Bitcoin's price is at a critical crossroad

Bitcoin is likely to go one of two directions from here.

After we saw bitcoin hit an all time high right near $20k per coin, we have since seen the coin trade as low as $10k per coin, and currently it trades around $13k per coin.

This is a defining moment for bitcoin.

Up until now it has mostly been owned by the "bitcoin believers", those that think (or hope) that some day bitcoin will change the way we use money.

Moving away from money that is backed by central banks/governments to money that is owned by the people.

These investors were buyers of bitcoin back in 2013 and have been holding just about ever since.

However, just recently we have seen a different kind of investor base show up. One that is chasing performance.

These new investors can mostly be labeled as speculators, and most of them are of the retail kind, with only a handful of institutions sprinkled in.

If there really are significant amounts of institutional capital that is interested in bitcoin, now is the time they will start to put that money to work.

They have likely been waiting for a correction of 40-50% to finally enter the space, and they finally have gotten one.

If that is the case, the recent pullback will likely be short lived and we will see new all time highs yet again in early 2018.

However, if institutions never show up, then this price decline in bitcoin is not likely to be over any time soon. It will likely continue to trend lower and lower as the late coming retail decides to run for the exists at exactly the wrong time after buying at exactly the wrong time.

Not to mention that this also seems to be a critical point in terms of regulations.

Exchanges are getting new and stricter regulations, while governments are weighing in every week with their thoughts on bitcoin and cryptocurrency and how they can better regulate or outright ban them.

For the reasons mentioned above, this coming year looks to be very pivotal for the price of bitcoin and the entire cryptocurrency market in general.

It could mark the point where the cryptocurrency bubble ultimately popped, or it could mark the point where a new asset class reached mainstream and garnered mass adoption by investors and speculators alike.

I'm hoping and betting on the latter.

Time will tell.

Stay informed my friends, and enjoy the holiday!

Image Sources:

https://www.digitaldealer.com/at-the-crossroads-of-culture-and-service-efficiency/

http://impactalpha.com/read-this-if-you-are-not-a-zillionaire-impact-investing-for-the-rest-of-us/

https://nodamselindistresshere.wordpress.com/2015/08/06/crossroads/

Follow me: @jrcornel

You're forgetting the 3rd type of user, the user who wants to use Bitcoin for it's utility. And as a utility coin, Bitcoin is FAILING.

Over the weekend, I made 2 purchases, one with BTC and one with BCH. The Bitcoin transaction cost me $40.00+ in transaction fees and took over 6 hours for confirmation. The BCH transaction cost me $0.03.

I don't see how you can be either a "believer" or a "speculator" if there is no practical, working application for the underlying commodity.

Good info here. Thanks for sharing some real world experiences. I think in time this will be what kills the legacy bitcoin chain, unless of course they can ever fork the necessary improvements, which recent history has shown that to be a long shot. It's just a matter of when.

