The next Tulip Mania or the Beginnings of Something More?

As I type this, Bitcoin is busting through the $1650 mark to the upside on the Coinbase exchange.

Making yet another all time high. If you haven't been paying attention, this has been going on for weeks now.

However, it's not just Bitcoin...

Ethereum is trading for over $90 right now. Also making all time highs seemingly every single day.

But it's also not just Ethereum...

It is tough to throw a rock right now without hitting some coin in the cryptocurrency markets that is either at an all time high or up significantly off the levels it was trading at just a couple weeks ago.

What the heck is going on?

What is fueling this incredible surge in prices in the cryptocurrency markets?

There are a couple things causing the surge in my opinion. One of the major factors being plain old supply and demand. Specifically in regards to Bitcoin.

Supply:

Bitfinex problems.

Some investors are having trouble withdrawing their funds after Taiwanese banks started blocking requests to transact in Bitcoins. Similar banks in the region are also following suit on any assets they have deemed as "too risky". This is causing problems processing transactions for the Bitfinex exchange.

So, basically some people that are using the Bitfinex exchange are unable to sell their Bitcoins.

As we have some holders of Bitcoin unable to sell, any new buying pressure pushes the price up. As the price continues to rise, more and more speculators jump in and the price continues to rise. Causing a momentum effect.

Therefore, because of exchange issues, the supply is being artificially constrained at the moment in some places.

Demand:

The demand seems have seen a sharp increase over the last couple weeks and it seems to be coming specifically from Japan, where recent rule changes are making trading virtual currencies cheaper and easier than ever before.

Starting in July, the consumption tax will no longer be applied to virtual currencies in Japan. This is big news and sparking demand for the virtual products.

Virtual currencies will now be cheaper and more accessible to the masses than ever before.

In response to the rule change, more than 10 companies are already launching exchanges for Bitcoin and other cryptocurrencies to be traded on.

How much demand is actually coming from Japan?

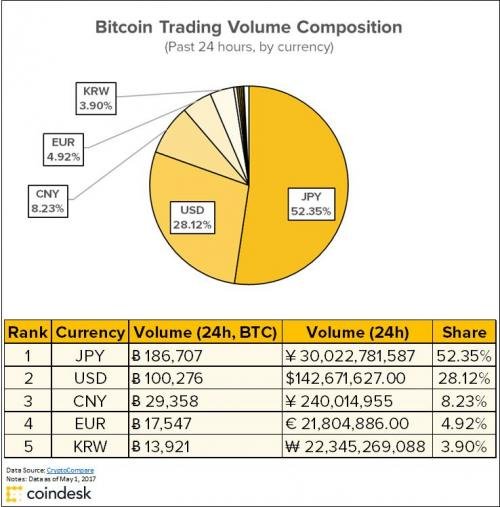

Check out the chart below and see for yourself:

As you can see, Bitcoin trading in Japanese Yen is more than half of all the trading volume over the last 24 hours.

The next closest currency is the USD, which is almost half the volume of what the JPY is doing.

Clearly, trading Bitcoins in JPY is leading the way.

Why are just about all the other Altcoins also going up?

I think one reason for that is that people are searching for the next hot thing.

If Bitcoin can go from $30 to over $1600, what is going to be the next one that does the same thing?

No one knows for sure, but if speculators buy enough of them, they will likely get one of them right.

The other reason (and probably the more important reason) is possibly related to why Bitcoin is running as well.

There are large groups of people that are being exposed to cryptocurrencies for the first time due to government rule changes as well as technology changes. These changes are helping fuel massive demand for the virtual currencies.

Another possible catalyst for Bitcoin and the entire crypto space in general has to do with the SEC reviewing their initial rejection of the Winklevoss ETF. You can read more about that here:

https://steemit.com/bitcoin/@jrcornel/breaking-sec-reviewing-bitcoin-etf-rejection

The only question that remains is how long this extreme bull market will last?

Some of the reasons for the run are likely only temporary, like the restriction of supply where people are unable to sell for example.

However, large groups of people getting access to the currencies for the first time might be something that is able to cause a longer term bullish trend. Something that might be more sustainable in the long run.

Many new people and dollars will be introduced to virtual currencies for the first time over the coming years.

Therefore, this may indeed be the start of something, a paradigm shift, as opposed to just a few week buying flurry...

What say you?

Is this the beginning of a paradigm shift of just a flash in the pan Tulip Mania craze?

Sources:

http://www.businessinsider.com/bitcoin-price-blows-through-1500-for-the-first-time-2017-5

http://www.zerohedge.com/news/2017-05-04/bitcoin-soars-above-1600-relentless-japanese-buying-frenzy

Image Sources:

http://www.reuters.com/article/us-bitcoin-etf-idUSKBN17R27J?il=0

http://www.zerohedge.com/news/2017-05-04/bitcoin-soars-above-1600-relentless-japanese-buying-frenzy

Follow me: @jrcornel

$1650 thats crazzzzzzzyyyy !!!!

Put another zero on. That's crazy.

It's getting even crazier today. Steem currently at $.35 :)

*high five ;)

*High five! :)

Was recently thinking of writing a post about the Tulip! As for tulip or moon thoughts as can all have our own choice on that. Enjoy the bull, but also because of the bull in case a bear comes out to play too. Enjoy the waves and diversify.

Some good advice here...

For what it's worth, I think that we are in the very early stage of the crypto bull market. When the Crash of 2017/2018 hits with full force, stocks, real estate, and bonds will all get crushed. There will likely be a flight to safety and stores of value like gold, Bitcoin, and silver.

