All Coins Crashing? Correlation matters! Weekly CryptoCorrelation Update (ending Mar 16)

Hey traders and/or investors alike!

Have you ever wonder if adding another new crypto to your crypto-portfolio actually adds or reduces risk?

Do you remember last time when all your cryptos crashed together and you were in pain?

Is your crypto-portfolio diversified?

Here might be something that could help you manage risk and avoid concentrated positions. If you cannot stomach the pain of huge swing in your crypto-portfolio, you may want to consider owning some coins that are less correlated with the other big positions you own.

If you have studied statistics in school you might have heard about correlations.

No worries if you don't recall correlations. Here's in layman terms what correlation represents:

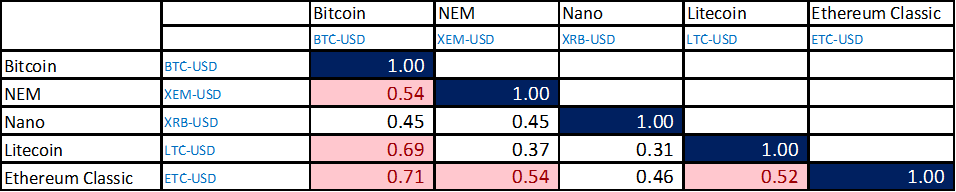

Correlation describe the relationship between two variables/assets

Correlation ranges from -1 to +1

Closer correlation to +1 means the two assets have position correlation so and up move by one asset is likely matched by an up move by the other asset, and vice versa for down move

Closer correlation to -1 means the two assets have inverse correlation so and up move by one asset is likely matched by a down move by the other asset, and vice versa

Correlation of 0 means that's no statistical evidence that a correlation exists

Let take a look at the top 5 noteworthy cryptos for this week as these seem to have some interesting correlations with most major cryptos:

Top 5 Noteworthy Cryptos

Here is a set 25 major cryptos' correlations against Bitcoin (a.k.a the mothership of all things cryptos).

(recent date range: 2018-02-02 to 2018-03-16; correlations calculated based on 30 daily returns)

Feel free to suggest other coins that you think are worthy of a correlation analysis and I will try to incorporate in the next update :)))

TO FOLLOW - @infinitesimal

For future viewers: price of bitcoin at the moment of posting is 7549.60USD