📉 Crypto Meta, Jan 14-20, 2019: Cryptopia Exchange Hacked, BitMEX Closes Its Services, ICOs Raised $160 Million and more

Results of the week: Bitcoin is held at around $3500-$3600, being in the red zone. Hard fork of the popular blockchain Ethereum has been postponed to the end of next month, the Cryptopia exchange experienced a hacker attack, which certainly had a negative impact on the overall landscape.

Shutdown of US Government Freezes SEC Activity, But We Still Can Hope That Decision on Bitcoin ETF Will Be Taken

At least we can think so.

At the moment, the global cryptocurrency market is still awaiting a decision regarding Bitcoin ETF, which has been scheduled for a later date. Probably, investors would also like to get some answers, regardless of whether they are in the United States or not, however, it is important to recall that the shutdown of the American government also affected the activities of the SEC.

At the moment, the SEC, one of the main institutions "controlling" Bitcoin and cryptocurrency, continues to work with limited personnel, which has a negative impact on the regulated market. Although there is still some time before February 27, the final date associated with the Bitcoin ETF decision, some have already begun to worry. But, according to Jake Chervinsky, the SEC continues administrative proceedings, so we can assume that the consideration of ETF appliactions has not been delayed yet another time.

Recently, the popular analyst Brian Kelly also expressed his view on the Bitcoin ETF case. According to him, there is "no shot” for that.

Constantinople Hard Fork Activation Has Been Scheduled To Hit On February 27th

One of the most significant occasions of the week in the cryptocurrency world is the upcoming launch of the Ethereum hard fork, Constantinople, which was set to happen in January 16-17th (18-19). However, a few days before the scheduled date, Ethereum developers discovered a critical vulnerability in this update, which was the reason to postpone the activation to the end of February. Now it is argued that the release of the upgrade will occur on (approximately) 27th February 2019.

At the devs conference, it was also decided to organize two stages of the hard fork, that is, to make the update gradual. The reason is that the bug has been discovered only after a while, when the 1/2 of the network nodes had been updated to the new client which containing the vulnerability. Now, of course, the correct upgrade without errors is necessary for completing the hard fork, and it also applies to those networks that have already been updated. Péter Szilágyi, developer, explained:

"My suggestions is to define two hard forks, Constantinople as it is currently and the Constantinople fix up which just disables this feature…By having two forks everyone who actually upgraded can have a second fork to actually downgrade so to speak."

Turning to the details, it is likely that the ProgPOW update is also in question. This another piece of the puzzle, ProgPOW should block ASIC mining in the Ethereum network, however, the developers have noticed criticism of the community and may probably change their mind. There are also some other important issues like the cost of gas and the future development of the network as a whole. But, watching what is happening now, we see a lot of theses and so few stable results.

New Zealand Exchange Cryptopia Hacked, from $2.5 to $14 Million Stolen

The one more thing that happened and, probably, made the cryptocurrency market to go deeper, following the negative trend is the hack experienced by the New Zealand-based exchange Cryptopia. The exchange discovered a security breach that led to significant losses on January 14 and reported this officially on Twitter.

Cryptopia said it would remain in maintenance mode and would not resume trading while the police's investigation continues, and the problem isn't resolved yet. Further, in the course of the proceedings, other facts became known. So, it is likely that some stolen funds have been transferred to another exchange, Binance. Later, Changpeng Zhao (Binance CEO) confirmed that some of the missing funds have been found on Binance. These funds are now blocked, as stated by Zhao, who added a comment about the situation:

Just checked, we were able to freeze some of the funds. I don't understand why the hackers keep sending to Binance. Social media will be pretty fast to report it, and we will freeze it. It's a high risk maneuver for them. https://t.co/i0PeahLzic CZ Binance (@cz_binance) 16 jan 2019 г.

Now there are many cryptocurrency exchanges in the world, and new platforms continue to open almost every week. And the hacks like that cause mistrust among users, so we understand that exit-scam is one of the versions why money could disappear in a falling market. The police of New Zealand joined the investigation of the incident, checking this version of the incident also. As for the losses, the amount of about $14 million has been announced so far.

Precedent: Two Leaders Of The South Korean Crypto Exchange Sentenced To Prison Because Of Overestimated Trading Volumes

Previously, several studies have confirmed the fact that cryptocurrency exchanges regularly overstimate their trading volumes.

Such actions have many negative consequences, both economic and for investors personally. However, this is probably the first time when overestimated trading volumes has been classified as a crime. The prosecution took place in South Korea, where cryptocurrency exchanges are under the close supervision of state structures today.

The two accused owners of the exchange fabricated 5 million transactions on their platform in order to deceive investors, who received this data as natural volumes. As a result of the fraud, Choi and Park earned $45 million. The source also emphasizes the possibility of automated trading.

The judge said:

"Choi has committed fraud for a countless number of victims for a long period of time… Futhermore, he holds the financial authorities responsible for failing to keep track of the industry better.”

CBOE CEO: The Bitcoin Market Needs Exchange-Traded Notes (ETNs)

The idea that crypto market will begin to grow with the help of traditional market institutions still lives on. According to this concept, ETFs, ETNs, OTC platforms and other non-cryptocurrency markets can positively affect the prices of digital assets. It is likely that the CEO of the Chicago Stock Exchange (CBOE) is of the same opinion.

During a press conference, Tilly mentioned that the Bitcoin trade in the CBOE was insignificant due to the lack of specific investment instruments in the market. CBOE CEO states that such an approach could be more beneficial for retail investors because of the specific mechanism of the ETN. He said:

"The power of having that future there is also having an ETN that is more attractive to retail, and then institutions can lay that risk off on the listed futures market… Absent that leg and introducing trackers or notes, I think we will be in this, ‘it trades every day, but it is not the store."

