Bitcoin was NOT in a bubble – the 2017 rise and the 2018 consolidation (Chaos Monitaur–34)

Being "in a bubble" is not the same as being "in bubble territory."

After the crash of the housing bubble in 2007–08, the Fed and other central banks blew massive bubbles in everything from bonds and real estate to student loans and money in general.

After the crash of the housing bubble in 2007–08, the Fed and other central banks blew massive bubbles in everything from bonds and real estate to student loans and money in general.

Everything Bubble, including Money Bubble

Indeed, we even have a money bubble – as a direct result of the coordinated money-printing programs in the US, the EU, Japan, and other countries.

In many ways, the money bubble is the cause of the many other bubbles. With so much easy money at their disposal, it’s been very easy for the financial pirates to blow up and over-inflate numerous secondary bubbles.As a result, almost everything nowadays is overvalued. Far overvalued. Insanely overvalued. And we know that the price of anything that is overvalued will eventually come crashing down to realistic levels. Most likely sooner rather than later. (Image source)

Which brings us to bitcoin.

Is being “In Bubble Territory” the same as being “In a Bubble”?

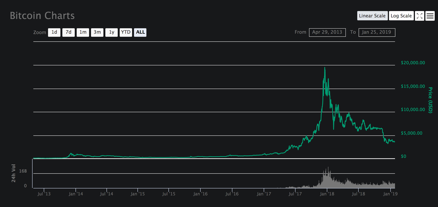

Given the increase in the price of bitcoin in 2017, some people said that it too was in a bubble. Its rapid rise (to almost $20,000) took even the most optimistic bitcoin proponents by surprise. Since then, of course, it has fallen to the $3,000–$4,000 level.

That’s a drop of over 80%. And certainly, that drop also makes it look like bitcoin was in a bubble. (Image source)

Maybe it was “Not a Bubble”

Regardless of whether or not one considers bitcoin to have been “in an actual bubble,” a quick glance at its its linear price-chart shows that it was clearly "in bubble territory." (To be clear, those two points are separate and discrete statements. Being "in a bubble" is not the same as being "in bubble territory.")

In a YouTube video (link below), Mike Maloney explained that if we look at bitcoin’s spike in “the proper way … logarithmically,” we get a totally different perspective. To clarify, let’s compare the 2 charts below.

The 1st chart shows the “linear changes.” As Mike stated in the vid, it “looks like a bubble.”

The 1st chart shows the “linear changes.” As Mike stated in the vid, it “looks like a bubble.”

Linear Chart (aka “Arithmetic Chart”) – Bitcoin, April 2013 – January 2019

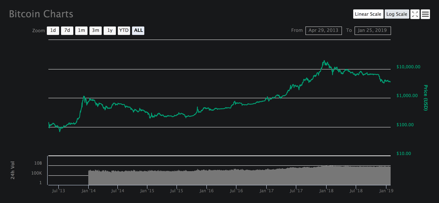

The 2nd chart shows the “the percentage changes” for the same asset over the same time frame. We do not see the bubbles and crashes that appear in the above linear chart.

Logarithmic Chart (aka “Log Chart”) – Bitcoin, April 2013 – January 2019

On the other hand, in the log chart, the percentage increase of the price remained quite steady over that timeframe. It appears as a solid asset whose price is increasing at a sustainable pace and to reasonable levels.

Mike adds that, if we look at it from this perspective, a further increase is fully sustainable and reasonable. That next increase might take bitcoin up to $50,000 or even $100,000. (Image source)

It’s been one year since the price of bitcoin peaked near $20,000. Is the price headed back there, or even beyond? Or will it soon continue its downwards trajectory? –– What do you think?

It’s been one year since the price of bitcoin peaked near $20,000. Is the price headed back there, or even beyond? Or will it soon continue its downwards trajectory? –– What do you think?  Since 2008, the bubbles in most other assets have continued to rise, inexorably and stratospherically. Bitcoin, however, has gone though booms, spikes, dips, drops, corrections, and consolidations. Maybe the bitcoin booms were not bubbles. –– What do you think?

