Scarce & Non-Sovereign – Bitcoin Narrative Update

As we’ve seen the price of Bitcoin rebound healthily over the last few weeks, a lot of bulls are coming out of the woodwork. CryptoTwitter, newsletters, podcasts, and even the recent SF Bitcoin Conference are all touting mega bullish scenarios for the digital asset.

While I have made my stance on Bitcoin and digital assets clear (1, 2, 3, 4 ) it is very interesting to see the narrative develop as it has in such a short amount of time. Crypto winter was full of people acknowledging the fact that the market would likely decline further or trade sideways for an extended period.

Now that the price has quadrupled from its bottom earlier this year, all this commentary seems to have been tossed to the waste bin. The community is back to debating whether store of value or payment is the real use case for Bitcoin. What is missed in this debate is the fact that they are both one in the same.

The overly used term "network affect" attests to the fact that no matter why people are using Bitcoin and crypto-assets, the only thing that matters is that people are in fact using them.

As a store of value, payment system, capital controls escape vehicle, fiat debasement escape vehicle, uncorrelated portfolio asset, etc. the specific use case is less important than the reality that people find its value proposition attractive, and they are freely engaging with it in a way that best suits them.

That said, much of the recent price action ought to be attributed to two primary events:

1 - Bitcoin supply halvening; reward supply being cut in half within the year

2 - Hong Kong and what it means for China and the CCP

With endless potential catalysts on offer to analyze, I find these two events best highlight the true value proposition of Bitcoin.

Halvening of BTC Supply

Many people still ignorantly claim that privacy is what makes Bitcoin valuable. This is not the case.

Bitcoin is valuable because it is scarce. Only 21M in total supply, written into code. (Code ≠ Law)

At the same time, from a private property standpoint — what can commonly be misconstrued as privacy — Bitcoin does offer incredible upside.

This is why the supply halvening is such a large catalyst: it highlights Bitcoin’s value proposition of being a truly scarce commodity/asset/measuring stick and it allows one to own private property with incredibly antifragile properties.

These antifragile properties are recognizable in the fact that Bitcoin cannot easily be confiscated, it is very transportable, and one acts as his/her own custodian without having to trust any third parties, which are always subject to security breaches.

Imagine an impending natural disaster on its way to your doorstep. Do you grab your heavy-ass bar of gold and throw it into your pocket? Or, do you slip your Trezor wallet into your pocket along with some silver coins, potable water and food for good measure?

This lineof thinking, in tandem with an asset that is going to experience a 50% supply cut within the next year, presents us with a textbook asymmetrical investment opportunity that is increasingly being priced into the market.

China's PR Nightmare

As I have previously stated , this bull market in crypto still has substantial legs to run so long as Chinese capital remains in play.

This thesis received a shot in the arm over the last few weeks when taking into account the developments currently transpiring in Hong Kong.

Of course, this does not even take into account the likelihood that the Chinese will have to devalue the yuan in order to keep their economy alive amidst tariff threats and imbalanced import/exports in commodities, resources, and food.

When taken in unison, the CCP co-opting democratic Hong Kong while tending to international trade and currency wars foreshadow very large, structural trends taking place in what is the world’s second largest economy, and the world’s number one engine of growth over the last several decades.

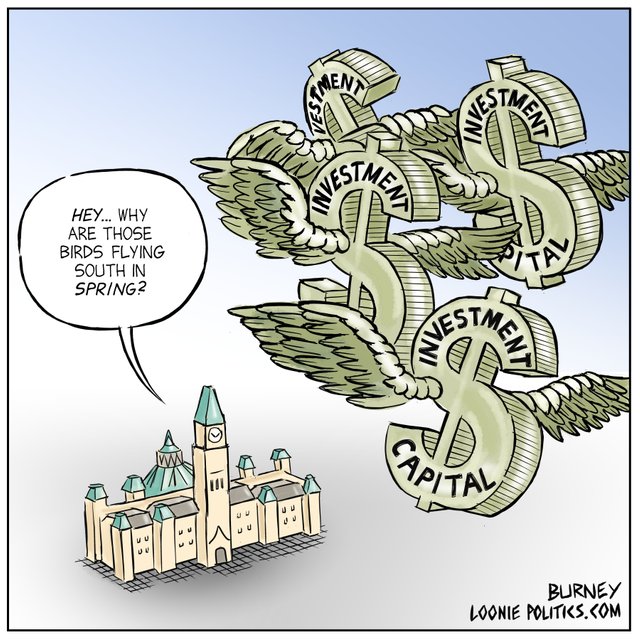

Now that the Chinese miracle growth narrative is showing physical cracks in its foundation, it seems reasonable to assume some proportion of money outflows from Hong Kong ended up in Bitcoin and crypto-assets. After all, if you are a person living in Hong Kong and you sense capital controls being instituted soon after extradition controls, why wouldn’t you protect some portion of your capital in an easy-to-transfer digital asset that is becoming recognized globally?

Especially after witnessing what happened to the elite of Saudi Arabia who had their fortunes confiscated overnight by MBS.

Speaking towards the currency wars, in this month alone we’ve seen the ECB and the Fed indicate that they will fire up the printing presses and lower interest rates once again.

More importantly, the Chinese will have to respond to this fiat currency debasement battle by materially debasing their own yuan. Of course, they will paste over this move as a response to the political trade war being waged by the Trump administration; however, I think we adults can all agree that China is more interested in keeping their economy alive, their citizens employed, and above all else, keeping the masses well-fed than it is in winning political battles.

At least, this is the consensus amongst Chinese citizens.

As a communist political group, Chinese politicians are more concerned with staying in power than they are in taking on the United States directly. They’ve painted themselves into an interesting situation by dispelling domestic commentary on how the US is the antagonist, the bully. Any concessions made to the US make the CCP appear weak or as appeasers to the US — unacceptable to the CCP who is predicated entirely upon power, force, control, and promotes themselves as the social glue that keeps China together and, once again for repetition, well-fed.

Combining this contradictory dynamic with the one of Hong Kong, and you’ve generated a major interest in alternative currencies, alternative remittance rails, alternative payment forms, and more broadly, non-sovereign, non-seizable, non-fiat currencies that can help mitigate capital control concerns.

Conclusion

While the major capital flows will predictably find their way into the USD and US Treasuries during times of duress, I have also expressed my thesis on why the USD and Treasuries will not soak up all of this capital in flux during the next major market panic.

Bitcoin, gold, commodities, and these alternative asset classes that are not correlated to real estate, bonds, stocks, fiat currencies, and conventional wealth storage mechanisms stand to catch a substantial amount of inflows as capital inevitably shuffles itself due to any number of reasons, increased uncertainty and volatility being amongst the most commonly cited.

The fact that Bitcoin is a scarce, non-sovereign asset will make it very appealing to those who are looking to preserve the purchasing power of their capital in this type of environment. Pairing this unique flavor of appeal with a substantial 50% supply cut creates for a situation that only comes along ever so often.

"In Hong Kong, the protestors have regularly managed to get a million people out in the streets, a figure that has swelled to two million on several occasions. They aren’t just young people. They are families. Retirees. Bankers. Lots of people who normally never protest. I’ve not seen anything like this since the broad-spectrum Iranian protests that dislodged the Shah back in 1979. It is a huge proportion of Hong Kong’s total population (less than 7.5 million). — Peter Zeihan

DISCLAIMER : This content is for informational, educational and research purposes only. This post is not to be taken as personalized investment advice.