2018 Will Be Bonkers for Bitcoin and Cryptocurrencies

If you thought 2017 was crazy for the cryptocurrency markets, then wait until you see 2018!

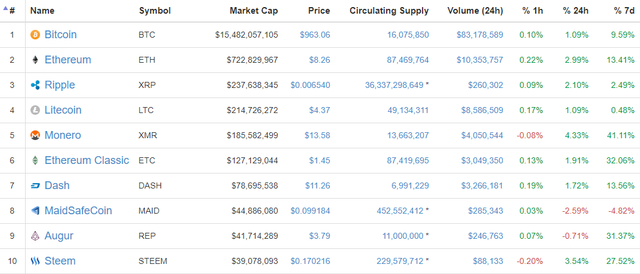

Looking back in the year, we can see an exponential increase in the price of cryptocurrencies. Take a look at the screenshot of CoinMarketCap at the beginning of the year:

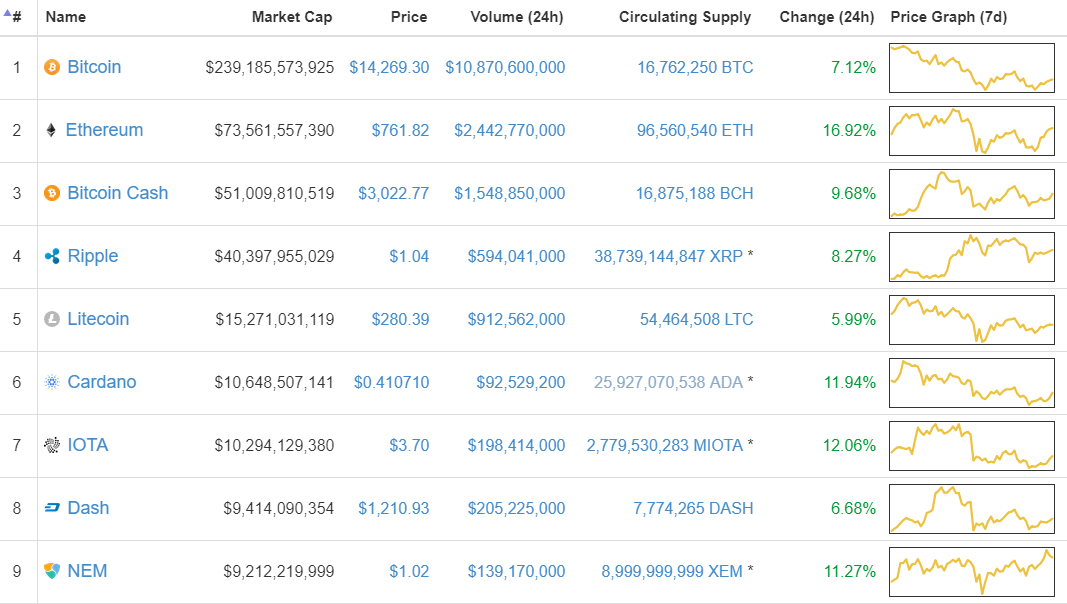

Vs now:

The market capitalization of cryptocurrencies went from $18 Billion to about $540 Billion, this is a 2,900% increase in less than twelve months! You might be saying to yourself “This is friggin’ crazy!!!” and/or “I can’t believe I missed out on such a big opportunity!” Regardless of what you may think, it’s still not too late to get in the game, and I am going to explain why.

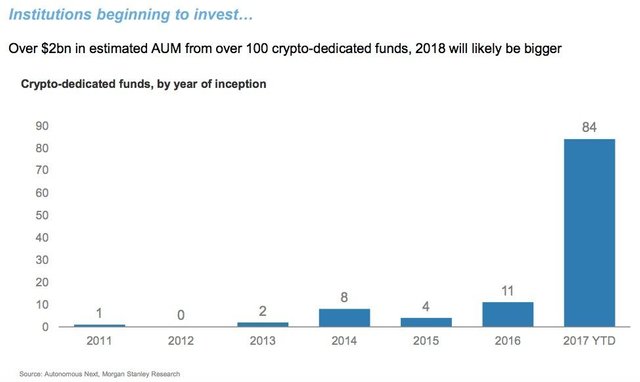

Institutions

Let’s take a look at the number of Cryptocurrency Hedge Funds operating for the most recent years.