Since 2008, the bubbles in most other assets have continued to rise, inexorably and stratospherically. Bitcoin, however, has gone though booms, spikes, dips, drops, corrections, and consolidations. Maybe the bitcoin booms were not bubbles. –– What do you think?

Watch the video at the link below

(Right-click to watch on YouTube) (Image source)

@majes.tytyty, the market is in a downtrend. So, the probability that the price of Bitcoin will go further down is higher than the probability that a new bull run will start. Yeah, we may see some rebounds, but it is still very early to think about trend reversal.

Btw, I am a cryptocurrency and FX analyst. If you want follow me and watch my analyses.

Posted using Partiko Android

McAfee is still saying he'll eat his dick.

I may have to sell what BTC I hold to pay my rent here in another three weeks. So, if I do, then of course Bitcoin will rocket up, because that's how my life goes.

I bet McAfee won't have to eat any "hot dogs" or "wieners."

I'm not so sure. There's a chance he could be enjoying a nice cockmeat sandwich come late 2020. :D

I think you are probably right about McAfee.

You know, one thing about the article above. I didn't come away with a clear understanding of what is the difference between "being in a bubble" and "being in bubble territory". Did I miss something?

Yeah, I say bitcoin wasnt a bubble. Fomo took over and nobody wanted to miss out and it rose the price hella. Then after the fomo and felm ( fear of losing money) everyone got out it went back to how it was, but people are still worried/cautious because of the lost they took.

Posted using Partiko Android

Good points. I myself have seen bitcoin go thru at least 3 bubbles, and each time, the subsequent dip / crash was inevitable ... at least in hindsight.

However, I'm not sure if those booms and busts were caused solely by FOMO and FELM. Over the past years, I've met many people who have FOMO, but that has not caused the price to rise.

I believe one of the underlying causes of the fluctuations is how the market reflects the essential value of bitcoin. For 10 years now, it has grown in value / price, simply because it has not yet reached its true value, and is continuing to move towards its true value.

To assume that such a movement will be in a straight line is simply naive. Like anything, they will fluctuate. Fiat currencies have been in a downtrend for decades, but for some reason, the US dollar is currently in a mini-boom. But we all know where it's headed. Downwards.

As Bitcoin, Steem, and other cryptocurrencies move towards their actual value, their prices will fluctuate, sometimes wildly. But we all know where they are headed. Upwards ... I believe.

Hi @majes.tytyty

I strongly believe that mentioned FOMO was obviously caused by mass media, which talked about crypto and bitcoin all the time and brought fresh blood into the market. wouldn't you agree?

We were all played by mass media.

Cheers

Piotr

I'm not sure if that is so. One reason is that I rarely follow any news in the mass media. ☺ Also, the bitcoin price has experienced several spikes, even when it was less than #10. Surely, back in those days, the spikes were not the result of a media focus or media exaggeration.

Most likely, the 2017 spike was partly owing to the fact that bitcoin is becoming better known. And, of course, once it surpassed $10,000, the media started covering it more and more. That may have played a part in the spike, but I believe it was a secondary cause.

Woah very well said. Ty for replying that to me.

Posted using Partiko Android

I'm not sure if that is so. One reason is that I rarely follow any news in the mass media. ☺ Also, the bitcoin price has experienced several spikes, even when it was less than #10. Surely, back in those days, the spikes were not the result of a media focus or media exaggeration.

Most likely, the 2017 spike was partly owing to the fact that bitcoin is becoming better known. And, of course, once it surpassed $10,000, the media started covering it more and more. That may have played a part in the spike, but I believe it was a secondary cause.

Good comment @midgeteg.

FOMO was obviously caused by mass media, which talked about crypto and bitcoin all the time and brought fresh blood into the market. wouldn't you agree?

I believe that we need at least a year for all those memories to be replaced again with greed (and more fresh blood, which didn't burn themselfs yet).

