Bitcoin's illiquidity is going to be a huge problem

Bitcoin is becoming increasingly liquid.

As more people buy bitcoin, the network becomes congested and transaction times get longer.

Transaction fees are getting higher, too.

This will be a real problem if the price crashes and everyone tries to get out at the same time.

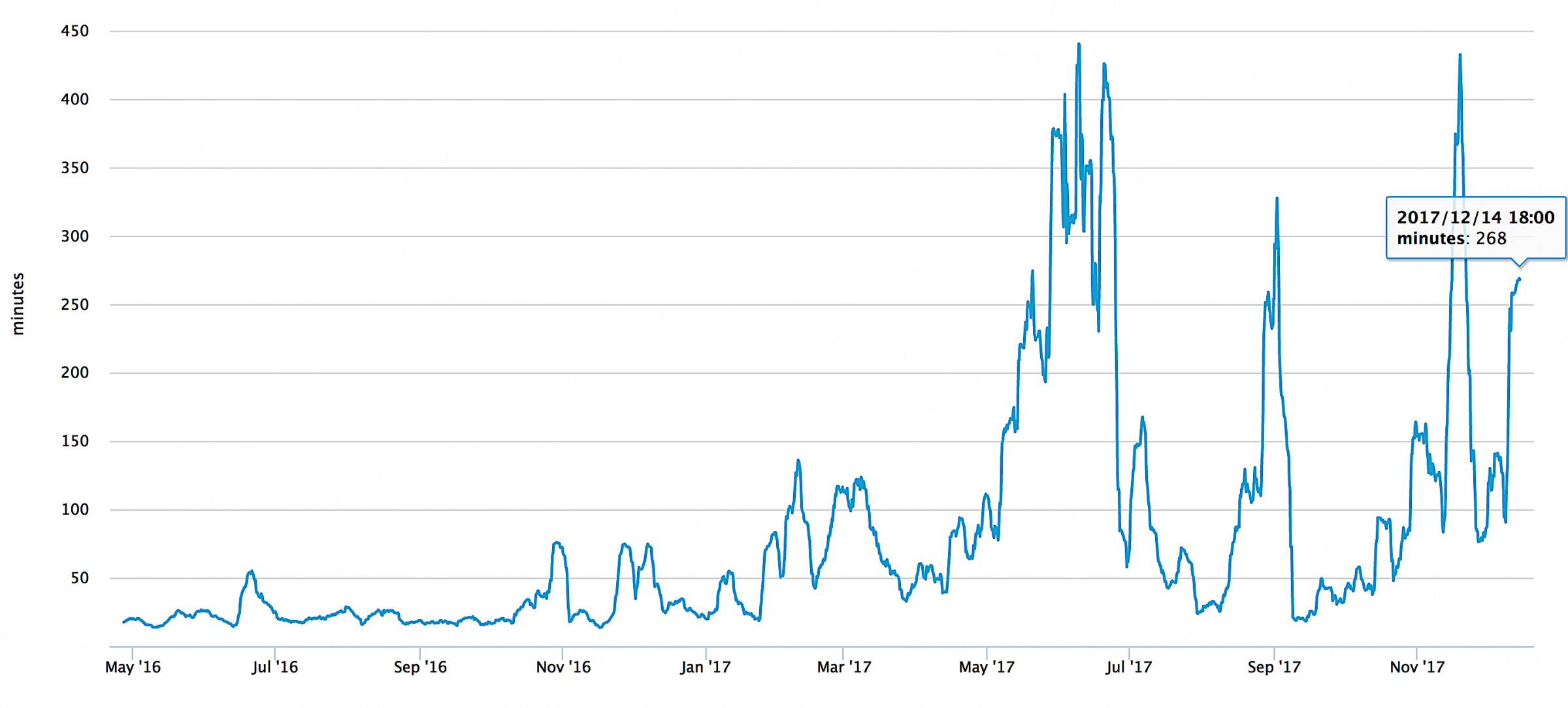

This chart shows a seven-day average of the total number of minutes it takes to confirm a bitcoin transaction, since May 2016.

Like the price of bitcoin itself, transaction time has been rising as the months go by. Right now, it takes four and a half hours to confirm a bitcoin trade, on average.

Blockchain Luxembourg SARL

If you are holding bitcoin and worried that the price – which cleared $17,000 last week — is a bubble, then bitcoin transaction times should really start to scare you.

The price of bitcoin is shifting up and down by hundreds or thousands of dollars each day. No one knows what the price will be one hour from now — but we know it will be very, very different.

And the schedule for the world's largest initial coin offering, the $500 million Dragon casino offering, has been pushed back two weeks.

"Due to the extreme congestion on both the Bitcoin and Ethereum Networks, ICO investors or contributors have faced significant challenges when transferring their Bitcoin and Ethereum to participate in the Dragon Pre-ICO," it said in a press release.

The transaction time is built into the system, as each transaction in general is confirmed by six bitcoin miners. There is a finite number of them, and the more transactions they have to confirm, the longer it takes as their network bandwidth fills.

Worse, they charge for transactions and prioritize transactions based on price. Those who pay more get processed first. (For more detail and nuance on this process, read this very useful Twitter thread from Michel Rauchs of the Cambridge Centre for Alternative Finance.)

Markets Insider

Imagine how bad this would get on a day some negative news hits the wires and the significant holders of bitcoin decide "I've had enough of this, I've made my money, I am bailing." The majority of bitcoins are held by a tiny percentage of the market — 40% by 1,000 people. Those few holders could crash the market whenever they wanted.

As anyone who remembers the market crashes of 2000 and 2008 knows, these things happen fast. Billions get wiped from the market in minutes. People who need to cash out now but are an hour or so behind the news can lose their shirts.

It is brutal.

And blockchain, the technology underpinning bitcoin, just isn't equipped to deal with it.

Part of the increase in transaction time has no doubt been caused by the recent arrival of new, less knowledgeable investors coming into the market only because they have seen the headlines about the price of bitcoin going up, up, up.

That gives us an idea of just how congested it is likely to be on the way down.

It would also be expensive. By some counts, transaction fees are doubling every three months. Ars Technica reported that fees recently reached $26 a trade.

Those fees would compound the losses of people trying to sell in a crash.

By comparison, stockbrokers and banks transact trades in less than a second, usually for less than $10.

To get an idea of how comically difficult it is to get out of bitcoin, read this chain of tweets from a Google engineer whose screen name is @TedOnPrivacy.

"I had to send pictures of my driving license and passport to some random website, which for all I know could be about as trustworthy as MtGox," he wrote. "I had enough time to eat lunch while waiting for the transaction to confirm, though, so this was nice, I had roasted avocado with an egg."

It took him days.

"Is it really money if you can't use it nor convert it to anything else," he lamented.

Bitcoin is on it's way to being dethroned, and all the better. Horribly slow transaction times, high transaction fees, and the inability for the Average Joe to mine make Bitcoin unsuitable as the king of cryptocurrency.

SteemIt, Zcash, and Ethereum, along with many lesser known cryptos, are superior to Bitcoin. Looking at the market cap as a whole, the price of Bitcoin has went down, but the market cap hasn't. People are wising up and flushing their investments into coins that have a brighter future.

yes you are right