Bitcoin Arbitrage Trading: Is it Really Profitable?

Arbitrage trading is the buying of bitcoin (or altcoin, fiat currency, stock, etc.) on one exchange for a cheap price and immediately selling it on another exchange for a higher price. The prices differ on various exchanges because the markets are not directly linked. Also the trading volume is often very low so the prices don't adjust very fast.

This enables traders to engage in arbitrage trading and make a (supposedly) risk free profit. I will go into the risk free part later.

Arbitrage trading can be separated into two big types:

Type 1: "True" Arbitrage Trading

True arbitrage trading is literally taking your bought bitcoins from one exchange to another to sell it there. There are obviously a couple of downsides attached to this.

- You need to already have money in an exchange because depositing fiat can take very long (up to 10 days)

- It takes a long time to transfer bitcoins. Imagine your transaction taking an hour while you are watching your lucrative arbitrage position to close before your coins arrived.

- If you add up trading fees for both exchanges, deposit/withdrawal fees and network transaction fees, you quickly lose several percent which can make your trade not worth it.

- Price differences on various exchanges often reflect their reputation. Exchange rates often fall when people stop trusting a company. This happened in the final days of Mt. Gox and BTC-e, right before they went offline and people lost a lot of money. (Post on the BTC-e case and their debt token coming soon)

As you see, when you don't fall for shady businesses and do your math correctly, the only real challenge is timing. Using this method you can only trade on huge price differences that stay for numerous hours if not days. The chance of the arbitrage closing to rapidly is rather high and not controllable by you. If you want to be successful here, you pretty much have to be a professional trader with a massive budget. If you trade gigantic volumes, the transaction fee is relatively lower and most markets will give you reduced fees. So nothing for the average hobby day-trader like you. Maybe the second type is more up your speed.

Type 2: Margin Arbitrage Trading

Margin trading is borrowing money to create positions on an exchange. This increases your profits and your losses because you only have to have a portion of the money you are trading with deposited as a security. You can also do long and short positions. Long positions profit from a price increase in the underlying asset, short positions profit from a price decrease in the underlying asset. The downside is, that you have to pay interest on the borrowed money for the time your position is open.

So what do you do now?

As soon as there is an arbitrage opportunity, you long on the cheaper exchange and short on the expensive exchange. If the exchange rate on the cheaper one increases to the higher price, you profit on your long position, if the higher rate adapts to the cheaper market your short position is profitable. Whatever happens, you always make money, right?

Not quite. The only way to lose money in this constellation is, if the price difference doesn't close fast enough. "But it will close eventually, and then I will earn money!", you might say, but remember the interest you are paying on both positions. If you are paying interest faster than the arbitrage is closing, you are, again, losing money.

Calculation example:

You have a 1% arbitrage between two exchanges. Both charge 0.25% per trade so you loose 0.5% for two trades per exchange (opening and closing your position)

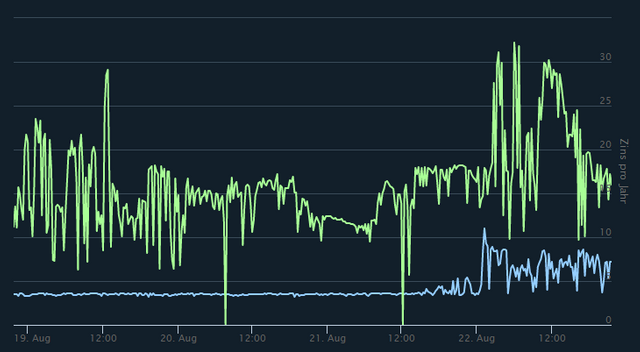

You have 0.5% left. Let's say you pay 13% p.a. for your margin positions (roughly 0.035% per day)

As long as you can close your positions before 14 days (0.5/0.035) are over, you make a tiny profit.

Your positions close after 5 days, you have made 0.32% on your initial investment. Well, actually only half of that because you only had half of your money on the profitable side.

Result: 0.16% profit. Not worth all the trouble

Usually, there are no such huge differences on reputable markets. And if there are, many traders are buying into them and the margin interest rates increase accordingly. You kind of have to balance the arbitrage opportunity with the current interest rate and that is that what we don't want: Gambling.

Example of changing interest rates on Bitfinex and Poloniex:

Conclusion

I can't give you a definite advise here because it is a very complex topic. There are bots out there helping you to get those trades perfect, especially for the second type but they aren't risk free either. With a growing number of professional traders in the system, it gets harder and harder for the individual to game the system.

What I can recommend is getting on the other side of things: Funding is lending money to other traders to trade with. You won't get super rich but an extra 13% per year on your BTC is nice, isn't it? Drop a like if you want me to review different kinds of funding on different platforms for you.

As always, stay safe!

EtherDelta is a Goldmine, insane arbitrage opportunity https://steemit.com/gifto/@fifelue/tips-be-a-millionaire-using-arbitrage

@grunzwanzling, thank you for supporting @steemitboard as a witness.

You can click on your award to jump to your Board of Honor

Once again, thanks for your support!

I wrote an article that explains the math involved in a simple way to arbitrage across cryptocurrency exchanges. Important to know what you are getting into so that you will not be trading at a loss. https://steemit.com/arbitrage/@kesor/the-math-behind-cross-exchange-arbitrage-trading