What Gresham's Law tells us about cryptocurrency

Gresham's Law and Cryptocurrency

Around 1558, when Elisabeth I sat on the throne for the first time, there lived an English banker. His name - Thomas Gresham. He was one of the wealthiest people in England and his economic genius had surely helped him get there.

Thomas Gresham wrote the queen a letter in which he stated a fact that would later become known as Gresham's Law. The last monarch, Henry VIII, had replaced about 40% of the silver content in the British shilling with worthless metal. These new coins pushed the quality coins out of circulation. Some keen minds though decided to collect these good coins and spend the bad ones, for they had less intrinsic value. This phenomenon is known as "Gresham's Law".

Around 1960, when the price of silver was not high at all, these good, silver coins started popping up again all around the world. However, when the price of silver rose above the nominal value of these coins, they disappeared again. People were hodling these silver coins.

To create "bad" money used to be to just lower the precious metal content in a coin. Today, making "bad" money is a lot easier. Because of the fact that precious metals aren't used anymore in today's currencies, the currency's value can be inflated by just printing more of it, inconsequentially. When people start holding coins, Gresham's law could be applicable.

Today, most of the people who own bitcoin don't spend it, they hold it. This is Gresham's Law in action. In this particular case, bitcoin, or any other digital currency, IS the better money.

And this makes complete sense.

Why would you spend something that increases in value the longer you hold it? In contrast, we have good old (one might even say obsolete) fiat. Why would anyone hold or save something that decreases in value? The rate of inflation is ABOVE the interest rate, which is not surprising, knowing that the latter is close to zero. The inflation rate is even catching up with the annual returns of bonds. Think about that for a second.

If Gresham's Law holds, and I'm willing to bet it will, cryptocurrencies will globally replace fiat for a large part.

Love this post! Always love coming across alternative ideas and theories. What's your knowledge on Gresham's Law? I'd love to get you on an episode of Crypto Nights to discuss how it plays a role. If you haven't seen the show before, check out the latest upload on my profile. If you watch it and are interested, drop me an email at [email protected]

up-voted

Anton

I'll definitely check it out!

I'm also not an expert on the topic, I just stumbled upon an article and continued to read and learn about it until I was qualified to write this post haha

haha fair enough! Love the honesty. Good post!

It is worth noting that plenty of crypto currencies are inflationary, disinflationary (rate of inflation goes to 0 over time) or deflationary (like bitcoin where there is a hard cap on supply and the rate of added supply decreases).

It will be interesting to see if Gresham's law applies within Crypto itself. I think that inflation protection is very important but I wouldn't necessary consider it the primary driver of Crypto's growth.

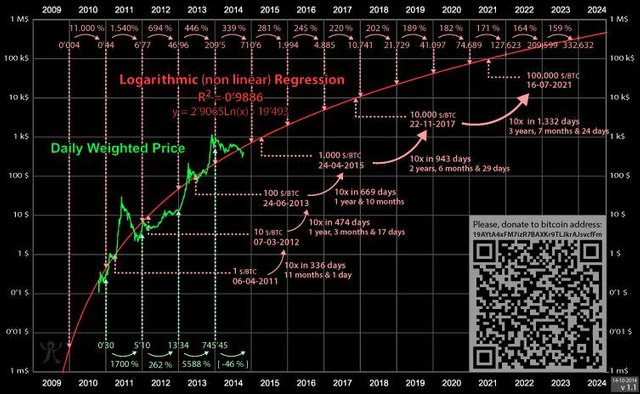

If you consider the deflationary character of bitcoin, and a lot of other currencies therefore, it should have a steady rate of price growth. Look at this chart from 2014:

I've seen that chart and it definitely is compelling, but I guess my big question is how do you think Ethereum compares (has had like a 15% inflation rate this year and has no definitive hard cap on supply) .

Yes that is true, but recent updates that came along with Casper stated that the total supply (which is not really decided yet) definitely won't increase. And as the Ethereum network grows and becomes the host of more and more dApps, I see eth becoming more valuable as well. But that is really just an educated guess.

Very nice, in-depth post. Thank you!

Appreciate it!