Best Bitcoin Investment Strategies for 2018?

How do we make the best profit investing in cryptocurrencies like Bitcoin? Which wallets and exchanges are the safest to keep our money in? Where do we cash out our digital currency to fiat currency like USD? Why is going all-in preferable for many compared to diversification? When will the cryptocurrency market show the best time to buy and sell?

Hopefully this blog post will be useful in empowering each of us to answer these questions in a way that perfectly matches our situation today.

Best Bitcoin Investment Strategies for 2018?

What's the best plan to profit with Bitcoin and any other cryptocurrencies?

Would you read this post or watch the video at the end because it contains a safe and simple system to diagnose what uniquely will be best for each of us as there's not one exact formula for everyone to use?

The key with making a profit strategy that's personal is to get to know ourselves. I've discovered over years of buying and selling, trading and now holding, making money and losing money, missing out on opportunities that cost more than everything else combined essentially that the best plan for me is something safe and simple, and that is from my own self-knowledge, and I realize that's not the right plan for everyone else.

What I will do here is go through some different options that I hope are useful depending on what you uniquely want to do.

If you are married, if you have one job, if you are consistently in a long-term commitment with places you volunteer, if you are very habitual and routine oriented, which I am, I suggest just to going all-in on one currency and sticking with it.

This is simple because it allows for not worrying about what the rest of the market is doing.

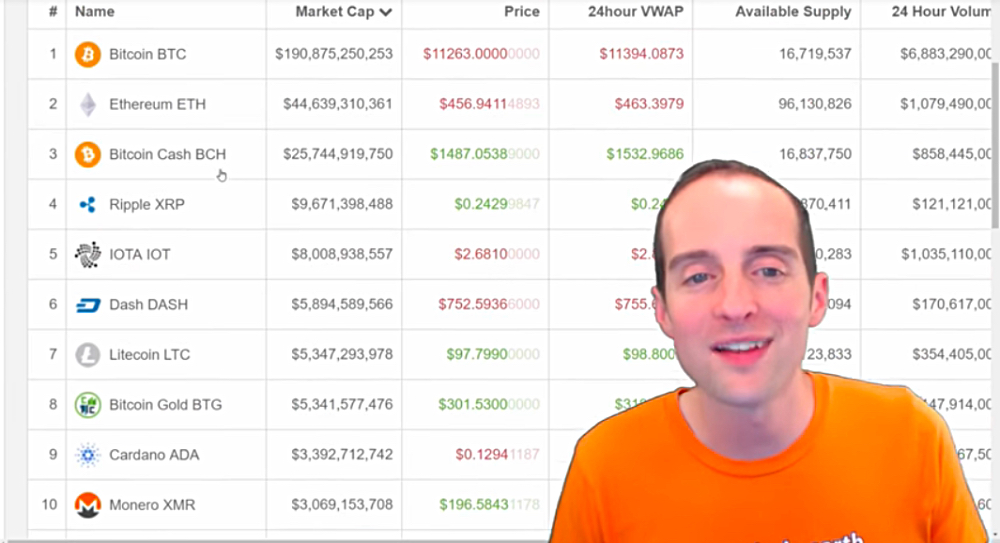

Now, there are so many currencies, so how do you choose one?

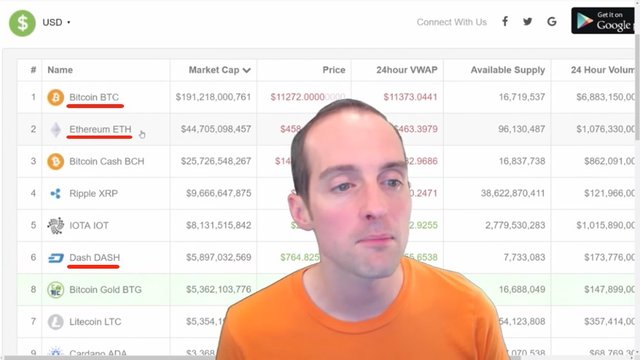

Sometimes, it may not be easy to just choose one that you go all-in on. I was all-in on Bitcoin to start with, then I bought some Ethereum, which I sold at $15.

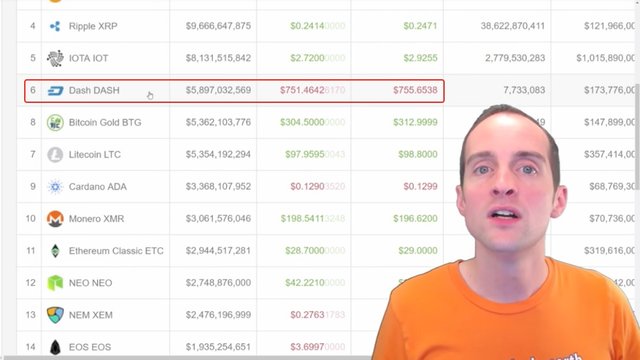

Then I went all-in on Dash.

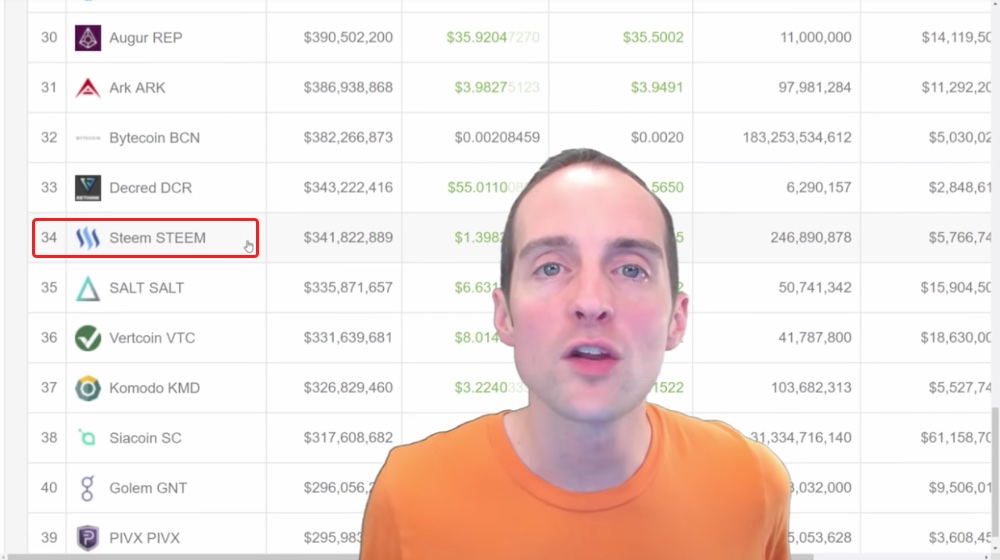

I had a Dash masternode when it only cost $11,000, and it's over a million dollars today to get one. I sold my Dash at $85, and then I went all-in with Steem.

