Conspiracy Theory File - Malicious Chain-Death Attack "Plausible" On Bitcoin At Next Difficulty Adjustment (Nov. 26) (Part 2)

First, and most importantly, this post resides in the area of speculation and one might rightly call this a "conspiracy theory." I don't necessarily ascribe to it. I am merely looking for plausible explanations for the actions of various market actors, and those controlling the hash power of the Bitcoin network. In other words, this could all be BS - but, at least it's interesting BS.

I rate this theory as plausible, nothing more, and I mean that literally. Plausibility is a low bar.

I consider this a warning post, bringing to light potential (albeit probably unlikely) risks. Unequivocally, I am not hoping for this event to occur. It would be a huge blow to the cryptocurrency industry, potentially not unlike Mt Gox. Bitcoin's fundamentals (fees, transaction times) already look poor; this is the last thing the sector needs. Get your coins out of exchanges!

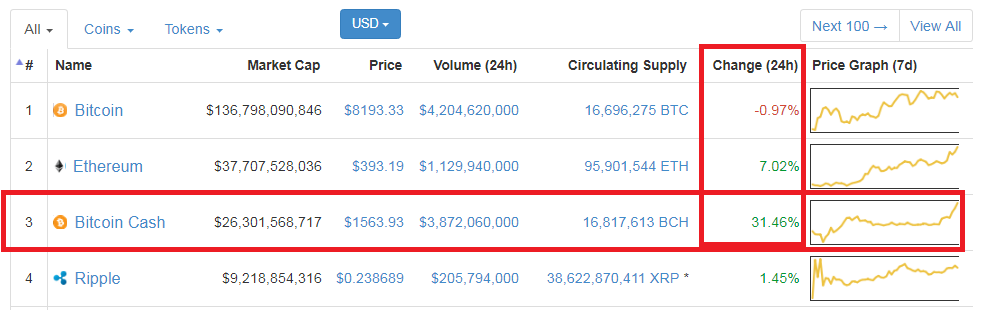

Also, to dispense with the somewhat off-topic in advance, if you have bought Bitcoin Cash based on my recent posts and enjoyed the 32% pump over the last 24 hours, consider taking some profits, particularly into fiat. Nobody has ever gone broke taking profits, and indeed the (likely) lack of an event on Nov 26th in Bitcoin could prove to be a negative event itself for Bitcoin Cash.

If you are currently in fiat, I suggest staying there but being ready to buy before the 27th. If you need a crypto "safe-haven", consider any stable coin like Ethereum or Litecoin, but they may do little good. Bitcoin Cash could be a great, or terrible, place to be - but it has already pumped 32% since my recommendation yesterday... (in other words, that means I like it less than I did yesterday...by about 32%.)

Finally, a note from my personal experience.

Markets are very thin around holidays. It's a dangerous time to trade, as liquidity is low and that means events have larger than normal impacts. Given how irrational the market can be in the short-term, this can have severe repercussions for your bottom line, as I found out when trading gold futures one fateful Thanksgiving when Dubai decided to default. One might think such a negative fiscal event would be gold positive, but it merely provided an excellent opportunity for the usual suspects at the COMEX to crush precious metals on thin volume. I was stopped out of otherwise fine trades and the manufactured volatility cost me plenty.

I mention this simply to highlight that I am no stranger to observing the markets around US holidays, having done so for for decades. Do not underestimate the potential for surprising volatility and irrationality at these times.

OK, that's enough jibber-jabber. Let's get on with the wacky theory.

