A Guide to Cryptocurrency Portfolio Diversification

Let’s talk portfolio diversification. If you follow the crypto space, you have probably seen all the ICOs (Initial Coin Offerings) and the huge price swings from the recent months. This guide will talk about portfolio management and diversification. Many new investors made huge profits from investing in ICOs. Others lost a lot of money because of scams. The crypto space is currently the wild west. It offers enormous opportunities and huge risks. An uneducated investor is more likely to lose his money instead of making any gains. I would like to talk about portfolio diversification and why it is important. I see many people invest in ICOs only. In my opinion, this is a very risky strategy, and a smart investor wouldn’t put all his eggs in one basket.

The Problem with ICOs and diversification

Currently, 99% of all ICOs are conducted on the Ethereum blockchain. Startups offer tokens in exchange of ether (ETH). This is all great, but you should keep in mind that you are dependent on one single platform - Ethereum. Investing in different ICOs is not equal to diversification because all of these are part of one ecosystem. If Ethereum fails to scale in the future, all of these startups will fail too. You might argue that if something happens to Ethereum, the startups could just switch platforms and move on. This is true, but it will have an impact on the price. In order to have a diversified portfolio, an investor has to distinguish between the different types of projects.

We have simple cryptocurrencies such as Bitcoin, Litecoin and Bitcoin Cash. All of these are very similar and offer the same features. We also have privacy-centric cryptocurrencies such as Monero and Zcash. This is the first step to a diversification. Owning a mixture of fully transparent and privacy-centric coins is a good start. If you want to dig deeper, you could also look into all masternode coins such as Dash and SmarCash. Applying this investment strategy, you get a diversified cryptocurrency portfolio by covering all variants and flavors.

Now we move to the blockchain platforms. These blockchains allow you to build features on top of them. The best example at the moment is Ethereum. Developers are able to build apps on top of the blockchain. Other examples for blockchain platforms are NEO, EOS, Lisk and Aeternity. If you want to spread your risk, please avoid putting all of your money in Ethereum.

There are also decentralized applications running on top of their own blockchain. Such example is Particl which is a P2P e-commerce. These dApps are not built on top of a blockchain platform but rather have their own dedicated blockchain. Identifying such dApps might be challenging.

An example for a bad investment: Let’s say you own OmiseGo (OMG), Agur (REP) and Maker (MKR). What do they have in common? These are all dApps (decentralized apps) running on top of Ethereum. Hence they have a single point of failure - Ethereum. I am not against investing in dApps, but a smart investor should spread his risk across different projects and platforms. The mentioned projects above still have substantial upward potential. I do not advise against investing in these but instead spreading risk by also buying other coins such as Bitcoin or Particl (Main idea: coins that are not running on top of Ethereum). This is how you form a robust portfolio.

How do you find out if you have built a robust portfolio?

The way you can stress test your portfolio is a market crash. If the value of your portfolio holds up well, then you have made a wise decision.

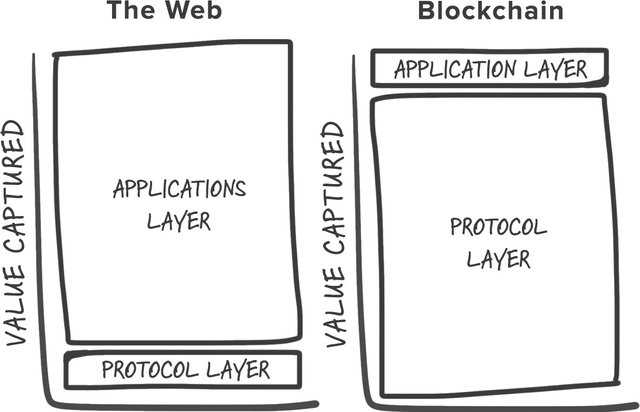

Thin Protocols vs. Fat Protocols

Blockchains have changed the way people evaluate protocols. When we look at the Internet stack, we see that today's internet protocols (TCP/IP, etc) have captured little to no value. On the other hand corporations such as Google or Facebook utilize these protocols in order to extract value with their services. Therefore, the most value of today's Internet is captured by centralized companies.

Source: Fat Protocols by Joel Monegro

Source: Fat Protocols by Joel Monegro

When we look at blockchains something different is apparent. The Bitcoin protocol has a market cap of $140B. Yet the companies building on top of Bitcoin are worth a lot less. Maybe the biggest one is the cryptocurrency exchange Coinbase. We see the same pattern with Ethereum.

Conclusion: Focus on protocols where people could build on top. This is where the most value in the blockchain space will be captured. Avoid investing heavy in dApps and ICOs. Even though they are a good way for making quick profits, a lot of these will not stand the test of time and will fail.

Happy investing!

Disclaimer: This article is not an investment advise!

I like it! A competent and simple explanation of the main things. Well done!

Interesting article!

Checkout @cryptobroye for more bitcoin info and analysis. Im sure there's a lot we can learn from each other!

Thanks!

Great detail on portfolio diversification. If you're interested, wandx is a marketplace where you can trade your portfolio in one go, have a look at it at wandx.co

Congratulations @kondor1030! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last announcement from @steemitboard!

Wisely! Thank you for advice! To be able to invest profitably, I need to learn to listen to smart and knowledgeable people. I trust you. Young people quickly understand the innovations of the economy.