Analysis of the ICO. BABB is a decentralized Bank for microeconomics

I studied the announcements of the different ICO, and among the masses the ideas of decentralization and transfer on the blockchain suddenly caught in the draft of BABB, with founders from London. Like anything remarkable, the website is not the most outstanding, grades are not the highest, but the ideas underlying the project are impressive.

Problems that the project solves, if briefly look like this:

The existing banking system is built on an outdated infrastructure which no longer serves the interest of its retail customers or the microeconomy as a whole. Individuals, freelancers and Small and Medium-sized Enterprises (SMEs) have always struggled to obtain affordable funding from these banking giants and often been excluded completely. This problem has been exacerbated recently by the banks’ reckless behaviour in the run-up to the financial crisis, which has further increased the public’s discontent towards these traditional banking institutions.

Banking Systemic Risk

As a society and individuals, we have become increasingly reliant on banks over time. We depend upon banks for daily tasks such as paying for our groceries with a debit or credit card, obtaining loans/mortgages to buy a house, or opening a savings account to put money away for the family holiday. Banking services have become ingrained in our day-to-day life, and this over-reliance has resulted in banks having a worrying amount of control over both our money and personal data.

This loss of privacy and control has far-reaching effects, effectively exposing us to the systemic risks from the banking industry, as seen in the global financial crisis in 2008.

Financial Exclusion

It is easy to take financial services for granted. Currently, 2 billion - or 40% of the global adult population - have no bank account or mobile money services . These individuals have very limited access to savings, credit, mortgage and insurance products that are common in developed marketplaces, meaning consumers cannot fulfil their financial needs effectively and firms miss opportunities to utilise untapped financial resources.

The consequences of financial exclusion go beyond the greater risk and higher cost to consumers of relying on cash and informal financial markets. Forcing people to rely on these methods also undermines government’s ability to collect tax and monitor expenditures.

Underserved Microeconomy

The efficient distribution of resources between businesses and individuals is of paramount importance to our quality of life and sense of well-being. The obvious conclusion, as we look to communities around the world, is that the current distribution is inefficient.

Individuals, freelancers and SME’s are often excluded completely from the system. In the UK - one of the wealthiest economies in the world - there are still 1.5m people who are unbanked. In addition, many of the people and businesses who do have access to banking, only have access to a very limited number of services, with their financial needs often not met due to circumstances outside of their control (e.g. their risk profile does not fit within strict risk parameters set by their bank).

SO WHAT DOES BABB ?

BABB leverages blockchain, biometrics and machine learning to offer revolutionary decentralised banking services for people across the globe. Regardless of background, location or income, BABB will offer a UK bank account to anyone in the world, helping increase financial inclusion and social integration, while also empowering local economies to generate wealth for themselves.

BABB will connect people and businesses to a frictionless new global financial system which revolutionises the existing micro-economic ecosystem through advanced technological, social, economical and regulatory capabilities.

By combining social connectivity with accessible banking (social banking), BABB building a global banking network fostering international collaboration and inter-community engagement.

In essence, BABB is building a decentralized bank powered by the blockchain, operating a full reserve and integrating digital currencies all around the world.

But now the most important thing that so interested me:

BABB will offer a bank account on the BABB platform, compliant with UK regulations, available to any eligible person or business in the world, instantly, without the need for a UK address or credit history. To open a UK bank account with BABB all you need is a valid ID document such as a Passport or National ID card. Access to basic account services will also be available to those without identity documentation by merely using biometric authentication and peer-verification from someone fully identified.

So, look further:

BABB leverage blockchain technology to facilitate the movement of fiat currencies anywhere in the world instantly, cheaply and securely. Through tokenization, BABB can host any fiat currency on its platform, as well as own native cryptocurrency, BAX.

BABB rely on technology and innovation to provide a bank account which is orders of magnitude cheaper, easy to use, secure and most importantly - accessible to all.

If they are really willing to implement it, I'll be one of the first clients of this platform !

Go ahead and check what else they have:

