Bitcoin Will Eventually Become Obsolete

When Henry Ford built the first car it was the most popular 4-wheel combustion vehicle. The invention was something that touched magic. It was also the underlying blueprint for all other cars that came shortly after. Today, not many people own an original first model Ford. If they do, they keep it for sentimental value — or worse — as a very expensive antique. Not as a utility.

Bitcoin is very similar to the early Ford T model. It was the first coin that introduced the world to the blockchain universe much like Ford introduced us to cars. Nonetheless, much like Ford could not upgrade the first cars into the next generation vehicles the same fate awaits Bitcoin. It arrived 8 years ago and due to the fast pacing development of blockchain technologies it is becoming obsolete because there is only that much we can built on it in order to get it upgradable (and functional). Which reminds me. My dad spend the other day $1500 to paint a car that is worth $600. Why? Sentimental value.

The recent forks and small additions to the technology are just desperate attempts to upgrade something that is no longer upgradable. The early developers of Bitcoin support and preach about it because they have a massive stake as earl adopters. They hold Bitcoin. They also happen to control many other alt coin ventures as angel investors. Bitcoin is still the funding tube for everything else in the ecosystem that found them to be kings.

In addition to this, people get their feet wet with blockchain technologies by first buying into bitcoin and then spreading their capital into alt coins. I decided to write this post at an alt-time high to demonstrate the point of my argument. If you asked me to do the same a few years back, I would have a completely different analysis since there were no revolutionary breakthrough coins that had blazing fast transactions, variant block sizes or smart contracts embedded in their code.

Most people that entered over the last few years and caused this massive spike in market cap have no clue about the alternative technologies that are being developed in the blockchain world. Mainstream news that serve as the gateway to the general public almost always cover the spike in Bitcoin rather than the spike in blockchain technologies. People buy the news, not the technology. This is what is driving and keeping the price so high.

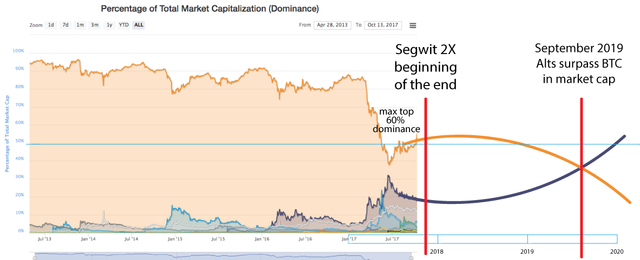

As the market cap increases we will witness a steady drop of BTC dominance and a rather crazy investment into altcoins that will overshadow May of 2016. It will be slow bleeding that will last over a year. I don't believe Bitcoin will serve any purpose in the future other than an antique for Bitcoin evangelists. Holding Bitcoin will be similar to keeping your wealth in a precious rare rock that weighs a ton. It will be cool to look at but hard to secure or transact with. The decentralized world demands utility and speed not relics that make life harder. Yes it was the first, yet it was revolutionary but the world will move ahead as new and more efficient coins dominate the market. More importantly more and more coins ensure true decentralisation which is the whole point of blockchain technologies.

I understand your argument, but I think you may be under-valuing the network effect when it comes to money. The USD isn't a great ledger system, and it's being inflated every day, but everyone still uses it as the world reserve currency because of it's massive network effect. Well, that and the aircraft carriers / petrol dollar / military industrial complex backing it up with threats of violent force. Now, I get how we should be comparing cryptocurrencies to cryptocurrencies here, but I wanted to give that as an example to show the power of the network effect when it comes to money.

For more on the "what gives bitcoin value" argument, see @sean-king's argument which I recorded to audio here. It's all about the network effect and Bitcoin's is huge.

Also, Bitcoin is open source. Changes, even difficult ones, could be made if the network decides it's necessary. As those altcoins rise, it will create more pressure to upgrade Bitcoin to compete. Anything is possible. We're seeing this with Ethereum talking about moving to proof of stake. That's an example of a huge change which can be done in open source projects. Unlike the Model T which was physical, protocols are just software code and can be changed at anytime as long as the consensus of the miners allow it.

