Bitcoin (BTC) Evening Update: Short IHS Pattern Invalidate but Medium to Longer Terms Remain Unchanged

SUMMARY

The very short term IHS pattern for Bitcoin (BTC) has been invalidated with the decline towards $8,466 but as the next charts will show, the bigger picture remains unchanged. The below chart shows that the decline is patterning out to be yet another wedge (blue). Price being so close to the apex should rise out.

The wedge fits into the larger IHS pattern and a riseout would allow the completiong of the Right Shoulder (RS). For this pattern, the $9,700 remains a critical juncture as the the Neckline resides at that price level.

The below chart still shows that the primary pathway is likely to be the white arrow. The long term support line has held and is expected to repell upwards another touch if it occurs.

The blue D wave option also is still valid and the subwaves of the abc is still in progress. Let's see how the overnight price action plays out. Zooming in and out from short term to longer term allows much better perspective than a single segment myopia.

Legal Disclaimer: I am not a financial advisor nor is any content in this article presented as financial advice. The information provided in this blog post and any other posts that I make and any accompanying material is for informational purposes only. It should not be considered financial or investment advice of any kind. One should consult with a financial or investment professional to determine what may be best for your individual needs. Plain English: This is only my opinion, make of it what you wish. What does this mean? It means it's not advice nor recommendation to either buy or sell anything! It's only meant for use as informative or entertainment purposes.

Please consider reviewing these Tutorials on:

Elliott Wave Counting Tutorial #1

Elliott Wave Counting Tutorial #2

Elliott Wave Counting Tutorial #3

Laddering and Buy/Sell Setups.

Laddering Example with EOS

Tutorial on the use of Fibonacci & Elliott Waves

@haejin's Trading Nuggets

Essay: Is Technical Analysis a Quantum Event?

Follow me on Twitter for Real Time Alerts!!

Follow me on StockTwits for UpDates!!

--

--

Am I reading this right @haejin ? Looks like what we're seeing is the end of a few days correction flat ABC correction.

Looks like we need one more 5-way rise up to complete D wave in large triangle. I wouldn't be surprised if there is a bear wick at the top (I didn't put it in chart), followed by a decline that will create E wave.

As for trading - not to be late with my buys, I assume E wave will be short and won't touch long term trendline support. Why? It's just how I read sentiment now - market is fed up with this correction and wants to go up. I think I see it in lower degree symmetrical triangles, both in BTC (one triangle is marked on my chart) and alts. More often than before, E waves end up short or even very short.

I'd love to hear Your comment on this one.

Cheers and keep up the good work. All I know at this point is thanks to You. You made me want to start learning TA :-)

Yes, the E wave is often the shortest and that is the primary count. The below chart also shows that the E wave is NOT always required but breakouts can occur at the D:

So, it proved to be zigzag after all with deeper retracement toward previous wave 2 rather than 4. Other than that, nothing really changed yet and primary count (C of ABC up, creating D, probably followed by E down to the level of longterm trend) isn't invalidated.

Getting really angry seeing so many comments of people panicking BTC decided to take a slightly different route to the same point. Thanks for Your reply.

@haejin i am very fan of your prediction and believe that bitcoin will be fine again we just have to have patience so that truely the price will be changed.

Hell yes...

Great analysis Haejin. Keep up the good work.

Im liking these charts, it would be awesome if we got a bull run soon, Something to lift our spirits lol

Is the bear period over and bull started

My thoughts here: https://steemit.com/bitcoin/@rmartin/bitcoin-3-25-18-the-way-to-7k-or-10k-here-s-how

Yes, Bear period over and doneky period started.

your a donkey

we should be serious many people are worried

I know

LOOLLLZZZZZZ😂😂😂😂

Your consistency never seizes to amaze me. You make updates on a regular basis.

Nice analysis. Nice update.

Very useful, informative, educational and we'll detailed.

Thanks for sharing @haejin ✌ ✌

good post, agreed

LOL POST 😂

Thank you @haejin

Lollzzz haejin😂

Hey @gmrbotswana,

Don't waste your vp. You can't do nothing. You are a fuckin kid😂.

Bear market

Congratulations, your post received one of the top 10 most powerful upvotes in the last 12 hours. You received an upvote from @ranchorelaxo valued at 128.49 SBD, based on the pending payout at the time the data was extracted.

If you do not wish to receive these messages in future, reply with the word "stop".

This is an one of the importance post.

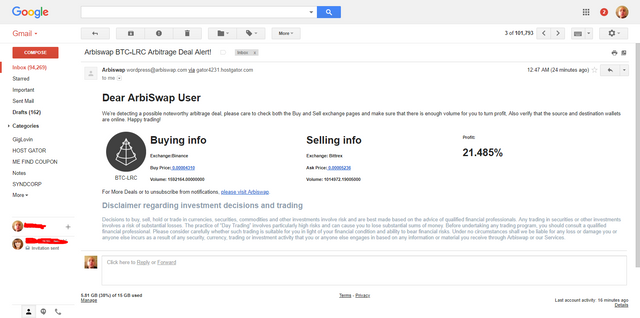

This market sucks so bad thats why you should have money on the sidelines and only arbitrage when you can...get arbitrage alerts to your email as they occur