As we can see, as the number of hedge funds increase, the market capitalization of cryptocurrencies increased dramatically. The reason behind this is because most people with a lot of capital usually spend most of their time working on what they are good at doing and don’t have the time to look at the markets or spend any time researching for investment opportunities. As a result, they tend to give their money to investment managers, such as hedge funds, to manage their money. When hedge funds prospect these wealthy people and show them the insane returns of Bitcoin and cryptocurrencies and tell them that they know what they are doing because they have been in the investments business for decades, these wealthy people believe them…especially if they already have a history with the fund manager and/or investment firm. The number of these private hedge funds will only increase in the coming year, without any of them going away anytime soon.

Entrance of the Exchange Traded Funds (ETFs)

With the advent of CBOE and CME Futures, the Securities and Exchange Commission (SEC) and other governmental authorities may finally allow ETFs in the financial markets. In the above, we can see how private hedge funds can affect the market considerably. With ETFs, this effect will be magnified significantly, and there are reasons for this. First, ETFs are easily traded on almost any platform (i.e. – E-Trade, TD Ameritrade, Interactive Brokers, basically any stock trading platform you can think of, will make ETFs available for trading). Second, trading with these platforms is a lot easier than signing up to a private hedge fun.

Nowadays, if you want to sign up for a hedge fund, you will most likely need to be an accredited investor and have to meet the fund’s definition of a qualified investor. And then you have to sign an application form, wait for a response. Perhaps, you might want to get lawyers involved if the transaction involves a large sum of money. Chances are that you might want to meet everyone on the investment team to see what you are getting yourself into. After the meeting, you may want to negotiate a reasonable management fee, and then finally you will have to write them a check. All this probably takes a couple of days. With ETFs, you can just deposit money into your trading account and hit “Buy”. And if you already have money in your account, just “click” the Market Order button, and you will have instant exposure to crypto in your investment portfolio. The ETF makes the whole ordeal a lot easier, with a lot more accessibility to the general public.

This Time will be Different with the SEC

For those of you who have been in the crypto game for a while, you may be thinking that the SEC has rejected cryptocurrency ETF applications in the past. What makes you think that they will allow ETFs this time? The answer to this question lies in one word: Futures. The introduction of the futures markets allow funds to hedge against the wild swings of the crypto markets. In the financial industry, we have this concept called “fiduciary duty” or “fiduciary obligation”. I other words, anybody whose profession involves handling other peoples’ money cannot use the money in inappropriate ways, which includes placing client assets into extremely risky speculative investments. Under the definition of fiduciary duty, pension funds, along with many other financial management firms, cannot place too much risk in their portfolios. However, with the newly created futures contracts, pension funds (among other institutions and ETFs) can hedge against the wild volatility of the crypto markets. And hedging is extremely crucial because crypto markets are traded 24 hours a day @ 7 days a week, and we don’t know what our friends in the other side of the world will do while we are sleeping.

