Bitcoin and Cryptocurrency Basics for Professionals Considering Investing!

Where can professionals like doctors and attorneys start learning the basics of Bitcoin and cryptocurrencies? When is the best time to start investing?

We hope to answer these questions and more during this interview between Bonnie Flom with "Billing Buddies" and Jerry Banfield, cryptocurrency investor.

Bitcoin and Cryptocurrency Basics for Professionals Considering Investing!

"Bitcoin and cryptocurrency," what do all of these things mean?

I'm grateful that Bonnie has collaborated with me to bring this information today to professionals like doctors and lawyers hoping to invest profits from businesses into cryptocurrencies. We hope to answer the questions here that Bonnie has asked on the behalf of the doctors she serves as clients based on my experience investing in cryptocurrencies for the last three years.

Would you join us in discovering the very basics of this because if you have seen Bitcoin somewhere or heard about the big price increase, then this might be useful in deciding what is the best thing to do next?

It might be most helpful to learn from all the ways I've messed some things up too because what I've found is I can learn straight from other people's experience or I can go make all the mistakes myself.

I hope this will be useful for all of us today.

Bonnie, thank you for doing this interview with me originally as a video call and now as a post also on Steem.

What motivated you to give this a try for the topic today?

Bonnie:

I've asked you about this before, Jerry, and I can't quite wrap my arms around it, but I have some clients and they are really interested in investing and I just thought it would be like a service announcement.

I knew you were really ahead of the game. You started buying before the late explosion this last couple of weeks and now might be the time to get in.

Probably, when you got in it was better, but like you said, you learned through the hardship of good and bad, what to do, and so I'd love to hear you share with us what you found and how we can proceed with it, if it's something we are interested in.

Jerry:

That would be wonderful. Even though you do medical billing, that's your main business with "Billing Buddies," I think it's nice that you have chosen this as a topic because your clients asked about it. I think this would be fun to talk about, and then we can see what we can do with it.

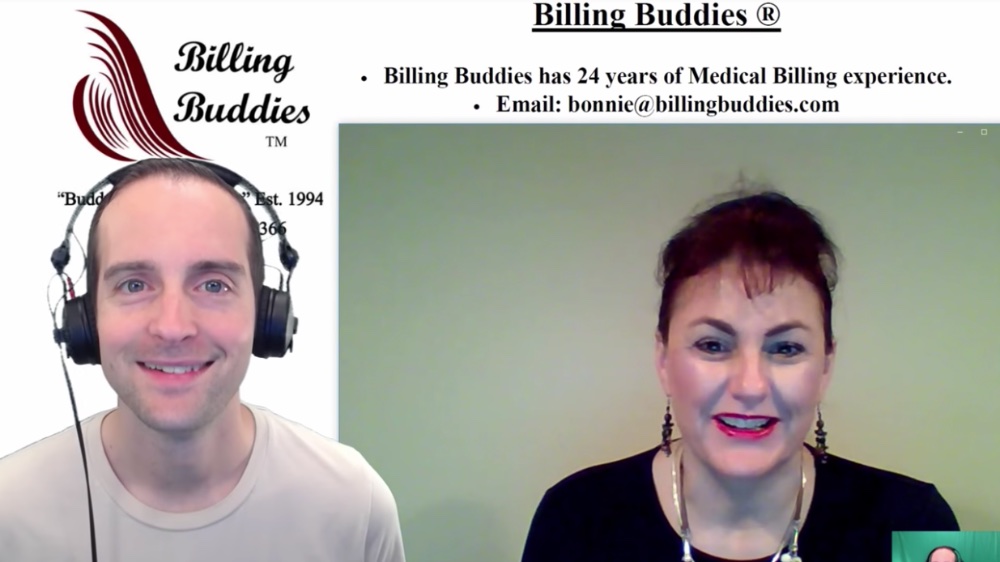

Well, Bonnie's made an excellent presentation here. She has given us this entire list of questions.

We will go over them.

- What is cryptocurrency?

- What are Bitcoins or what is a Bitcoin?

- What can I do with Bitcoin and cryptocurrencies?

- Why would I want to get involved in investing with them? It's very possible you might not want to get involved in investing with them.

- How do you know if you can trust in investing in them, which links directly to number 4?

- Where do I get started to purchase them? This is one of the most challenging parts, not just in terms of getting it set up, but then the ego component of it and getting obsessed with purchasing and the pricing.

- Any other tips and tricks?

Yes, the main tip and trick is to get in when other people are getting out. Right now, there's a huge excitement about Bitcoin and cryptocurrencies. So many people want to get in now.

I bought Bitcoin a few years ago when it was at $170. Everyone was selling, not everyone obviously, but the market was selling. No one wanted to buy it or hardly anyone wanted to buy it at $170 after it had been up to over a thousand.

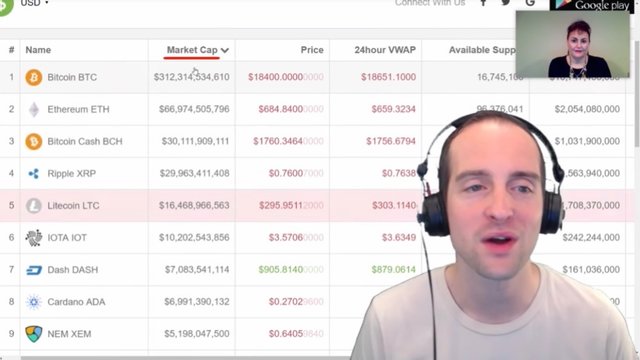

I sat there and I said, "This will never be this low again," and today it's $18,000. I look at it and say, "Ugh. I don't want to buy any Bitcoin at $18,000." It's as high as it's ever been.

Generally, we don't want to buy things as high as they have ever been. We want to buy them, if we believe in them, when others are saying, "This is crap. It's horrible. It's all going to fail."

What do you think so far about just the initial thoughts, Bonnie?

Bonnie:

What I was trying to wrap my arms around, cryptocurrency means more than just Bitcoins?

Bitcoins are a type of cryptocurrency?

Could you kind of cover that?

