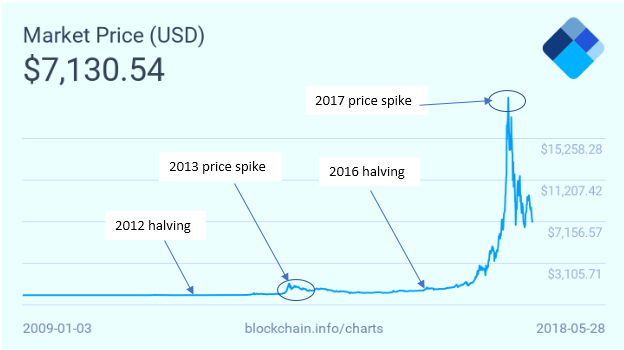

Bitcoin tends to make new highs shortly after its block reward halving!

Bitcoin often makes new highs shortly after its halving event.

In my post yesterday, I mentioned how we are now roughly only 14 months away from bitcoin's next block reward halving.

Block rewards are going to go from 12.5 to 6.25 per block.

This is significant because it will be the first time in bitcoin's history that its annual inflation rate will be lower than that of the USD.

Likely making it even more attractive as a store of value.

More from that post can be seen here:

https://steemit.com/bitcoin/@jrcornel/we-are-now-only-14-months-away-from-bitcoin-s-next-halving

What does the halving event mean for bitcoin's prices?

This is the part where we are all most interested in I am sure...

If you look back at prior halvings we can see that prices tended to start moving up roughly 12 and 10 months prior to each halving event.

They tended to move up anywhere from 200-300% when they started to move up till the actual halving event.

Not a bad return!

However, post halving is when the price action gets really interesting...

In both previous halving events, prices hit their highs roughly 1 after the halving event.

Check it out:

(Source: https://bitcoinist.com/bitcoin-halving-2020-what-will-the-price-of-bitcoin-be/)

Which means...

That means that if the next halving event is projected to be May of 2020, we can expect the peak of this next bullish phase to happen somewhere around May of 2021!

Not only that, but we can project that high to be somewhere well north of the previous high, which was around $20k.

Put that in your pipe and smoke it!

There is no guarantee it all plays out like this of course as history rarely repeats itself perfectly...

However, it does often rhyme.

Which means, I would not be shocked to see something at least remotely similar to this play out over the next 2-3 years.

Now is a good time to be buying if history is any indication!

Stay informed my friends.

-Doc

Sometimes i imagine what will happen if the big nations like USA ,RUSSIA, CHINA get the FOMO ... :D

I'm not counting on them coming in any time soon. Would be nice though!

You drew my attention to new information that was not in my mind ...I did not agree with the naive sayings that were saying that Bitcoin will fly again to 20k at the end of 2018 ....I think it takes two or three years for Bitcoin to regain its strength and jump even over 20k...Now you have supported my point of view with valuable information...Unlike others, I hope that the bear market will last as long as possible ,because I will occupy this period to keep accumulating ...

THANK YOU

That is likely the right mindset...

Go Baby Go! 😎

Only 2 more years to wait.

Nice article. I don't really agree on the price spike prediction that may happen in May 2021. Statistically, the price trend line for Bitcoin is not a result of independent factors. The news released, the government control, the speculation mindset and the unexpected fad of crypto currency all influence the price direction. Now the market is going more mature and more sensible. The government's altitudes towards Bitcoin have gradually settled down. I may think the price curve will fluctuate but with a trend slightly down until some unexpected demand rises or technology grows to make Bitcoin irreplaceable in some field. Otherwise, the price Spike cannot happen just based on the halving theories. Happy to discuss on this though.

Yes, a lot of that is correct. However, miners represent the biggest sellers. If you cut the amount they are selling each day in half, and demand just stays constant, prices will go up. If prices are relatively steady now, all we need is a reduction in supply and prices will go up. If there is an increase in demand like you are talking about as well as a supply decrease, prices will go way up.

The movement pattern you describe can be seen easier on a logarithmic chart:

(Chart courtesy of https://bitcoincharts.com/charts/bitstampUSD#rg60ztgSzm1g10zm2g25zv with BitStamp data because they have been around since 2011)

I have noticed a similar trend relating to the bitcoin halving. However, I think the pattern of the halving just so happens to line up well with fluctuating interest in the blockchain space. The early rally and recover periods between 2012 and end of 2014 had a lot to do with Silk Road and the technological flaws of bitcoin such as transaction malleability. Since then a lot of the price movement is related to government regulation and mainstream intrigue. The near future will probably follow similar reactions to mainstream adoption, as we can see recently with JPM coin and the Samsung Galaxy S10 hardware wallet. We may see a mooning in the next few years but it will be influenced by much more than just the next halving. :)

Yes I am sure it is mostly related to a positive catalyst. However, the setup is there due to the reduced selling pressure from miners. It's akin to a box of tinder, just waiting for a match!

Would you say it is better to move from alts to btc around that time? As we have seen a lot of times that when btc spikes, alts go down. What’s your view?

Posted using Partiko iOS

Good question. Sometimes when bitcoin goes up it pulls everything up with it. Other times it pulls value from every other coin. Tough to know which time this will be. I think it will be good for altcoins overall though.

Thanks. Let’s hope so :)

Posted using Partiko iOS

Not sure...sample size seems pretty small to draw conclusions out of that statistic ;-)

Sure, after the halving overall supply of new coins goes down, but this really being an indicator for a price surge? Wouldn't bet too many BTC on that exactly

Posted using Partiko Android

Yep, only 2 other examples is a very small sample size indeed.

I wonder if the Wall Street guys see this and will be playing the Futures Market as it could be a low cost best to get good pricing!

Posted using Partiko iOS

Short the spot price, buy the futures contract!

"expect the peak of this next bullish phase to happen somewhere around May of 2021!" - This is the date we need to look out for!!!

History tends to repeat in financial markets, usually because people understand it, and this might be one of those situations, because the helving event is a very significant event and will be the most impactful until now, for the reason you mentioned. ("first time in bitcoin's history that its annual inflation rate will be lower than that of the USD.").

Yep, agreed. I am not sure if it is just coincidence that prices tend to reach their peaks about a year after the halving event, but it has happened both times prior. Hoping to ride that trend over the next 2 years!