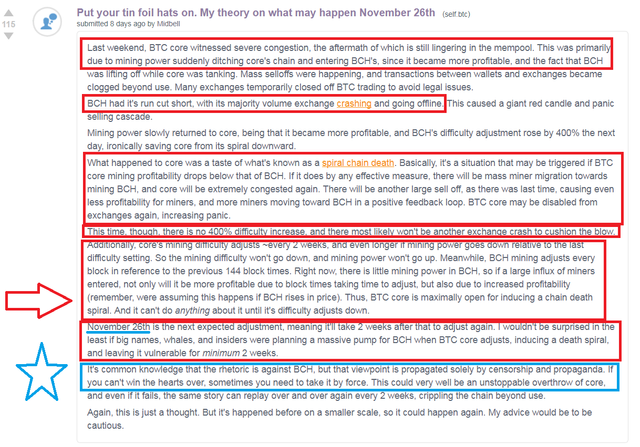

Honestly, after attempting to distill this excellent summary by u/Midbell, I simply could't make it much more concise. Here is the potential problem, in their words:

I can confirm personally most of this post's understanding of the mechanics involved. The understanding of the difficulty adjustments and timeframes appears to be correct. The poster correctly identifies that the EDA (emergency difficulty adjustment) that Bitcoin Cash had is no longer in effect, so it will not be there to "put the brakes" on such an effect.

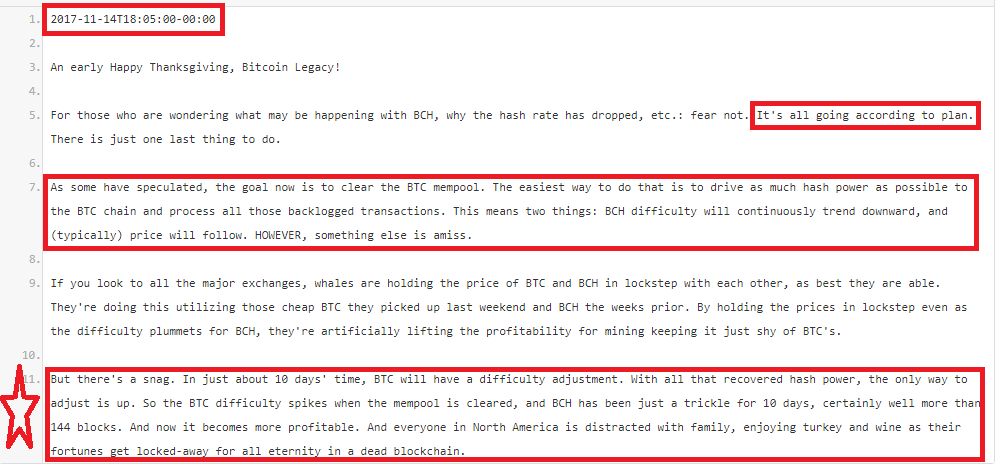

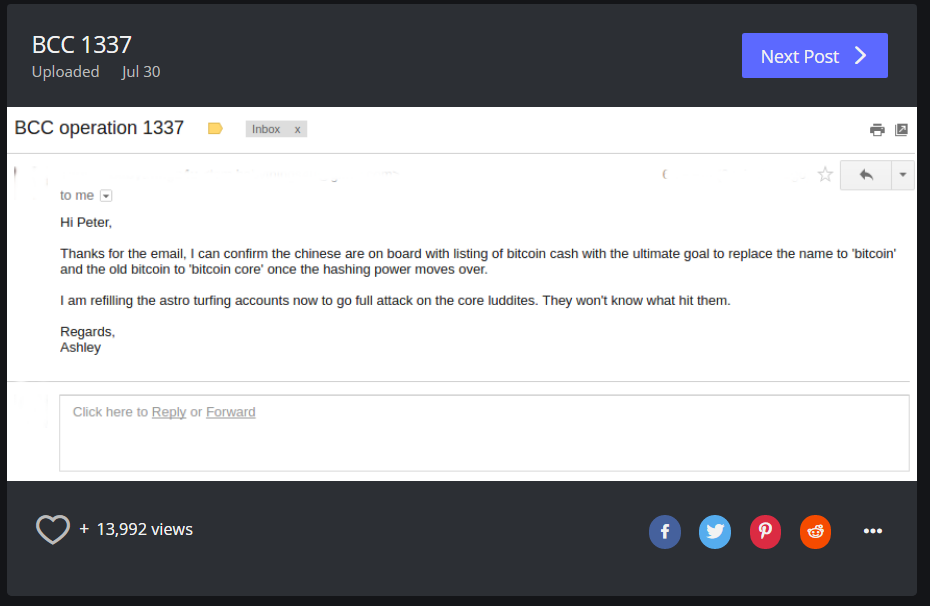

There is some...corroborating "evidence" (uncited hearsay) that lends credence to this post. This post was spotted by another Reddit user on Pastebin:

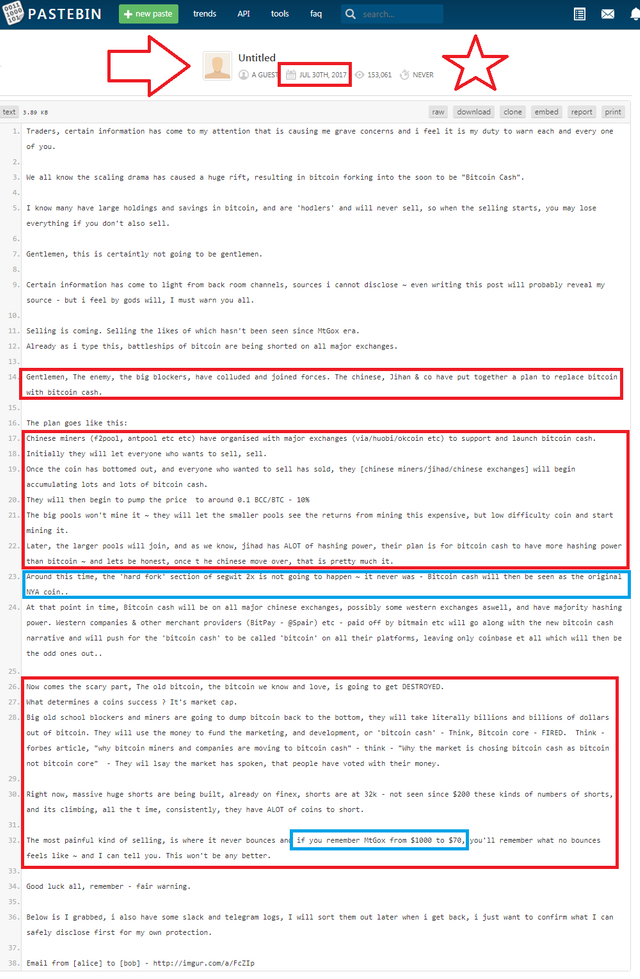

This is not the first time such a plan has been highlighted. In fact, this "plan" was outed before Bitcoin Cash even existed, allegedly, by a supporter of Bitcoin Core (based on their classification of "big blockers" [aka "Satoshi Whitepaper Followers"] as "the enemy").

Again, I will simply let this image speak for itself, and speculation can continue in the comments section below. Note lines 17-23, in particular.

The link at the bottom of the previous pastebin goes to the least "credible" looking of all the sources, in my opinion:

If anyone has any further information on this topic, please let us know in the comments.

PS - DO NOT LEAVE YOUR COINS ON EXCHANGES. This is never a good idea but seems particularly pertinent RIGHT NOW (not next week, NOW.)

If you have any additions or errata for this post, please let me know! I will see that they are voted to the top of the comments, and will make the appropriate edits (if possible).

We also have a Radio Station! (click me)

...and a 5000+ active user Discord Chat Server! (click me)

Sources: Cointelegraph, Reddit (r/btc, r/bitcoin), Pastebin, Imgur, Google

Copyright: Weird Al Yankovic, Cointelegraph

Am waiting with bated breath.

If nothing else, I will lock away that little gem about getting money out of exchanges over Murican holidays.

And while I can claim a certain amount of ignorance about the technical side of cryptocurrencies, your description is simple enough to give me a basic understanding that the miners drive the currency.

Most people simply try to follow the price fluctuations and predict where they're going to go (usually unsuccessfully), but having an idea where the miners are taking their hashing power is a whole different level.