I now feel that I'm in the right place with Steem, that this is a community that I want to be a part of indefinitely. This is the right place for me.

Bitcoin didn't feel right. Ethereum and Dash didn't feel right. I wasn't comfortable there. I didn't feel that I could make my maximum contribution to the blockchain in any of these cryptocurrencies.

I felt like I started too late in Bitcoin.

I felt like I didn't really know what was going on in Ethereum, that things were too complicated for me.

I felt like the community in Dash already had their video producer and they didn't want another one.

I feel like what I have to contribute in Steem is very valuable.

I recommend this strategy.

You don't have to pick Steem like me if you don't want to, you have the option to pick any one of these cryptocurrencies and to essentially go all-in. Going all-in means that all the holdings or say 95%, or the majority of them, are in that one currency.

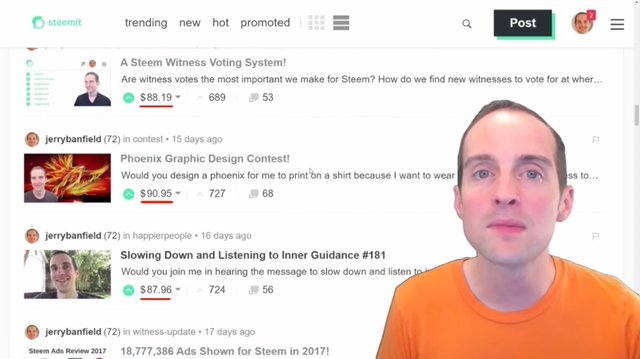

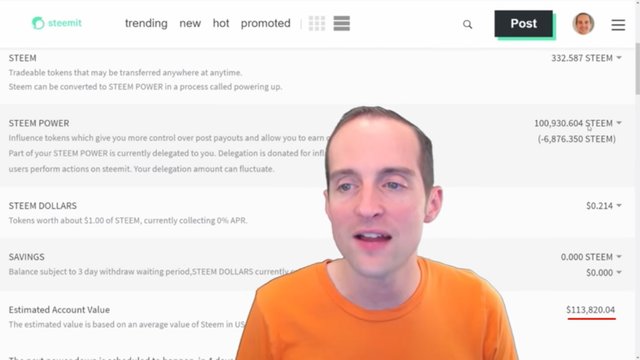

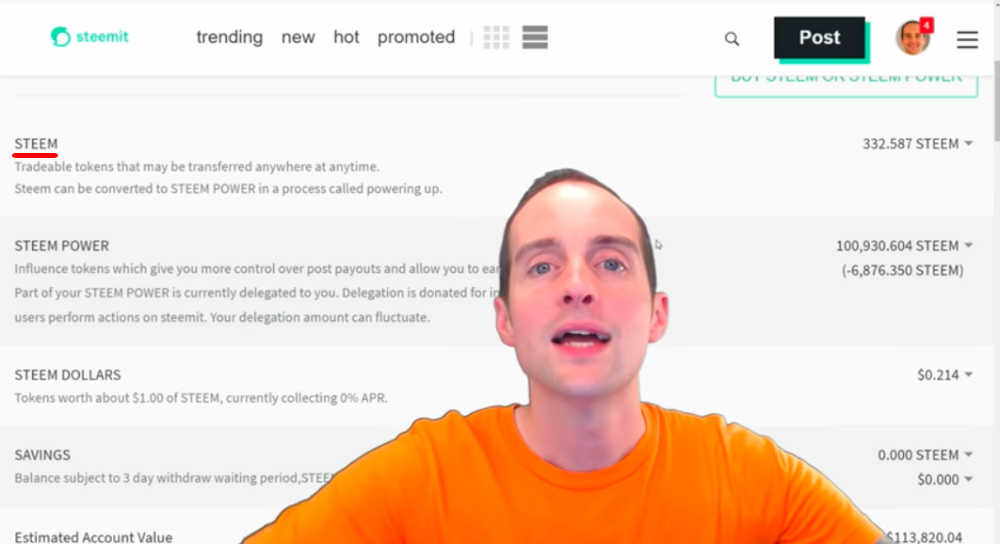

For me, this is Steem because I can blog and make money on Steem, I can be a witness, I can earn rewards just by upvoting other people's posts and I get interest on my Steem.

In my opinion, Steem is 10 times better than Bitcoin and it's 10 times better than existing blogging platforms, which makes for an ideal environment for me who is a blogger, who has one spot to go all-in.

Steem is an ideal platform to be all-in on because it shows our wallet exactly how it is. It allows us to have tons of ways to earn in exchange for being all-in.

If I'm all-in on Bitcoin, the only way I make money is if the price goes up. Or I can loan my Bitcoin out, and then potentially lose it. That's the same thing, if I stake my Ethereum, then there might be some other opportunities. With Dash, when I had a masternode, there was a great opportunity to earn Dash payments, which would be about $1,000 a week right now. That Dash offers a good opportunity, if you can get together $756,000 in Dash today, there's a good opportunity to earn in relation to that.

Steem is the one currency I personally have found that offers the most opportunities uniquely for me to both give to the community and to receive. Therefore, I think the best option for a lot of us is to pick one currency where we can actually influence what happens with it.

You see, when I'm all-in on Steem I have an impact on what happens with Steem. What I contribute helps build the value of the blockchain. That's the same with Dash, I take some credit for the Dash price being where it is because I helped promote Dash, I talked about Dash.