Jerry:

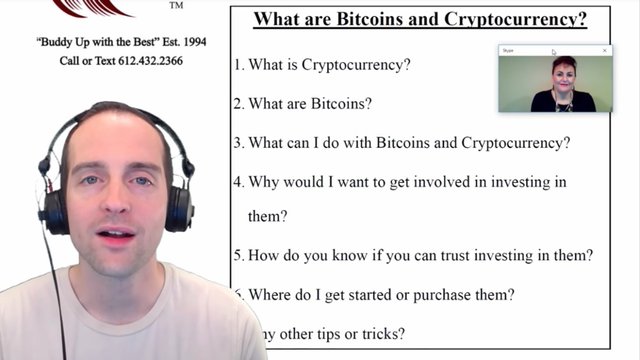

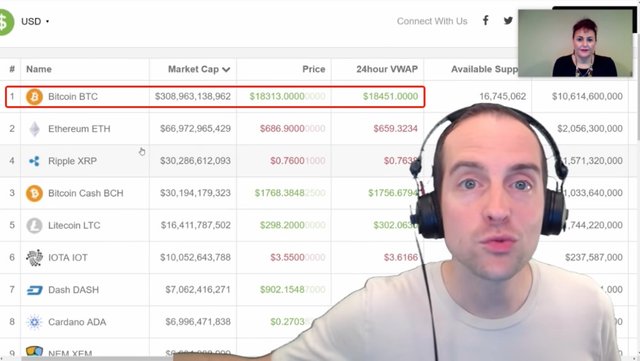

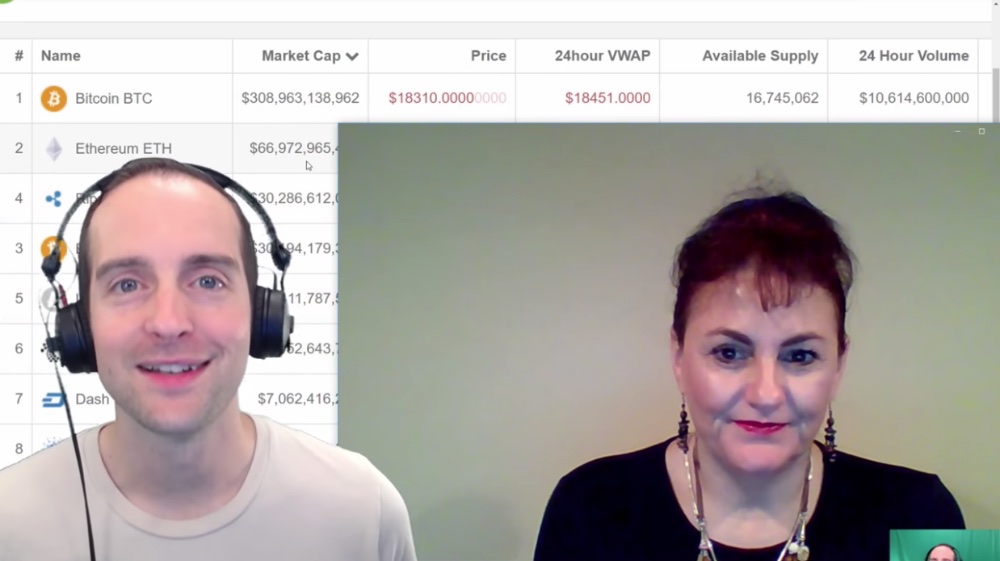

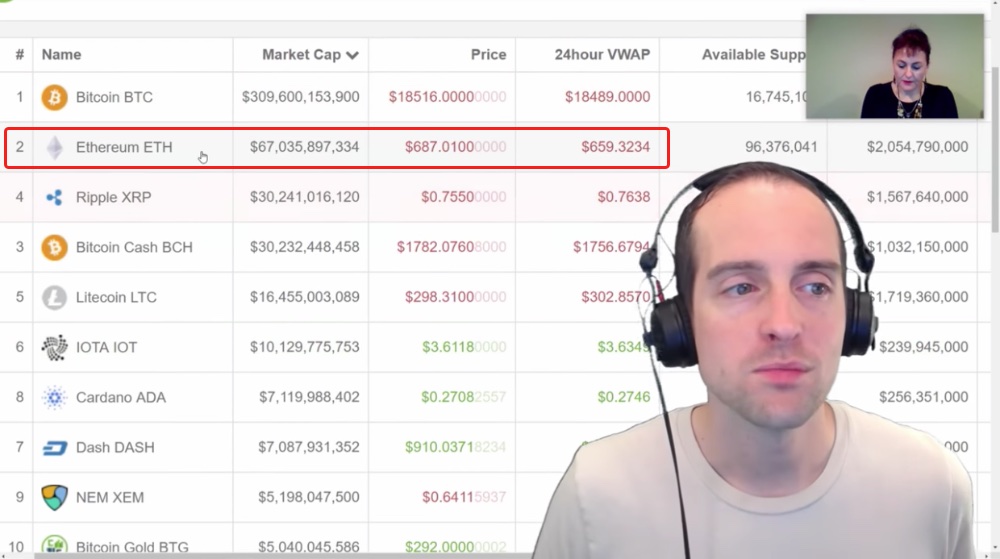

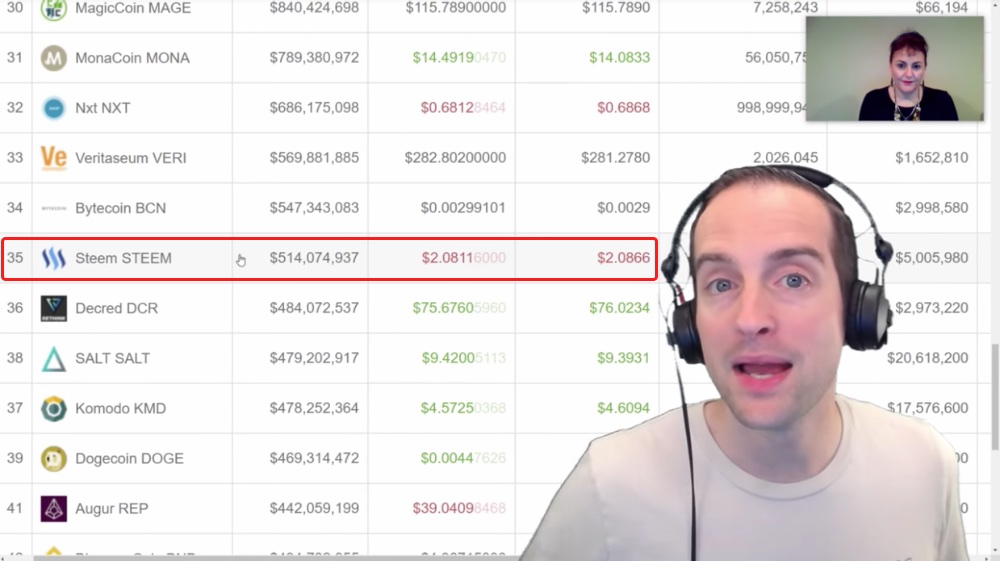

Yes, in order to do that I will go over and show a lot of different cryptocurrencies. What I'm on is www.coincap.io. This has a list of a lot of cryptocurrencies on it, not every single one, but lots of them. There are hundreds of cryptocurrencies.

Bitcoin was the first of what we call a cryptocurrency, but now there are hundreds, perhaps even thousands depending on how they are counted.

A cryptocurrency is based on the "crypto" term that comes from cryptographic, I believe, as these are based on cryptographic hashes on a public ledger.

Now, in plain English, that means something that anyone can go look at that is also private and secure. There's essentially a public and private key pair where there's a public key, and then if you run through the encryption you have a private key that can interact with that.

For example, if I have a Bitcoin wallet I've got my private key in the wallet. I can encrypt the wallet even, and then even though anyone can go look and see where my Bitcoin is on the blockchain and see all the transactions I've made with it on the blockchain, I'm the only one that can actually interact with it and do transactions with it, unless someone else hacks it or steals it.

These are a giant leap forward financially in terms of having an entire ledger out for the public to look at and the money can be sent globally in just a few minutes most of the time.

Bitcoin was the first of all these cryptocurrencies, but I think there's definitely one if not a few that are in position in time to overtake Bitcoin. I don't think necessarily anytime soon, but there are now currencies that basically do everything better than Bitcoin at this point, but what makes a currency valuable comes down to wallets.

What makes the US dollar valuable is that people use it, that people believe it's a store of value. All these different cryptocurrencies then are being run by different people, different communities of developers running different software, and that comes back to your question you asked about, how do you know if you can trust in investing in them?

Basically, investing in these currencies is investing in the people that are using them, the companies that are backing them, the investors that are participating. That's a general overview, how does that sound so far?

Bonnie:

That's good, it really is a complex language. I appreciate when I talk with people about medical billing, sometimes it's hard to relate because each terminology that you shared has a meaning to you, but to me, it doesn't.

I've gone on bitcoin.com and downloaded a wallet, as you would say, and I've secured it with the passphrase and I've invested one time with it to see what it's like.

I understand that I can use that wallet to pay other people if I buy things online or other people can pay me online through Bitcoin. What were some other sites you mentioned, you think a couple might pass Bitcoin potentially?

Jerry:

Yes, that also ties into the questions you asked. I think we have answered what is a cryptocurrency and what are Bitcoins, and then this gets into what can I do with Bitcoins and cryptocurrency, and then where do I get started or purchase them?

