Top 3 Psychological Mistakes Made By Crypto Investors

Top 3 Psychological Mistakes Made By Crypto Investors

Now that we're all deep in the red (congrats if you had sold in time!) it is time for reflection.

The crypto market has been overwhelmed by newcomers in the space. I've seen them all make exactly the same mistake. And for these people, this is the first crash, the first lesson.

Here are the top 3 psychological mistakes I've noticed.

1. Bitcoin is too expensive. Better to buy abother coin that is still $1.

Ripple is about $1 a coin. It has a marketcap of $39.207.886.439. If it could reach $15000 like Bitcoin, that would mean a marketcap of 15000 * $39.207.886.439. That's more money than exist on earth.

What is important, is price and supply: the total amount of coins there are. There are many more Ripple's than Bitcoin's, that's why the price is much lower.

You have to look at marketcap, that is the price vs total supply.

You can buy a half bitcoin, a quarter bitcoin, or 0.00001 Bitcoin. A coin isn't expensive or cheap based on price below.

2. I'm buying Ripple because my nephew has made 100% on it in a month.

Many people tend to buy at the top because that's when they heard it the most around them. When your friends are making double digit gains its hard to ignore. It also means we're likely at a top.

3. I'm selling. This could go to zero!

When panic is at its highest, that's a good time to buy.

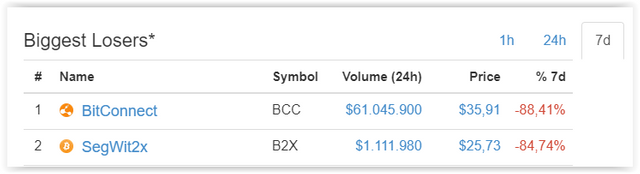

Many of the coins in coinmarketcap could definitely go to zero. Teams can stop working, blockchains can be hacked, the community could disappear, or there could be a major recession in the market. Some coins will go to zero like Bitconnect is now doing.

Bitcoin will not go to zero. Ethereum, Neo, these are major platforms with lots of community and partnerships. They will live on.