BITCOIN - How To Catch a Falling Knife

Hello all you Bitcoin holding Steemians, lets see how we can enterprise on a great buying opportunity.

I have taught a lot of people how to trade, including market makers at several firms. I also love showing people some tricks I have taught them to level the playing field. The crypto's are experiencing an awesome pull back, but how do you know when you should start buying more. Is the pull back over?

Many of you have heard the expression 'Never catch a falling knife' and I couldn't agree more! Let me show you a quick tool to get some perspective. Many of us look at short term charts such as the 1 minute, 5 minute or 15 min charts. These have a lot of noise in it and can frankly cause you to become a deer in the headlights.

When I was trading Dot Com stocks we often experienced moves like this and some thought, 'yup - this stock is done and gone forever...' However, they were often wrong! Many of those stocks with big moves need big pull backs. Just remove the noise and you can see it too...

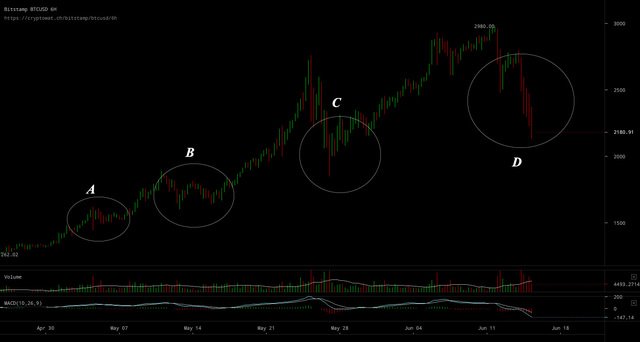

Try using a 4 or 6 hour chart to eliminate the noise and get a better picture of when the true selling has dried up. Compare the A B C and D circles. Do you see the difference? We have a bit more selling to experience, so wait for more buying to come in before you start to catch this falling knife. Scale in slowly and wait for the tide to come back in and lift all boats!

There is no need to rush in, you are never going to catch the exact bottom. Let it wash out and if you miss a hundred points or so, then so what, at least you won't have to wring your hands when it continues its pull back.

I will be posting the Zero Point Lines again tonight to help coincide with the pullback so you brave traders can trade the intermittent short term trading opportunities.

Don't catch a falling knife, but also don't let the cristal fall.

Great advice. There is so much so so options out there but what you have said sir is spot on. I often get caught up in the smaller charts looking at the bigger picture is the answer. FOMO fear of missing out is the biggest enemy I need to fight of on a daily basis. Also the trap of trying to catch the absolute bottom!! Thanks for the words of wisdom :)

Thank you! It's important to get perspective and keep a cool head. The Big Boyz know how the little fish panic and are quite emotional. At least your only dealing with selling and not short selling.

Don't worry about catching the bottom, if its ready to turn the momentum will carry you. The trade should be easy, don't force it. There is a tool "they" use called reflexivity, in order to whip saw everyone into oblivion, 'they' make money up and down in the stock market. However, Crypto's are a bit different. I will be covering it in an upcoming article.

Good luck with your trading!

Look forward to it cheers.

Overlay of GOLD 1970-80's to that of BITCOIN current

I would say its too early to call for the bottom yet !!! It has breached few technical(s) and we have to reconsider how we look at it going forward IMO.

Hey Nice Overlay Chart! I use to find a ton of correlations out there, such as Gold and the Japanese Yen. They can be helpful if you understand the game behind it.

Yes, too early to call the bottom, and this is why I suggest changing the perspective. However, this is a grand chess game unfolding. It's not just a stock and certainly not Gold, as they can be manipulated very easily and directly.

Gaming crypto's takes a very different and patient approach, as the 'Boyz' have a lot to lose if crypto's take hold. "They" need to work it from a different angle. They will be persistent, but so shall we!

It's a game changer, and it will not play out over night. We will see a lot more events like this to come, but I believe the overall trend is up! It's just the first inning. The fundamentals haven't changed.

@Hive-mind, whats your perspective on overall stock and bond markets !!! do you feel a rigged game.I'm asking because i see no co-relation to overall markets to that of stock market.Whats your view??

Now that's a loaded question indeed. I have been in this game a long time and truth be told, I have never experienced a time where the manipulation is more evident than ever. You can see evidence of this everyday. For instance, having all the big tech companies down and yet the market was still up...Really?

All fundamentals are gone, there is no logic to this stock market. It's always buy the dip, despite many sectors having real economic problems. You're looking at something that can't afford to go down for fear of a complete loss in confidence. Zero interest rates for as long as any one can remember doesn't bode well for a false economic recovery story that has been peddled. Them raising interest rates now is just enough to save face.

Trading allows you to get in and out without having the full risk of the trap door suddenly opening up on the stock market. You must learn their game if you want to play it successfully, it's their rules and they can rig it anytime they wish.

My focus is now on cryptos, much harder to manipulate. For me it's one stack to buy and hold, the other to trade. It's the future and it has long legs...