Analysts fear Bitcoin Price Crash as EU Struggles to Survive

One could easily argue that bitcoin has had more important news affecting it in the past month than it has in the past year.

It's recent 160% price rally has accompanied a great deal of content highlighting the contrast of bitcoin's halving to fiat's explosive increase in supply, suggesting that this is some of the most bullish news there could be for bitcoin. Except, is it?

There is one major macro-economic concern which could give bitcoin a ride for it's money. Approaching 30 years of existence, the EU now faces a serious threat of failure for which Brexit may just have been the trigger.

According to a forceful Twitter thread by Tuomas Malinen, CEO and Chief Economoist of GnS Economics,

"The breakup of the Eurozone is a near certainty."

While popular tweets ought to be taken with a grain of salt, due to their nature of often being exagerrated for effect, Malinen raises important concerns which cannot be swept under the crypto bull rug.

The long and short of the tweet can be summed up as follows:

- Germany's Constitutional Court made a staunch ruling regarding the ECB, suggesting it is entertaining thoughts of withdrawing from the EU.

- The bailouts being proposed to counter the COVID-19 outbreak may cause citizens of creditor countries to object to their taxes being used to bail out banks of other financially distressed countries, thus eroding the cohesiveness of the union.

- The "unlimited QE" that the EU is currently implementing will serve to further distend the already high sovereign debt burdens of key European countries.

According to Travis Kling - founder of Crypto Asset Management firm Ikigai and former manager of a $200m Equity Portfolio - this is an important macro-economic factor to consider for bitcoin's price. He explains in a tweet that this would lead to investors wanting to take risk off of the table, thus leading to a crash in bitcoin's price.

Interestingly, he notes that this could subsequently be a principal cause of "hyperbitcoinization", a state where Bitcoin becomes the world's dominant form of money.

Despite bitcoin's delirious price rally, it was only last month that the king of cryptocurrencies endured a devastating 45% crash on Black Thursday.

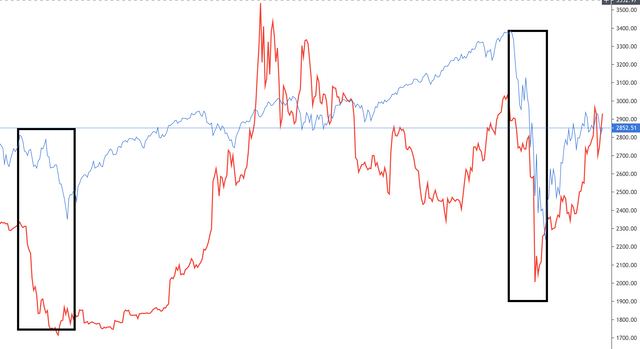

Bitcoin has had a strong correlation with the largest retracements of the S&P 500, in spite of the effort of a myopic retweet by bitcoin's largest (unofficial) Twitter account to suggest otherwise, as can be seen below.

In conclusion, the very factors which present excellent arguments for buying and using bitcoin over fiat - a crumbling of existing financial institutions - are the very factors which will likely lead to large interim crashes in bitcoin's price.

Want to connect and see more of my content? Follow me here at @hooked2thechain, follow me on Twitter, subscribe to my YouTube channel or follow me on Publish0x.

Note that this article contains a referral link and I may earn a small commission for my effort in spreading the word about crypto if you click on it.

Image Source [1]