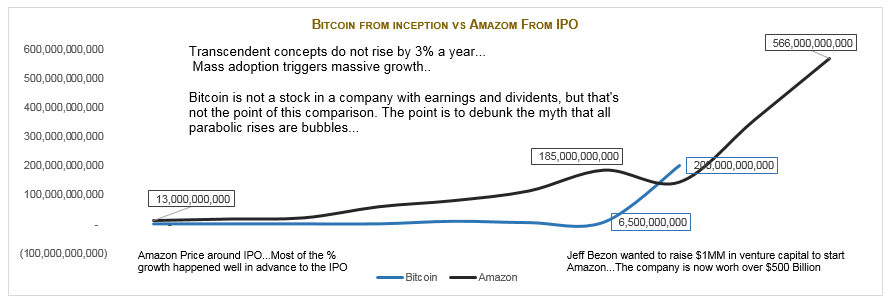

Those comparisons are wrong, in my view, for two reasons: 1) It misses the baseline of comparison completely. Comparing Bitcoin from inception thru the first 8 years, to public companies that have been in operation for years and sometimes decades before going public, or in a mature stage of their cycle is irrelevant and misleading. 2) It assumes that meteoric rises are never justified and do not happen in the real world, which is not the case.

Facebook did not start as a public company with a $100 billion dollar valuation. It started on Mark Zuckerberg's door room with a $15 thousand investment from his college roommate, Eduardo Saverin, for 30% of the company. From that perspective Facebook grew from a $50 thousand company to the $520 Billion dollar giant it is today. ( For more information please click on this link: https://techcrunch.com/2011/01/10/facebook-5/). That Parabolic ascend from a dorm room project to the largest social network in the planet is what Bitcoin and blockhain's trajectory have been to date. That's because they are the same thing, they are a revolution and change from the current paradigm, That have a global impact.

Amazon is another example. Amazon didn't start as a $13 Billion dollar public Company, but started with a investment from Jeff's Bezo's parents personal savings. Microsoft, Apple, Google, Yahoo, and may more multi billion companies had they start as a very small project and had parabolic growth because of how they eventually changed the world.

Now you may argue that those are companies with earning and solid revenue growth and they deserve their valuation, while Bitcoin doesn't have any of that and there is nothing to back it's valuation and meteoric rise. I think this is debatable and will eventually depend on Bitcoin's adoption and eventual roles as a currency or a commodity. However, Bitcoin valuation is not the point in this post. I am just trying to argue that not all meteoric rises are bubbles, but happen frequently when new technology, or a new way of thinking is introduced in a way that changes the world around us.

I don't know what the future of Bitcoin and the many altcoins will be. But I know they are a disruptive technology that cannot be ignored, and are here to stay. I do hold bitcoin and a number of other platform altcoins based on my believe in the technology and their potential impact. Every major innovation brings change and with that detractors that want to keep the status quo, however history proves that those detractors are fighting a loosing battle and progress can't be stopped.

I do, however, think that ICO's for private held companies are running amok, companies are running it just for the purpose of raising money in an unregulated environment when they could not raise the same capital on the debt or capital markets. I think many of these ICO's are concept's that are purely on a white paper stage and may never come to fruition, and that there is not enough information made available to investors to proper price the tokens. I do think the ICO's of are in bubble stage with companies raising millions of dollars with basically no disclosure while demanding a very high price. But that's a topic for another post!

Very nice illustration and comparison. I will be waiting for that another post I also have the same feeling towards the current ICO madness.