Let's look at this again.

Now, what we have got are all these different currencies, and then a few of them I think are in a position to overtake Bitcoin because of mass adoption potential. One of the problems with Bitcoin is it's essentially a store of value, but you have to have some value to put into it first.

That means if you don't have any money, then there's little to do with Bitcoin. Now, sure, you can help or assist with various projects, but if we don't have any money there's not a lot we can do with Bitcoin. On top of that Bitcoin takes some massive fees.

Bitcoin was started with the idea that it'd be lower fees than using things like PayPal, credit cards or wire transfers, but Bitcoin now is actually a very similar fee, if not higher lots of times, than sending a wire transfer, that's not an improvement over our existing banking system.

Not only that, but most of the time, if you want to get started to buy some Bitcoin, it often requires us to use our existing banking system, which is also not an improvement over our existing banking system.

Finally, with Bitcoin, what is putting it in the number one position basically is that it has the most wallets, it has the most users and it has tons of transactions. This has actually been a problem because it has overwhelmed the entire Bitcoin blockchain.

Right now, if we send a small transaction with a small fee, it might take days for our transaction to go through. That is not an improvement over the existing banking system.

Now, some of these other currencies have addressed those limitations in Bitcoin, but the problem is user adoption. Bitcoin is number one because the most people use it, buy it and invest in it.

Now, as we go through the list of cryptocurrencies, the main thing that's important is user adoption for the long term, and we don't want to invest or trade in anything just with short-term results. That's one of the tips and tricks I can give you getting started.

When I started out with Bitcoin in 2013 or 2014, the price started out at $600. I looked and I said, "This will be amazing. This is going to be huge," and I started buying a little bit of it at $600. We can see it is at $18,000 today.

I was right about it being a big deal and I managed to lose thousands of dollars being right and impatient, and that's what gets a lot of us in life today.

Bonnie, what do you think of that?

Bonnie:

I'm kind of getting a gleam of what you are saying. You invested to start with at $600, and then you kind of got nervous and you maybe got out for a little bit.

Jerry:

That's exactly what I did.

Bonnie:

So you kind of lost by getting out, but then you eventually reinvested at like $170, and then you stuck in there with that and kept going?

Jerry:

I made mistakes all over the place. I started buying at $600 when it had been a thousand. I started buying at $600 and I bought all the way down to $170, and then I got impatient. I couldn't take the stress of, "When's this going to go up?"

I was brand-new, I'd never done any investing. I was like 29 or something, I didn't hardly have any money to invest, but I put everything I had. I actually borrowed money from personal loans and was buying Bitcoin, but I was too impatient to realize the results.

I sold everything at about $200 and some dollars as soon as I bought like 20 or 30 Bitcoin at $170. I just couldn't handle the stress of it anymore and I sold.

