Bitcoin whales accumulate massively BTC: what can private investors learn?

The Bitcoin Halving is now a good 2 weeks old. Since halving a lot has happened not only in the hashrate. Bitcoin whales have an interesting pattern.

In recent weeks, these have massively increased their stake in BTC and are therefore buying more Bitcoin. In this article, we look at whale accumulation, the potential impact on the Bitcoin course, and what private investors can learn from it.

Bitcoin exchange rate slightly downtrend since Halving

Let's start the article with a snapshot. For this we take a look at the Bitcoin price of the last 30 days. We particularly look at its performance since halving.

We can clearly see that the bitcoin price plummeted to around $ 8,600 just before the halving. The price has risen again since May 11, 2020, moving towards the $ 10,000 mark. The preliminary high point was reached on May 18 at around $ 9,900.

A few days later, on May 20, the Bitcoin exchange rate plummeted again, initially pushing the BTC to $ 9,400 and then to $ 8,900. Bitcoin is currently trading between $ 8,800 and $ 8,900 again.

Whales have been accumulating BTC since May 20, 2020

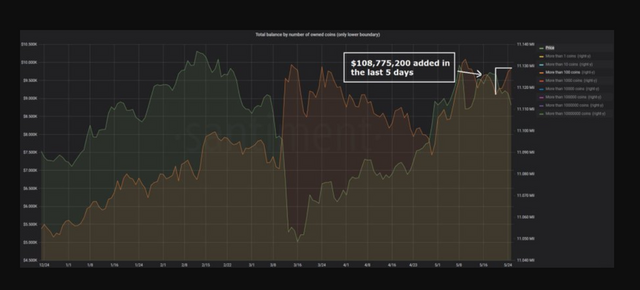

According to current data from the analysis portal Santiment, bitcoin whales have started to massively accumulate BTC since May 20, 2020, i.e. the beginning of the short-term downward trend.

The graphic below shows that wallets with a balance of more than 100 BTC accumulated a total of more than 12,000 Bitcoin. This is equivalent to around $ 108 million.

This is exciting in that whale market behavior is often used to get a general feel for the situation on the crypto market. Due to their market power and the high number of Bitcoin alone, whales have a certain dominance in the market.

At this point, one may ask whether someone with at least 100 BTC (about USD 1 million) can already be called a whale.

Back to market behavior: When whales accumulate bitcoin, this often indicates a medium-term upward trend. Because buyers speculate on an increase in price. If many BTC is withdrawn from the wallets, this is definitely a bearish indicator as there is selling pressure and a stronger supply on the market.

Bitcoin and the psychology of the whales

Santiment also notes that entities with large amounts of Bitcoin have shown characteristics of day traders in recent weeks. The amount of BTC increased significantly during short-term dips. Shortly before local highlights, the Whales sold Bitcoin to take profits.

Still, we have to be sober that a total purchase volume of $ 108 million is not yet strong enough to tip BTC into a bullish scenario. On the other hand, it shows - and now it is also becoming interesting for private investors - that despite the (historically) relatively high price, whales are interested in increasing their holdings of Bitcoin.

This in turn underlines the need and desire for a permanent store of value. Even if the global unrest around Corona levels off again, some investors have probably drawn their consequences. BTC comes first as a hedge.