A bunch of people who bought Dash when it was cheaper bought it because of my recommendation. I have, in fact, at least one directly tracked masternode sign up.

Now, I did a foolish thing essentially with Dash. I cashed out before I realized all the returns on my investment promoting Dash. Every day, people are still watching my Dash videos on YouTube.

Steem gives me the ability to essentially invest not just money, but time and energy and then continue to promote Steem just as it is happening here. That's why I'm suggesting all-in is truly the ideal strategy for a profit plan, and I trust you to pick whatever community is right for you. Each currency is basically a community and each community offers unique opportunities. I say go to whatever community attracts you.

I was attracted to Steem. I was attracted to Dash. I was attracted to Bitcoin. I blundered into Ethereum and quickly blundered out of it. I was attracted into each community. If you feel attracted into one certain community, then by all means, get into that community and go all-in with it.

All-in helps with maximizing return, but all-in also makes us extremely vulnerable to getting wiped out completely, which I'm okay with because let's say my 100,000 Steem instead of being $113,000 goes down to one dollar, then I've got some free time on my hands.

I can stop fooling around with Steem and doing anything mentioning Steem, and maybe cryptocurrencies in general. I can do something like gardening or spend more time making music, which I would have done if I'd known I had this much time this morning.

You see, going all-in is just like having a partner. It's much easier. I know with having my wife a lot of things that if I'm single are uncertain. It's very easy mentally and simple to just be with one person, to be with one job, to be with one volunteer organization, to live in one house, to own one car. We own two cars now, but what we do, my wife has one and I have the other, and it's just more complicated even than having just one car.

At the same time, I realize everyone does not want to go all-in. I've made the benefits of all-in clear, but at the same time, I will also make some of the benefits of not being all-in clear.

Not being all-in has its advantages.

For example, if my wife dies, it is a complete and utter devastation in my life. Whereas, if I had several goddesses like Charlie Sheen, one of them died I guess it might not be such a big deal.

I know that tried to be a joke, but I will trust you to interpret that in love.

In other words, if I had a bunch of different girls I was just dating and something happened to one of them, it wouldn't be as devastating as having something happening to my wife.

You can clearly get that point.

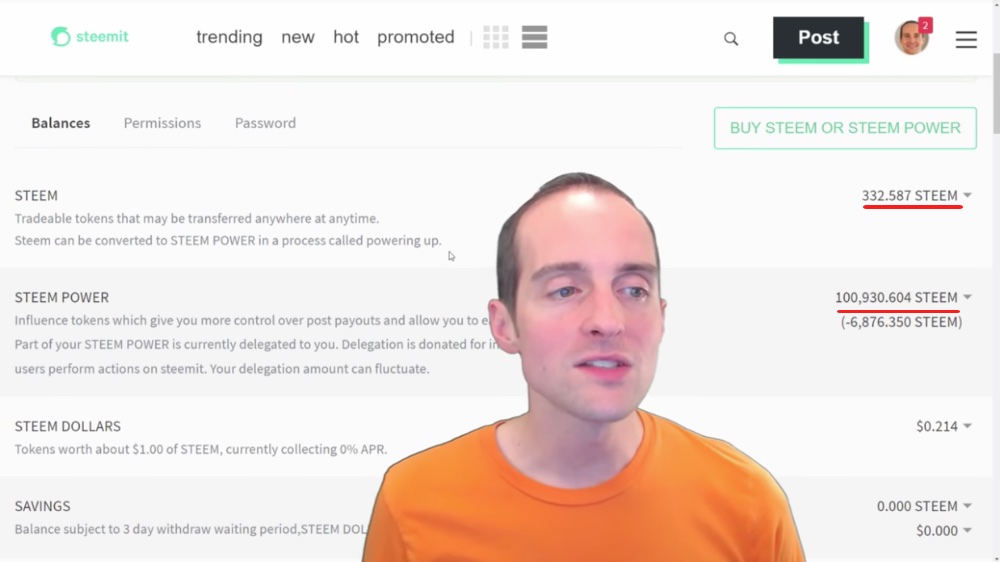

That's the same thing with currencies, if you are all-in on one currency, like I'm all-in on Steem, if Steem gets wiped out it will be utter devastation. Steem is my entire investment portfolio, I have nothing else, I sold everything for Steem.

Sure, I can get wiped out, but at the same time if something happens with Bitcoin, then Steem may or may not go down with Bitcoin.

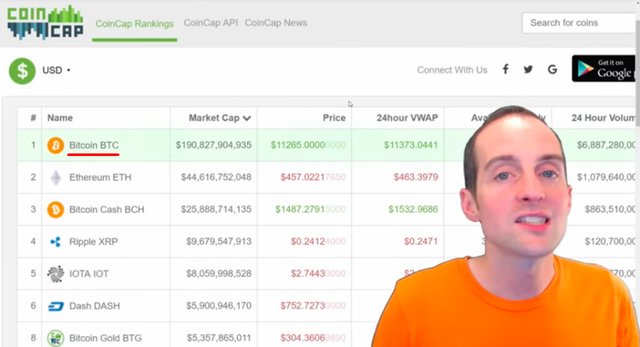

Now, holding several different currencies has additional benefits. If I had held a bunch of different currencies instead of holding Steem, in the short term I would have made a lot more money.

If instead of buying 15 Bitcoin of Steem when Bitcoin was $1,000 or so, if I'd have just held some Bitcoin, put it into Ethereum, and put it into a few others, I'd probably have made a lot more money in the short term because Steem is essentially the same price as when I bought it meanwhile Bitcoin is about ten times the price.

I would have made ten times as much on holding some of these currencies as I would have made on others.

Therefore, having a diversified portfolio allows for more chances to win, which is really nice when some of the currencies are likely to go up ten, twenty or a hundred times.

Dash is up 70 times from when I bought it.

Bitcoin is up almost 60 or 70 times from the lowest I bought it at.

Lots of these cryptocurrencies are up a lot from where they were whenever I could have first bought it.