But then, after taking almost a year or so off, I realized, "Look, I am right about this. This is amazing." The price went up to about $300 over a year from $200 and I thought, "Okay. I need to get into this in a rational way, not an emotional and ego-driven way, but I need to get into this in a consistent way with a plan before I've bought anything and I'm all wrapped up in it."

I realized the best way to do that was just to buy a little bit every day. I started buying about $20 of Bitcoin a day at about $300 and I kept buying all the way up until about $1,000. By then, I had about $11,000 or so, and then I traded and did some tutorials.

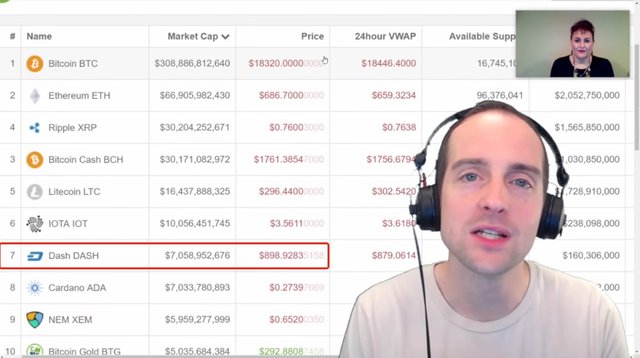

But then I invested in this currency Dash because it has a way to self-fund its own growth through budget proposals. It's a huge innovation in the cryptocurrency world. I bought that when it was about $11, and as you can see it's $900 today. But I sold it at $87 after just a few months, and I thought, "There's no way this is going to keep going up so much more because life rolls in seasons."

Right now is the worst time to get involved in Bitcoin. It's the worst time to get involved in most of these cryptocurrencies because there's a ton of speculators that have essentially pushed the value up ahead of where it really is, and many of these currencies have not been battle tested by dropping 90% in value.

Bitcoin has been battle tested. It went down about 80% in value and it didn't die. The users kept building the community anyway.

I sold my Dash because it doesn't have the potential to be number one, in my opinion. What I want to do is to be invested in one of these currencies that looks like it has the best potential to overtake Bitcoin, because you might as well just hold on to Bitcoin otherwise. A lot of these are good, but being number one tends to have almost all the benefits while being even number two has way less.

I've looked around and I said, "Which of these cryptocurrencies has the potential to be number one and overtake Bitcoin, and which of these isn't blown up in price, is undervalued?"

What I came to is Steem.

Bitcoin is almost nine years old and Steem is just a year and a half old. All the transactions on Steem are free. They take bandwidth, which means if you are a brand new user and you don't have any Steem, you can't send a thousand transactions or whatever in one day. You have a limited number of transactions you can send, but if you have a lot of Steem, you can make huge applications that use tons of bandwidth on the network.

Steem, in my opinion, is what Bitcoin was supposed to be. Steem has no transaction fees, the transactions go through in three to six seconds every time.

If I send you Steem, you will get it in three to six seconds. With Bitcoin, there are these cryptographic hash wallets and you can't memorize them practically.

Steem is more like a social media network in the sense it's got readable usernames and that's what's amazing. On Steem, it also has a built-in blogging blockchain, which now is over 500,000 users in the first year and a half, which is amazing growth.

Now, what we can see on my profile here, I'm grateful I'm making about a hundred dollars on every single post on my blog on Steem, which is incredible. That's ten times better than using a WordPress blog. I've had a WordPress blog for years and it makes a fraction of what my Steem blog made from the very beginning.

What's amazing is that all this is on the blockchain. As we go through times now, countries have huge censorship and it's not even obvious to most of us that there's huge censorship on the Internet. We think there's not and there's free speech, but it's discrete.

The websites censor at the highest levels. Google, Facebook and YouTube very much exercise censorship in terms of blocking things or removing them. My friend posted an article on Facebook that went viral, which very quickly was censored, and then it wouldn't show anymore in the newsfeed. When you clicked on his website, it wouldn't go to it. It got censored within a few hours of going viral.

This Steem blockchain is set up to be censorship resistant. This means we can post whatever we want to on Steem. No central authority can come in and take it down and say, "Well, you can't talk about this," and then it's not stuck to one specific URL either.

The innovation I've seen in six months on Steem is incredible, with what people are building and the Smart Media Tokens that are being released for Steem.

Most big content publishers like Facebook, YouTube and Reddit, most websites with a large existing audience look at Bitcoin or Ethereum and at these other cryptocurrencies, and while these could be used to accept payment, it's more of a hassle to even integrate them and to try to sync them with regular banking.

There's not a good way to raise money off of it either, all the transactions have fees, so that's not a good thing to use like on Facebook for a billion users, to use something that has fees, but Steem is about to release a system called Smart Media Tokens that will essentially allow any publisher to bring the Steem blockchain into a customized token onto their own website and that's a huge innovation. In my opinion, the only one of these cryptocurrencies that's worth investing in right now is Steem, and that's because they were all I listed.

Bonnie:

What is the blockchain?

I keep getting lost there. I don't have a concept of what a blockchain is.

Jerry:

Oh, thank you, Bonnie, for mentioning that. The blockchain is, in simple terms, the public ledger of all the transactions that have occurred on the blockchain.

For example, on Steem I have a server that actually contributes new blocks to the blockchain. That means when people are on the user interface on steemit.com and click upvote a post, that's a transaction on the Steem blockchain because that contributes to how much new Steem is paid out on the blockchain.

Therefore, the new user clicks upvote, that transaction is sent to my server or mostly it's other people's, but sometimes it is sent to my server, and then my server adds that transaction on to the blockchain. Therefore, the blockchain is the entire collection of everything that's ever happened.

On the Bitcoin blockchain, any of us can look back and review all of the transactions that have happened. If I have all the addresses I've used, I can look and see every single Bitcoin transaction I've ever made on the blockchain.

The blockchain is essentially the public record of all the transactions including where all of the money is stored. Right now we can look on the Bitcoin blockchain and find where all the Bitcoin is stored. We can essentially see everyone's wallet on there.

