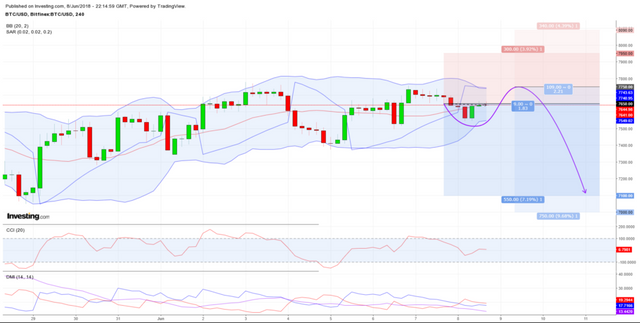

[BITCOIN DAILY ANALYTICS] 09 JUN — Bitcoin seeks for down targets.

In the last analysis a downward target was formed: based on 4H/5H MAs, it was expected to have a decline to SMA/EMA50 ~ 7530–7580. After this bitcoin rebounded up from the support at 5H SMA50, and immediately slowed the further growth at 5H SMA100.

Lets analyze further possible movements:

1)Based on TIs, we can distinguish the following:

At the 4H TF, we have a number of potential downstream projections: CCI=2 (negative trend), ROC=0 (negative trend), MACD=15 (MACD < signal line, DMI=13 (+DI < -DI), %R=-43. At the 5H TF, there are no significant differences from the 4H TF.

At the daily TF, TIs are giving down-signals: CCI=0 (negative trend), ROC=-7 (negative trend), MACD=-200 (MACD seeks down to signal line), DMI=30 (+DI < -DI), %R=-18.

In general, TIs point to a significant transition to L/BB ~ 7450.

- Based on SMA/EMA, we can distinguish the following:

At the 4H/5H and daily TF: EMA6, 9, 12, 26, 50 are concentrated around 7600–7650, with small positive projections.

In general, MAs indicates a possible increase to 5H U/BB and 5H EMA100 ~ 7740–7780, though with further rejection.

Finally, if bitcoin would fix above 4H EMA100 ~ 7680, then we can expect growth to 5H EMA100 ~ 7740–7780. Nevertheless, if such growth takes place, I would recommend further increasing of short positions, while increasing SL (including the first short entries) to the level of “entry + daily ATR” ~ 8050–8090.

The targets for a potential downward swing trade are still the same, at daily L/BB ~ 7000–7100.

Take care of your BTC and USD!

Head Analyst,

David Goldberg

Our links:

Site: https://matador.fund/

Twitter: https://twitter.com/matador_fund

Steemit: https://steemit.com/@matadorfund

Telegram: https://t.me//matadorfund

Best Regards,

MATADOR FUND Team

#cryptocurrencies #blockchain #cryptofund #investments #profit #fund

Go here https://steemit.com/@a-a-a to get your post resteemed to over 72,000 followers.