You're going to be in my next #bernieblackfriday post for sure (and it won't be in a sarcastic way like @sweeeettsssssj's mention was in my first shameless upvote grab).

"getting money out of exchanges over Murican holidays."

In my opinion, problem the only real actionable point in this post.

"understanding that the miners drive the currency."

Ultimately, absolutely right. Their profitability is what keeps the chain alive. That is one reason I've found the whole Bitcoin Cash thing so interesting - there's finally very two similar chains and protocols, that work on the same hardware (like ASIICS), now competing for mining activity based on who is more profitable. Exciting stuff...for awhile, it went back and forth every couple of days.

"You're going to be in my next #bernieblackfriday post for sure (and it won't be in a sarcastic way like @sweeeettsssssj's mention was in my first shameless upvote grab)."

I'll make sure to check that out...and the one you mentioned here.

That sounds suspiciously like free market capitalism. ;-)

You made a sarcastic comment about sweetssssssssj? Curious. I use that name as well. And have been known to be sarcastic on that topic as well.

$300 per post or $10K per month for a few pictures and a bit of text is definitely a sweet deal.

Highlights the unresolved issues with steemit rewards system.

I'm finding Steemit to be more and more analogous to the US Con-Gress.

Pound your chest with righteous indignation while continuing to milk the cash cow.

That's not directed at @lexiconical, he's one of the few who manages to balance criticism with optimism here.

Read this theory before but this might be the best anyone has done at piecing it together. I guess it's possile, but bitcoin will have to survive more than this in the coming years. The silver lining in all of this for bitcoin is its market dominance and the possibility that if it crashes the entire market most likely will also (at least short term). Another thing that might prevent this is that people on both sides of the block argument love making money and bitcoin's recent returns have been substantial.

I think it's well worth pointing out that even if something like this worked, and Bitcoin were toppled by some other coin, that new coin would immediately be susceptible to very similar shenanigans. It may occur differently - perhaps, with unbacked futures rather than difficult adjustments - but the motivation will be there.

Someone is always going to be gunning for the top spot (or to make volatility to cash in on).

good work @lexiconical

I am resteem this publication

Basically, I agree with that but the idea of making money from this can never over emphasized.

@lexiconical, sorry to go offtopic, but did you hear about STEEMPUNKS yet?? It's a RPG which you can play on Steemit whilst Steeming!!

I just installed it, trying to spread the word of it. I think it's super amazing and they have huge plans.

I actually came here, trying to see if I could challenge you to a duel. Sadly, I cannot (yet)!

You better watch it though. Once you do, I'm coming for you!!

* sharpens blades*

Come help me spread this word to others so more people sign up to this awesome gamification of Steemit!

That was a very interesting read. Exciting days ahead let's see if BCH can replace the incumbent chain. What ever the case it small holders like me will always follow the incumbent chain whether is is BCH or the incumbent BTC.

I just want to point out that the pastebins read like they were written by Dr. Evil. The whole conspiracy is technically plausible and based in reality in principal, but I can't help but read this in Dr. Evil's voice.

Agreed. The gmail paste at the bottom, in particular, looks to me like the kind of made-up evidence a high-school hacker would create for a prank.

We'll know in 4 days I guess.

I love this movie though :)

Cheers for the info bud. I have been reading some disturbing things around the BCH, and the 'theories' behind its implimentation...still not convinced either way as yet.

Ive read in to this a little and it seems like a very real possibility. I hope it doesn't come to fruition because it would rekt the entire market not just bitcoin.

You are THE investigative journalist on Steemit!!!

Would love to get your thoughts on the latest episode of Crypto Nights regarding recent issues with Bitcoin.

Upvoted.

Alex

Good post, I'm gonna laugh if this happens and the markets decide to be irrational as they often are and the price gets pumped because nobody can deposit their Bitcoin into exchanges to dump.

Disturbing that there are endless plans being made against bitcoin, they should be happy with what they have and how crypto currencies are evolving. Public confidence will be undermined and they will undoubtedly want to stay with the devil they know, FIAT.