Bonnie:

Does the blockchain have all the cryptocurrencies in it and you can dig down and look at the transactions for Steem, or dig down and look at the transactions for Bitcoin?

Jerry:

Each of the cryptocurrencies, at least in theory, has its own blockchain. Now, in practice, if we look at the list of these currencies some of them are purely speculation and start-ups. I won't name any in particular, but some of them don't really have their own blockchain.

Some of them are what's called an ERC 20 token that's created on Ethereum, which means that technically it's not its own token, it's just on the Ethereum blockchain and it doesn't truly have its own separate blockchain.

A lot of these newer ones are just currencies that have been put on a different blockchain and Steem Smart Media Tokens works the same way in terms of, let's say you launch a token with Steem, then that token will actually be on the Steem blockchain.

The main blockchains are Bitcoin, Ethereum and Litecoin. I don't know much about Ripple. Dash has its own blockchain and many of these currencies in the top have their own blockchains, but not all of them.

Some of them are essentially just on other blockchains, and I don't want to be invested in something that doesn't even have its own blockchain or that doesn't have its own huge community within an existing blockchain.

Bonnie:

This is so technical.

Do you ever help people?

Do you do consulting to help people learn about this or is there anything you offer to go further?

Jerry:

I have a Discord channel for answering questions on a daily basis, it's on jerrybanfield.com/contact/. There's a free channel where anyone can hop in there and participate, ask questions, and then I've got a Members channel and a Partners channel.

You have got access to the Partners channel. I check them and I go in order of the Partners, then Members, and then the free channel. If there's a lot of chat in the Partners channel, I may not see the free one that day.

You have access to the Partners channel where you can ask questions and you essentially get a priority response, and I also buy and sell Steem directly with partners. If you wanted to buy some Steem, you could send me money on PayPal directly and I would be able to send you Steem directly back.

The easiest way to make a transaction is to transact directly with another user using existing payment methods. If we want to make transactions another way there's a bunch of tutorials I've got on my Steem blog that shows how to do that, which is at a steemit.com/@jerrybanfield.

Bonnie:

Okay. You know, what I keep thinking of is my son in the mid-90s came home from grade school and they had this investors' project that they were doing, and he said we should invest in eBay, but we had never heard of eBay. He kept telling us this was going to be the thing. Well, it was. It really did come out. While there's been many other sites that tried to duplicate eBay, but still eBay is predominantly the one that you go shopping on if you want to buy or sell online.

Then, Amazon is also out there, of course, but that's more for merchants in my eyes. I don't know, it probably is for smaller sellers too. I'm thinking that you are onto something that's going to be really big.

In the last two weeks, it's hit it. You have told me about it probably for a year now, and it's finally come out in the news, and like you said, now is not the time to buy because it's so popular.

All right.

How do we get started?

Where would you start?

Jerry:

The key place to get started is education, to learn more. Sometimes it's helpful just to learn where not to start. One of the worst ways to get started is to go get a wallet on Bitcoin, and then to start buying a lot of it or a significant part of it.

Even just buying a little bit, if it becomes an ego trip, then it can be a big distraction. If you just open a wallet and buy a little bit of it thinking, "Well, I wanted to get in on this. Now, I know I have some," then that's fine.

What I did, I bought a little bit of it, didn't think very much of it, and then I started getting into it and buying a bunch of it, trading it back and forth, and a lot of people I know start trading on all these exchanges even getting into things like margin trading trying to make money.

I was at my brother's wedding months after I had started, I was sitting there on the way to his wedding trading Bitcoin on my phone and that's about the worst thing we can do getting started, to jump in without even realizing how much we don't know that we don't know.

The best way to get started is with education, to just learn more about things before we have any money in the game because when we just jump into things and put money in, then we get this skewed perspective.

It's like football teams or political parties. We just pick our side or our team and then everyone else stinks because they are on some other team or my team's the best just because it's the one I picked.

It's good to do some more research before investing and I don't want to invest in anything where it's as high as it's ever been. If we look at the market today, most of these currencies are as high as it's ever been.

Steem actually has been to $4 before and it's $2 today. When I bought into Steem, it was anywhere from 80 cents to $1.30, but it's been as low as 7 cents.

Dash had been $14 when I bought into it at about $11. Bitcoin has never been higher than $18,000. This is the absolute worst possible time to buy in. Even if it does go to $25,000 or $50,000 eventually, it'd be just better to see how far down it is going to go.

Everything comes in seasons in life, and I can tell you the last winter for cryptocurrencies was brutal. Litecoin, for example, which is $300 today was up to $40 four years ago, and it went all the way down to something like a dollar and it stayed there for years.

I don't know how many years exactly, but it stayed very low for a long time. If you had bought it at $40 you would have had to have something in terms of faith to be able to hold it as it went down to almost nothing, and then wait until this year where it finally went back to $40.

Bitcoin might be at $100,000 someday, but it might go down to $1,000 first or it might go down. Almost everyone that's been in this for a while expects a crash.

There's a lot of sketchy things that seem to be going on with at least one, if not all or many of the exchanges right now. These dollar amounts on here for the market cap are almost completely imaginary.

Now, technically, they are correct, but what about someone who lost a thousand Bitcoin in a wallet and can't get to it. That Bitcoin is not really on the market. The Bitcoin price will probably continue to go up and up over time, but it was $1,000 a year ago or less and it's $18,000 today.

It's just likely that it's going to come down, and therefore, an ideal thing to do if we want to look at these, is to just watch and see what they do. One of the main errors we make as humans is the rollback or the hindsight error.

I had 60 Bitcoin in May, when I sold my Dash masternode for $87,000, which is $900,000 today. I had 60 Bitcoin and it was at $1,700. It just went up almost double in a few months and I said, “It's gone up too much. I don't want to hold any Bitcoin." I sold almost all of it to US dollars except for what I bought into Steem.

Yes, if I'd held my 60 Bitcoin, I'd have like a million dollars right now. If I had simply held my thousand Dash, I'd have almost a million dollars right now. I do have over $200,000 of Steem today, but the funny thing is I feel worse about having sold my Dash at $87 and watching it go up to $900, than I feel good about having bought it at $11 and selling it at $87. There's no perfect system.

