Manage exchange failures: Switch to a Decentralized exchange like CryptoBridge

Your entire portfolio can be wiped out when a centralized exchange fails. Switching to a decentralized exchange (DEX) is a smart thing you can do to limit this risk. Here's a summary and in this article I willl explain why doing so is beneficial.

Crypto asset exchanges

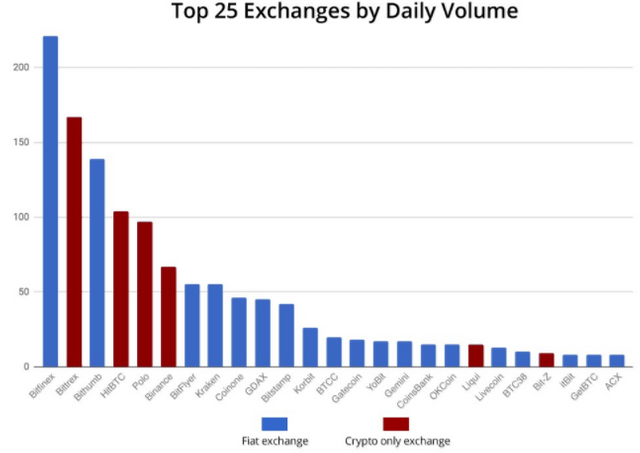

As the crypto space grows, the number of exchanges and their daily trading volume does too. As illustrated by Willy Woo today (see figure), exchanges are big business nowadays. They play a vital part in the crypto infrastructure and failure of one of the bigger exchanges has a big impact on the space at large. Look at, for example, the Mt Gox hack and more recently the shutdown of a number of Chinese exchanges.

As the daily volume grows, together with the value of assets held at these exchanges, the impact of an exchange failing increases. They become more attractive to malicious hackers and a more obvious target for regulators. The failure of any exchange, small or big, could potentially have a detrimental impact on your personal portfolio.

Risks related to exchanges: Counterparty risk

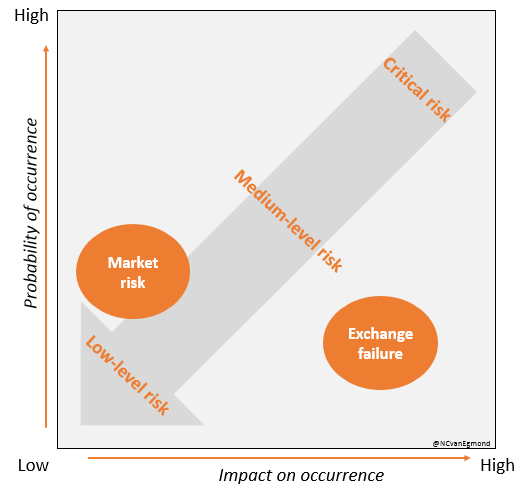

As a trader or investor, you are constantly making decisions regarding risk versus reward. Unfortunately, most take a limited view on what risks they are exposed to. The main focus is on market risk. Decreasing prices leads to losing trades, which leads to a decrease in portfolio value. Market risk may be the most obvious risk, but is absolutely not the only one. Today I want to talk about counterparty risk:

"Counterparty risk is the risk to each party of a contract that the counterparty will not live up to its contractual obligations. Counterparty risk is a risk to both parties and should be considered when evaluating a contract." - Investopedia

In other words, you keep your portfolio at an exchange and the exchange cannot or will not let you withdraw that money. Translate that to return terms, this event will cause the value of your portfolio to decrease by 100% and it is now worth zero. Cryptoassets are volatile and huge price swings are not uncommon. However, the price of an asset going to zero instantly is rare and usually only happens if the asset turns out to be a complete scam. Besides being rare, the downside risk caused by scams is managed using regular risk management practices such as position sizing, which a trader practices anyway. Exchange counterparty risk is not.

