$1 Billion in Mining Equipment added to Bitcoin, 7 Billion GigaHash, in 50 days.

Satoshi Nakamoto’s Introduction of Bitcoin, 2008. In today’s world, nodes or “timestamp servers” no longer perform “computational proof”. Instead, Miners perform computational proof and Nodes timestamp.

Since January 1st, 2018, it is speculated that well-over $1 Billion has been invested into Bitcoin Mining, primarily by Jihan Wu, and associates, or the better known entity Bitmain. One article conservatively estimates the operating profit of Bitmain as over $3 Billion in 2017, which is largely derived as a percentage of the overall Bitcoin Block Reward.

The Fugio Cent, one of the first coins of the Continentals, designed by Benjamin Franklin. In parts, Business is represented by Time (sundial), and Mind emphasizes ingenuity. Which could translate to ‘be ingenious with your time’, as maximizing production yielded a more plentiful life, and nation. As a whole, they form a witticism: ‘Leave others be, improve thyself instead’. In later years, this was replaced by “In God We Trust”.

The Bitcoin Block Reward is comprised of two parts, transaction fees and mining bonuses. In 2008, Satoshi Nakamoto set the minimum mining bonus to be 4% of total Bitcoin value between 2016 and 2020, or $6 Billion for 2017, plus transaction fees, which would drive the total block reward over $7 Billion.

And from that pool of $7 Billion, Jihan Wu and associates have ‘conservatively’ profited $3 Billion, and have been awarded over 50% of the $7 Billion in transactions fees and bonuses.

To achieve this marvelous feat, Jihan Wu has made significant advancements in GigaHash, using ASIC mining. A GigaHash is a standard unit of Hashing Power. For non-ASIC mining, such as 2017 Ethereum, to obtain 1 GigaHash one might need to spend $5,000 in Equipment. Since January, 7,700,000,000, or 7 Billion, GigaHash per second has been added to the Bitcoin blockchain. At a cost of $5,000 per GigaHash, that would be $35 Trillion dollars in hardware added over 50 days.

However, since ASIC mining, a GigaHash now comes relatively cheap, making all other forms of mining of comparable efficiency to a horse and buggy. At a cost of $5,000, one might expect to produce 35,000 GigaHash (vs 1 GigaHash, non-ASIC). However, adding an average of 150 Million GigaHash per day (over the last 50 days) still requires a substantial amount of investment, of approximately $20 Million per day in New Hashing Hardware, or $1 Billion total, over the period from January 1st to February 20th.

For comparison, total hashing power of Bitcoin at the start of 2017 was 3 Billion GigaHash, in 2018 it was 14 Billion GigaHash, and in February it is now 21 Billion GigaHash, or a growth rate of 350% during 2017, and a growth rate of 50% in the last 50 days. If this pace continues linearly, one might expect 70 Billion GigaHash come December.

A typical depiction how many view ‘miners’. Most Hash is created within centrally owned, sterile warehouses, with the objective of maximizing profit through the conversion of Block Reward into equipment and labor.

What does this mean for miners, and their profits?

While Bitcoin is increasing in value, hardware and equipment depreciates and becomes obsolete. While 7 Billion GigaHash earned 50% of the $7 Billion block reward in 2017, by December it may only earn 10%. For Bitcoin to keep pace with projected Depreciation, it would need to need to be valued at over $50,000 by December, 2018.

Put another way, where as ASIC mining equipment may have a functional useful life for 2 to 4 years, the percent of total output relative to value is likely to be reduced in half approximately every 4 months, unless the price of Bitcoin escalate at a similar pace (a doubling twice a year). By December 2018, Bitcoin might be projected to be valued at $15,000 to $30,000. Today’s value of Bitcoin is $10,430.

In other words, persons who prepaid and reserved mining equipment are projected to earn far less than their projected Return on Investment, and to obtain revenues 75% less than expected.

Roger Ver (owner of bitcoin.com), John McAfee, and Jihan Wu (owner of btc.com and Bitmain founder) discuss the future of Bitcoin, and the creation of Bitcoin Cash (BCH). Roger Ver went on to redirect bitcoin.com to Bitcoin Cash, and has done several media campaigns introducing “Bitcoin Core” terminology. Jihan Wu set Bitcoin Cash mining structure to maximum disruption to Bitcoin. Together, they fought to prevent Segwit technology, increase transaction fees, and weaken the culture of Bitcoin.

Satoshi Nakamoto’s explanation behind his intention of adopting “proof-of-work”.

What does this mean for the Security of Bitcoin?

The Original Bitcoin White Paper, published under the pseudonym Satoshi Nakamoto in 2008, spent much of the 9 pages speculating upon the Security of Bitcoin. If we are to refer to Bitcoins as Units of Value, it suggests that you need two things to maintain integrity:

- Value Units distributed approximately equally between persons, and

In contrast to the concept that one person could obtain multiple IP addresses, Page 4 asserts using Hash Power as “proof-of-work is essentially one-CPU-one-vote”. It cites this broad distribution of Value Units as a Byzantine mechanic to ensure Nodes (often interchanged with Mining, as they were presumed to be one and the same at the time of original authorship) remained ‘honest’. Within the context of the paper, ‘honest’ means uncoordinated.

As block chain technology is reliant upon many persons agreeing upon a single Bill of Accounts, so long as each Node is interrogated independently, only the truth is capable of being consistent. Any sort of lie, or misstatement, would be immediately contradicted by the majority, who are presumed honest.

- Hash Power does not become significantly coordinated, or concentrated.