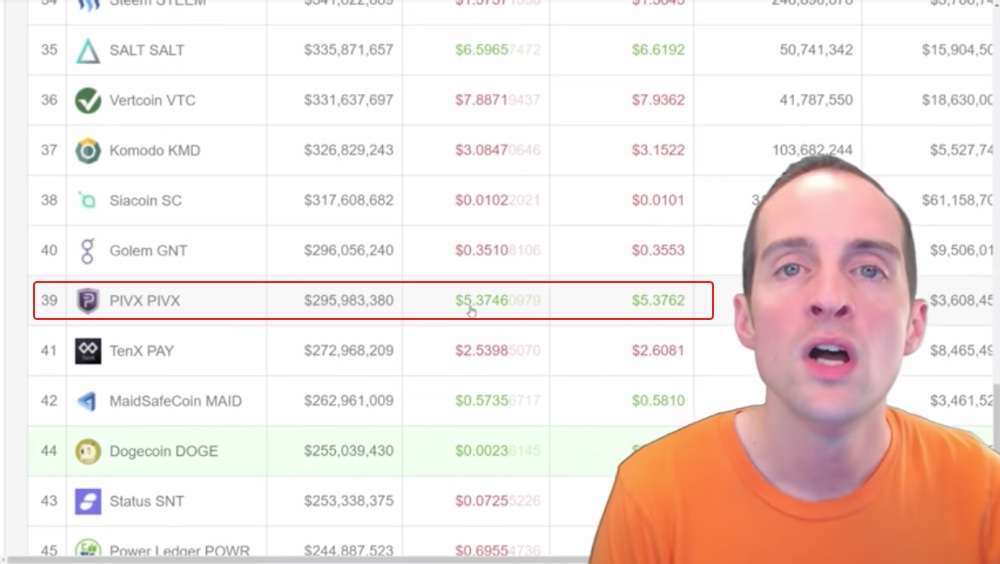

What's PIVX at today?

I could have bought into PIVX or I actually did buy ten Bitcoin of PIVX, enough to have a masternode when it was $1 something, and now it's $5 plus.

If I had hedged my bets more and not went all-in on Steem, I'd probably have three or four times as much US dollar value as I have today.

If I sold everything, instead of having 100,000 in Steem I might have several hundred more thousand, and that's okay. That's the benefit of having a diverse portfolio, if the entire market goes up, you stand to benefit. A diverse portfolio is good if you don't want to commit to one community, if you don't want to just do Steem all the time.

If you just like trading and messing around with all these different numbers, then sure, having a diverse portfolio could be a good way to go, and in that case the diverse portfolio takes a lot more time and energy to maintain.

You see, what's nice with Steem is, I've kind of got one thing to maintain here. I've got my Steem wallet, and then I've got everything in my account, which is nice because my account just can't get instantly cleaned out if I have Steem Power.

My account must be powered down, and then only essentially 1% of my Steem can come out of it every day and made in weekly payments. Let's say I lose access to my account, not by losing the password because then I can't get into, but having someone steal it, then I actually could fool around and have a chance to not even lose most of it.

Whereas, let's say I'm all-in on Bitcoin, someone somehow gets into my Bitcoin wallet. However it happens, all the Bitcoin is immediately gone and lost.

Having a diverse portfolio makes it more difficult just to manage all these different assets, but again, you are less at risk at losing everything.

I know when I was all-in on that Dash masternode — I can't even imagine it's $750,000 — when it was $100,000 I was paranoid about having something that was so easy to steal. Initially I didn't even have it encrypted, if you'd just got my little wallet private file, loaded it up on your own computer, you could have taken my masternode and sent it off anywhere, and then I built better security procedures up before I then sold it.

That's the problem too with going all-in, it can be very easy to essentially lose something if you have it everything in one spot, but with a diverse portfolio, you have the opposite problem.

You have so many things to maintain that if you have a Bitcoin wallet, an Ethereum wallet, a Dash wallet, a Litecoin wallet, and you got a Steem account, and you got six other wallets, then you are more likely to lose access to one of those wallets.

You are more likely to have some problem that you end up losing that wallet over it. I think the ideal solution for most of these is to have a wallet under our own control, which starts to get overwhelming.

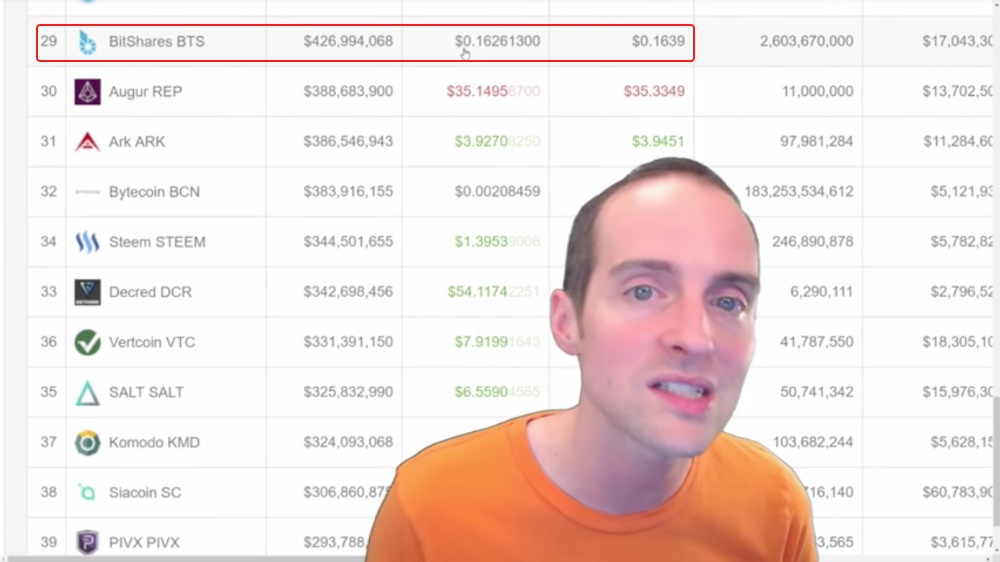

If you really want to have a diverse portfolio you are thinking, "Okay, I need a Bitcoin wallet in my computer. I need an Ethereum wallet. All right, I want Bitcoin Cash, so now I need a Bitcoin Cash wallet. I need a Dash wallet. I need a Litecoin wallet. I'm going to get a Neo wallet too, and then I want to get a Bitshares wallet. I can trade on there."