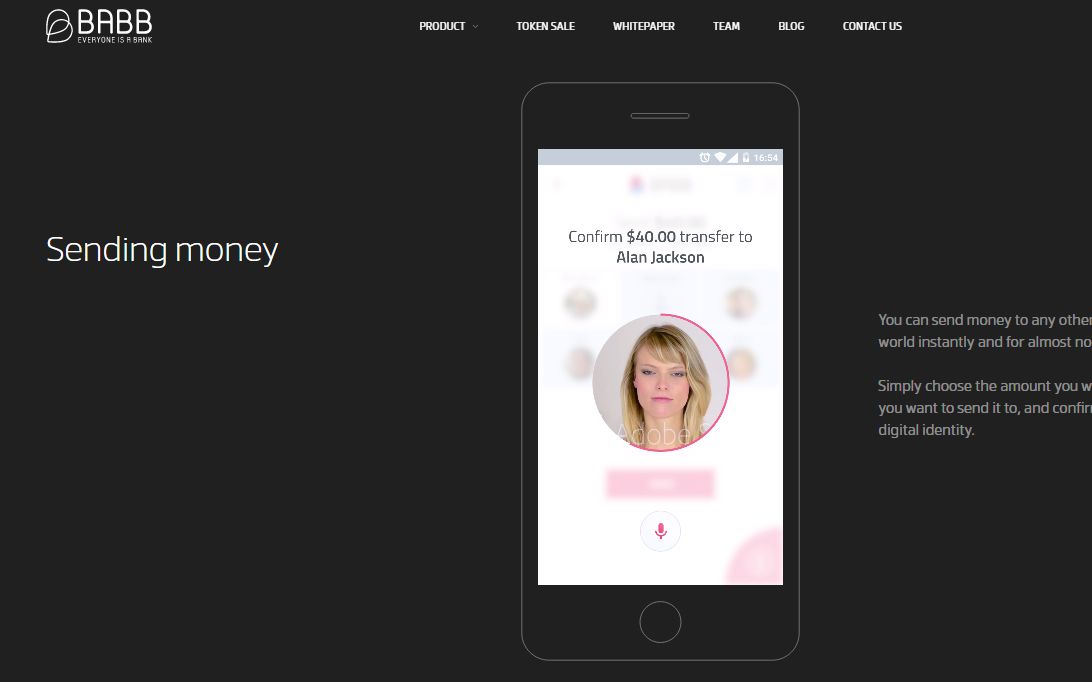

Mobile Application

Via the BABB Mobile Application, anyone can quickly create a bank account as easily as “taking a selfie and humming a tune”, with no ID document required to open a basic wallet. Upload one form of ID or get referred by someone who is fully verified in the system to get access to your own basic bank account.

BABB allows businesses and individuals to control their money anywhere, as long as they have an internet connection.

BABB supports traditional banking functions such as transfers, payments, cash in/out, as well as other peer-to-peer transactions using smart contracts.

In addition, users can generate income from their own money, by providing peer-to-peer services such as currency exchange and loans and earning a fee, just like banks do.

The last paragraph certainly unique. Surprisingly, but Bank is ready to share revenues from earnings with their clients !

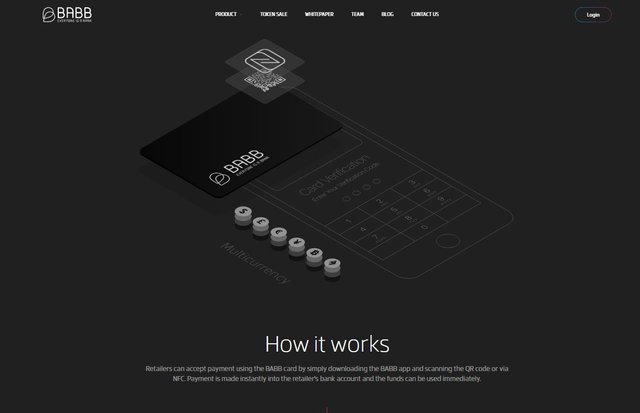

Black Card

The BABB Black Card is a secure payment card that links directly with your BABB bank account via a QR code or NFC. It allows both a debit-like functionality, or it can be issued as a pre-paid card for your friends and family. This approach allowed us to design a simple yet elegant card with no need for a chip and pin.

With the BABB Black Card you will be able to spend your funds within your BABB bank account in shops and in-person (peer-to-peer). Retailers can accept payment using the BABB card by simply downloading the BABB app and scanning the QR code or via NFC. Payment is made instantly into the retailer's bank account and the funds can be used immediately.

The BABB Black Card is the first card of its kind, containing no personal information on the card itself, which greatly improves card security.

If the card is lost, it can be easily unlinked from your bank account, preventing anyone else from using it.

High level of card security is a very big plus, because we are all afraid of fraud in this area.

Finally got to the good part, digital currencies:

Central Bank Digital Currencies

BABB believe it is inevitable that Central Bank Digital Currency (CBDC) will be adopted by Central Banks (CB) over the next decade.

Based on this BABB will work with the Central banks primarily in two ways:

1. Integration with existing CBDCs

Central banks that have already launched their digital currency could benefit from BABB’s inter-blockchain approach and provide for a natural extension of BABB, allowing us to quickly onboard those currencies.

2. Issuance of new CBDCs

Central banks looking to launch their own digital currency can leverage BABB’s technology, and host and operate domestically a portion of the federated network. This takes into consideration local jurisdictions and the complexity of the existing fiscal and monetary policies. This sub-network essentially becomes a part of BABB’s global platform, allowing central banks to ensure security, regulations and economic control, while at the same time providing their citizens with the opportunity to transact not just locally on the central bank’s local system, but also internationally on any currency supported by BABB.

About BABB

BABB is currently licensed as a UK financial institution (Authorised Payment Institution) by the Financial Conduct Authority, and it is in the process of applying for a UK banking licence.

BABB Platform will issue the native token BAX and raise funds through the BAX token sale. These funds will be used for the development of the platform and mobile app, and also to cover costs running the infrastructure, both cloud and initial federated blockchain.

BABB App is the Bank, a completely separate and ring-fenced entity. The bank will raise funds separately through traditional means, and will be granted an indefinite license from BABB Platform LTD to operate on its technology platform.

BABB LTD will use the funds raised from the token sale to develop the platform and BABB mobile application. It offers product and technology development for BABB Platform LTD, BABB App and other parties who wish to use the technology.

CONCLUSION:

BABB’s unique vision for the future of banking is both radical and feasible. BABB will empower each individual and business within the microeconomy, by creating a decentralised and inclusive financial system. BABB intends to usher in a new paradigm of Fair Banking, by embracing emerging technologies and applying a ‘people first’ approach.

The BABB platform has huge potential for growth, through the three main touch points of the BABB app, the Black Card and Social KYC.

By maintaining a physical and digital presence and implementing a natural viral growth mechanism, expect to see

exponential uptake throughout our target markets.

The BABB proposition is infinitely better than the current offering across many different use cases.

The token sale will raise the funds necessary to develop and distribute the BABB solution.

The BAX token is instrumental in BABB’s functionality, and will be integrated into the operations of the platform worldwide. There is enormous untapped potential in the global microeconomy, and BABB (with BAX) has a plan to unlock it.

So I think it's not too late to join this team in any way, or they will build the World Bank without us.