Investor Who Predicted Two Major Market Crashes Calls Bitcoin a “Bubble”

Jeremy Grantham, co-founder of the GMO investment management firm, wrote in a letter to investors that he believes that Bitcoin, along with the stock market at large, is in a bubble. Famous for predicting the market crashes of 2000 and 2007, Grantham holds that “[a] melt-up or end-phase of [the] bubble within the next 6 months to 2 years is likely.”

To Grantham, A Bubble Unlike Any Other:

In his usual report on market trends, Grantham dedicated a section to address Bitcoin’s meteoric rise.

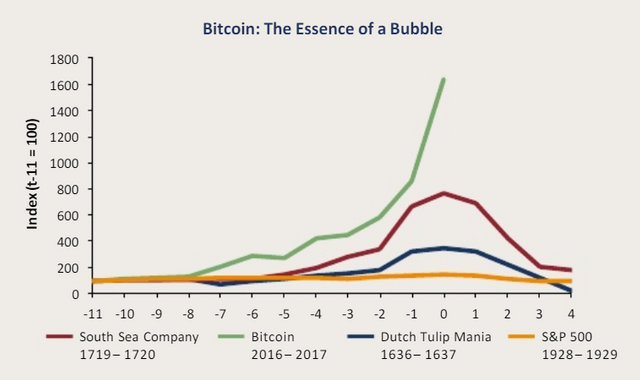

“Having no clear fundamental value and largely unregulated markets, coupled with a storyline conducive to delusions of grandeur,” Grantham writes, “makes [Bitcoin] more than anything we can find in the history books the very essence of a bubble.”

He goes on to add that “[anyone] around in 1999 and early 2000 has had a classic primer in these signs,” arguing that historical precedent would have the bubble “crash and burn even before the broader market peaks.”

Bitcoin has seen explosive growth over the past year. Trading at just over $1,000 at the beginning of 2017, the flagship cryptocurrency peaked at an all-time high of $20,000 in December. While it has since fallen to roughly $15,000 per coin, this figure still puts it at a 1500% increase from 2017 to 2018.

This growth has financial analysts and experts from Mike Novogratz to CNBC Mad Money Host Jim Cramer and beyond crying that Bitcoin has achieved official bubble status. As did those before him, Grantham has drawn comparisons to the Dutch Tulip Mania of the 17th century and “the legendary South Sea bubble,” as he calls it, of 1719-1720

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.ccn.com/the-very-essence-of-a-bubble-jeremy-grantham-lumps-bitcoin-into-larger-market-trends/