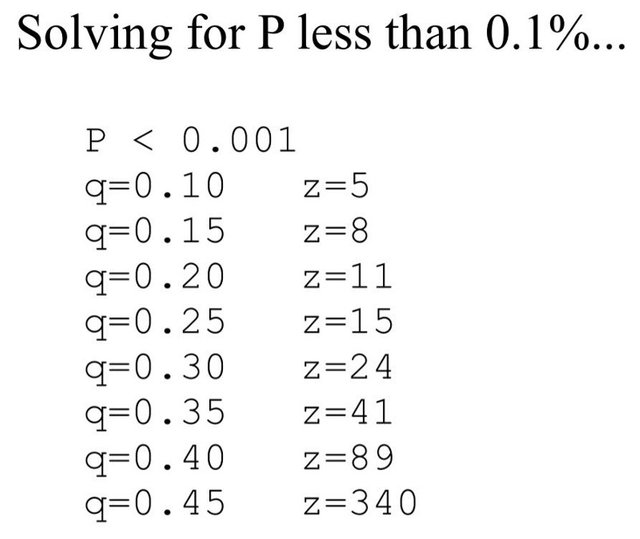

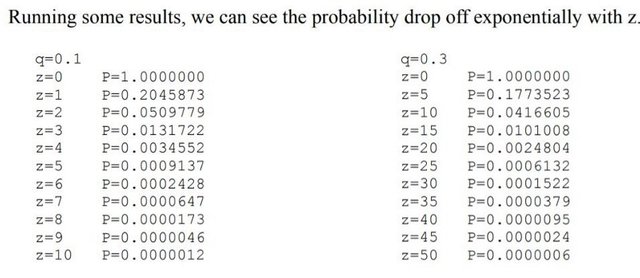

Indeed, approximately 3 pages of the 9 page document warn against the dangers of concentrated hash power. The symbols used on page 8 translate as follows : q = % of Hash, and z = Number of Blocks (or 10 minutes). Page 8 of the White Paper suggests that Bitcoin should strive for 99.9% accuracy. Accuracy increases with the number of blocks created, and percent of uncoordinated Node verification. The White Paper asserts the following, to obtain 99.9% Accuracy:

- 90% Independent Hash Power : Wait Time 5 Blocks, or 50 Minutes

- 75% Independent Hash Power : Wait Time 15 Blocks, or 150 Minutes

- 60% Independent Hash Power : Wait Time 89 Blocks, or 890 Minutes

- 55% Independent Hash Power : Wait Time 340 Block, or 3,400 Minutes

Within the White Paper, it does not even speculate the continued use of Bitcoin should the Hash Power become concentrated beyond 50%, aside the off-hand comment “it would undermine the system and the validity of his own wealth.” This of course was true in 2008, before the Crypto Currency Marketplace, but today there are many other versions of “Bitcoin”, and the Bitcoin brand name has been muddled with copycats, and modern sources of information (such as the Bitcoin Twitter handle) redirecting to similarly named products of divergent objectives from those of Satoshi Nakamoto : Which we can simplify to creating a trust-less system of agreement, one in which many independent actors participate, or “peer-to-peer”. Within context, “peer-to-peer” is not meant as the exchange of coin, but the hosting of Nodes and computing of Hash. In other words, the ‘Bank’ would be powered and protected “peer-to-peer”, not merely exchanged.

Page 8 runs through a variety of scenarios, at differing levels of Hash concentration, however it speculates little beyond 10% and 30% concentration. As these are the only two value ranges presented, we can assert this to mean less than 10% concentration to be inconsequential, and over 30% presumably intolerable.

For a mere 95% rate of accuracy, with a 10% concentration of hash, this can be achieved after 2 blocks, or 20 minutes. With a 30% concentration, this requires 10 blocks, or 100 minutes. No other values are provided, but at a 45% rate of concentration, we can speculate achieving 95% accuracy would require 6 to 12 hours. Even the achieving the lowest value presented in the White Paper, of 80% accuracy, might take 3 hours alone.

In conclusion, I ask you to agree or disagree to the following statements, and present your reasoning if you so desire:

- Satoshi Nakamoto warned against hash concentration over 10%.

- Satoshi Nakamoto would consider Bitcoin insecure.

- Satoshi Nakamoto knew the timing of future values of Bitcoin.

- Bitcoin is a protocol, or code, and change there to is ‘not Bitcoin’.

- Bitcoin is an independent ledger, and degradation there of is ‘not Bitcoin’.

- Bitcoin is a peer-to-peer dispersion of global technology and wealth.

- The most important aspect of Bitcoin is the micro exchange of payments.

- The most important aspect of Bitcoin is the advancement of technology.

- The most important aspect of Bitcoin is the Independence of Nodes.

- The most important aspect of Bitcoin is the acquisition of GigaHash.

Satoshi Nakamoto, Bitcoin, 2008

The Fugio Cent. “We Are One” showcasing the 13 Links of the Original 13 colonies. During the reconfiguration of the nations, the colonist were scared by the mass media gazettes into believe each ethnicity, language, or religion needed their own territory. These divisive labels were countered with One: ‘The Continentals’.

Keller Barnette, CPA, Tennessee

In the picture above is Hal Finney, participant in the first Bitcoin transaction, along with Satoshi Nakamoto. What was made, was unmade. Go forward with diligence and song.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/@kellerbarnette/1-billion-of-new-mining-equipment-added-to-bitcoin-f5bbbddf2764

Disclaimer: I am just a bot trying to be helpful.

Congratulations @kybarnet! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!