FTX files for bankruptcy

That was fast...

Less than 24 hours ago we were being told that FTX had a chance and white knights were being consulted to save the day.

Well, less than a day later the company is filing for chapter 11 bankruptcy.

I guess that is what happens when the country where you are located decides to freeze all your assets.

Even more surprising was the fact that FTX.US was included in this bankruptcy filing...

Anyways, this is not great news but this is what happens in most of these cases and is all part of the process.

Now it will likely take weeks and months for those involved to see if they will get any of their money back, though I am sure they will get some, just not sure how much.

Based on the numbers I have seen, ie liabilities of roughly $10 billion with assets of a little over $2 billion, which would imply something in the neighborhood of investors getting something like $.20 on the dollar... though those numbers could be wildly off.

Now we wait and see what the fallout will be from, considering the assets are frozen and no one really knows how much they are going to lose, perhaps the margin calls coming from this will be delayed to a later date, or perhaps have already happened.

Here's to hoping!

The good news in all of this is that the stock market has been strong the last couple days and I expect that to continue in the near and medium term, which should help put a bid in bitcoin which will likely hold up the crypto market compared with what it could have done.

The algos tied to stocks will do their best to hold bitcoin up as long as stocks are going up.

The End of the Bitcoin Game.

Bitcoin has done its job in the international arena.

It's Time for Altcoins and Crypto Games.

The gaming industry is gaining an increasing audience every day. Now these are new printing presses Currencies.

This collapse had nothing to do with bitcoin. It was one large exchange playing fast and loose with customer funds, and that's pretty much it. If there were checks and balances or regulations in place this never would have happened and bitcoin would be trading around $25k right now.

The difficulty in accepting reality lies in the fact that you either have this currency at your disposal, or you have had the bitter experience of losing money on it.

Accepting what reality?! If anything this is the end of the altcoin game and further pushes people towards bitcoin. Though I don't even think it's the end of the altcoin game, and certainly not the end of the bitcoin game. How does a centralized exchange collapsing due to playing fast and loose with their in house printed altcoin have anything to do with bitcoin dying?!

If you haven't noticed yet, maybe I'll open your eyes. Many countries are on the verge of war. A large number of people around the world oppose the governments of their own countries. Ipidemias all over the planet have been destroying people for a long time. And all these events needed money. They were not printed to the extent they were needed. This would lead to inflation. They created an electronic currency, and it has already done its job. And the abyss into which she is rapidly falling will become her grave. The Bitcoin era has definitely passed.

Lol I am not even sure what you are trying to say here... To be honest what you are going on about sounds more like something that would drive people to a non-sovereign means of exchange, like bitcoin. But, lets make an on-chain bet though since you are so confident in the demise of bitcoin... we can bet a certain amount of steem that bitcoin will be higher than this 2 years from now... you in?

This is what I've been waiting for. You answered your own question about Bitcoin. Bitcoin and exchanges are just casinos. For those who like to argue. And the fact that FTX was closed proves once again that the license was simply taken away from the next exchange, or rather, the next cash production pack was closed. I give you a guarantee that in 10 years everyone will forget about bitcoin. After they get the last one in the blockchain. Although the blockchain is just a program, and centralized. And the payment for solving some tasks is paid from the developer's wallet. But since you do not understand how many companies were involved in this offer, you will not understand that the work of bitcoin as a currency is over.

Huh?! Bitcoin will be minting tokens for the next 120 years or so... not sure what you are saying here?!

Second of all, most of what you said here doesn't make much sense or provide any evidence for your "facts". They were saying bitcoin wouldn't be around 10 years ago, yet here we are. They were saying bitcoin would never make a new high again after every single bull market, yet here we are with new highs every 3-4 years like clockwork. The fact you think bitcoin is over because one Exchange collapsed means it is you that clearly doesn't understand bitcoin or its value proposition. One, that is only strengthened by a centralized altcoin Exchange collapsing... You clearly weren't around when Mt. Gox collapsed 8 years age you, that collapse was infinity worse for the crypto market than this one, yet bitcoin survived and thrived afterwards.