Yours

Piotr

Thanks @crypto.piotr

I agree with what you said.

Posted using Partiko Android

Hi @midgeteg

Thanks for replying to my previous comment. I always appreciate people who engage back.

Yours

Piotr

I too believe Bitcoin can reach $50,000+ and I believe there will be a next bubble in the future. How near is that? I don't know... and I can even be mistaken.

No one knows when the price will again rise. However, there were at least 2 times when bitcoin peaked and then plummeted, and subsequently stayed well below those peaks for long times.

..........

The first time was after it peaked at $200 in April 2013. It then dropped and lingered in the $50–$100 range for 7 long months, before recovering and shooting up past $200.

..........

The second was after it peaked near $1,100 in November 2013. It dropped, eventually falling to about $300. It then lingered in the $300–$500 range, until early 2017, when it finally returned to the $1,100 mark. That was more than 3 years.

..........

The next upswing might start soon, or it might start after another relatively long wait. In fact, Jeff Berwick recently opined that, while he believes the price will continue to rise into the stratosphere, it might remain around the $3,000–$5,000 level for another year or so. (Key word = "might.")

(Source)

You're very optimistic @ahmadmanga

I'm not sure if BTC can reach 50k without support coming from mass media (the way they did in 2017). And those are bored with this topic and have more interesting things to talk about.

Anyway I would love to see it happen :)

Yours

Piotr

Dear @majes.tytyty

Amazing piece of work buddy.

Don't you think that current bubbles are not really as bad as many think? When I look back at property bubble or dot com bubble or even crypto bubble I see one similar thing. Almost everyone at that time around me was talking about buying house, buying stock, buying crypto.

Basically market was always full of professionals and common people, who were the ones to panic the most. Right now there is very few amateours playing on stock market, buying bonds etc. Those are people panicing the easiest. Right now entire market is full of professionals and they do not reac the same way.

So for that only reason I would not expect Stock Market bubble to burst hard. Simply because this bubble is not really as bad as many think.

But then it's just my impression. I wonder what's your opinion.

Yours, Piotr

Excellent comment, Piotr, with a great though-provoking thesis. I'd never heard of it expressed in that way, and I've never considered it. You are correct in saying that the common people are not involved in this bubble. At least, not to the extent that they were in the dot.com and real estate bubbles.

However, that does not mean that the bursting of the bubble will be less traumatic. The fact is, as you implied, that the bubble is at the top, among the professionals. But they are the ones who own most of the stocks, and they are the ones who will dump their stocks when the market turns down. I believe they will react in the same way, once the shit hits the fan. And their reaction will be to throw much more of "their" shit at the fan.

Over the past decade or so, stocks have been bouyed by central banks' QE money-printing strategies, which allowed many corporations to buy back their own stock. That monetary morphine has resulted in an even exaggerated bubble.

And now, it's about to burst. (I'm not a stock analyst or an economist, and that's not my opinion. That's what many clear-eyed "expert" analysts say. Many of them accurately predicted the bursting of the dot.com bubble, and the bursting of the real estate bubble. 2 out of 2 is pretty good, so I'll believe them when they say Crash Number 2 is coming.)

So, even though the common people may not be actively involved in this bubble, that does not mean that the bubble is not big, nor that it will not burst, nor that they will not be affected.

It's big, it will burst, and all of us will be affected. Hang on tight!

Dear @majes.tytyty

Most likely you're right. At least to some certain degree. One need to rememeber about power of mass media and power of mass human panic.

If regular joe didn't invest in stocks then media will also hardly talk about this subject. Simply to avoid showing "boring" content. On top of that so called FUD will hardly have any impact if regular joes will not care and will not be involved.

That's obviously just a good wish :)

Very true.

Indeed. But it also means that mass media will literally not care that much about this bubble. And that's a real game changer. One must assume that mass media in current world are the biggest power. Playing with people by using fear or hope. Building dreams or crushing them.

Ok, let's put it this way. If this bubble will burst, then surely it would be MUCH MORE painful if regular joes would be involved and market would be "hot" and everyone out there would be trying to "jump into that train".

