Is there a link between the decline of encoded currencies and their mining operations? What are the reasons for the current decline?

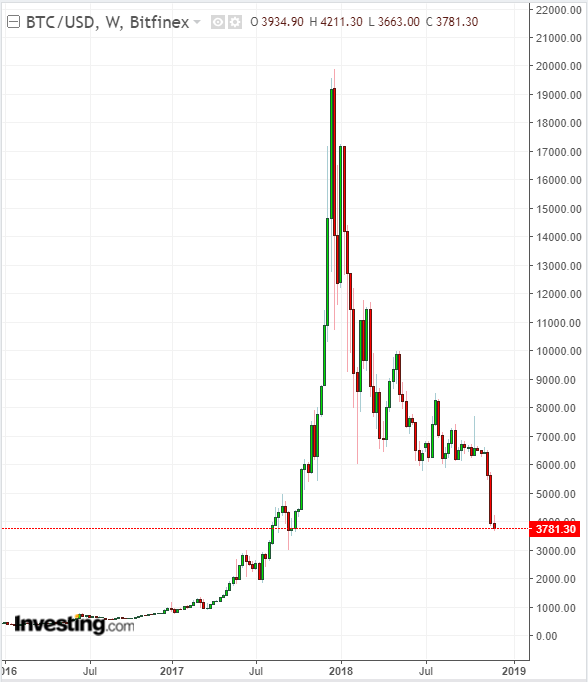

Last year, the markets focused on the impressive rise of coded currencies. Now, the lives of investors pull out slowly while watching penetration ({{945629 | configure }}) below the level of $ 3000, and the looming possibility of decline further, does not fall configure alone, but accompanied by most of the alternative currencies in the descending vortex.

What difference can one year make?

The value of the digital currencies continues to decline, but there is an undirected side in the decline of currencies, and the lack of focus does not prevent it. And this aspect is: rapid change in the field of encrypted currency mining. Is there a correlation between mining and falling prices?

A harbinger of operators and hardware suppliers

Mining news reports are also pessimistic. On Monday, November 19, the US mining company Giga Watt announced its bankruptcy.

Earlier in November, NASDAQ (Nasdaq: VIDIA ) shares fell nearly 19% after the company responsible for the digital chip industry failed to live up to the Q3 earnings forecast and also reduced its outlook for products in the non-warehouse Sold, due to the evaporation of the flourishing of encrypted currency mining.

One analyst pointed out on Twitter:

As I warned earlier, we will see a collapse of the two, because of the high electricity tariffs on the minerals, and this high cost will force them to leave mining, and a lack of composition. China, the United States and Norway are lifting tariffs on minerals, or resorting to lifting subsidies, causing the bankruptcy of many minerals.

With the drying up of mining hotspots, capital market linkages, and the collapse of mining hotspots, leaving the metal with no choice but to sell, configure, and escape.

The low price is logical, says Frank Wagner, CEO and co-founder of INVAO . Coded currency prices are affected by the balance of supply and demand:

" With the low rate of mining operations, there will be fewer metal sellers selling currencies, and this will probably reduce the downward pressure on the market, and therefore the asset will appreciate."

The number of metals will fall as economic incentives fall, according to David Tabachnikov, co-founder and creator of the Jerusalem Chain chain . However, there is still an existing structure that maintains economic incentives, for a number of minerals, regardless of price, and says:

"For the case of the composition, the difficulty lies in the re - estimate due to occur almost every two weeks. The land mining price, and adapts to the market price of each 1 - 2 month. Thus , for the cost of mining, for transport , for example , the price fell below the 3,000 dollars, Valmadenon in Germany or the United States If you look at the basics, we do not have so many minerals in the first place, many companies are borrowing to expand, and those companies will go bankrupt in the end But the metals in Belarus, Kuwait, Venezuela or Trinidad, Where the cost of mining is less than $ 2,000 , will remain in the market. "

Tapachinkov believes that the two minerals that have invested in graphics processing units, a more general category of solid computer parts, and have not put their money in the only processing plants such as ASICs, will adjust their activities to switch to new cluster chains such as Etherm or EOS , Mining on those chains. They are more likely to describe any unprofitable coded currencies, pushing the price down. "But the two minerals that have invested in the ASICs - which are just shaping up - will hold positions as long as possible."

Mining transformations

Mining techniques are now also located at the site of doubt. Seth Patinkin says: "Mining with proof of work, an essentially irrational economic proposal," Patinken is the executive director of Ampersand Markets. A labor verification protocol requires verification of each mining or mass transaction, making its implementation very costly. "What has now been demonstrated is an economically unsupported and unsupported structure that is damaging the integrity of the business-proof clusters, and drives suspicion of utility as a form of payment," Patinkin says.

"When a stock market drops to a firm, stocks find support, because the company is putting an end to market value, even if it is less than the decline in stocks," Pattinkin says. This is not available in the largest encoded currencies, which do not have a physical downtime on their landing. Coded currencies were an easy target for all the deadly powerful juices in the market.

"The validity of coded currency prices depends on the metal participation rate of the labor proof protocol, which was destroyed by the recent deterioration in the structure of the currency price."

However, some encrypted currency monitors reject the principle that there is a link between the mining of encoded currencies and the falling prices. Alex Machinsky, Executive Director of Celsius, said :

"The fact that the currency companies face encoded mining problems does not affect the prices of the composition, the total production of the new currencies from the composition will remain at the same level, even if half of these minerals come out of the market.

According to Mashinsky, the current selling pressure is driven by the continued flow of bad news, with major exchanges such as the ICE lagging behind the launch of services focused on encoded currencies. According to this view, there are many currencies that drive the current decline, making it impossible to focus on one catalyst:

"You have more than 400 hedge funds that face the risk of liquefaction, the withdrawal of investors and some have fallen by 50 %." Platforms like BitMex are selling rapidly, providing a leverage of up to 100x . Sales are going on because the platform is forced to liquidate A large part of the centers of the long form of the crane. "