CEO of Bitmex doubles down on bearish comments

Bitcoin not out of the woods yet?

The CEO of cryptocurrency exchange Bitmex, Arthur Hayes doesn't see any improvement in the price of bitcoin any time soon.

Arthur Hayes had some pretty bearish comments regarding bitcoin yesterday, and today he doubled down on them

Yesterday Hayes said that he could see the current bear market lasting another 12-18 months from here.

More about that can be seen here:

Today, he doubled down...

After his remarks yesterday, Hayes felt the need to add a little fuel to his bearish fire.

Today, Hayes says that he thinks that bitcoin could fall all the way down to the $2,000 - $3,000 area.

Yikes!

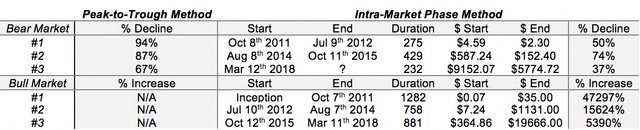

His reasoning has to do with how similar this bear market has been to what happened from 2014-2015.

Back then, after bitcoin broke its 200 day moving average, it fell another 74%.

Currently, bitcoin is ONLY 37% below its 200 day moving average:

(Source: https://www.ccn.com/bitcoin-price-bitmex-ceo-doubles-down-on-bear-call-says-btc-could-fall-to-2000/)

Which means, if bitcoin really is to mirror what happened in 2014, things could have a lot further to fall.

Using those same numbers from 2014, Hayes comes up with $2k-$3k as his price targets for bitcoin.

Personally, I think he is just hoping for those numbers...

He tends to think the lack of volatility is a problem for bitcoin and without it, prices will continue to slide.

It remains to be seen whether that is true or not, but I do know that in other asset classes when things start to slow way down like they have after pulling back some 70% from the highs, that tends to mark a bottom more often than a continuation.

Fundstrat Global Advisors tends to see it that way as well as they think the lack of volatility likely means bitcoin is putting in a bottom as opposed to something else.

We will know more shortly as the bitcoin trading range is getting ever tighter.

Stay informed my friends.

Image Source:

Follow me: @jrcornel

I think a major fact many are missing and a figure probably difficult to quantify is the amount of buying occuring OTC and into hands of long term investors that continue to limit the amount of supply outstanding...

I have always wondering why OTC trading does not affect prices more. I mean, in a way, isn't OTC trading the same as black market trading?!

Falling below 6K will also make mining less profitable! Assumed some deep pockets have already saved us from dropping further a few times now

Posted using Partiko iOS

That is a good point. We are already below many places break even cost of mining.

Hmm people will pay attention to this news, I know from trading that sometimes bad news and comments affects prices adversely, hopefully this isn't the case here.

But at the end of the day the reason the price of bitcoin will go up is that if people believe it will, if people don't believe then they sell their coins and the price goes down. Psychology is a huge part of the game.

Buuuuuuuuut as long as it doesn't affect my Etheruem i'm happy 😁.

Yea this might be this guy trying to speak it into existence. He needs volatility for his platform to make money. Perhaps he might even make more if prices crash.

I'm sure he's hit a few nerves.

A while ago he also forecasted that btc would be at ath again soon.

Yea he actually said it would hit $50k before end of 2018. Now he is going the opposite direction with his forecasts.

If Bitcoin were to hit $3,000 I would stop paying all of my bills and buy BTC with my income and just live out of my car :-D!!!

Once BTC goes on a bull run I would pay back all my debts and then get an apartment again LOL

Haha that is not a bad plan actually. If bitcoin runs way up again afterwards, perhaps next time you buy the apartment. :)