Bonnie:

Right, but in the end, you have made a considerable amount. You have lost quite a bit too, but by learning the ropes it has paid off to some extent.

You have got $200,000 in Steem and I suppose it would be really hard to track how much you had to actually put in and how much you lost to get that $200,000.

Jerry:

Yes, the time and energy were gigantic. When I first started messing around with Bitcoin all I did is lose money. I bought into it right after the huge excitement, essentially at the same time as now.

This is going to be the next big thing, and then maybe it's not going to be the next big thing right away. Well, maybe this isn't going to take off. I bought into it right then and put a ton of time and energy into it. I was checking the Bitcoin price all the time and I managed to lose $5,000 after putting in probably hundreds of hours fooling around with it.

If you think like, "Look, I believe in this. I'm going to buy a little bit every day," and say, "This is awesome, I definitely want to get in. Bitcoin is going to be a great store value," then one of the best ways is to just set a certain amount that we can afford to lose every day.

You can say, "Look, I'm going to buy $10 or $100 or whatever a day," and just buy that every day regardless of what the price is. Then, if the price goes up to $50,000 and drops to $5,000, and goes back to $20,000, there's no ego in it.

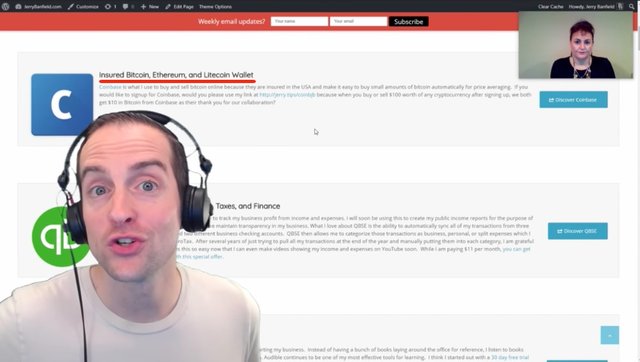

There are websites you can set up an automatic daily purchase like Coinbase, which is a wallet I use and you can buy Bitcoin automatically on it every single day. That's what I did for months.

I think it is a great thing to do that with Steem. Just buy a little bit of Steem every day. I think the Steem price is on its way to $10 in the short term and $100 plus in a year or so. Steem is the only cryptocurrency that's got a good shot of passing Bitcoin in wallets and whoever has the most wallets wins.

Bonnie:

What I've done so far is I've started a wallet with Bitcoin, and then I went to Coinbase and bought Bitcoin.

How do those two link together?

Jerry:

Coinbase is an exchange and a wallet, which means that on Coinbase we can change our US dollars to Bitcoin, and then if you have got a Bitcoin wallet what you can do is send your Bitcoin from Coinbase over to your Bitcoin wallet.

I think it is ideal for most of us to keep Bitcoin and any cryptocurrency in our own wallet. All of my Steem is in my Steem wallet, in the likely point of a crash, which I think the big cryptocurrency crash last time happened after Mt. Gox went down.

That was the largest Bitcoin exchange at the time. Actually, the largest Bitcoin exchange now has a good shot of going down again, even though it's a different website.

We want to keep our Bitcoin off of centralized websites and exchanges, and keep it in our own wallet. If we buy on Coinbase for example, it's good to put it in your own wallet.

Bonnie:

Okay.

So step one is to get education and research. I got that from you. You have a lot of tutorials at steemit.com/@jerrybanfield, right?

Is that the link to go to?

Jerry:

Yes, exactly, or you can just google Jerry Banfield.

Bonnie:

Okay, so once we have a wallet with Bitcoin, we invest in a site like Coinbase and get the Bitcoin, and then transfer that back to our wallet.

Is that the right process?

Jerry:

The easiest process for smaller amounts, like say a few hundred or a few thousand. I think Coinbase or Bitstamp.net are two of the best.

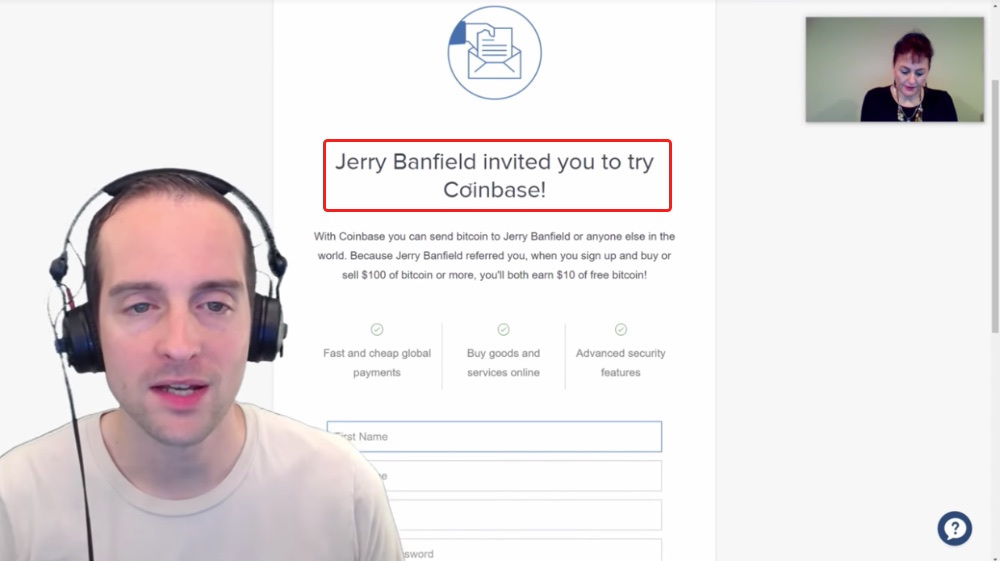

I've got a link on my website that you can use to get $10 if you use my link to join, and I get $10 too.

Bonnie:

What is that link?

Jerry:

I will go over to my website here and show that for you.

Bonnie:

That would be wonderful.

Jerry:

If I go to my website, then I've got a link called Gold Mine.

The idea is there are all these valuable things on here that I use.