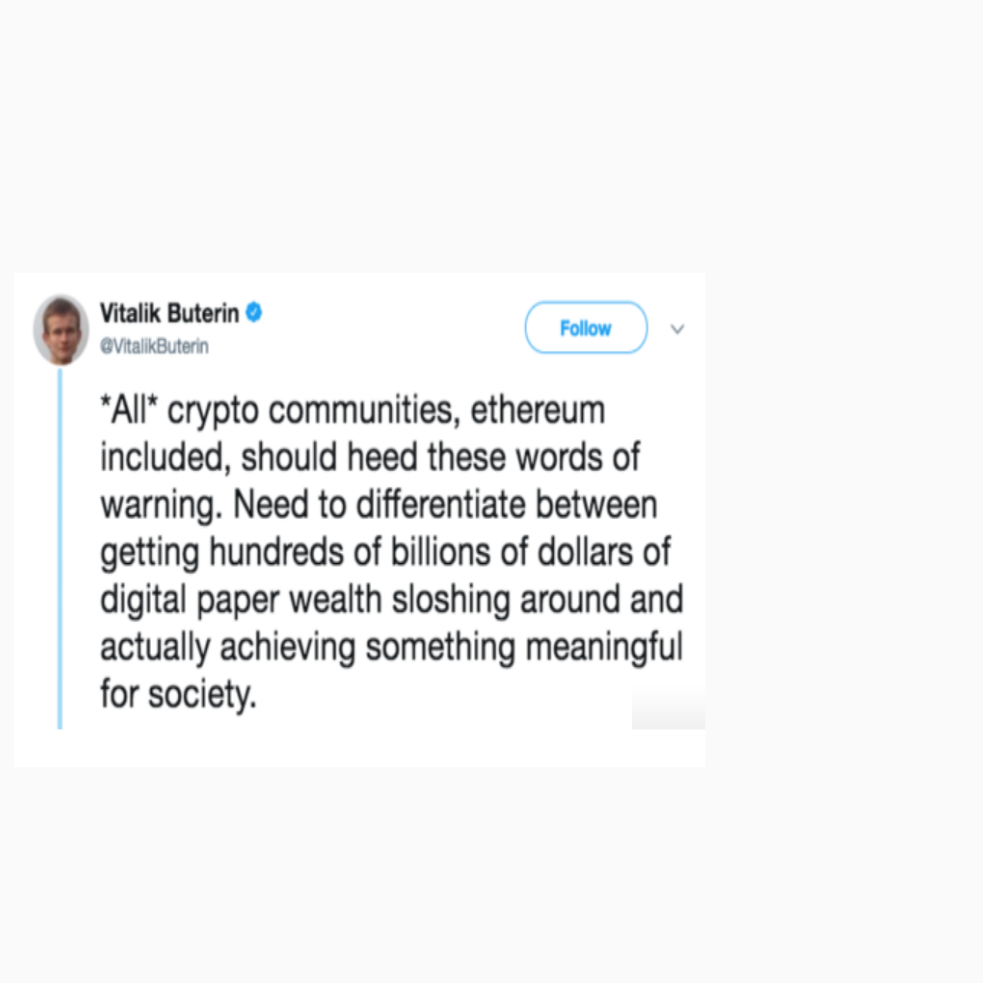

Bingo. People need to be chasing utility which will develop into real value, not some vague "store of value" argument that BTC proponents like to tout.

In BTC you pay 0.002 BTC to transfer....How much you pay in BCH to transfer in BCH?

How much of it relates to BTC at 14000 and BCH at 3000?

Indeed should BCH reach the size of BTC I expect similar issues for BCH....

Well said. Bitcoin has failed due to poor decisions made by the devs and their inability to quickly enact change and move forward. They turned down a temporary solution (Segwit2x) and thus the underlying consequences. They must be proud.

I should add that the lack of adoption of Segwit by BCH exchanges is sabotaging solutions like Schnorr signatures which can contribute to solving BTC scaling issues...

I have heard many theories on the price of Bitcoin but I have read this with interest as well!§§

With the LN coming up and several ETFs in the works, I think we'll start to see bitcoin regaining some of that dominance back, although competition from the altcoins is getting more intense.

Ethereum has already outpaced bitcoin in terms of daily transactions!

As is steem ;)

Not really. Posting blogs and comments and replies on steemit is not the same as daily transactions on blockchains that have value. Sure, STEEM can handle a lot of traffic, but would you trust the system with serious investment dollars? Whale flagging wars, the big ninja pre-mine, and the fact that 95% of STEEM is controlled by so few accounts in a Proof Of Stake system, are all reasons NOT TO TRUST STEEM as a store of value.

transactions are transactions, should we exclude certain ones from the data?

Short answer is YES. Not all transactions are the same.

Using an analogy, which is not perfect but close enough, consider the Excel spreadsheet as a further example of distributed blockchain, on continuum from BTC to STEEM to Excel. BTC has close to perfect security proven over years, STEEM in the middle, and Excel at the far end.

There are billions of transactions in Excel spreadsheets every year. But is the Excel spreadsheet technology valued at $100 Billion? No? Why not? Because not every transaction in an Excel spreadsheet carries value or is linked to value. Many are just meaningless text.

Making all the Excel spreadsheets in the world somewhat similar to STEEM. Most of the "transactions" are meaningless text. So it is hard to ascribe value to that.

Until the "transactions" are linked to value, it is hard to ascribe value.

Why do FB and Google have such a high market cap? Is their market cap driven by the volume of posts or searches?

Sort of but not directly. Their value is driven by linkage to advertising, which is linking to a money stream.

Until STEEM can make some sort of comparable linkage to some money stream, STEEM is just an interesting play toy.

Are their money streams STEEM could get linked to? Sure. Quite a few possibilities exist.

But until their is a linkage to some money stream, then the "transactions" on STEEM are perhaps technically interesting but of much less financial interest.

block chain is changing the world, one user at a time

Blockchain is changing the world for sure but which one do you pick? Bitcoin seems like a rich mans game now, I prefer something with low transaction fees and faster conformation times

That will likely be the case for most investors as well. The question is, how long will it take the better blockchains to rise to the top?

I don't think you will have to wait more than a year or so, this space is very fast moving with a lot of developers being attracted to the quick money. Although bitcoin might still hold the crown if the core devs up there game a bit.

Bitcoin is the gold foundation for investing and the foundation will be needed. Buy Bitcoin now

Actually GOLD is the gold standard. It has been money for 6,000 years and counting. Bitcoin has only been around for 8 years and it's already starting to drop the ball.

As soon as people stop believe something is a good store of value it stops becoming one. I own a good amount of gold and silver coins, but I am seriously concerned that the prices I paid for them may never been seen again, and I purchased around current levels by the way.

I'm buying gold now as a crypto insurance policy. So are Russia and China for when the US economy crashes..