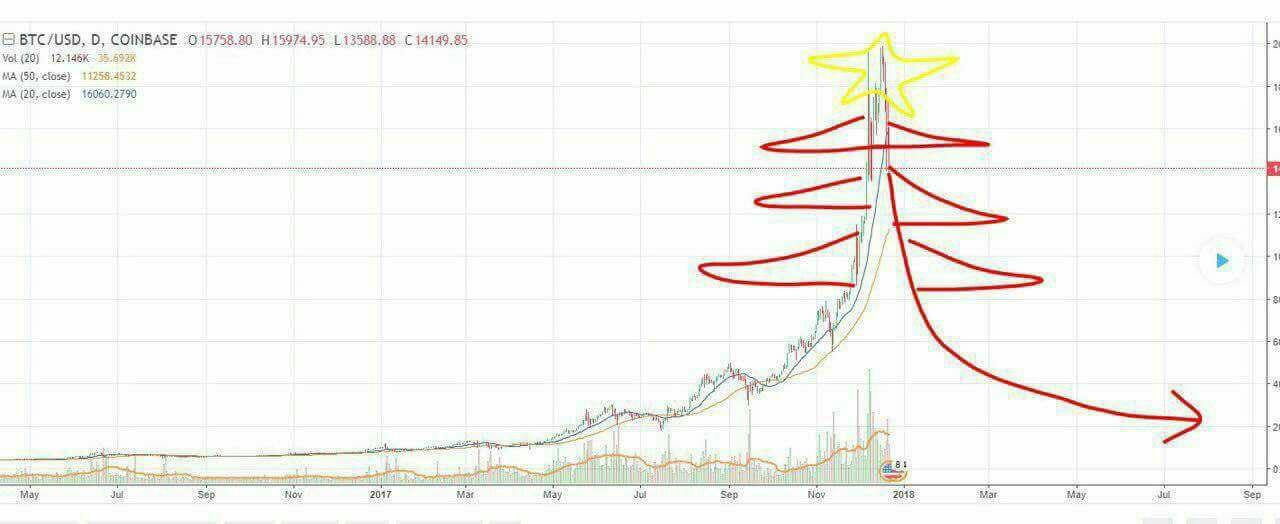

The Recent Sell-Off

If you have been following the news lately, you might have heard there was a recent pullback in the crypto currency markets where Bitcoin lost almost one half of its value within less than one day. For people who are new to the crypto space, you might have freaked out and panic sold during this period. It’s always easy to say that you will hold, in good times and bad. However, when it all comes down to it, do you really have the stomach to watch the market drop like there’s no tomorrow within minutes and stay rational throughout the whole entire time? Most people probably cannot stomach this kind of volatility and that’s okay. Crypto is not for everybody. But needless to say, the selling did stop, and the worst is probably behind us, for now. There will be other future sell-offs very similar to the one we had a few days ago. In fact, there is speculation around the rumor mill, saying that there could possibly be one more major sell-off before January 15th, 2018, which can lower the price of Bitcoin to the $8,000 level – this happens to be in the 100-day Moving Average support level. Again, this is just a rumor. Chances of this happening is very slim.

Catalysts for 2018

Christmas. Have a happy, joyous, and Merry Christmas for everyone who is reading this. I’m hoping that you are meeting with loved ones and enjoying this time with the people you love in this great time of the year. And as I’m typing this, people from all over the world are getting back with their families, and similar to what happened in Thanksgiving, people will convene with their families and talk about Bitcoin, which can lead to more users on Coinbase.

New Year’s. It’s a New Year, New You. Many people probably take the Holidays as a time to self-reflect and evaluate what they can do differently in the year to come. I am pretty sure many people are thinking about their financial futures during this time of self-reflection. So, for all these people who have been putting off taking action on Bitcoin and cryptocurrencies, they may finally get off their behinds and do something about it. A study was done recently, asking people if they are aware of Bitcoin and cryptocurrencies. The study concluded a good majority of people know about Bitcoin, but only a handful of percentage of them actually hold any Bitcoin or crypto in their investment portfolios. Like in most things in life, most people are talk, with no action. However, New Year’s is usually a time when most people take massive action. So, we could see more users entering this space very soon.

Additionally, January 1st marks a very important day in many hedge funds’ calendars. We can presume that a multitude of hedge funds raised money during the end of 2017, being that Bitcoin was all over the news with its giant run-up towards the end of the year. And the news of the CBOE and CME futures also gave fund managers more incentive to jump into the crypto train because they can now hedge risk for client funds. All these newly created funds would have filed all their required paperwork to the appropriate governing agencies and collected all the checks for their raised funds by now. For many of these hedge funds, their Fiscal Year will begin on January 1st. The very beginning of the year is usually when they start making purchases and taking positions in the market.

Coinbase. Coinbase, which provides an on-ramp fiat-to-cryptocurrency service, announced on November of this year, that they will be adding more options to the list of available cryptocurrencies you can buy with your US Dollar of EU Euro during 2018. My predictions for these new options include Ripple (XRP) and Ethereum Classic (ETC).

The “Legitimatization” of Crypto in the Financial Industry. We are starting to see more and more traditional financial software recognize cryptocurrencies as an asset class, including Bloomberg Terminal and Interactive Brokers. This can just leading to greater adoption…not so much as a currency, but more of an asset class in the investment space…for cryptocurrencies. One might say that how could crypto be worth anything if it’s not doing its intended purpose? Well, crypto is still very young in this stage of development. Because of its volatility and seemingly deflationary characteristics, it is very hard to tell if Bitcoin could be a medium of exchange in the near future. Only time could tell. But for now, it’s considered an asset class, and we just have to go along with it.

I have said this many times in the past, and will continue to say this: There are still many doubters and naysayers, regarding crypto, out there. And as long as there are doubters and naysayers, we know we have not reached the peak of the bubble yet. Many of these doubters and naysayers are probably going to jump on the bandwagon as soon as ETFs come out because it will be so easy for them to make some easy gains at a click of a button. At this point, they will probably stop doubting and naysaying, and that’s when you know: It’s time to get out of Crypto.

Caution: Be careful. Keep your eyes on the Asset Bubble Curve and never invest more than you can afford to lose. Don’t be dumb. Make your $$$, don’t be greedy, and never look back.