That said, I recently had a transaction hang for 48+ hours and ultimately had to push it through with $9+ in fees and the "Child Pays for Parent" trick. I'm not a huge fan. I much prefer the newer technologies that are coming out. I do think they will take quite a bit of bitcoin's marketshare over time and maybe two years is a good timeline for that. Still though, most people have no idea what cryptocurrency is. Those that do, often think Bitcoin is the only one. It will take time for information to spread enough for people to reject Bitcoin as a good store of value.

Thank you for your input man. I am sharing your views as well. The last part about people being ignorant about blockchain is what is important. Bitcoin reached these levels with a very small % of the population. Imagine what would happen when alts hit 10-15-35% of the population — from businesses to programmers. I believe Bitcoin's overshadowing is inevitable (considering that Blockchain moves to massive adaptation).

We are 5 months in @lukestokes

What’s your point? Check back in five years, not five months.

Well, I called the Alts December pump + not even halfway to the flippening yet. 2019 is the time for me to come back. not 5 years.

To be clear, I'd love to see BTC's dominance go away. In many ways it's like the petrodollar, controlling the prices of all other cryptocurrencies since they are all traded on BTC pairs. I prefer to see good decentralized exchanges with volume trading in every pair with simple-to-use bots anyone can hook into to automatically arbitrage the markets.

Will we get that any time soon? I'm doubtful. Predictions about what the future markets will do are always... iffy. Maybe you're right and September 2019 will be the flippening to altcoins. Already, however, we're seeing some divergence from your image:

But who knows. It's early. I'm fine with checking back in 5 years and in crypto currency terms, September 2019 is a decade away. :)

My image has a huge zoom out and surely i can't draw the entire path from last year to q3 2019. BTC will come even lower in the coming months and Eth will start gaining traction. There is no other way really.

Thoughts on posts like this? Do you think this is just maximalist idealistic thinking and they will be in for a rude awakening by mid next year? Maybe EOS will eat the world. :)

Or how about this one?

nop. I think none of these coins will survive. They will but like i said above, no better than doge or rubies

Never underestimate the network effect. That's probably the #1 selling point of Bitcoin. Everyone in the cryptocurrency scene can accept and send bitcoins. It's used as the gateway to and from fiat for quite many.

I like to compare Bitcoin with IRC. Back in the 90s, everyone that was chatting on the Internet would be connected to the IRC network. In 1996 the network was efficiently split in two parts due to disagreements on the obscure details of protocol development - and I'm quite sure that of all those remembering the split, very few remembers what the argument was all about. The split followed geographical borders pretty much - making it very clear that the very most of the irc server administrators didn't really look objectively into the arguments and technicalities and made up their own mind - that's just what we're seeing with Bitcoin too, I believe most big-blockers and small-blockers haven't really tried hard to make up their own mind based on the technical arguments and objective facts, they just happen to trust and believe in some people, while distrusting the others.

The utility value of IRC fell when users experienced that some of their chat-friends ended up at the wrong side of the fork.

In 1996, ICQ also appeared. Compared to IRC, I think it was quite retarded - i.e. no group chat, just person-to-person-chat, users identified by numbers instead of easy-to-remember nicks, and worst of all - it was a centralized, closed commercial silo. I experienced that quite many of my IRC-friends stopped being on IRC, they told me to install ICQ to get in touch with them. I won't say that the network split was the only reason, but I believe it was a major part of the reason why people went to ICQ instead.

In absolute numbers of users, IRC probably peaked around 2003 - but as for the percentage of the internet population being connected, it probably peaked in 1996. ICQ outpaced IRC very quickly.

Where is IRC today? Well, I do use it, and I'm not the only one ... but I do admit it is indeed quite bad, very little protocol development since 1996, quite bad security-wise, and quite many bad design-choices. Unfortunately the alternative to IRC has become a jungle of alternative chat-platforms, most of them commercial centralized closed-down silos, some few alternatives based on open source and open standards.

Anything Bitcoin can do, some alt-coin can do better - the problem is just that if Bitcoin would fail (arguably, for the payment usecase - the very usecase bitcoin was supposed to fill - Bitcoin has already failed), there would not be one alt-coin to fill the vacuum, there is indeed a jungle of them, there wouldn't be any universal agreements on "let's use this one" ...

Cosmos, Kyber, EOS, Wanchain will make the network effect irrelevant. how long?

well...like i said. in about 2 years.

