CryptoGram_0011: January 12, 2018

Network Effects and CryptoCurrency

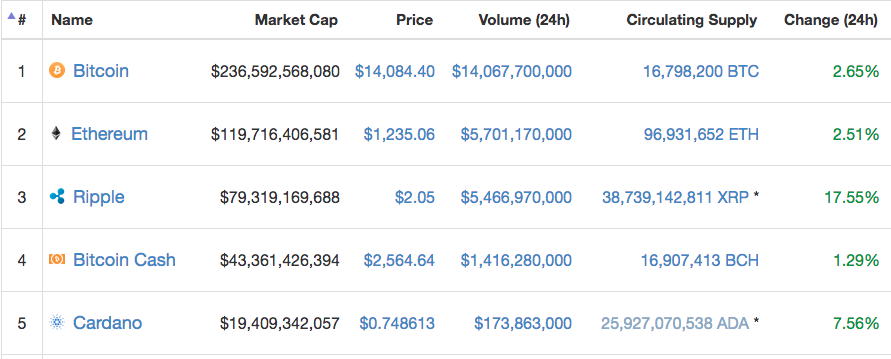

State of the market:

For new readers:

Cryptogram is my personal journal of thoughts about cryptocurrencies and related topics. I am posting them on Steemit as a means of keeping a record of them. At the bottom of each post is brief summary of the general layout of this, and future posts. Thanks for reading. (Also to find other posts, search "cryptogram")

Getting into it...

Yesterday I had a moment of clarity in regards to network effects and cryptocurrency.

Network Effects:

When a product displays positive network effects when more usage of the product by any user increases the product’s value for other users (and sometimes all users).

from when wikipedia:

Broadly, there are two kinds of networks effects:

Direct network effects:

An increase in usage leads to a direct increase in value for other users.

Indirect network effects:

Increases in usage of one product or network spawn increases in the value of a complementary product or network, which can in turn increase the value of the original. This is also called a cross-side network effect. Most two-sided markets (or platform-mediated markets) are characterized by indirect network effects.

SO

- The most valuable coins will be those that can access the most direct network effects. i.e. the stronger the advantage a coin gets from more users, the more likely that coin is to be valuable.

- Coins with indirect network effects will also be extremely valuable although these can be harder to break and are easier to change into reverse network effects. (just a fancy way for saying effects that are negative.)

First, I already held this opinion, but I wasn't connecting the dots like I did yesterday.

This lead me into the following line of thoughts.

Trayce Mayer identifies 7 different networks effects achieved in bitcoin. Here is the link:

- http://www.thrivenotes.com/the-7-network-effects-of-bitcoin/

In short these are: - Speculation

- Merchant Adoption

- Consumer Adoption

- Security

- Developer Mindshare

- Financialization

- Adoption as a World Reserve Currency

These are all interesting, and I recommend reading about them in the link above. After some thought, here are the blockchains that i think that best take advantage of these effects and a brief description, as i consider these to all be accessing unique sets of network effects:

- Bitcoin

- Store of Value & Payments

- Ethereum

- Contracts, Payments, Application

- ZCash

- Privacy via technology Zero Knowledge Proofs

- Monero

- Privacy via lack of Lack of Compute (Anyone have a better brief description of the methodology of Ring CT?)

These all have competitors that operate along their same ideals. Here are what I consider the primary competitors:

- Bitcoin

- Bitcoin Cash

- Litecoin

- Dash

- Ethereum

- NEO

- EOS

- Cardano

- QTUM

- ZCash

- Bitcoin Private

- Komodo

- Zencash

- Zclassic

- Monero

- Electroneum

- PARTICL

- Sumokoin

There is one other group that is really what I am looking at for investment. These are coins or tokens that take advantage of direct networks effects in ways that current coins do not. Currently the best example i have of this is 0x (ZRX)

Zrx is at its core, pooled liquidity for exchange. Buying zrx is a direct purchase of a potential network effect:

More relayers = more liquidity = more trades = more zrx fees = more value for zrx

This kind of direct access to a network effect seems hard to find. there are a couple other coins that i think may create a similar effect. these are:

Raiden Network: Payment channels

LoopRing: Pooled Liquidty (Much like zrx)

Melon Protocol: (they havent been very specific on the token use case, but it seem very possible that decentralized financial infrastructure could certainly build on itself.)

I am continuing to look for tokens like these and trying to decide which ones will access networks in the strongest way. I may do a more thorough post about network effect later.

Thanks for reading,

-libertyhound

Purpose of CryptoGram:

Currently in the crypto space it can be difficult to remember what you have discussed or been thinking from one week to the next. The rapid development of, and many changes in the space keep everyone on their toes. Now that I have been financially involved in the space for roughly a year, I realize that I would love to have my thoughts from 2017 written down somewhere. I believe having this information will help me stay focused, avoid repeating past mistakes, and hopefully help some other people, (anyone who decides to read this,) from making those same mistakes.

Briefly, I need a place to record my train of thought and that place will now be dubbed "CryptoGram"

My thoughts on the structure of this post are:

- About 500 words.

- Frequency of once a day to once a week.

- Each post will have a number and date.

- A snippet of top 5 cmc coins for price reference. (state of the market)

- I will always use these 5 tags, (unless of course there are drastic changes, but for now these will be the tags!)

- bitcoin cryptocurrency ethereum cryptogram libertyhound