Mining Goals and Where to Get More Money

This idea today of simply connecting your computer and everything works, specialized mining platforms on the Internet and are making money with your extremely attractive air. However, it is obviously not as simple as it seems and the mining industry is one that has become very competitive and sophisticated.

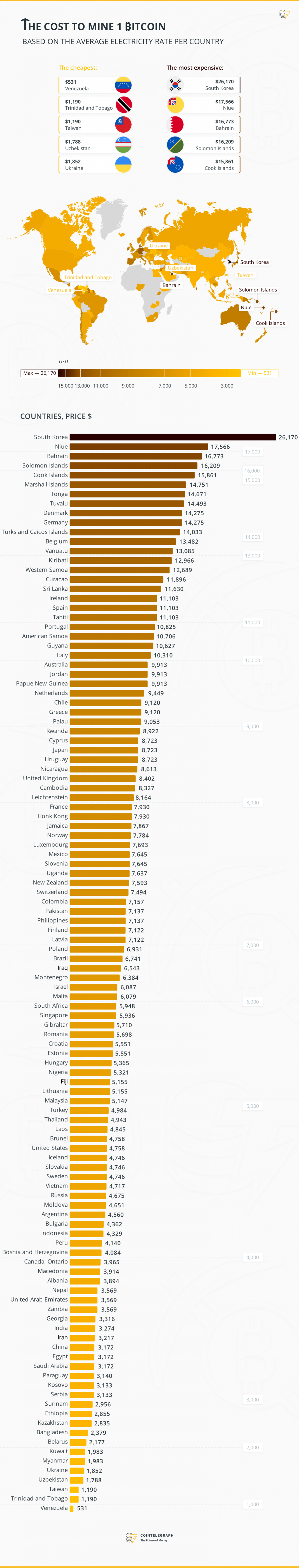

People who are interested in mining can still join, and by reducing their spending margins, there is the possibility of a very reasonable profit. It all comes down to cheap resources, but in the case of mining, this resource is electricity. The inequality between electricity prices around the world means that mining a Bitcoin in a given country can often be more profitable than doing the same thing across the border.

How is this calculated?

The image below shows a list of countries and the average cost in US dollars to exploit a single Bitcoin. This study, conducted by Elite Fixtures, was assembled using the consumption required to extract a Bitcoin average on three different mining platforms: AntMiner S7, AntMiner S9 and Avalon 6.

The study obtained the electricity price data provided by the government of the countries themselves and local utility companies, as well as by the International Energy Agency, as reported by the IBTimes.

Where to make money

So with such data available, suddenly mining around the world starts to make sense. The best place to make a profit from mining in Bitcoin is in Venezuela. The process costs "only" about $ 530.

With the current price of Bitcoin hovering around $ 10,000, there is potential for a huge rate of return for South American miners. Moreover, given the economic and political climate of the country, it is not surprising to see that many Venezuelans took advantage of mining. It is not interesting to mine in Venezuela only in times of peace; the South Americans use this cheap electricity in times of crisis with their own currency, inflicting useless proportions.

Where not to worry

Many Western European countries (such as Germany and Denmark) are classified as some of the more expensive places to try to pull the Bitcoin out of the ether. In fact, in the current climate, mining a Bitcoin in any of the above mentioned countries would end up costing you $ 4,000.

Mining dispersion around the world also clearly follows the cheap electricity lines, such as a study by Cambridge University last year, which showed that countries in the Far East, especially China, took the title of mining capital of the world.

Minimizing super powers

The power that China "and even Russia" holds as mining superpowers comes almost directly from the price of its electricity. China, according to the study, is left with a modest $ 3,172 per coin, which is still currently a 70% return.

China has also benefited from open government to allow miners to use the country's excessive power, but this has recently come under a vote. The Chinese government is now trying to crack down on all facets of the criptomoeda, which has to look at mining.

Russia, another superpower that benefits from relatively cheap electricity (which stands at $ 4,675 for Bitcoin), as well as government subsidies, could soon be under more stringent regulation and control.

The Future of Mining

As electricity is one of the first expenses that need to be considered in the creation of mining, it makes sense for large mining organizations to consider the low cost countries above listed as an attractive prospect. However, as Bitcoin continues to grow, regulators seek to target different sectors, including mining.

There may be other countries where electricity is more expensive, but the regulations around mining and crypto-coins are much lighter, such as Japan. There are also certain mining pools and even ICOs that are looking at their operations near green sources of renewable energy to try to lessen the expense and burden not only on the wallet but also on the environment.

Tags: #bitcoin #mining #eletricity #cryptocurrency #investment

Author: Coin Telegraph