I was right on that, I said to buy Bitshares at five cents and it's sixteen now. I realize that I'm wrong sometimes, but it's sixteen and I said to buy at five.

Then you got your Steem account and your PIVX wallet. You see, the more you're diversified, the more stuff you have to maintain. Having a bigger house takes more work to maintain, and if you want to hold a bunch of these cryptocurrencies what a lot of us do is just hold them on an exchange.

We say, "Okay, well then I'll just hold all of it on an exchange."

Now, holding on an exchange is an all-in strategy on that one particular exchange. This is a very risky proposition because while individual blockchains might be just fine, while having a hacker individually come on your computer is relatively unlikely, to have someone that hacks your particular computer and steals your particular Bitcoin, it is more likely having it on your own computer to just lose access to it ourselves.

Having your Bitcoin on an exchange is very risky. Having it on an exchange is choosing to go all-in on that one exchange and what if that exchange goes down or if there's some big hack?

While they do have bigger security, they also present much bigger opportunities for hackers.

Why try stealing a little bit of Bitcoin?

Why try taking Steem out of my wallet when you could try to take 20 million Steem out of the Bittrex wallet. It's much better to try to go after the Bittrex wallet than to fool around with my wallet.

These exchanges are magnets for attacking hackers and problems, and even insider theft is probably the single biggest problem. Employees who have access to private keys and wallets. That's a huge temptation to just lift off a few million dollars of Bitcoin, go fly off to another country and live comfortable forever.

Going all-in on an exchange is extremely risky because these exchanges are all fairly new, any of them could totally collapse in one single email.

You could get an email saying, "This exchange has been hacked. We've lost all our funds. Sorry."

That's it!

I think it's ideal to be having the wallets on our own computer, but if we want to hold a whole bunch of different currencies, then we can diversify based on exchanges. There are lots of different markets and exchanges.

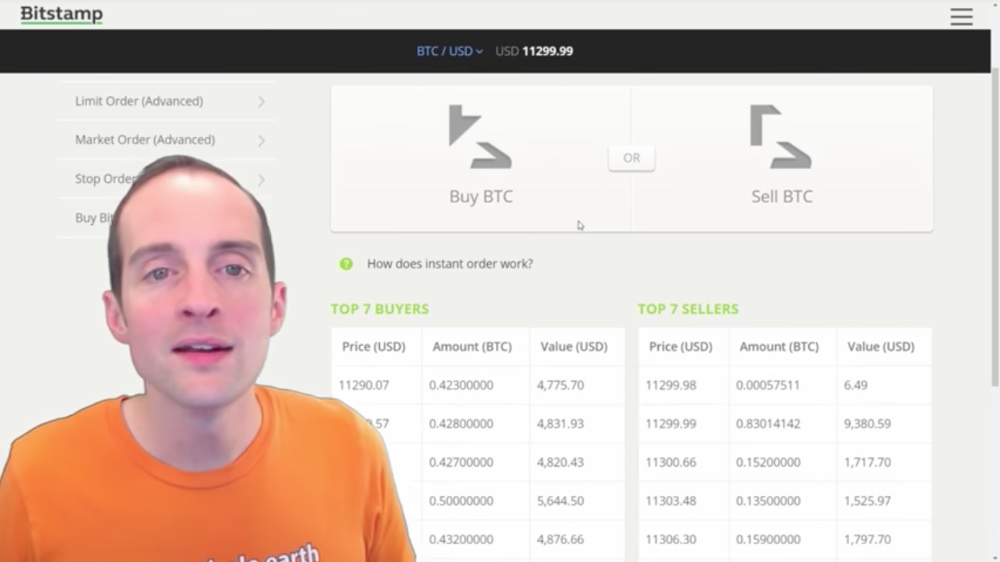

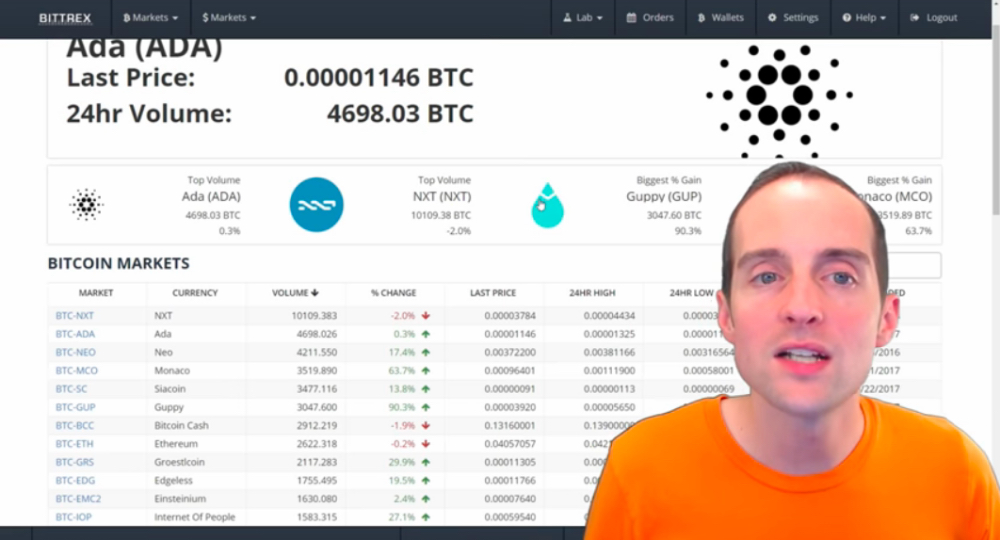

Some of the ones I trust the most are Coinbase and Bittrex, which I use. For trading a bunch of different coins I like Bittrex, and then Coinbase that I think is good. I realize that some people disagree, but I'm very happy with Coinbase, and then I also like Bitstamp.

