The Valuation Of BTC, LTC And BCH Based On Transactions - Remarkable Outcome!

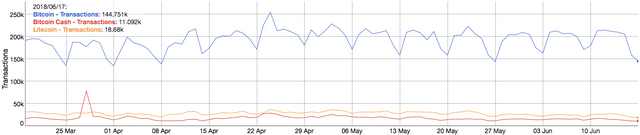

Since the beginning of Bitcoin there is a correlation between price and transaction volume. When more transactions are made it signals that the network is more intensively used and thus valued higher. In this article I want to compare the amount of transactions of the 3 biggest cryptocurrencies that are ment to be a peer to peer payment system and see how this matches with the value of the network. Doing this we can visualise whether a cryptocurrency is overvalued or undervalued as a payment system.

What is the most undervalued cryptocurrency if we look at the transactions?

Dollar valuation of the network per transaction

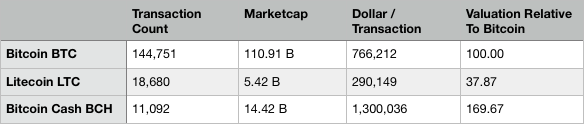

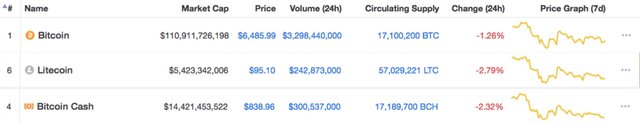

In the table below you can see at how many dollars every cryptocurrency is valued by the market per transaction per day. Of course this is only a PART of the valuation because many other factors will play a role. However, it indicates the real use of the network and can beside other metrics be very useful.

Sources:

Transaction value

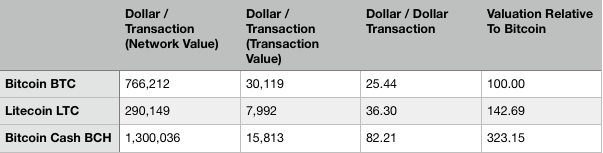

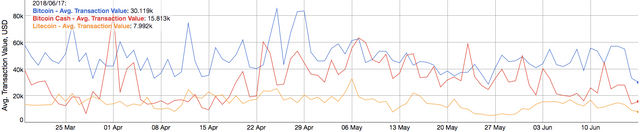

To make transactions the user is required to hold some of the cryptocurrency. When bigger amounts are send bigger amounts will be held too and thus will increase the demand and value. To make this valuation more relevant the transaction value have to be considered.

As you can see: LTC is valued 1.42 times higher per dollar send per day and BCH even 3.23 times.

Sources:

Other considerations for a fair valuation

Bitcoin is most undervalued when we only consider the network value divided by the amount of dollars send on the network per day. This only means that Bitcoin would be most undervalued one when ALL the other factors would be the same every investigated cryptocurrency. Of course this is not the case. Here the most important factors:

Network effect

When you own a cryptocurrency it will become more useful if many others own it too because there will be more peers to transact with. Network effect is a huge advantage for BTC. LTC and BCH are far behind on a shared 2nd place. This will add enormously to the value of BTC.

Infrastructure

BTC is around for ten years already and an infrastructure is build around it to make it more useful and accessible. Litecoin was one of the first alt coins and has build a proper infrastructure too. BCH has stolen a part of the BTC infrastructure when they split off. The BTC infrastructure is clearly the biggest and most advanced complete with a satellite service and the crypto reserve function on the exchanges followed by BCH because a few important websites are backing it and it gets support from companies like Bitpay. LTC is here the loser.

Development team

Bitcoin has a big development team and this team is also the most talented one. 95% of the real innovation comes from this team and the other teams mostly copy it. BTC is here by far the nr. 1 and LTC is 2nd. The BCH team is the big loser here because it is small and the quality is terrible. Upgrades are badly written and poorly tested.

Offchain transactions

The entire valuation above was purely focussed on onchain transactions, but 2nd layer like Lightning are a source of transactions too. Lightning Bitcoin is by far most popular and has the most transactions, but LTC is joining the game too on a lower level. BCH doesn’t transact off chain at all.