How does it sound? :)

Yours

Piotr

I see your point. And in a way, you have a good argument. Unlike the dot.com bubble and the sub-prime / real estate bubble, the current bubble does not actively involve Regular Joe.

So, when the massive financial bubble pops, Reg Joe will not lose on stocks, bonds, real estate, or other of his assets or investments.

However, I believe Reg Joe will still feel the effects, and will in fact be hurt by the effect. In a sense, it's gonna be like the 1929 crash. That resulted in primarily in the loss of the fortunes of the big, powerful investors and businessmen. But it had knock-on effects, which hurt Reg Joe for the subsequent decade.

This time, it will be the same. Or worse.

Yes, the knock-on effects on Regular Joe were terrible, because RJ was employed by the big, powerful investors. When they lost money, RJ got laid off.

This is probably a good point to mention that I do not believe austerity works to repair the economy; it works to enable the rich to buy up distressed assets for pennies on the dollar.

This is what's happening here in Argentina right now. The government is selling off the foreign reserves at great speed, nominally to satisfy the demand for dollars, thus keeping the exchange rate between the Argentine Peso and the US dollar stable. But the only people with the available capital to buy those dollars are the rich. Thus the net effect is a massive transfer of wealth from the national treasury to wealthy private individuals. The main theme of the Macri government is looting and sacking of the public treasury.

Of course this accompanied by the usual "privatization" of public assets, and we all know what that means. For more detail, you can see the article I wrote last week-

https://steemit.com/argentina/@redpossum/redpossum-mansplains-about-argentina

I guess there's nothing to worry about bubbles as long as it won't explode.

When a crypto particularly bitcoin goes down to the bottom, its only being tested how strong it is to sustain and grow stronger.

For me, its part of a process.

Indeed it is part of a process @ronel

You nailed it. Yours, Piotr

Definitely part of a process. And let's remember that insane, exponential growth is not healthy. In most cases, such growth is cancerous. So, after bitcoin's various spikes, the pullbacks are in fact very healthy, and very promising in terms of long-term prospects.

Let's just watch the process unfold.

Yep.

Spikes are also good for traders who make profits during ups and downs.

For me it is very difficult to deduce whether bitcoin was in a bubble or not, it is also very difficult to predict if it continued its downward trajectory, increase its value or stabilize at current levels, due to my little knowledge of economic behavior and the little information that I manage close to the cryptocurrencies, but I would like to see the increase in them.

What are the odds that this happens? I do not really know, but if it happens it would be beneficial for all those who handle cryptocurrencies now. In any case the information you provide is encouraging and creates a lot of expectation in people.

I also want to sincerely thank you for supporting me by delegating a sum of SP to my account, thanks to you and the initiative of our friend @crypto.piotr who is determined to grow support among members of this community.

Blessings to you!

Pr Euclides Villegas.

Nobody knows the odds, but most in the crypto sphere are 100% certain that bitcoin will eventually surpass its previous high of $20,000.

If that sucde would be great, we pray for it to happen. Although I do not own bitcoin, I imagine that that would boost steem and other cryptocurrencies. Right?

Hi @fucho80

I think that since STEEM is being traded mostly against BTC, so if price of BTC would grow then you can expect that price of STEEM will grow as well.

@Majes.tytyty correct me please if Im wrong.

Yours

Piotr

I aint gonna correct you, cuz I do not know if you're wrong. I have no idea which crypto pairs are trading at what volume.

Nevertheless, I believe that the price of most of the top cryptos will increase, like luxury rowboats in a rising tide.

Congratulations @majes.tytyty! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Dear @majes.tytyty nice work in writing this detailed post about Bitcoin price analysis. If we look at the overall Bitcoin prices last 10 years then the growth looks realistic but in the year 2017 it was all time high in fact it was at the peak.