If you want to have a diversified portfolio strategy with Bitcoin, then having it on several different places is ideal.

For example, if you're all-in on Bitcoin and you want a diversified portfolio strategy in terms of holding it, then it might be ideal to hold some Bitcoin on Coinbase, some Bitcoin on Bitstamp, some Bitcoin on Kraken, and some Bitcoin in a hardware wallet.

Hold the Bitcoin in different places, so that way each of these exchanges has different rules about how to sign in.

Now, probably the ideal solution is to just go all-in if you want to just hold one. Go all-in and have it in one wallet. I've got all my Steem in one wallet.

If you got Bitcoin, it's probably best to get some kind of hardware wallet or get something on your computer that's secure, maybe the Bitcoin Core wallet with a good password and a backup for it. Get it all in one wallet on a computer.

Now, if you want to hold a bunch of different currencies it's probably better to also diversify on exchanges. I would highly recommend if you want to hold more than 10 currencies, without using ten individual wallets, to not holding it all on one exchange, especially if it's an exchange I've mentioned having serious problems in the past.

You can also use your wallets and exchanges to choose which things to hold, like I can hold Bitcoin, Litecoin and Ethereum on Coinbase.

I can hold Bitcoin, Litecoin, Ethereum and Ripple on Bitstamp, and then there's a lot more options on Kraken like Dash, EOS and ETC. There's also lots more options to hold on Bittrex.

If I wanted to have a diversified portfolio, which might include Bitcoin, Ethereum, Litecoin, Monero, Neo, Zcash, Steem and PIVX, then I'd have some on Bitstamp, some on Coinbase, some of the ones that were on Kraken, and then I'd have the rest on Bittrex.

Between or among all those different exchanges, if let's say Bittrex gets hacked, then I don't lose everything because I've got it on different exchanges. But it goes back to the same issue, if I've got it all on one exchange, then if something happens to a different exchange I don't lose anything. If I've got it all on one exchange and that one exchange gets hit, then I might lose everything on that exchange, but the same thing can happen with a wallet.

It's key just to get to know ourselves. If you have a lot of trouble keeping passwords and you frequently have to use the "forget password" link, if you don't have a good password system set up, then an exchange might be best because losing access to one of these hardware wallets would be a disaster.

If I lose my Steem password, I can't get back into my account. There's no one that can help me. I'm locked out forever. I'm done!

It might be better if you know you are not that great with passwords to just use an exchange because if you forget your password, they can help get back into the account most of the time, especially setting things up like two-factor authentication.

An exchange might be better if you know that you are liable to forget your password and get locked out of your account after taking an honest inventory of the past.

I have been talking about different basic strategies because these overall mental approaches are much more valuable than individual prices. Once you get a good mental approach, once you get a good high-level strategy for this, then it's just a matter of diving deeper into each individual currency and into each community.

It's just a matter of doing research and participating. It's pretty much the other 99%, but the most important thing is to structure things mentally in a way that is conducive to making a profit over time given your own unique strengths and weaknesses.

It's too much mental activity for me, too many things to think about to trade cryptocurrencies. I used to have fifty or a hundred different currencies. I made lots of money. I started with a few thousand dollars, two or three thousand, and I made thousands just holding a bunch of currencies on Poloniex, and then they went up a bunch. I made a lot of money just holding onto a bunch of different currencies.

Although I managed to lose money on Steem in that phase, I made money on most of the others that allowed me to get a Dash masternode. The Dash masternode worked itself into $100,000 of Steem now.

All that started with a few thousand dollars and with buying a few dollars of Bitcoin every day. That's the key to profit. Once we've got that high level mental plan in place, once we have figured, "Okay. This is where I want to hold these at. This is where I want to keep my money at," then it's simply a matter of consistency.