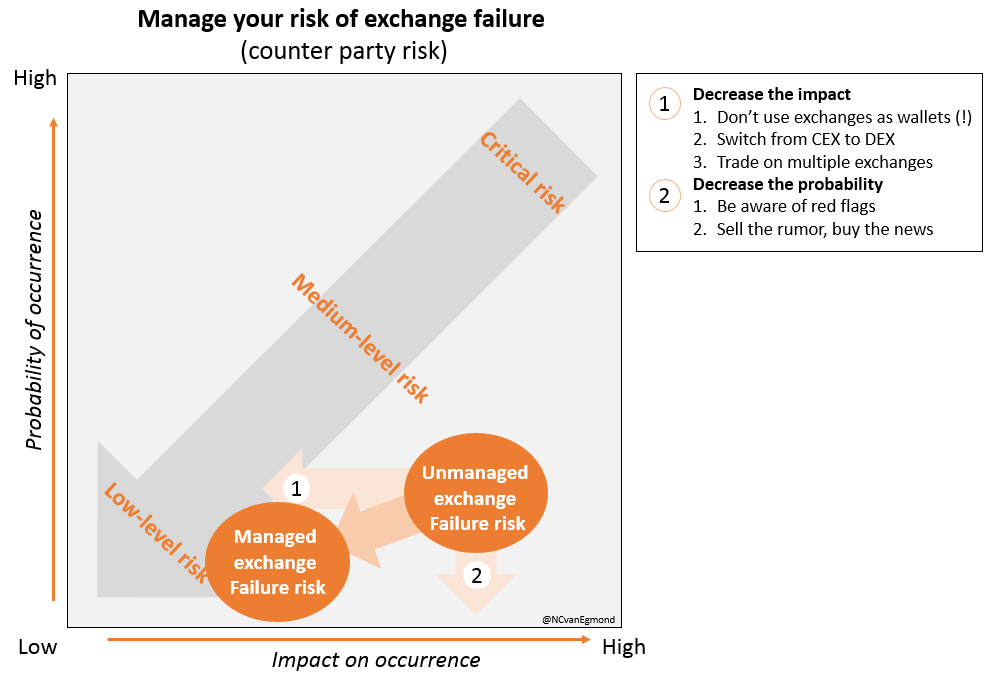

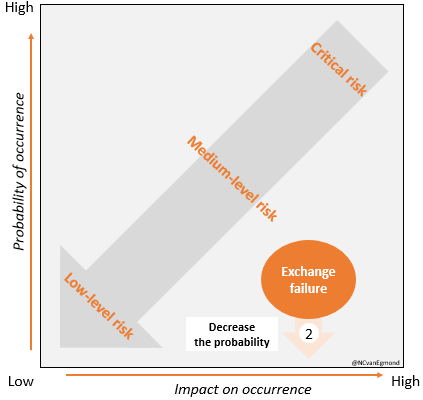

We can evaluate risk using a simple probability-impact risk framework. Market risk has a high probability as prices fluctuate by the minute but the impact is limited when adequately practicing risk management. An exchange not allowing you to withdraw your money is a low probability/high impact event. There are a number of reasons why a (centralized) exchange will be unable to let you withdraw your money:

- Theft: Third parties (Mt Gox BTCUSD -23% and Bitfinex BTC/USD -20%) or insiders

- Regulative restrictions and take-downs: PBoC shutting down exchanges

- Performance issues: Poloniex and recently Kraken

- Market manipulation: Spoofy (?)

- Hardware failures

These issues affect centralized exchanges (CEX) to a greater degree than decentralized exchanges (DEX). They are known as single points of failure. That is, if the CEX suffers one of these issues, the entire exchange suffers and is at risk of shutting down. CryptoCompare did a decent job outlining the pros and cons of CEX versus DEX here.

Managing counterparty risk: Exchange failure

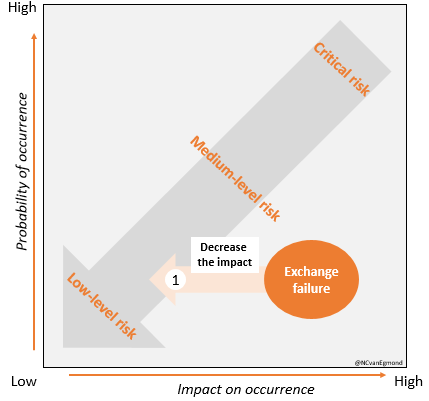

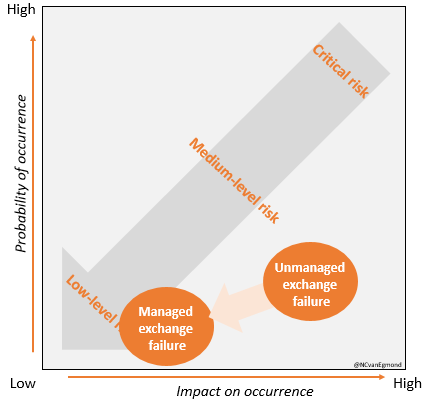

As discussed, the risk of exchange failure is real, has multiple possible causes and should be consciously managed. To make the risk more manageable, we can use the probability-impact risk framework to decompose it into two dimensions: probability and impact. We can manage the risk of exchange failure along these two dimensions by taking actions, which can be classified into four categories: 1) avoid, 2) mitigate, 3) accept and 4) transfer. Let's discuss.

1. Decrease the impact of exchange failure on your portfolio

Limiting the impact of exchange failure comes down to limiting the value exposed to a scenario where a single exchange fails. First and foremost, you should avoid using an exchange as a wallet at all costs. Remember:

You don't own the private key to your cryptoassets? You do not own those cryptoassets.

Simply put, you cannot lose value to exchange failure if it is not stored on an exchange. The second step is to mitigate the impact of exchange failure. You can choose to spread your holdings across different exchanges. This further limits funds lost in case a single exchange fails as a result of e.g. theft. (This has the added value of reducing exposure to tiered capped withdrawals that most exchanges impose. In addition to increasing your relative withdrawal power, it also partially limits the information you have to provide exchanges under KYC regulation.)

