Will Bitcoin Surge Upward Again in the Near Future? CME Futures Price Curves Say “No”.

Because contracts are cash settled in the bitcoin futures markets at both the CBOE and the CME, the influence that trading in the futures market might exert on the spot market prices is indirect. Yet, it could be an important influence, as you will see by looking at the set of abstracts under the topic entitled “Vulnerabilities arising from the multiplicity of small largely unregulated exchanges dispersed among many countries” here at the Arawak_InfoSYS “Knowledge Repository” concerning the trading of bitcoin futures.

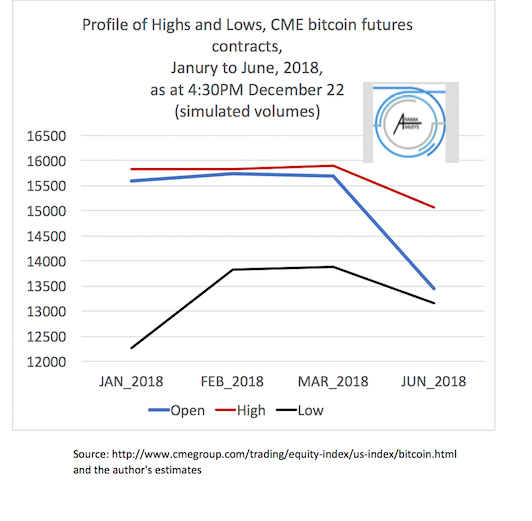

In the next chart, I have simulated what the price profile for the forward month prices of bitcoin futures at the CME (from January to June) would be, if the volume of contracts at each month was the same as in January (roughly 2,400). Think of this simulation as giving you a rough estimate.

This chart is based on the actual midpoints between the High and the Low prices at each forward month. That is, the midpoints not simulated. Thus, what we are getting here is a picture that, as of this past week, the Big Boys trading in the futures market are not bullish for the near term.

Note in particular how the bulk of the trading around each forward month except June tends to pull away downwards from the relatively high Open price for that month.

This chart may suggest that we have a solid forecast from the institutional traders concerning where the price of bitcoin should go (in its general drift) over the next six months, in terms of the main trend.

However, it's very important to keep in mind that the price patterns in both the futures and the spot markets can be quickly disrupted by major news.

All the same, when I was actively trading options in the stock market I used the overnight futures price patterns to develop a useful model which predicted how far (in percentage terms) and in what direction the relevant spot prices would change over the ensuing day of trading. This was for the broad indexes.

The model was not 100% accurate by any means; but it had good reliability on a day-to-day basis, and here, as with bitcoin contract, settlements were done in cash.

So, my own experience supports the substantial literature which says that even when the contracts are cash settled, we should pay careful attention to what is happening in the futures markets.

This may be particularly relevant if the following forecast turns out to be correct. I have encountered two analyses which argue that the big institutional money is going to avoid participating in the bitcoin spot market and do their trading almost entirely through the futures and other instruments that are traded in more regulated markets.

Thus, looking across the whole world then we may find two very different populations trading in the spot market and in the futures, although it is a sure thing that many futures traders will be taking positions in the spot market as a part of the hedging operations.

Thus, whether or not we are planning to trade bitcoin futures, it is important to be sensitive to the potential linkages between what the Big Boys are doing in the futures market and what the rest of us might be doing in the spot market. That is, some basic education about the nature of the futures market is in order.

At the bitcoin futures “Knowledge Repository” maintained by Arawak_InfoSYS, you will get a quick overview of the contents of the best available articles and videos by inspecting their lists of main points (their abstracts). Beside the text of each abstract, a link takes you to the original source document.

The abstracts are classified under the following subject headings.

- Basic education about bitcoin futures contracts at the CME

- The relative frequency of selling versus buying futures contracts

- How can the actions of futures traders affect the spot price of bitcoin?

- Impact of futures trading on bitcoin’s price volatility

- Managing counter-party risk in bitcoin futures trading

- Vulnerabilities arising from the multiplicity of small largely unregulated exchanges dispersed among many countries

(Psst — did you notice how much more sexy are my subject headings, compared to one-word tag names?)

So, the Arawak_InfoSYS “Knowledge Repository” will be a “go to” place for those who wish to find a helpful assembly of abstracts and links to the most useful published thinking about key aspects of the impacts of bitcoin futures trading on the price pattern of the underlying bitcoin asset ( the pattern of the so-called “spot price”).