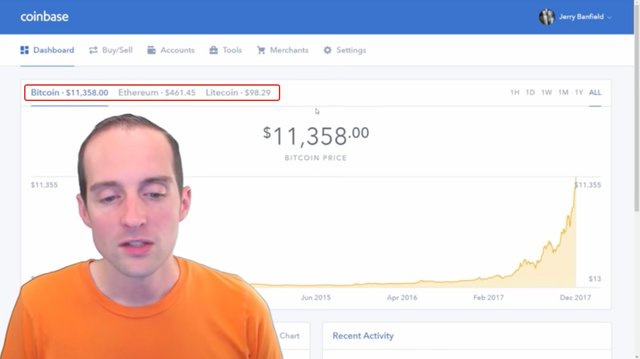

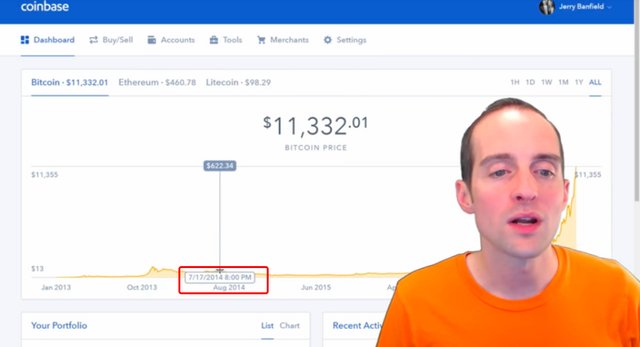

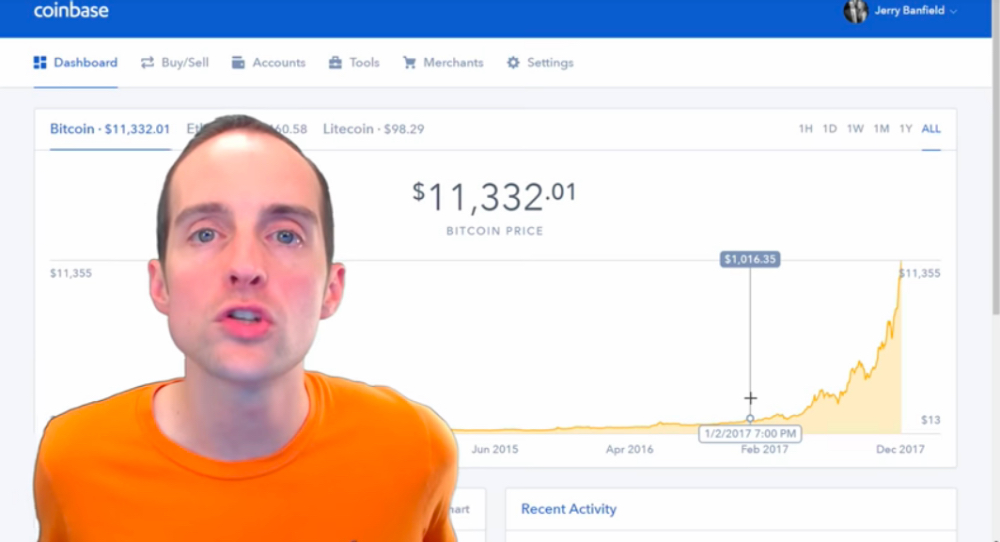

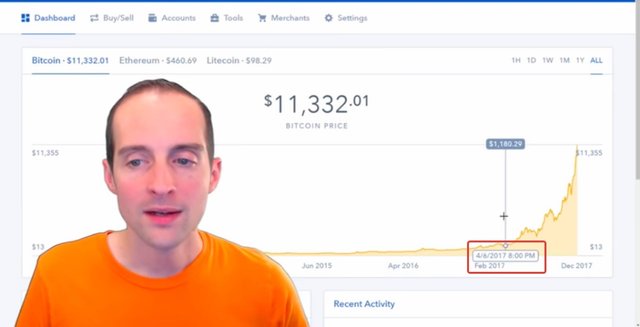

I think the best way, based on doing it wrong a lot, is to just buy in steadily over time and just to hold indefinitely. For example, with Bitcoin I started buying Bitcoin on Coinbase in 2014.

When it was $600 I said, “You know this Bitcoin is going to be a big deal.” Actually, I might even have bought my first Bitcoin earlier, here when it was $600 and I watched the price go all the way down while I was buying it. It went all the way down to $170 one day while I was buying Bitcoin and I bought 20 or 30 Bitcoin at $170.

I bought 10 or 20 at $200 and I went wrong through impatience. I went wrong through not having a higher level long-term mental plan. I just blundered into buying Bitcoin on Coinbase and started trading Bitcoin on Coinbase. I knew it would go up. I was sure the price would go up. When it was at $600 I was certain that someday it would be really valuable, but I didn't have the patience to realize that until I'd lost five plus thousand dollars trading Bitcoin.

I have put in at least ten or twenty-thousand dollars over time and I came out with five thousand dollars, less than I'd put in and that's because I got impatient and I got scared, so I sold most all of my Bitcoin. I had thirty plus of them and I sold at $215 or something like that.

I didn't have much of a mental plan and I was just blundering in, playing around. It was very easy to lose patience. After I started buying at $600 and the price had gone down to $200 over the course of a year, I couldn't take it anymore, and that's why I suggest an all-in strategy with a long-term approach.

If you want to make really good profit, if you believe in something, it's nice to just keep buying a little bit of it over time. The problem is if we buy all-in at once we don't have much more data. What I started doing that led to all this profit, I started buying like $20 a day of Bitcoin after it went back up to $300 and I took most of a year off.

I said, "Okay, I still believe in Bitcoin. I'm going to buy a little bit of it."

I think I bought like a dollar an hour and I made a plan on a spreadsheet.

I wrote it out and said, "Okay, what I'm going to do is keep buying it until it hits $900, and then I will sell a little bit of it at a time."

What I did, after selling at $200, I started buying again at $300 and I continued buying and buying until 2017 at which point I had turned a few thousand dollars into eleven thousand dollars. I then bought a Dash masternode.

Then, that turned into $80,000 plus and some of the profits from that on Steem turned into a $100,000. Now sure, if I'd have just held all my Bitcoin and just continued buying Bitcoin over time, I might have come out much further ahead because I had 10 Bitcoin right here.

I had 10 Bitcoin when it was $1,000. If I'd have just continued buying Bitcoin for the next year, I'd have much more than a hundred thousand dollars now, but I didn't think too much about this high-level plan. I didn't think about my long-term profit and my taxes and all that. I got short-sighted so often and that happens a lot.

It happens with people on Steem, buying in and, "Okay, I'm going to make all this money. Well, it didn't work how I wanted it, so I'm just going to power down and sell."

Thankfully, I've learned this time with Steem. I'm holding on to my Steem indefinitely, at a bare minimum for a year, and more than likely for 5 or 10 years, maybe even 20 or 30 years.

We will see how long it will run, but I'm holding on to my Steem indefinitely, and I've got my Steem in my Steem wallet, so I don't have anything on exchanges except that I use a little bit to make payments on Coinbase. I make payments to contractors on Coinbase and if Bitcoin goes down to $6,000, then I will buy $500 of it and I will use that for a contractor payment.

You can see my setup, and then if you want to have a bunch of different currencies, I like Bittrex for an exchange with a lot of options, I like Coinbase and Bitstamp for the basics, Bitcoin, Ethereum, Litecoin and Ripple, and I like Kraken for an expanded set of options.

Any of us may have different options locally, but I think if you want to make the maximum profit the ideal system is to start before you are invested or if you are already invested, just sit there and think long term now, and look at where all these different coins are actually being stored, what the benefits are versus the risk. Having everything on an exchange has benefits, but it also has a big risk.

This is my plan for maximizing the return with Bitcoin. If you think Bitcoin is awesome, it's going to go to the moon, the ideal strategy is to use one or a couple of websites, maybe Coinbase and Bitstamp, and just buy a little bit of Bitcoin every day, whatever you can afford to completely lose. This way, let's say the price keeps going up to $20,000, you buy a little bit every day, and the whole time you make money.

Let's say the price goes down to $5,000, you lose money down the whole time, but then it goes back up to $10,000 and you made all that money between buying from $10,000 when it went down and back up. Let's say even the price goes up and down, buying it a little bit every day takes the ego out of it then.