If we take a step back, we see that we now only minimized our risk to single exchange failure (idiosyncratic exchange risk). The recent intervention by the PBoC shows that some groups of exchanges are exposed to a common risk factor: regulators. For better or for worse, growing network values and increasing trading volumes have lead to an increase in regulator scrutiny. One method to decrease the impact of regulatory action is to spread your funds across exchanges subject to different regulatory regimes. An even better method is to switch to a DEX. Decentralized exchanges are extremely resilient to regulatory action.

As a trader you can hardly avoid exchanges. To some extent you have to accept that there is a level of risk. However, accepting does not mean there is nothing you can do! Think of the steps you would need to take when the writing is on the wall:

- Can I still withdraw funds from the exchange? (if so, until when?)

- Under current withdrawal limits, how long does withdrawing 100% take?

- Do I want to liquidate all your positions to fiat/bitcoin or withdraw in alts?

- Do I have addresses/wallets set up to withdraw positions to?

- Are these addresses validated by the exchange yet?

In all likelihood, impending exchange failure will cause bank run-esque circumstances: liquidity dries up, prices fall, performance is hampering and the helpdesk is MIA. Personally, I use this simple metric: Number of days required to withdraw all funds (= portfolio balance / withdrawal cap) and try to steer to max one transaction for most exchanges.

Hope for the best, but plan for the worst.

Finally, transferring or covering counterparty risk seems impossible at this moment. Despite calls to keep regulators at bay, this might be one thing they could bring: insurance. For example, U.S. based customers at Coinbase are insured up to $250,000 in case of theft.

In summary, to decrease the impact of exchange failure on your holdings be sure to minimize the assets you keep on exchanges, spread them across multiple exchanges to limit exposure and to minimize the time it takes to withdraw all your funds, and have a plan in place for when shit hits the fan.

2. Decrease the probability of exchange failure in your portfolio

In addition to decreasing the impact of exchange failure, managing the probability of exchange failure is important. This is less clear cut and largely depends on being aware of two factors:

- Impending regulatory action: regulators are slow and often signal action in advance. The actions of the PBoC were hinted at days before actual action was announced and, subsequently, it took a couple of days for action to be effectuated.

- Red flags regarding exchange functioning: ominous rumors often surface, e.g. customer service deteriorates, vague comments from the exchange itself.

In short, decreasing the probability of exchange failure relies on taking action when information becomes available. It is probably smart to avoid exchanges with dubious reputations, like Yobit or C-Cex. Crypto assets are a nascent sector and the regulatory environment is rapidly evolving. Being aware of developments in the market is your primary tool in managing the probability down. In all fairness, this likely requires a touch of paranoia, but:

Better safe than sorry: Sell the rumor, buy the news.

Introducing: decentralized exchanges

As discussed previously, decentralized exchanges are less sensitive than centralized exchanges and therefore, in my opinion, preferable. The number of new decentralized exchanges is growing steadily. The table below lists a number of exchanges that are currently operational (Let me know if I am missing any!). As outlined by CryptoCompare, the liquidity on these exchanges is somewhat limited for now and most user interfaces have room for improvement. However, they have come a long way and I expect they will improve rapidly.

One important hurdle DEXs have yet to tackle is the lack of fiat trading pairs. This will likely require some level over regulatory compliance. In my opinion, widespread adoption of decentralized exchanges as the trading platform of choice will likely hinge on offering fiat trading pairs.

| Exchange | Daily volume | Online |

|---|---|---|

| CryptoBridge | ?? USDk | Yes |

| CounterParty DEX | 0.75 USDk | Yes |

| BitShares Asset Exchange | 230 USDk | Yes |

| OpenLedger DEX | 450 USDk | Yes |

| EtherDelta | 3,670 USDk | Yes |

| BitSquare | ?? USDk | Yes |

| Blocknet | ?? USDk | No |

In conclusion

In my opinion traders should approach counterparty risk with the same rigor as market risk as it is potentially devastating. This risk can be managed along two dimensions: decreasing the impact of exchange failure on your portfolio and decreasing the probability of exchange failure in your portfolio. Most of these considerations sound commonsensical and hopefully sound like open doors. An easy way to mitigate most of these risks is switching to a decentralized exchange. Be safe, switch to a DEX. I moved to CryptoBridge and so should you.

Ps. Personal security is also extremely important! (Good primer by @notsofast)

Should include Blocknet in your list of prospecitve DXs! The UI hasn't been revealed yet, but you can expect to see news on that in the coming weeks. Have a read of their reddit FAQ here: https://www.reddit.com/r/theblocknet/comments/6vrxel/blocknet_faq/

Thanks for the addition! I've added it to the overview.

Thanks, good information.

@hardball, great post. Since a couple of weeks I I'm also using the OpenLedger DEX and submitted all of my bitshares to this wallet, even before the currently discussed delisting on Bittrex. I like the vision of being my own bank :) Just the lack of good fiat gateways and the low trading volume are a bit of disturbing. But due to the fact, that we are just in the beginnings it's not that problem, IMHO. And for buying and holding it's perfect. Cheers.

Thanks! Good point about the fiat trading pairs. I think the decentralized nature of the exchanges will perhaps make it hard (impossible?) to get those online as DEX are impossible to regulate. What's your take on this?

Added this point to the article.

Congratulations @hardball! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!