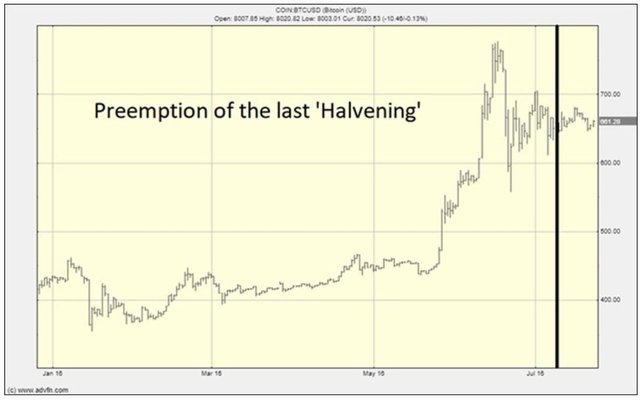

BTC - What happened the last time we were 6 months pre Halving?

Bitcoin is a little over 6 months away from its next halving event

Historically, these have been very bullish for the price of bitcoin, both one year prior and one year post halving.

We only have two other data points (halvings) to go off of, and two data points don't really give us a large set of data to draw from, so keep that in mind.

That being said, what happened the last time we were roughly 6 months out from the next block reward halving?

Interestingly enough, we saw prices make a low right around that time as well.

In 2016, we saw prices make a low of around $350 roughly 6 months before the halving and then reach a high of $780 roughly one month prior to the halving.

Check it out:

(Source: https://twitter.com/realSatoshi_/status/1187331794967896065)

Cool, so what does that mean for us right now?

Well, maybe nothing, but perhaps something.

If we take those same percentage moves and apply them to today's time frame...

We would see the price of bitcoin bottoming around this time and around current levels.

Then, applying the same percentage move...

We would see a price of roughly $16,500 by March/April of 2020.

The odds of things playing out exactly like this are probably pretty low, but it is interesting to note never the less.

The next halving event is currently expected to take place on May 13, 2020.

https://www.bitcoinblockhalf.com/

We are about 25% of the way into what has historically been a very bullish period of time for the price of bitcoin.

Stay informed my friends.

-Doc

Well, if your patttern calculations are true, that's going to be bad news for some people. Actually, a lot of people, as it wasn't that long ago that many were predicting a $100k or more price target by The Halving. The goofball McAfee, if memory serves correctly, was so sure of a mooning that he has threatened to "eat his own dick" if BTC wasn't at least a million bucks per by the end of 2020. Although I don't think anyone will try to hold him to that consequence, I'm sure there are some disappointed investors out there who took his advice serious and placed their bets accordingly.

Then again, as I didn't make any big bets based upon his trajectory predictions, my feelings might not be as intense as those of others who took him seriously. I suppose that if I had, and made big enough bets that now bring me such suffering and pain from the recent crypto performance, I might want to see him suffer horribly too, by demanding he follow through with his word to dine on his own dick. Why, I might even be vengeful enough to insist that he fulfill his commitment without allowing him a bun or even mustard to help him finish his meal of punitive and compensatory justice.

In any case, your calculation of $16,500 target by May seems reasonable, by BTC standards...and an incredible return if applied to other investment vehicles. As you point out, a 50% ROI within 6 months is a homerun in any other arena. Nevertheless, when compared to the predictions of just a few months ago, many predicting BTC prices in the six digits...50% seems a little disappointing at this point, don't?

Whatchagonnado?

McAfee's (and many others') predictions probably include an assumption of a legacy banking system crisis (or at least record breaking recession) as fundamental to their modelling and speculation.

I think the current rally was the tether train taking profits (just a hunch). If you overlay the previous cycle with the current cycle there is a lot of things out of the ordinary. 1st was the hash war and directly after that was the tether pump... we are returning to a realistic price which should be in the range of 6-7k and then a slow rise from there (my opinion) but WTFKs...

Ha, good point. No one really knows anything. All we can do is look at past patterns and trends and guess that they might sorta kinda repeat at some point, which they never do exactly, but sometimes they rhyme a little. Hopefully this one in particular rhymes a lot.

I wouldn't take McAfee's word for it. I'm certain the prices are going up but by what percentage I can't say for certain. Mr John on the other hand claims his twitter account has been hacked more often than not, so it's easy for him to play the I don't know who said it jive. Not so long ago, some hackers got sent lots of crypto through an ad on his twitter account after claiming to be him and promising a thousand percent returns for whatever amount you sent through. Once again he said it wasn't him. It's pretty difficult to take a sarcastic guy seriously some times.

Posted using Partiko Android

He's said it on video and in interviews multiple times now. He can't back off that $1 million call by end of 2020 at this point, even with a hacked twitter claim.

Lol you hit the nail on the head on this one.

Posted using Partiko Android

Yep, very true. Though, keep in mind these are not my predictions, but they are what would happen if history were to repeat in exactly the same way it did during the last halving. I think if you dig through my replies I am on record of calling for $20k by the halving. So, I guess I am even more bullish than the model. :)

mmmm... I don't know, it's all based on expectations it will be a bubble and return to levels 10.000 afterwards probably. Which is nice, if 10.000 level becomes a consolidation I would call it a big win. After all if you look at the big picture we are just going every year up and more up (if you ignore the levels of 2017 bubble of course).

Settling at $10k would be a 50% gain from current levels. I'd take it!

Greetings dear friend @jrcornel.

I think it is positive to analyze how BTC's behavior was before its previous Halving in order to establish valid hypotheses for May 2020. This could offer us valuable indicators to support decision-making.

Although we cannot ignore external factors that might have influenced their behavior in 2016 and that they could do so again in 2020.

By the end of Q1 2016 The world oil market experienced a significant collapse that led to the rethinking of OPEC policies precisely in the months of June and July 2016 when the previous halving occurred. Currently the US has issued economic sanctions that affect large producers such as Iran.

Perhaps this could have some effect on the crypto market, especially now that these same nations are developing efforts and policies to express and manage their international reserves reflected with cryptocurrencies such as BTC?

All best, Piotr.