Then, there's a Coinbase wallet where it says, "Insured Bitcoin, Ethereum and Litecoin Wallet."

Now, it is insured against theft and it is insured if your US dollars are in their US dollar bank account. It is not insured against price changes. It is not insured against misuse by a user, which includes, for example, if your roommate comes in and sends all your Bitcoin out.

Coinbase is an insured Bitcoin, Ethereum and Litecoin wallet and it only works in some countries though. It works in the US, but it doesn't work in every country.

If you want to get started on Coinbase, would you please go to my Gold Mine on my website, and then click on the link to Coinbase?

You will see it says, "Jerry Banfield invited you to try Coinbase!"

When you sign up using this link and buy or sell $100 of Bitcoin or more, both of us get $10 in free Bitcoin. I'm grateful that about 500 people or so have done that already, and that's how to get started with Coinbase.

Another great website is Bitstamp.net, but for smaller amounts like a hundred dollars, a few hundred dollars or a few thousand dollars, the simple thing is just to buy it on Coinbase.

I've got a post on my Steemit blog that shows eight different websites we can use that are similar to Coinbase. It's at Steem.guide where I list all the basics about Steem and Steemit, and it also has tutorials showing how to buy and sell different currencies there.

The best to do is we buy in on Coinbase or Bitstamp, and then we just leave our Bitcoin, Ethereum or Litecoin in that wallet because that's easy, it's easy to withdraw and cash out back to US dollars at some point.

Now, if we want to start putting in larger amounts, I'd say over ten thousand dollars would be a good threshold, then that would be better kept in a wallet that's not on one of those websites because what happens is, if Coinbase or Bitstamp goes down, which is possible, and especially some of these other exchanges seem like a good possibility, then we could actually lose everything.

If you were holding a Bitcoin worth $18,000 for example and someone steals the Bitcoin out of that exchange's wallet, then that gets passed on to the users. Bitfinex.com already had that happen, it had millions of dollars of Bitcoin stolen. They created some system to try to reimburse users, but the fact is these exchanges have tons of money all tied up in one spot.

They are a huge target for theft not just externally, but internally from the people who have access to them. You are looking at one of these crimes you'd watch a movie about. You can steal a hundred million dollars and go live off on an island and potentially totally get away with it.

Bonnie:

So what I hear you saying is if you buy from Bitstamp.net or Coinbase.com, transfer it to your Bitcoin wallet, to securely hold it, or one of your Steemit wallets to securely hold it?

Jerry:

Yes, if it's a larger amount because if we got a few hundred dollars or a thousand or a few thousand, we actually lose a significant amount just sending it from one wallet to another if we are using Bitcoin.

Now, with Ethereum and Litecoin that's not an issue. However, for just getting started it may be a lot easier to just keep the money in the wallet on the exchange because the biggest problem I think with cryptocurrencies is the ability to lose it and the ability for us to get locked out of our own wallets.

If I lose my Steem account password, I'm done. There are $200,000 of Steem and no one can help me with it either. Now, if someone steals or hacks my password and I have my password, unlike Bitcoin, Ethereum or Litecoin, I actually do have a shot at keeping my money in Steem.

That's why I used my Steem wallet because I can put it in and power it up and even if someone gets a hold of my password, which is the highest level of security, I have a very good chance at only losing like 7% or less of what's in my account.

Now, if someone gets a hold of our Bitcoin or Ethereum, or any of these other wallets, that's it. Picture it like having all your money invested in the stock market by comparison and if someone signs into your eTrade account or whatever, it can instantly be cleared out and sold.

That's the biggest problem with cryptocurrencies. Not just that, but we can lock ourselves out of it. I was paranoid with my Dash masternode and almost a hundred thousand dollars in there. Literally, if I lost the password for it, no one could help me get back into it and that's probably happening a lot.

Bonnie:

Why are you investing all this energy to do this?

What is behind it all?

Why take the risk?

Jerry:

That's an outstanding question, Bonnie.

The cryptocurrencies have a lot of liabilities and in many ways, they are not as good as just having money in the bank or using something like PayPal.

What these cryptocurrencies offer is huge potential to help us connect and transact directly with each other person-to-person, and that is a huge benefit.

Things like Steem with no fees that literally just have enough users with wallets and have an application, we could do things like go to the grocery store and instead of paying the grocery store directly, we actually could have it instantly set up where I make the payment for like the tomatoes at the store, and then the grocery store gets their part automatically, the person who picked up the tomatoes and the warehouse. These currencies have some incredible possibilities.

On Steem specifically, this is the one website where we actually get a fair share of what we contribute.

When I post on Facebook and get a thousand likes, I don't get any money. Meanwhile, Facebook gets inventory to show ads based on the attention I've driven with the post. If I do something that goes viral on Reddit, it has the chance to make money on it, I get nothing. That's the same thing on websites like Twitter.

Cryptocurrencies have massive good for the average person and for connecting, for even raising our consciousness on the planet. Bitcoin makes it so much easier in countries like China where it can be difficult to turn Chinese money, I think Yuan, into investments on a global scale. Bitcoin has been huge in China because it's a way out essentially of China. It's a way we can just instantly transact all over the world.

I'm excited because of what this can do for the average person and that's why I'm excited about Steem. It's one of these cryptocurrencies that truly looks like it has a lot of value for the average person who hasn't bought any of it.

Bonnie:

I could ask you questions all day. I keep thinking of things, but to get started I really need to do some research.

Could you give me a to-do list?

Where do I read this first, go to that second?

Anything like that.

Check this out.

Jerry:

Yes, I think it is best to start with Steem because of everything I've shared. I think it is best to get started with something early because Bitcoin has been out for nine years. Some of these other ones that are at the top have been out for years although some of them are brand new and have almost no real value, but they are worth a ton for some reason.

I'd say learning about Steem is the ideal way to get started because what most of us want to do is to have been in early on something. We want to get the biggest possible return out of our investment. I'd say going to my Steem.guide might be a good thing to do to just read about Steem, to see all these different things that are going on on Steem like the account security or blogging on Steemit.

