I Learned a Few Things About Crypto Taxation & Security Tokens

Last week, I attended the bitFlyer Europe meetup which hosted an event on Crypto regulation. The speakers of the session were two regulatory experts from the LetzBlock association, a Luxembourg-based lobbying group for promoting cryptocurrency and blockchain.

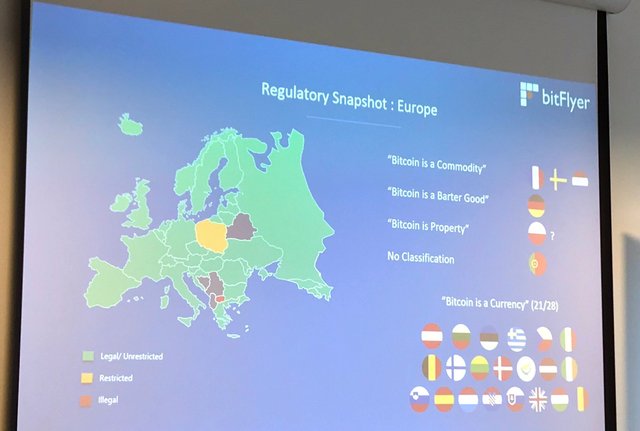

The evening started with bitFlyer analyst Kian giving an overview of the fiscal landscape by region, classifying each country’s stance on bitcoin by whether it’s legal, restricted or illegal. To my surprise, while North America and Europe are mostly bitcoin friendly, the same can’t be said for several Asian countries, where cryptocurrencies are still restricted or even considered illegal.

Kian went on by showing the progress that has been made in defining a regulatory framework at both the EU and National level, with countries such as Luxembourg, Gibraltar and Malta being at the forefront in Europe. Luxembourg was the first country to issue a payment institution license within the EU to bitFlyer and Bitstamp, Gibraltar recently launched the Gibraltar Blockchain Exchange (GBX), while Malta approved a Bill providing a framework for cryptocurrencies and ICOs.

Crypto Taxation

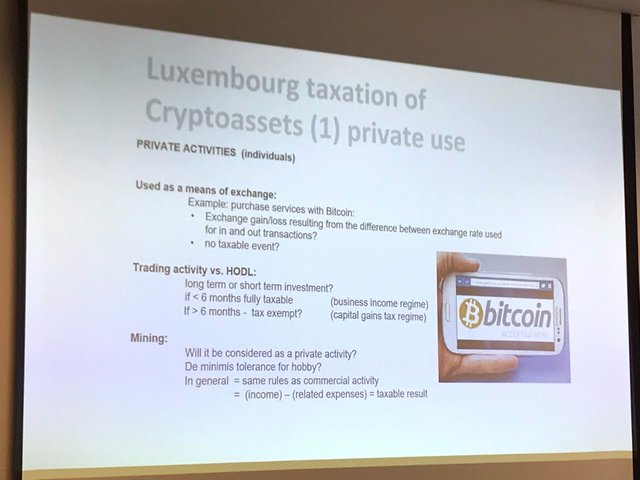

Next came a presentation by tax advisor Audrey Baverel of Happen Consult, who brought up the recent Circular published on 26th July by the CSSF, the country’s financial supervisory authority.

To give some context, while the CSSF had stated in 2014 that it considered digital currencies including Bitcoin as money, it coincidentally removed that statement back in February 2018, the same month that ECB board member Yves Mersch (also from Luxembourg) backed the Bank of International Settlement’s condemnation of cryptocurrencies.

With the new circular, the national authority now reminded people that cryptos do not constitute an actual currency, because they cannot be considered as a legal tender.

Virtual currencies are now to be treated as “intangible asset” for accounting and tax purposes. However, when it comes to real life scenarios, the picture still isn’t very clear. Whether a token should be qualified as debt, equity or another type of security, and whether a token issuance is subject to income tax upon payment or usage is yet to be clearly defined.

You won’t be surprised to know that the presentation was followed by a long Q&A session where attendees (including myself) asked questions on how their personal situation would fit in this regulatory mosaic!

To summarise, these are the most important things I took away for an individual owning cryptos.

Lesson 1

Always keep transaction records for reporting your crypto gains and losses! If you’re using exchanges, you can either take a screenshot of your trade history or download it as a .csv or excel file. If you’re using a wallet, you can find that information either in the wallet itself or the Bitcoin Explorer online. The same applies to other cryptos.

Lesson 2

Unless your country’s tax authorities have explicitly stated that cryptos are not taxed, you should always assume that they are or may be subject to taxation and hence follow lesson 1, keep a record of all your transactions!

Lesson 3

This will vary by country depending on how they classify cryptos, but in Luxembourg, crypto-to-crypto transactions are also a taxable event, same as crypto-to-fiat. Additionally, transactions are perceived as speculative if they are HODLed for less than 6 months. Always keep this in mind when exchanging cryptos.

Security Token Offerings

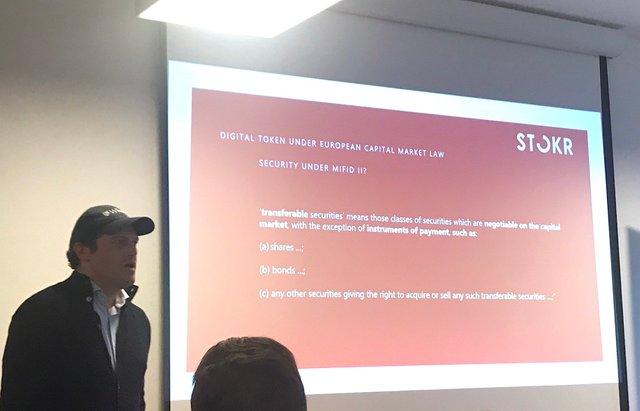

The second presentation was given by STOKR and SICOS co-founder Tobias Seidl. STOKR is a crowd investment platform allowing SMEs to raise funds from retail investors by issuing tokens via Security Token Offerings (STO). Once the platform launches, investors will be given profit participating tokens when investing in these companies.

Tobias explained how under MiFID II rules, “transferable securities” means those classes of securities which are negotiable on the capital market, with the exception of instruments of payment, such as:

- Shares

- Bonds

- Any other securities given the right to acquire or sell any such transferable securities

In essence, a security needs to meet the following criteria:

- Transferable

- Negotiable on a Capital Market

- No Payment Instrument

- Equivalent to Shares or Debt Instruments

Based on this information, many of the existing tokens would be considered utilities in Europe as they often act as a means of payment and do not constitute ownership of the company, unlike shares. However, this does not necessarily apply to the US where many such utility tokens would actually be considered securities.

Fun fact, in Germany tokens are actually considered a financial instrument, so exchanges would need a proper license and the ICO would need to follow same set of rules as other financial instruments, including AML and KYC regulations, hence why you don’t see many German exchanges on the market (maybe not so fun after all…).

As the crypto market becomes increasingly regulated, security tokens will become more common and this will allow institutional investors to enter the market. Even retail investors have an incentive for participating in STOs - as the company grows and becomes profitable, they receive a share of those profits, which are transferrable in nature.

Conclusion

As you can see, the regulatory environment around cryptocurrency is still opaque and it will only become clearer as authorities, exchanges and token issuers start woking together in a more collaborative way. STOKR is one such soon-to-be regulated project that will facilitate new money into this emerging space.

This is going to take time but it will ultimately provide a clear framework to remove the current uncertainty and for these types of projects to really flourish.

@mforsingdal Pretty good.

Hallelujah!