Is It Over for The Stock Market? FIVE Factors in Play. By Gregory Mannarino

Is It Over for The Stock Market? FIVE Factors in Play.

By Gregory Mannarino TradersChoice.net

History may not repeat itself, but it sure does rhyme. And when it comes to the financial markets, cycles do more or less repeat.

There is a widely known and followed market trend called “The January Barometer.”

Historically, the January Barometer has proven to be an effective way to gauge how the S&P500 will perform for the entire year. Specifically, this barometer runs from January 1st through to the 31st. How the stock market performs between January 1st through the 31st generally sets the tone for the year. With that, and in my opinion, stock market performance can be further zeroed in by looking at the first full week of trading, which gets started during the second week of January. This year, it begins on Monday January 6th, 2025. (The first week of trading is interrupted by the stock market being closed on New Years Day).

This year the set up going into the first full week of trading is particularly interesting. Here is why… Lets call this factor one.

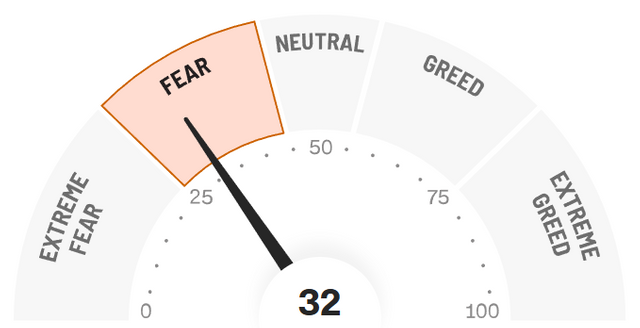

Below is a snapshot of the Fear and Greed index.

In a time as shown above, when the Fear and Greed Index is showing FEAR/EXTREME FEAR, this is generally a BUY signal. On the opposite end, when there is GREED/EXTREME GREED, it’s time to SELL.

Factor two.

The second factor in play is the continuing bad economic news. On Friday 1/3/25, according to their own numbers, the manufacturing sector remains in contraction. Immediately following the announcement of further contraction in the manufacturing sector, the three major stock market indexes all put on strong gains. (The reason behind that was the market believes that The Fed. Will act, further cutting rates making more “easy money” available for the market).

Factor three.

Below is a snapshot of the Mannarino Market Risk Indicator/MMRI. (The MMRI is available for free for everyone on TradersChoice.net).

(Admittedly, I am doing a bit of “tea leaf” reading here).

Generally, a Rising Wedge indicates the growing potential for a drop, in this case, a falling of the MMRI. A falling MMRI would indicate an upcoming rise in stock prices.

On December 24th, the Federal Reserve cut rates another 25basis points. With that, the longer end of the yield curve sold off, pushing the 10-year yield higher, precipitating a sharp sell-off in the stock market with the DOW falling over 1,100 points- and as of this article it has still not fully recovered.

Also on December 24th, and I made a public announcement on this, I closed ALL my positions in the stock market. My reasons were two-fold.

- On the back of the Fed. Announcement on monetary policy, the 10yr yield spiked rapidly, which pushed the MMRI to over 300

- During the prior 7.5 YEARS, I have been long the market, buying every single dip which came along, and I frankly needed a break. Moreover, IT IS NEVER WRONG to pull profits.

Factor four.

A show for the public is being set up… A fake “battle” between the Federal Reserve and Trump.

Trump is an outspoken advocate for low, and even negative rates. We know this first from his last Presidency when he called the Fed. “Boneheads” for not lowering rates to zero and even negative. More recently, during the campaign, he promised that if he was “elected” he would lower rates. (No president can lower rates. Presidents do not possess a printing press for dollars/central bank issued notes, nor can a President buy debt). With that, a President can work with a central bank to lower rates.

Here is the set up. The economic news will continue to be bad, and Trump is going to call on the Fed. To lower rates, (a campaign promise). The Fed. Will pretend to push-back saying, “we will lower rates as appropriate.” Of course the Fed. wants to lower rates! As every central bank does, as doing so allows them to inflate, which is the single goal of every central bank.

Factor five.

Tech giants like Facebook, and Amazon are donating MILLIONS of dollars to Trump for his inauguration. Other multimillion dollar donors to Trump for his inauguration includes the Wall St. Super Bank Goldman Sachs (among others), Bank of America and ATT. With that, as one of my top trends for 2025, we can expect massive and highly destructive currency devaluation, which is the direct result of artificially suppressed rates- HOWEVER! This is highly stock market positive.

On Friday, 1/3/25 I re-opened a single, SMALL, position in JEPQ. (JEPQ is an exchange traded fund/ETF which gives the investor exposure to the tech sector). I did this specifically understanding the current “factors” in play for the market. With that, I am FAR, FAR, AND I MEAN FAR! From being fully invested back into the stock market. (I bought just 350 shares of JEPQ). I am also prepared TO BE WRONG HERE. It is certainly possible that we are just in the early stages of a much worse sell-off in the stock market. Henceforth why I am only risking a relatively small amount of cash re-invested in JEPQ. Every move I make in the market, I publicly announce in my 100% free Substack newsletter AND in my 2X daily Market Reports on YouTube. I am an open book when it comes to this market.

IF The MMRI continues to spike, and I intend to watch this closely, I am fully prepared to close my new-small JEPQ position.

Moving forward, I am planning on adding to my current holdings of physical gold, and especially silver. I am also planning to add MORE to my cryptocurrency’s holdings. I will make public announcements on all this when I do take any of these actions, or others.

With all this, and in my opinion, next week should be very interesting!