I personally don't think that Bitcoin is a bubble but some where I feel that there was some manipulation in its price in 2017. We all know that the current price is more than 80% lower than it's the price we saw in 2017 end. Currently it's trading between 3000 to 4000 US dollar which was around 5 to 6 thousand US dollar couple of months back.

Many experts are saying it will touch 1 lakh US dollars in one year or so. I also think that it can test 100000 dollar price in future based on the developments happening in many countries. A very big community is working behind Bitcoin to get it accepted for transaction or payment purposes but at the same time few countries or not in favour of it looking at the current scenario and India and China is one of them.

I have long term goals with Bitcoin so I personally don't worry much about the price because I am pretty sure that it will show all time high again but don't know the exact time. I'll be holding all my investments for a long term which is going to be few years. In my opinion Bitcoin is not a bubble and it is a digital asset.

Thanks dear @crypto.piotr for sharing this post as I enjoyed reading this post and undoubtedly a great piece of knowledge by

@majes.tytyty

Dear @alokkumar121

This is surely great piece of comment and I wanted to read it through, but it's just so hard to read since you didn't use "enter" even once.

Perhaps you could consider using enter sometimes to separate blocks of text? it would make reading much easier :)

Yours

Piotr

Sorry for the inconvenience dear friend. I will update this comments and will be considerate in future.

Posted using Partiko Android

Thank you @alokkumar121 :)

Now I can really read it without feeling that it's a struggle :)

Yours

Piotr

I agree (altho I'm seeing it now in its revised form). As an editor, I know that it's essential to format and present any writing, properly and clearly. Otherwise, most people (including me and Crypto.Piotr) will not want to read it all the way thru. :-)

Thanks for advice dear @majes.tytyty I will be careful.

Posted using Partiko Android

Dear @majes.tyty

In case I haven't mentioned it yet, thank you for your SP delegation. Our friend @crypto.piotr sent the link to me and, I find the subject very interesting.

I have to apologize that it took me quite awhile to figure out what my answer would be as I understand most of you guys are quoting from this and that source and are closely watching the market.

So, my answer is that bitcoin is not in a bubble by simply watching the overall perception of the governments around the world. No one is making any move to advertise expressly to their citizens to "get rid" of their btc or alt coins. No one is announcing yet that btc is a huge ponzi scam or doing any move (like closing down btc or alt coins exchanges) that would massively affect its general patronage.

Secondly, if btc is just a bubble, why are there a lot of watcher monitoring its value and making a living commenting, predicting and giving their expert opinions on the topic if it does not really matter at all? Furthermore, why is everyone interested to know about these things if it runs the risk of becoming worthless anytime?

Then, there is the cyclical moves of btc whales- transfering their humongous assets from one dormant wallet into multiple wallets- which for me is not a move at all to sell out but perhaps for security or trading purposes because if they did intend to sell out, why have we not heard(even a rumor) of it when we do have a whale watch?

I think that most people who believe that btc is just a bubble are those who wanted to make a quick profit out of it- I think they call them swinger trader or opportunistic trader- I am not quite sure of the term. If anyone out there knows, please inform me. Thank you.

Lastly,like everyone, I too am sometimes confused where btc is going- up or down but as long as its higher than an ounce of gold, I am good. I don't know how the halving of btc would affect us all but,I am hoping for the best.

Kind regards

Anne

Amazing comment @nurseanne84

Probably I asked you before about droping me short message to my email ([email protected]). Right?

Would you like to keep in touch closer? I would be happy if we could support each other on steemit and establish better and more private communication channel.

I'm not really planning to spam you with emails so you don't have to worry about it :)

Cheers,

Piotr

its all right Piotr...I can always block you.hehehehhehehe But yes, I would like that very much. Happy Chinese New Year!

Good point, Anne, particularly about the many people closely monitoring the entire ecosystem. They're doing so because it's definitely an major change, and definitely worth monitoring.

On a related note, there are now 10s of thousands of people working in the field, with bitcoin and other cryptos. Most of them are very well-versed in the subject, and they know what they're doing and what they're working with.

And, most importantly, they know the potential. 'Nuff said.