P.S. This article is all “green content’. You will not find it anywhere on the Internet, except at Steemit and at Arawak InfoSYS’s marketstatsanalytics.com. It would be nice to put the Arawak_InfoSYS “Knowledge Repository” here inside Steemit; but it will disappear in ether about 20 minutes after being uploaded, and then almost nobody will know it was even uploaded to Steemit. Furthermore, those who know about the upload will have a very hard time finding it.

The mere fact that the CEO of bitcoin sold his bitcoins shows that there possibly is no more hope for bitcoin and the transaction rate of 12 hours is just too poor.Thanks alot for sharing.You did great.

stop listening to the CEO of bitcoin.com lol he tells a lot of bs and is just trying to co-opt the brand he did not create bitcoin and is clearly involved deeply in market manipulation. Honestly I'm still holding bitcoin cash because I think his propaganda campaign will work but it doesn't make him right about everything

Thanks for your encouragement, @stephenpaul. Do note, though, that the futures price look forward only six months (the bitcoin early adopters had to wait more than 5 years), and they remain highly sensitive to highly consequential and unexpected news.

Regarding the transaction confirmation rate (and the fees), I too feel that bitcoin is a dead duck as a payment mechanism (it remains great as digital gold, to me anyway). The developers seriously misjudged corporate support for segwit (the support is coming but oh so slowly) and have badly over-hyped lightning due to the fact that lightning will not be available to us for another year (I understand).

It is not too reasonable to think (IMHO) that the competition to lightning will fall asleep for the next year so lightning can catch up. It is more reasonable to think that when lightning goes public its competition will also have made relevant software advances, and over these next 12 or so months people like you and I will have long ago gone over to LTC, DASH, etc., to send small sums to our relatives abroad.

All this is IMHO, of course, and one thing I learned in the stock market is how to accept being wrong most of the time in my opinions!

I am following you!

A solid evaluation of the current trend. I have to agree with the data and say that the party is over, for now.

I think the range will be 11000-14000, with an eye on a break above 15500.

Cheers!

Thanks @abh12345, and nice to hear from you! First, I put the focus on "for now", and I keep in mind that we could wake up any day and find that some truly great news has dramatically changed the psychological landscape.

I too am looking at the range you cite. I have not yet checked support zone formation; but a quick glance at the little chart at coinmarketcap.com suggests one is forming the 14000 area. So I'm getting ready to add to my holdings once I feel the disappointing downturn is sort of fully digested.

Thanks for that, very interesting indeed. Anything around $9000, i shall remember that. I'm determined to own 1 of these!

Thanks for your encouragement, and TTYL!

This is exactly how the banks manipulate the silver and gold markets but it won't work with bitcoin as the lightning network will provide incentives to nodes bringing increased privacy and faster transaction times with it.

Yes @safetony, it does look like the strategy used on gold and silver is going to encounter some "new variables" with bitcoin.

For one thing, it is so easy to think that the action is all happening here in North America + Europe, when that is not so at all.

If the Chinese gov. ever figures out how to get the amount of gov. control they need and let go off the tight reins they are now holding, and the Chinese population gets back into bitcoin more seriously, it will mean that we in the West will be just the "second string team" when it comes to driving the bitcoin price. In that scenario, the strategy used to "manage" gold and silver will have a few problems!

Cheers.

Bitcoin is a protocol and can be improved, with new things being built on top of it I think once the lightning network gets rolled out the price will start to soar again. We just need to get people looking past short term interest as it's the politics not the tech that is the problem.

Thanks @safetony. Do you have a guess as to when the rollout of lightning will happen (about what time window in 2018)?

well how long did it take to get segwit lol but that was what we needed as a stepping stone to get to the lightning network I would imagine 6-9 months from now we should have it.

Thanks! I will strategize with your time window in mind. I am guessing, e.g., that LTC might take a big "hit" (perhaps temporary) when the Big Boys sense the lightning roll out to be imminent.

Do yu have any thoughts on what other coins might be greatly hurt or helped by that rollout?

P.S. I am now following you. Do let me know of any post you make that could be very helpful, and thanks in advance.

I think LTC will continue to do well as it has a more unified development team and 2minute per block average.

Personally I like NEM as it seems the most feature rich and useful https://steemit.com/cryptocurrency/@safetony/10-reasons-why-i-love-nem

I will hop over to your post now; but am happy to tell you that I have been “on board” both of them for a few months, based on my studies of their technical aspects. I have no plans to sell; but am concerned that LTC's developers keep moving along during the time we do not have lightning, so that when lightning rolls out LTC will still look technogically competitive.