Upvoted! Thank you for supporting witness @jswit.

The following weeks are gonna be really painful. What a disaster.

You think there is more pain to come? I personally think most of the deleveraging has already been done...

I think @sarahjay1 is right.

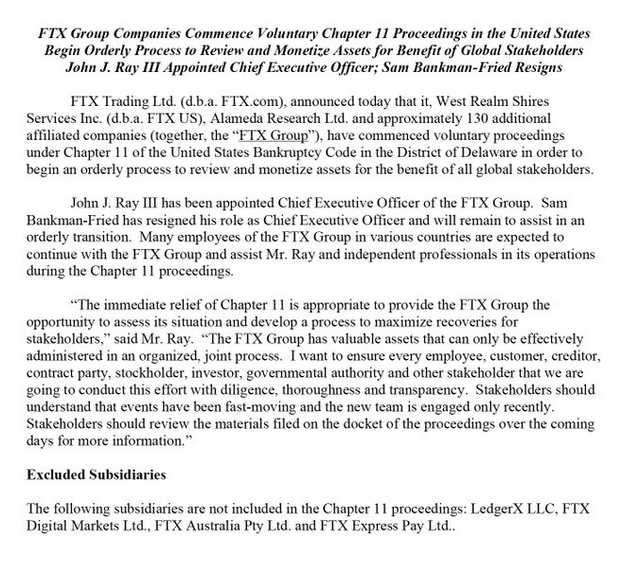

A friend sent me this, this morning.

"About 130 additional companies affiliated with FTX -- including FTX US and Alameda Research -- have also begun the bankruptcy process"

I guess this is no big surprise. An Exchange worth $32 billion must have hundreds, if not thousands of affiliates. And they are all going to be affected in one way or another.

Thanks.

I hope I'm wrong, but I do think the damage will have lasting consequences.

It clearly will have long lasting consequences, but in terms of outright dumping of crypto assets, I think we are through the majority of it already.

It says it right in the release that there are many companies involved, how does that change my statement above that "most of the deleveraging has likely already been done"?!

Jesucrist in motor bike

On one side, this will cause a massive trust issue in the crypto space, especially for the normal folks the crypto space was working so hard to attract for mass adoption.

Now aside from the loss that this is representing, we must at all times try to make the best out of the worst, like, try to turn trash into gold. So first i will have to say to not just trust someone's thoughts on the internet, I'm just an unknown mate with a keyboard, with this in mind, i believe that DEX(Decentralized Exchanges) are going to boom after this event gets to its conclusion.

I believe we're going to see a massive activity towards DEX, whether because of fear or knowledge, i believe folks now are starting to understand the dangers that lies within CEX(Centralized Exchanges), after all. "Not your Keys, Not your Cryptos".

So my idea for turning trash into gold, will be to eyeing DEX tokens and maybe look for potential short opportunities that this FTX event may provide.

I agree with this almost in entirety, except I think you missed most of the short opportunities already. Most of the selling has already taken place in my opinion. The FTT token may be an exception that could still go to zero though, so there is that. Apart from that I agree, the fallout will be crypto being stored on self hosted wallets, use DEXs to exchange, and centralized exchanges will be required by regulators to have a lot more transparency going forward.

indeed, most of the selling has already taken place, however i believe it may not be over just yet, somehow i believe that FTX was just the first domino, however i must admit that this is just based on recent events reaction such as Luna Crash, Voyager, Celsius... so i believe this will lead to other projects to fall and out of all the reasons, Fear may be the critical one, but for now i'll just watch and wait for opportunities.

There may certainly be collatoral damage, but I don't think it will be large enough to have a material impact on the crypto markets looking out several months from now. For that reason I think bitcoin is likely getting close to a bottom already. I wouldn't touch most altcoins, but buying bitcoin on this latest plunge and looking out several years from now seems like a decent bet to make.

I agree, on the long run, buying Bitcoin amidst this drop it is going to pay off.