I totally disagree. Bitcoin will remain king for a very long time. I never should have spent some of my bitcoins on steem, or any other shitcoin for that matter. The development team behind bitcoin smokes any other crypto development team on the planet right now. The altcoin circlejerking on this site has reach ridiculous levels. I don't have the time or energy to explain it all right now, but go watch Richard Hearts most recent youtube videos if you want to be more informed about why you are just wrong.

I watched them actually. If you noticed summer of 2019 is pretty long time still to be king. Also don't forget that many of the bitcoin gurus are moving to other projects to maximize their profits. Once regulation comes, once governments start issuing their own coin, bitcoin won't matter than match and all exchanges will bow. I don't like it but it is what it is.

you still disagree?

How likely is it that Bitcoin will become obsolete? - Andreas M. Antonopoulos

"hard to secure or transact with" - I disagree. It can be 99.99% secured and the transaction will be just as easy as other coins.

Will BTC get replaced? Of course. Every tech does at some point.

The fees, slowness and lack of progression of the Bitcoin protocol is what the author is more or less talking about here if I am not mistaken. Generation 2.0 blockchains are upgrading at a very rapid pace compared to Bitcoin. For example, ETH has two major hard forks schedule shortly and another one within the year transitioning from proof of work to proof of stake. Its my belief and many others that have been in the space for a while that mining blockchains are similar to the Model-T. Yes it still works. Even today a Model-T still gets you from point A to point B. However, the end user will still choose the Tesla or the Camry if they have the chance. The Model-T was a revolution at that time but eventually got replaced due to the fact it only came in black and was not upgradable. Is was like a one function vehicle similar to how Bitcoin is today. Slow expensive and not very user friendly along with a host of governance and funding problems that lead to a variety of protocol inefficiencies.

fees are high. this is after all why BCC was created..and failed

Bitcoin Cash hasn't failed yet, if anything it's just getting started. It's possible your thesis is right and Bitcoin Cash will overtake the legacy coin as it seeks to provide more utility, speed, and lower costs.

BCC hasn't "failed". The price is being suppressed at the moment, but that means the banks are scared of it, not that its failing.

I support BCH and the reason I think it failed is the FUD and Dash. Why bother with BCH when Dash offers the same scale plus Privacy+1.3second transactions and excellent governance that also has a self funded treasury. Also there are my other 2 favorite currencies NEM and PIVX.

Why switch to BCH when you can switch for something even better.

Bitcoin cash hasn't failed at all. :/

Hey, @kyriacos.

Did you write to golos.io?

Your post was stolen?

See more: https://golos.io/ru--apvot50-50/@naminutku/bitkoin-ustareet-ranshe-chem-vy-eto-poimete

The one issue Bitcoin boosters will never ever address is the possibility of government regulation and what that will do to their "to the moon" trajectory.

The evil overlord agencies have yet to really put their foot down in the activities in the crypto space. In this day and age of budgetary shortfalls and ever increasing expenditures, do you really think they are just going to turn a blind eye to an asset that is trading outside their control?

But, "Bitcoin is Decentralized", "It's not just in one country, it's worldwide", "Bitcoin can't be controlled". I've heard all these arguments before. But, in the end, Bitcoins are useless if they cannot be converted into a local currency.

And, that is the choke point. Uncle Sam and his never ending string of alphabet agencies does not need to control Bitcoin, it only needs to control the conversion points. When that happens, Bitcoin $10K becomes Bitcoin $10.

Look at Amazon. Look how fast they caved to the States demanding they collect state sales tax. These states are all scrounging for revenue because of their rampant spending. When they figured out the they were losing revenue because the giant Amazon was beating the competition because you could by items state-tax free, they came after Amazon with a vengeance. In the end, Amazon caved.

Do you really think Coinbase or Poloniex will be any different???

Jamie Dimond says bad things about Bitcoin and it drops 20%. What do you think will happen when the IRS speaks up?

it's an interesting theory. I don't disagree; however, there's usually a first out of gate dominance that will prevail.

The key I think is that people see value in buying small portions of one Bitcoin to enter the market and use it as a currency. Time will tell of course. Personally, I glad to be part of it at this early stage.

I upvote all comments and replies on all of my posts to help my fellow Steemians earn Steemit rewards and gain more voting power. Consider doing the same.

You might have a point, I believe some coins will come and go but I do think crypto currency's are here for a very long time. Cheers mike

Bitcoins strength is that Is was first. Massive first mover advantage and network effect