What's really difficult to do is to try to trade and time the market. The fact is most of our market timing is luck. Is it bad luck I went through from Dash at $85 before it went to $752 or stupidity?

Who knows?

Is it good luck I started buying into Bitcoin at $300 steadily, and then continued to hold and hold, and buy more and more steadily over time, and worked my way into having a six-figure investment, which a year ago seemed ridiculous?

You could say these are luck.

Timing the market is a lot of luck and we don't want to play around with luck because luck comes and goes.

Whenever the market goes down, then everyone's luck seemingly runs out. Every time the market goes up that's essentially guaranteeing that a bunch of people's luck will run out when it goes down, but a lot of us get the illusion that we are somehow smarter than everyone else because we happen to get a lucky trade here and there.

It's certainly lucky that I bought Dash at $11, but at the same time, I was aware of that because I was already buying Bitcoin and Ethereum, I was already trading on other exchanges.

Just trading on an exchange can be a nice fun way to get started, but the problem is when we start getting hundreds of thousands of dollars racked up on exchanges and we have never made a plan as to where we are going to hold all this or what we are going to do with it, and we are just free-styling it, we are very subject to lose all that overnight when an exchange crashes or a price crashes, we are very subject to emotion to just panic and sell everything at once, and then we are subject to lose all those things we were so excited about, to finally be essentially right back where we started.

I appreciate you reading this post. I've tried to offer a plan that I hope is well-suited for most of our different interests whether we want to be all-in somewhere, whether we want to be all-in on an exchange with different currencies or whether we want to be all-in with one wallet on our own computer or one particular currency.

I hope I've offered some different options here if you are looking around and were thinking about what's the best way to go forward.

How do we make the biggest profit?

The biggest profits come from looking and seeing what we are most uniquely qualified to contribute for and accepting our own limitations.

If you watch my epic Bittrex fail tutorial, "$100 A Day Trading Cryptocurrencies on Bittrex EPIC FAIL Tutorial!" you will see that I'm not a trader, that's not what I do. I am not good at it and I don't have skill with it or anything. I am good at holding one thing and promoting the heck out of it. That's what I do.

Thank you very much again for reading this post on Steemit, which was originally a video filmed in my studio and published on YouTube, so it has the chance to get read as well as watched.

I love you.

You're awesome.

Thank you for reading this and I hope this was useful for you today.

Final words

Thank you for reading this blog post, which was originally filmed as the video below.

If you found this post helpful on Steem, would you please upvote it and follow me because you will then be able to see more posts like this in your home feed?

Love,

Jerry Banfield with edits by @gmichelbkk on the transcript from @deniskj

Shared on:

- Facebook page with 2,226,859 likes.

- YouTube channel with 219,999 subscribers.

- Twitter to 103,989 followers.

Our Most Important Votes on Steem are for Witness!

Would you please make a vote for jerrybanfield as a witness or set jerrybanfield as a proxy to handle all witness votes at https://steemit.com/~witnesses because we are funding projects to build Steem as explained here? Thank you to the 2500+ of us on Steem voting for me as a witness, the 2 million dollars worth of Steem power assigned by followers trusting me to make all witness votes through setting me as proxy, and @followbtcnews for making these .gif images!

Or

Let's stay together?

- If you want to stay updated via email, will you sign up either to get new emails daily at http://jerry.tips/steemposts or join at http://jerry.tips/emaillist1017 to get an email once a week with highlights?

- If you would like to build a relationship with me online, would you please visit https://jerrybanfield.com/contact/ because I would like a chance to get to know you?

I Think going All-in for one financial instrument is not the best thing you should do. Diversifying is always the best option.

★★★★★★★★★★★★★★★★★★★★★★★★★★★★★★★

https://freebitco.in/?r=8869745

WIN BITCOIN

Roll to win up to $200 BITCOIN

You can enter to win every hour

There is also a weekly jackpot drawing of $500

The more you roll the more entries you get for the weekly lotto

The best thing is it's completely FREE!!!!!

★★★★★★★★★★★★★★★★★★★★★★★★★★★★★★★

This should have been your 1st post ever. Warning people every time your a part of the community it struggles. According to your own story about each currency you left has an exceptional amount of growth once you left. Could you help out Steem and use the exit too?

Exactly.

Here's some free advice about investment strategies: Don't listen to Jerry Banfield's investment strategies.

Haha. I thought this guy was actually good. Should I not listen to this guy?

@muscleroast.com As per @ifartrainbows https://steemit.com/witness/@ifartrainbows/how-i-followed-jerrybanfield-and-lost-1000-s-in-sbd I would highly recommend watching the video and draw your own conclusions! It would be great if @jerrybanfield could address the issues raised in the video to set all our minds at ease, you didn't respond to him maybe you will respond to us?

Jerry creeps my kids out

hello, i will so glad if u add me in ur steemvoter

Earn passive income daily with Bitcoin!

I am just wondering how much effort you put in this cryptocurrency research. I have not even made 1% research in crypto world. But after reading this posts, I am going to put 10% of my savings in steem now.

Then I will be adding more cryptos in my portfolio by selling some of my bitcoin profits.

Good idea.

Hi jerrybanfield,

Very interesting read, Thanks you for sharing it!

I have seen people talking about this loading up strategy .. buying a little each day.. I am not sure I understand how to apply it.. how would you compute your percentage every day and why not get involved with all you have.. I can only see sense in it if you have an income that you repurpose.. where is my thinking wrong/flaud ?

latest meme I've posted on Steemit...

hahahah thats too funny , i just did a post on bitcoin reaching all time high's you might be interested in checking it out https://steemit.com/bitcoin/@jsonkidd/bitcoin-reaches-20-000-usd-as-crypto-currencies-reach-600-billion

The best Bitcoin and cryptocurrency strategy seems to be accumulate and HODL especially with the way everything is going up

Sounds like you didn't learn from your mistakes of constantly selling. If you held on to your investments you'd be a wiser man ;)

If you want to play (relatively) safe with the potential of making a lot of money (by hodling). Just get EOS, period.

hello, i will so glad if u add me in ur steemvoter