Bitcoin Continues Legitimizing As Arizona Senate Passes Bill To Allow Tax Payment In Crypto

In a 4-3 vote, the Arizona Senate has passed a bill to allow tax payments in "Bitcoin, Litecoin or any other cryptocurrency recognized by the department."

This is merely the first step in actually creating this payment option, as the Arizona House must also pass the bill, then the governor must sign it. It is, however, arguably the most difficult step in the process of becoming a law and is certainly a sign that Bitcoin is gaining more and more mainstream traction.

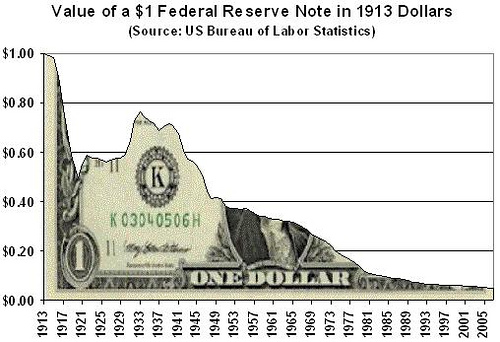

I also think this present potential future tax advantages for Bitcoin. Being accepted for tax payments is often a critical lynch pin of a currency's legitimacy. Gaining status as a currency, rather than an asset or property, can come with substantial tax and legal advantages. Nobody pays capital gains taxes for hodl'ing US dollars in their checking accounts, and that's not only because the dollar's value mostly goes down.

Arizona itself has stated a desire to compete for blockchain investment, which is a great indicator that the cryptocurrency market has gotten large enough that any unilateral control (centralization) of it will become increasingly difficult. Suppose New Mexico wanted to ban or heavily cryptocurrency...that just got a lot harder with their neighbor increasing its legitimacy.

One can only imagine this will lead to some humorous swings in tax bills due. Clever traders will be able to pay their tax bills at temporary highs in accepted currencies like Bitcoin/Litecoin, and those who pay at poor times will owe larger amounts of coin. Unless, of course, the government institutes a moving average system not unlike the 7-day moving average Steemit uses to value post rewards. (Perhaps I shouldn't be giving them any ideas...)

I, for one, welcome our new future of day-trading IRS tax bills.

We also have a Radio Station! (click me)

...and a 5000+ active user Discord Chat Server! (click me)

Sources: CoinTelegraph.com, Bureau of Labor Statistics, 4chan, Zero Hedge, Google

Copyright: The Simpsons, Dade County Georgia

So does this mean bullish for bitcoin? Seriously I bet the bottom line is these people see hoe big crypto is and they want to get in early before the big run up whereas the dollar keeps dropping in value. With state budgets wanting more money and difficult to raise taxes, receiving deflationary currency only makes sense.

Tried to introduce concept of cryptocurrency use and eventual replacement to todays paper currency. I get looks of total disbelief. Mostly they think governments will not allow it. This sort of indicates governments will back it.

This is amazing news! I can't wait to pay my taxes with Dash!

The same thing will happen that happened with weed...one state passes a bill then suddenly all over them start lining up to do the same thing....20 years from now things are going to be VERY different

Pay our bills with weed? ;) Now that's an oversupply we could do with! 😃

It is in the best interest of governments to accept and adopt crypto in their vernacular because it is another method of ensuring payments for various taxes. Similar to legalization of marijuana, acceptance is key so they can legitimize tax collections and increase revenues for much needed infrastructure improvements.

I strongly agree with you

They already have all the money and the roads around here are crap. Do you really think more money eould mean better mamagement? Nah, just more spending on what they want and into their pockets.

Its very good news for all who believe in cryptocurrency.......

I think the point of crypto is lost upon the author.

Taxation is theft.

Statism is slavery.

Actually there's a difference in United States income taxation between functional currency which would be the United States dollar, versus a non-functional currency. No tax advantage necessarily just the potential to lose capital gains tax treatment and instead receive ordinary income tax treatment which is a worse answer for taxpayers engaged in income-producing transactions or a trade/business. On the other hand, for individuals involved in personal transactions, (1) there is a small deminimis rule that prevents taxation for very small transactions, (2) there may be capital gain potential, however (3) there is also the potential to lose the ability to deduct losses as capital investment losses - because, non-functional currency Losses under a certain dollar threshold are subject to personal loss deduction dis-allowance. In short, we can't just assume being called a currency is the best from a tax perspective.

Edit #1- clarifying a point and adding the source of IRC Section 988.

https://www.law.cornell.edu/uscode/text/26/988

Edit #2 - Pinging @alhofmeister another tax writer on the platform for consensus (or divergence) on the point.

Accepting payment of income taxes in cryptocurrency has profound symbolic and practical significance. Historically, the use of government-issued currencies for the payment of income tax has helped guarantee those currency’s widespread adoption as a payments medium. Skeptics of systems like Bitcoin, which allow quick global payments but are not issued or backed by governments, have argued in part that their separation from government revenue structures reduces their inherent usefulness and, in turn, value.

Its very good news for all who believe in cryptocurrency. I hope more good news will come and most of the cryptocurrency will flourish with such good news.