At the present moment, Tilly promotes CBOE VIX, CBOE's index that measures market volatility and so on. It is not known whether the exchange will take other initiatives to create cryptocurrency platforms/instrument or not. At least there is no information about this now.

Media: BitMEX Closes Its Service For Us And Quebec Customers, Representatives Deny It

According to media reports this week, BitMEX, one of the largest cryptocurrency exchanges, deactivates trading accounts of clients from the United States and the Canadian province of Quebec. Most likely, this is required by regional regulators. So, in the USA and Canada, this may be due to the intensification of the fight against unlicensed cryptocurrency platforms. And although it is definitely not possible to establish where the cash flows to BitMEX come from, it is clear that when trading is deactivated in the USA and Quebec, the exchange loses a significant market share.

Joe Coufal (Wachsman/BitMEX) said:

"BitMEX has banned all US traders since 2015, and has been proactively closing accounts since guidance was obtained by US regulators, in particular the Commodities and Futures Trading Commission (CFTC)"

The canadian representative of Autorité des marchés financiers (AMF) claimed:

"BitMEX is not registered with the AMF and is therefore not authorised to have activities in the province of Quebec [...] We informed this company that its activities were illegal"

BitMEX, the cryptocurrency exchange located in Hong Kong, is one of the most expensive companies on the market. And although the US Securities and Exchange Commission (SEC) have not yet commented on the information related to BitMEX, as well as the head of the exchange Arthur Hayes, the words of 2 other regulators probably confirm the letdown between the platform and the law.

Later, BitMEX responded to the claims:

"Unfortunately, the SCMP article sensationalized what went on with the Authorite des Marches Financiers (AMF). The AMF reached out to BitMEX with a request to assist Quebec regulators in identifying and closing accounts from Quebec. Throughout the execution, we kept the AMF updated on progress. And upon completion, the AMF informed us that they were satisfied with the expeditious completion of the request."

ICOs Raised $160 Million in First Half of January

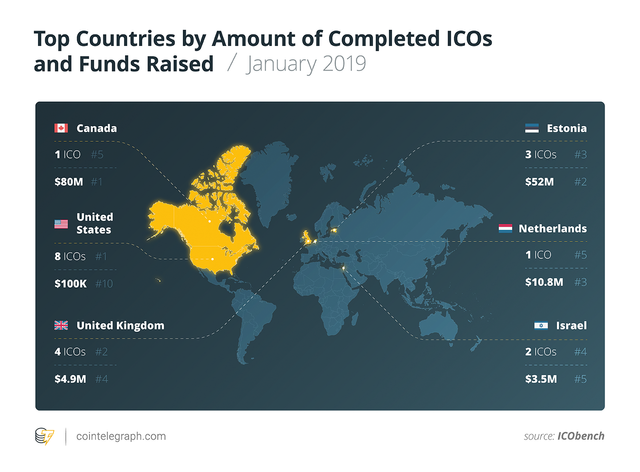

According to the regular half-month study by ICObench, various ICOs collected a total of about $160 million during the first weeks of 2019. Moreover, the 1/2 January investments capital amounts to 33% of all funds raised by cryptocurrency startups in December, which means a rather gradual decline in the market, as far as can be expected. In January, the ICO market also has its leaders; half of the funds raised account for one project.

Starting from the new year, such countries as the Netherlands and Canada are leading in terms of investments in the initial coin offerings, Israel is in second place, Estonia is in third. Moreover, the United States occupies only the 8th place in this list. It is interesting observe how ICOs will evolve in 2019, given the new regulatory measures taken by a number of governments.

Bittrex Launches Asia-Oriented Exchange

Bitsdaq launches a digital asset trading platform using Bittrex technology. This platform is focused mainly on the Asian region. The website of the new exchange is available in Chinese. Other details are unknown.

It also became known that Bittrex will launch the OTC platform, which provides the possibility of operating with 200+ cryptocurrency assets. What is also important, the cryptocurrency exchange is focused on operations worth $ 250,000 or more, at least its creators promise to ensure the possibility of such transactions. Interestingly, earlier, amid a downturn in the market, new options for so-called "whales" only continued to appear.

Swiss Bank Vontobel Will Provide Custodial Cryptocurrency Services

The new solution called Vontobel Digital Asset Vault will allow banks and asset managers offer their customers a full range of services for trading and operations with cryptocurrencies. According to the company itself, "so far none of the traditional custodians in the market have had such a solution that would meet the standards required by financial intermediaries in terms of the safekeeping of digital assets and comprehensive service offerings.”

There are not so many custodial and other specialized cryptocurrency solutions on the market today. It is likely that some cryptocurrency exchanges/platforms will sooner or later start to use such tools to continue to provide services for their clients.

🏛 Anonymous cryptocurrency transactions may become prohibited in the Netherlands | The Stock Exchange of Thailand (SET) plans to apply for a cryptocurrency operating licence | Chile plans to set cryptocurrency taxation in 2019 | Wyoming is introducing a bill according to which crypto will be legal as "ordinary" money

💱 BitTrade (Japan) has been relaunched as a part of Huobi Group | Binance's crypto-to-fiat european exchange has been launched | Ethereum co-founder Joseph Lubin joined the ErisX's board of directors

💸 Bitmain closes its overseas office in Amsterdam | USDC has successfully completed an audit by Grant Thornton | Grayscale Investments launches Stellar (XLM)-oriented fund

👁 Research: 64% of the Lightning Network capacity is controlled by LNBIG.com

Cryptopia, a cryptocurrency exchange in New Zealand, is all set up to relaunch with advanced options and features.

What's point of view on Cryptopia relaunch?