Dirty time for investment funds in cryptocurrencies

Since the beginning of the year, investment funds in cryptocurrencies have been hit hard by the fall of crypto-markets.

Crypto-funds plunge

According to the Financial Times, investment funds in cryptocurrencies have recorded an average decline of 35% since the beginning of the year.

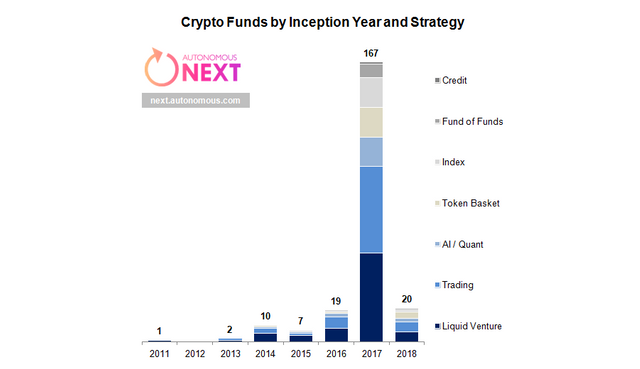

Figures that contrast sharply with those of 2017, year in which they had soared by 2,700%. 167 investment funds specialized in digital assets were then launched, against only 19 in 2016:

But crypto-markets have had a complicated 2018 year. The prices of digital currencies fell sharply, while the few hopes of recovery that were observed were soon extinguished.

Henri Arslanian, FinTech's Asia-based ecosystem director and Crypto of PricewaterhouseCoopers, said:

I expect crypto markets to remain volatile in the near future. But while retail investors may view the volatility of digital asset markets as a disadvantage, many crypto-fund managers perceive this volatility as an opportunity.

Bitcoin, the first cryptocurrency, is now trading at less than one-third of its historic price last December. At the same time, crypto-funds are suffering from the decline recorded by the majority of digital assets since the beginning of the year. In April alone, nine investment companies closed, while only two of the top 25 crypto-funds managed to make a profit.

New hopes?

Bitcoin Investment Fund Despite this decline, there are positive signs for investment funds in digital assets.

The latest statements of the gendarme of the US stock market - which judges that neither Bitcoin nor Ether are true financial securities - seem to have offered a stay in crypto-markets, which have stabilized in recent days. With the two main cryptocurrencies shielded from a strict regulatory framework in the United States, institutional investors could be encouraged to turn to these markets in the coming months.

In addition to regulatory fears, Arslanian attributes the recent drop in prices to the lack of tools that would allow non-insiders to easily obtain cryptocurrencies.

The man also believes that an influx of large investors in this sector could have a significant impact on the market. This arrival could be facilitated by the initiatives of companies like Coinbase and Goldman Sachs, who decided to launch products for investment companies. With the emergence of clear regulation and trustworthy custody tools, many observers believe that a recovery should soon emerge - a recovery that will benefit crypto-funds.