In my opinion, this is the best opportunity for most of us. I just have a new system and it's returned an equivalent of 62% APR to investors, those that have essentially delegated me Steem Power. Not even actually giving me money, but just giving me the voting power on Steem. I explained that in my last two posts and how that works.

Bonnie:

Where do we get to your posts again?

Jerry:

You can just google Jerry Banfield and you will see my blog on Steemit, or you can go directly to steemit.com/@jerrybanfield. It's also on my website, anything that goes to my blog, there's a link right at the top that goes to my blog on Steem. We can just click that and go there.

I just did a post showing about these investor payments. For example, @freedom gave about $200,000 worth of voting power, not even actual money, but voting power, and then he got $500 back in 36 hours for that.

Bonnie:

Wow!

Jerry:

What's cool on Steem is that we can just buy some Steem and there are all these ways to essentially power it up, and then make money off of that. That's 10 times better than lots of these other cryptocurrencies like Bitcoin, because if you have Bitcoin in your wallet, you don't get anything.

If you want to make money with your Bitcoin it often involves risking it a lot as well like loaning Bitcoin out to others, which might cause all of it to be lost. With Steem there are so many ways to make money that don't even involve risk because you have voting power, and if you don't like what's being done there, you are not getting a returning ticket back.

I'd say where it starts to learn about Steem, take a look at my posts on Steem because this is the one with the biggest return potential. Bitcoin may go up to $100,000 someday, but that's only 10 times where it is at right now, whereas a lot of these cryptocurrencies are going to go down a lot.

Steem has been twice as high already. I've been talking about Steem since it was in the dollar range and it's already up double, and I'd say that Steem has got the best shot to go up a hundred, even five hundred or a thousand times over the next several years.

Steem already has the most transactions out of any blockchain, which is a good sign, but once people start using Steem and the further Steem develops, there's no need for most of these other blockchains.

Now, some have unique abilities, some will be able to do things, but Steem is the first mover on the social media network, with a built-in blogging platform and free transactions. It's just like Bitcoin, that first-mover advantage is gigantic. That's why Bitcoin is number one even though in terms of features it's technically inferior to almost every other one.

It was first, and Steem is the first mover on essentially the mass adoptable cryptocurrencies. You can sign up on Steem without investing anything and have a very good shot at making several dollars a day in posts, which may not be a big deal in countries like the US or the UK where the wealth is high, but somewhere like Nigeria, Indonesia, India or Nepal, you can sign up and have a very good shot within a few months to be making a few dollars on every single post. The dollar is very strong and that's a huge deal.

Bonnie:

Right.

This has been really helpful, Jerry. I'm really glad we are doing this presentation because I started off with Bitcoin in trying to get my arms around what a blockchain is, what cryptocurrency means, how to buy and sell, what the risks are, and you have really addressed them.

I'm going to start with that Steem.guide and really check that out.

I really thank you for your time.

This has been really helpful.

Jerry:

Well, thank you very much, Bonnie, for recommending this topic today.

I hope we have had a good discussion for our viewers today and I appreciate you have scheduled a call with me every month this year.

So, thank you.

Bonnie:

Thank you.

It's been very helpful.

Have a great day.

Jerry:

Well, thank you.

I hope you have a wonderful day as well.

And for you that have read or watched, we appreciate you being with us and we hope you have enjoyed this.

Final words

Thank you for reading this blog post which was originally filmed as the video below.

If you found this post helpful on Steem, would you please upvote it and follow me because you will then be able to see more posts like this in your home feed?

Love,

Jerry Banfield with edits by @gmichelbkk on the transcript from @deniskj

Shared on:

- Facebook page with 2,226,859 likes.

- YouTube channel with 219,999 subscribers.

- Twitter to 103,989 followers.

Our Most Important Votes on Steem are for Witness!

Would you please make a vote for jerrybanfield as a witness or set jerrybanfield as a proxy to handle all witness votes at https://steemit.com/~witnesses because we are funding projects to build Steem as explained here? Thank you to the 2500+ of us on Steem voting for me as a witness, the 2 million dollars worth of Steem power assigned by followers trusting me to make all witness votes through setting me as proxy, and @followbtcnews for making these .gif images!

Or

Let's stay together?

- If you want to stay updated via email, will you sign up either to get new emails daily at http://jerry.tips/steemposts or join at http://jerry.tips/emaillist1017 to get an email once a week with highlights?

- If you would like to build a relationship with me online, would you please visit https://jerrybanfield.com/contact/ because I would like a chance to get to know you?

Another brilliant step by jerry to bring cryptocurrencies to main stream adoption. I have just got 5 persons in this market and 1 of them has already 4X his money and very happy with my guidance.

Now I am planning to start a crypto currency class at local level to educate friends and my students in this summer.

This is a great post to teach everyone , great answers to the questions.

I always say to everyone: START WITH BITCOIN!! First learn about bitcoin and invest a bit in it and then look to other cryptocurrencies and use a small part of your BTC to invest in interesting alts.

When you understand Bitcoin it is way easier to understand other crypto's and BTC is the reserve crypto currency and because of the network effect it is the most secure long term bet.

Today I meet more and more people who are invested in altcoins and don't know anything about BTC. In general I see them lose a lot of money (in BTC terms)

Good advice. It reminds me of how I used to onboard new people to the internet. Get them on AOL first and learn that before venturing out into the "real" net. This saved a ton of support calls for me and gave these young "Bitcoin Babies" the head-start they needed.

source

Dear Sir as like all time your concept, stand and material about cryptocurrency is outstanding and we are learning a lot, many things and aspects really awesome as I was not aware with that so it's a big knowledge booster for me I say thank you dear brother. The Holly Monk of Steemit.

With best wishes.

Great tutorial for crypto newbies...

Awesome stuff! Interviews like this are what's going to help spread crypto to the masses. Thank you @jerrybanfield for being an evangelist for steemit and crypto in general.

@jerrybanfield, dash is very cheap now, i know you want it

Thank you for your informative post. Your every post is nice and informative. I have a question to you. is it rational such raising of Bitcoin price? @jerrybanfield

great information for crypto.

More good info to archive and resteem. upvoted. I think I am learning more and more from these hopefully enough to keep it going.