BTC can be used in other forms of offchain transactions too: RSK is doing ETH like smart contracts, Liquid does settlement for businesses and even physical cash can change hands in the form of Bitcoin by using banknotes or Opendime. Also here is BTC far ahead and thus most valuable and BCH the big loser.

Security

Security is the foundation of a blockchain and adds hugely to the value. BTC is by far the most secure network because it has the biggest amount of computing power behind it and is the majority chain of the PoW algorithm that it is using. LTC is 2nd, although their chain isn’t the one with the most PoW behind it, it is the leader in its own PoW algorithm. BCH is by far the least secure chain since the same algorithm is used for BTC while they only have 10% of the total hash rate. This makes it extremely vulnerable for an 51% attack or double spends.

Store of value proposition

Bitcoin is seen as the best store of value among all the cryptocurrencies because it has the longest track record, is extremely secure and decentralised and very hard to change. The store of value proposition will add HUGELY to the value, because people who make transactions hold usually only small amounts in their wallet while HODLers are often holding a lot. This means that in order to add value for one store of value user you will need many medium of exchange users. Bitcoin is the king as a store of value and BCH is the worse seen all the risks and the regular appearance of hardforks.

Conclusion:

Only purely valued as a medium of exchange BTC is the clear winner and most undervalued. LTC comes quite close after that on a second place, but BCH is very overvalued and the big loser. Add to that the other fundamentals and the differences in valuation will become even bigger. In my opinion based on this information LTC is around 100% overvalued compare to BTC and BCH even 5 to 10 times.

I consider BTC as a strong buy, LTC as a HODL and BCH a strong sell. Manipulation and misinformation are probably the reason that the fundamental value and the market price of BCH are so extremely diverged. When you buy BTC you buy the revolution and when you buy BCH you buy hype and air!

Long story short: BTC is the most useful cryptocurrency and used the most and BCH is a hyped alt coin that is hardly used while it is NOT reflected in the price.

Disclaimer

This is no financial advice, just my view on the market.

Never stress in a bear market anymore: Follow my diversification protocol

Store your Bitcoins securely

Ledger hardware wallet

Trezor hardware wallet

Trade Cryptocurrencies

Binance Exchange

Buy Bitcoins anonymous with cash

Localbitcoins

Protect your privacy with VPN and pay with crypto

Torguard

Buy gold securely with Bitcoin and store in Singapore

Bullionstar

Like this post? RESTEEM AND UPVOTE!

Something to add? LEAVE A COMMENT!

I would really like to see the comparison with NANO. I think is the future!

You have recieved a free upvote from minnowpond, Send 0.1 -> 2 SBD with your post url as the memo to recieve an upvote from up to 100 accounts!

You got a 15.85% upvote from @postpromoter courtesy of @michiel!

Want to promote your posts too? Check out the Steem Bot Tracker website for more info. If you would like to support the development of @postpromoter and the bot tracker please vote for @yabapmatt for witness!

The future of Bitcoin and Crypto is still so bright. Right now that the steem is quite cheap, it's time to buy more so that if the day comes that the price goes up, you'll have a good smile :)

Remember when bitcoin was about a dollar ?

I don't

Very Clear Information about the comparison between BTC, LTC& BCH and their Transaction value, Network effect, Infrastructure, Development team, Offchain transactions, Security, Store of value proposition, and also understood about that we need to buy BTC hold LTC and sell BCH.

Thanks for this information it really helped me

This post at least illustrates that BCH seems overvaluated.

What are your thoughts on ETH? I if my back-on-the-envelope calculation is correct it is actually valued fairer with a market cap of 48.9 B and 648548 transactions.

Coins mentioned in post:

I'd say BCH is growing. It is definitely the last place of these 3 but they are focusing on growth in Asia. That may help them grow all of a suddwn if truly adopted.

Didn''t bitcoin cash just came out in 2017 orff August whilst bitcoin came out in 2009?

If you talking to Roger Ver- Bitcoin cash is bitcoin. If you check his site Bitcoin cash is written like this: Bitcoin(BCH)