Bitcoin will not Show Another Explosive Price Jump Before June 2018, CME Futures Forecast

The primary route by which trading in the bitcoin futures might influence the price pattern in the spot market is psychological, according to the experts whose works I have studied. There is at least one other route; but this will be the topic of another post.

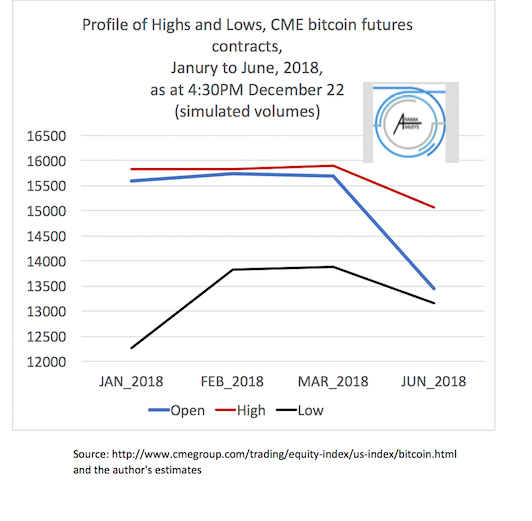

The statistical charts above and below indicate that the Big Boys trading the bitcoin futures are at this time not seeing another big price spurt in bitcoin before the middle of next year.

Indeed the profile of the curves does not suggest that these institutional traders are bullish in terms of the near-term future. Notice, how trading tended to start at the High for each month (the Open price) and then was mostly done at lower values.

However, there are two caveats to keep in mind.

First, the pattern that is shown here is highly sensitive to disruption from the arrival of consequential news. Second, there is a huge variance in the contract volume as we go further out in time from January to June (see Chart 1 above), which means that we fail to have a decent random sampling of sentiment as we move forward among the months.

In the second chart, I have simulated what the pattern would look like if the range around the midpoint value for each month was the same as it was for the month of January. This is a just a wild guess, however.

I will be posting update charts as soon as feasible after the CME publishes the data as at 4:30 PM of the next trading day. What will be most interesting is to have a series of about five days to study how to profile of trading by these Big Boys shifts.

This could be the most useful indicator of their sentiment, once again subject to the caveat that the arrival of consequential news can quickly disrupt the patterns already shown in the data.

I’m not trading bitcoin futures, you say”? Read on, all the same.

Whether or not we are planning to trade bitcoin futures, it is important to be sensitive to the potential linkages between what the Big Boys are doing in the futures market and what the rest of us might be doing in the spot market. Thus, some basic education about the nature of the futures market is in order.

For this purpose, I invite you to hop over click here to the Arawak_InfoSYS “Knowledge Repository”, where you will see abstracts from the best available texts and videos that provide basic education about the bitcoin futures.

At the “Knowledge Repository”, you will get a quick overview of the contents of the articles and videos by inspecting their lists of main points (their abstracts). Beside the text of each abstract, a link takes you to the original source document.

The abstracts are currently classified under the following subject headings.

- Basic education about bitcoin futures contracts at the CME

- The relative frequency of selling versus buying futures contracts

- How can the actions of futures traders affect the spot price of bitcoin?

- Impact of futures trading on bitcoin’s price volatility

An update is being made, and it will entail adding three new sub-headings for articles and videos. You have all these closely related documents nicely “curated and collected” at the same Internet URL, and the collection will be increased periodically.

So, this URL will be a “go to” place for those who wish to find a helpful assembly of abstracts and links to the most useful published thinking about key aspects of the impacts of bitcoin futures trading on the price pattern of the underlying bitcoin asset ( the pattern of the so-called “spot price”).

Thus do remember to click here to get to the Knowledge Repository. At this posting there are eight articles or videos, and about six more will be added over the next day or so.

P.S. This is all “green content’. You will not find it anywhere on the Internet, except at Arawak InfoSYS’s marketstatsanalytics.com.

We actually support your conclusion, but moreso in the short term, not 6 months. Our reasoning centers more on bubble-type flows of money and social moods as relates to how crowds work. It ALSO relates to actions Coinbase took in last week's flashy-crashy, which you can browse our reasoning here...

https://steemit.com/cryptocurrency/@harpooninvestor/buy-the-dip-not-yet-here-s-why

Kinda has to do with centralized control (coinbase) which is paramount to spirit of bitcoin as per Szabo and Satoshis.

Thanks @harpooninvestor. Apologies if I left the impression that I was making any conclusion about where the price would go; because my only conclusion had to do with what I perceived to the sentiment of the Big Boys (as represented in the data from the futures trading) as of last week.

My text is absolutely clear that new developments could drastically upset at sentiment and create a new sentiment tomorrow morning. If you are an old-time stock market investor as I am, you are familiar with this reality -- even the Big Boys will change their minds on a dime with enough incentive!

So you will never find me forecasting for public consumption where the price of any asset will go!

I have a small portfolio of cryptos distributed across well-chosen coins, and I intend to more or less forget about them for several years, keeping in mind that the original bitcoin investors also had to wait several years. In fact nothing really happened to the price of bitcoin throughout 2014-2015 and a good part of 2016!

While I wait and hope, I have already written off my investment in coins as a total loss (financially). To repeat, psychologically I have already lost all that money.

So during the coming years my trading will consist of periodic portfolio adjustment, and occasionally picking up "good stuff" when people are throwing it out the window!

One of the great things about cryptos is that you can maintain this strategy because it does not require a large cash outlay to get into positions that can make you really rich, over the long-term of course.

Cheers!

P.S. Please see my comment at your post.