Sure, I could be wrong, but I think that the bond bubble finally bursting will be just brutal.

If people are selling everything else, why wouldn't they also sell bitcoin?

Cos you have to sell "everything" FOR something. Something that will not lose value

Good point but at that point I feel like cash is king, will bitcoin be on the same level as the almighty dollar?! Time will tell...

For what it's worth, my theory is because Bitcoin is inherently finite and deflationary. An almost infinite number of bond debt can be created (heh, this has basically already happened).

You have a point...

Last night (ignore all time references, we're in New Zealand) when we went to bed Bitcoin was at $1510. And this morning it was at $1512.

Until I read your post I never realised that Bitcoin had gone up to $1602 and then "crashed" back down to $1500. Meanwhile all the altcoins we have invested in have also gone through the roof.

So today we are looking at having made over 10 grand, basically all from using Steemit for eight months. Right now I'm very happy with cryptocurrencies:)

That is fantastic! Is that paper profits or realized gains?

Well it's in our Wallets - Jaxx and Steemit - is that a realised gain? I guess it is unless the market crashes:)

I would call it a realized gain once it is in your local currency that you can spend on groceries or bills :)

We have done that, and it all worked fine, but mostly we are leaving it in for the wild ride!

Holy cow - we have just made another US$350 since I last looked a few hours ago

One currency is showing up as our “worst” investment (Dash) – it’s only made 15.6% in the past three weeks… Hopeless!

The best (Ripple) is up 166.5%!

That is awesome. I see Steem is ticking around $.35 right now... nice :)

Yes - that's our biggest investment so when it goes up we are looking good :)

I am checking the values on https://www.cryptocompare.com and they always seem to be a bit lower than the ones you are seeing. Steem is currently .29 which is still awesome.

I think a correction is necessary as in any market. The further the rise, the harder the fall. Blockchain technology is changing the world in many ways, but the coins have risen so fast in such a short period of time. It is a little concerning.

I agree. A correction, at the very least, is coming... but when?!

I know.. That is the question of the year!

A correction will come but I do still think cryptocurrencies will all be up by the end of the year, I think more and more people are starting to see the benefits of blockchains and the benefits of using cryptocurrencies, I can only see it all getting better and better, there will be drops but overall I think it's all gonna be good

That is very true. I wonder what percentage of people are invested in any cryptocurrencies at all? I wonder what percentage of those are invested in Bitcoins. I have no idea, but would venture to say that less than 5% are invested in any cryptocurrency and that 60% of those people are only in BItcoin. I could (and probably am) extremely off in these numbers. But mass adoption has not come close to taking place

You need to consider that maybe 80% people are broke and they living from paycheck to paycheck.

That is an excellent point! People can get started with just a few bucks, but so many people these days have no savings whatsoever and are deeeeeeep in debt.

Not in the slightest yet! I can't say I know a single person personally that even knows about blockchains or crypto..I've friends working in tech companies and even then haven't a clue they've heard of bitcoin but that's it! Mass adoption will come and when it does alot of us will be quite rich

That is the same response that I get from all of my friends. All of them are so focused on the stock market.. :/

I get the typical response "Don't they use those bitcoins for purchasing drugs and financing terrorism"

I don't bother with the stock market at all or forex, actually in my eyes paper money is old fashioned and on the way out, we will see cryptocurrency being adopted more and more, with japan adopting bitcoin, this year is the start of it

I have a few gold miners I pick up when they get smashed, but they have been beaten down so bad recently, cryptos would have been a much better investment

In a world where everything is going digital it only makes sense digital money is next, also a reason we need to support startups like Viva, companies that have a vision of making it mainstream and easily accessible and easy to spend, one of the biggest problems I see even on here is people trying to actually spend their steem, converting crypto to cash is still too technical a thing for the average Joe but if you could just have a debit card like Viva plans to do that is linked to your crypto account making it simple and easy to spend is the next step to mass adoption

I think there are people who have fomo but are afraid to buy the peak, so they're trying to buy gamble on alts until the BTC bubble bursts then buy the dip.

Things are NUTS right now!

upvoted

@shayne

I think you may be on to sonething... I could see people doing exactly that.

I'm hoping to be part of the Bitcoin millionaire club. I read somewhere that 10 bitcoin by 2025 will be worth a million dollars....I can dream😁

Haha I hope you get there! Steem would likely be a lot higher as well :)

I have been watching markets rise and fall for over 45 years and this too will make a correction. Which I believe is a good thing. When something takes off too fast ..... in my opinion not too safe of an investment.

Good point. Will it be just a correction in a long term bullish trend or are we seeing the highs here?

I think just a correction as there are many that are finding interest around the world. I am believing that this is just the beginning. Isn't it fun to be on the cutting edge!

Cryptocurrencies certainly have more "intrinsic value" than tulips.

Having said that... How much is Bitcoin worth? Ethereum? Gold for that matter.

With cryptocurrencies, there are no dividends paid out. Which would be necessary for actually measuring the value.

Interestingly enough, the value of steemit and the steem currency is probably easier to actually measure. Steemit does offer some type of ROI.

I'm also curious to see how POS will work with Ethereum. I think this prospect is also a part of the recent rally.

That could be, Ethereum has rallied more than most!

We live in times where ROI is barely possible. Return OF investment is the main concern today. Note the negative interest rates for european bonds.

I'm at a loss for words.....I'm thinking the moon is the next stop!

Haha hope so!

oh yeah!