I'm very confident bullion will climb. And Bitcoin will be replaced by better cryptos...

https://www.marketwatch.com/story/why-china-and-russia-are-buying-so-much-gold-2016-08-01

I am not sure gold is the way to go anymore, though it has a lot of history to back it up as a store of value in times of uncertainty.

I know its a bit boring and it's never going to go nuts like cryptos, but ultimately gold bought using cryptos from gains made on cryptos is truly anonymous and will hold its value whatever happens to economies, cryptos, and laws.

So it's insurance. While cryptos go up gold won't. And vice versa!

Truth is I couldn't trade cryptos with full confidence if I thought I could lose the lot. Having 10% as gold means I can't ever lose the lot, so I can gamble the rest.

And Bitcoin I've made big gains on, sold and moved on from.

minimum investment is $1,000+ for bitcoin otherwise your loosing too much in fees.

Yea, the fees are pretty ridiculous. If they don't change something people will go to other chains/coins.

If they can get the lightning network implemented on the exchanges this will go along way to reducing the problem.

Bitcoin = digital gold. Litecoin = transactions coin

What is steem? The social media coin?

Buy Bitcoin now says stronglyteam with $1.50 in his wallet! :)

The market cap is still very small, there is still lots of room to grow even without institutions. Mass adoption from people who want out of the current monetary system is enough to bring bitcoin in to the trillion $ market cap.

Bitcoin - the Myspace of cryptos...

Someone who gets it. That makes you fairly rare and unique.

Look to ADA as a blockchain with long term future.

😂😂, yea or the Hi5

I can confidently say that Bitcoin is just going to move upward without any doubt in my mind... It will cross $50,000 mark in the year 2018.

In New Zealand we can buy gold bullion with cryptos so there is no trace of the trade.

https://www.mygold.co.nz/

They take other cryptos too.

You are right, this moment is pivotal and I like you think things will turn to the upside but I think you skipped one inportant consideration.

BTC's price is no longer just about whether more mainstream adoption takes place but also about how the mainstream responds to the growing options in crypto investment. It used to be if you liked the idea of crypto you had to first buy BTC to enter the space but more and more this is not the case.

Coinbase lets you buy four different coins to start off with.

Many exchanges will trade ETH for other crypto straight up, making BTC less important. Binance, Changelly, and I'm sure others for example.

Also competition from BCH has got real bitcoin believers torn into two factions. Could BCH become the cornerstone crypto its not beyond possibility, albeit unlikely.

All this adds to the growing sense that if BTC is going to continue growing it needs to become the coin we all want it to be. That early adopters imagined years ago.

Scale, speed and fees will hold BTC back from its fullest potential if not meaningfully inproved.

But like I said I'm hopeful too. Let's see 2018 be a year of exciting and meaningful innovation, and subsequently wider and wider adoption for BTC, as well as all quality crypto.

Great points. I would imagine that is a big part of it's dominance as well. Plus its technology is not very scale-able, especially compared to several others. Will be interesting to see what the market does from here.

I really hope for Cardano (or even XRP, ETH) to step up and replace BTC soon. The thing is, that the coin that gets added as the next gateway currency with trading pairs at the exchanges, will win the race. Interesting to see, how influential the exchanges are in the end. Even looking at the impact of Coinbase is stunning.

ADA will be big in the long term. Good call. I wish that even 10% of the folks posting would take the time to read the ADA whitepaper. Get themselves at least marginally educated.

True, but this is the case with every coin/project out there. Just have a look at the Telegram groups and even if there are sophisticated users and communities, as soon as some coin goes up, you mostly get people coming in who ask "when moon?","when lambo?" and "where can I buy?". Sometimes I have the impression, that 90% of all investors have absolutely no idea what they are buying into ;)

This is abs true:

Absolutely! The danger with having a real product and value in the cryptoworld though is, that then people will need to understand, what it´s all about and not just live from the hype. Also if the product does not work out perfectly from the beginning, people will suddenly doubt it and scream "scam" all over, while they should do so in totally worthless shitcoin projects. Well, I guess, this is how it is at the moment....

THere are better alternatives to Ripple with much faster transaction proccess. Bitshares, ,per their website, process 60,000 tps vs. ripple 1,500 tps.

In Ripple, ONLY institutions can become a "validator" (processor of transactions in Ripple network). Every server processes every transaction according to the same deterministic, known rules.

However, in Bitshares (BTS) ANYONE can supposedly become a validator ("witness"). The stakeholders (i.e. BTS holders) can elect any number of witnesses to generate blocks. Each account is allowed one vote per share per witness. To me BTS does the same things as Ripple but faster and in a more decentralized and democratic way (I know this is not an issue with some people but I rather not go on the same path as current financial system just with some shiny tech names in it).

https://steemit.com/bitcoin/@ka82/what-s-the-difference-between-ripple-closed-permissioned-blockchain-vs-bitshares-open-permissionless-blockchain

What's special about ADA?