Bitcoin Futures Go Live Today @6 PM EST!

Get ready for some extreme volatility, even by Bitcoin's standards.

In less than 5 hours, we are going to see Bitcoin futures products introduced for the first time.

The CBOE will be the first to introduce such products and even they say that they expect things to be volatile at first as they have hiked margin requirements to a minimum of 40%, which is much higher than just about any other asset.

Interactive Brokers will have a minimum of 50% margin requirements and won't allow people to take short positions initially.

The futures contracts will be cash-settled based on the auction price of bitcoin in dollars on the Gemini exchange, owned and operated by the Winklevoss twins.

You may have heard of them, those bitcoin billionaires that were on the "losing" end of that whole Facebook debacle...

Will this make bitcoin go up or down?

That is the question on everyone's mind.

On the one hand these products will open bitcoin to many more investors than ever before, specifically the institutional kind. Allowing them to be involved in bitcoin without actually having to create a digital currency account.

On the other hand, it will allow people to take short positions in bitcoin in a much larger way than ever before.

Over the long run, allowing shorting in a meaningful way as well as getting large institutions involved will ultimately help with price discovery and with reducing volatility.

It is just not clear at what price point that might be. It could be $10, $1000, $10,000, $100,000+ or any number in between.

However, in the short term, it is not clear exactly what will happen.

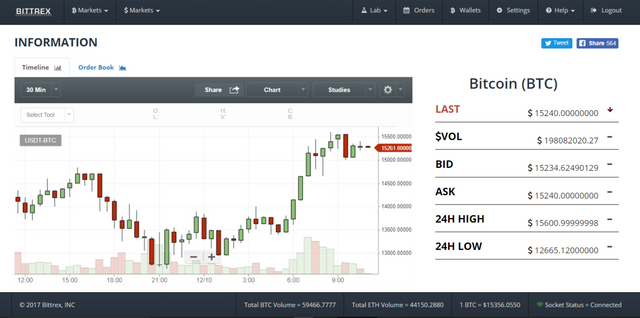

Judging by the volatility in the last 12 hours of trading already, we might have an idea of what is to come...

Bitcoin hit $12,500 and $15,500 all within a couple hours of each other.

Get your popcorn ready ladies and gentleman, things are about to change in a very meaningful way in less than 5 hours.

Stay informed my friends.

Image Source:

https://pixabay.com/en/rocket-red-orange-fireworks-461750/

Follow me: @jrcornel

yeaahhhh ..interesting times ahead.

Based on my research, bitcoin futures have nothing to do with bitcoin. It is a way to take bitcoin's wealth away from us into a worthless system. Stick with what we already know, which is bitcoin.

If there is a way for the Banksters to corrupt BTC, be sure they will find it and exploit it.

So its just fiat bets on the price of bitcoin they are not actually buying or selling any bitcoin and therefore cannot effect supply or demand and so cannot effect price.

That's where you're wrong, unfortunately. Manipulation is real so if they are placing bets against Bitcoin for hundreds of millions they can make their outcome happen by dumping the real Bitcoin. Say a group of 20 hedge funds/or even individuals came together to place a bet against BTC at 20K, they all have $100M shorts on CBOE equalling 2 billion. But before they did that they bought 25M worth of REAL BTC through GDAX, GEMINI, etc. They dump their 500M worth of BTC, win the options trade and then keep placing higher bets which will allow them to manipulate more and more BTC.

This makes me want to convert my Bitcoin to Steem. I have been speculating the same scenario..

If any exchange creates any type of asset or contract people will try it.

Nobody knows what is gonna happen but, the sure thing is that this is gonna be the next source of speculation, once that Chinesse are out, and I think this could be a bad thing for crytpo because they are melting with the people that had alwayd created bubbles, which could affect very much bitcoin and cryptos in general.

https://steemit.com/bitcoin/@alhmali/history-of-bitcoin

hello there dear i follow you and upvotes you also you think will help

don't forget follow me @alhmali steemit people said it may help for these new here with steemit so what do you think do so and upvotes me as well

and this is for you it may help you to make moeny with tready at bitcoins you need just chick then do one click to open these Links have a nci day seeyou there

Indeed, has nothing to do with actual BTC or even its price movement. It will simply allow to place bets based on what is happening with the price action of BTC. They are using prices from existing exchanges so the only problem I see is if they try to buy out the majority of BTC and manipulate it that way while also placing bets on the outcome on CBOE/CME which would require hundreds of billions on dollars, which only the government can feasibly do.

https://steemit.com/bitcoin/@alhmali/history-of-bitcoin

hello there dear i follow you and upvotes you also you think will help

don't forget follow me @alhmali steemit people said it may help for these new here with steemit so what do you think do so and upvotes me as well

and this is for you it may help you to make moeny with tready at bitcoins you need just chick then do one click to open these Links have a nci day seeyou there

The holder of the futures will probably hedge by owning BTC, so I think we can expect a greater degree of volatility as more players enter the market.

*---- Bitcoin to Da Moon!

https://steemit.com/bitcoin/@alhmali/history-of-bitcoin

hello there dear i follow you and upvotes you also you think will help

don't forget follow me @alhmali steemit people said it may help for these new here with steemit so what do you think do so and upvotes me as well

and this is for you it may help you to make moeny with tready at bitcoins you need just chick then do one click to open these Links have a nci day seeyou there

https://steemit.com/bitcoin/@alhmali/history-of-bitcoin

hello there dear i follow you and upvotes you also you think will help

don't forget follow me @alhmali steemit people said it may help for these new here with steemit so what do you think do so and upvotes me as well

and this is for you it may help you to make moeny with tready at bitcoins you need just chick then do one click to open these Links have a nci day seeyou there

Really?? Things have been so calm around here.

So, if the futures hit the breakers/fuses - that won't/shouldn't change anything on the exchanges. Kinda seems to defeat the purpose if the "real" market continues while the futures market is frozen...

I think smart investors will wait for the first expiration date to go through, so they can get a sense of what the "futures" will look like. I think initially you will see more of the high risk speculators take the 1st crack at these futures. Too much uncertainty at this time for more conservative investors. However, this will help with mainstream adaption of BTC and other alts, as well as increase liquidity.

https://steemit.com/bitcoin/@alhmali/history-of-bitcoin

hello there dear i follow you and upvotes you also you think will help

don't forget follow me @alhmali steemit people said it may help for these new here with steemit so what do you think do so and upvotes me as well

and this is for you it may help you to make moeny with tready at bitcoins you need just chick then do one click to open these Links have a nci day seeyou there

Thanks for info jr! Keep on laying it down man, you are a great source of important bitcoin news and a fine currator of the available news stories out there.

resteemed

Not sure about all that, but thank you for the kind words! :)

there gonna be a lot of options to eat some shorts if you know what I mean

That's hillarious

This will carve out a path for the true big-time: ETF's!

https://steemit.com/bitcoin/@xsid/bitcoin-futures-meh-the-real-deal-is-etf-s

So far the futures price action has been tepid and uninspriing

https://steemit.com/btc/@davebrewer/xbtc-trading-opens-at-cboe-big-shorts-nope-slight-up-tick-in-btc-price-in-the-initial-futures-contracts

I'll have my popcorn and sharing the moments with you

Heres a link if anyone wants to watch this kick off

https://www.cnbc.com/quotes/?symbol=BTC.CB=

initial results are tepid

https://steemit.com/btc/@davebrewer/xbtc-trading-opens-at-cboe-big-shorts-nope-slight-up-tick-in-btc-price-in-the-initial-futures-contracts