Bitcoin, Ethereum, Bitcoin Money, Swell, Stellar, Litecoin, NEM, Cardano: Cost Analysis 29 january 2018

Historically, January has dependably been a frail month for Bitcoin and 2018 is no special case. Some trust this is because of Chinese speculators changing over their Bitcoins to fiat cash with a specific end goal to purchase endowments and presents to praise the Chinese Lunar New Year, which falls in February. All things considered, the Chinese market is one of the significant players in the crypto world.

Historically, January has dependably been a frail month for Bitcoin and 2018 is no special case. Some trust this is because of Chinese speculators changing over their Bitcoins to fiat cash with a specific end goal to purchase endowments and presents to praise the Chinese Lunar New Year, which falls in February. All things considered, the Chinese market is one of the significant players in the crypto world.

In any case, a similar conduct does not remain constant for stocks, in light of the fact that the Hong Kong and Chinese markets have been among the best entertainers. The value markets are outflanking the crypto markets, in any event in the main month of the year.

With just two or three days all the more left in January, it stays to be checked whether the fortunes of the extensive cryptographic forms of money take a hand over February.

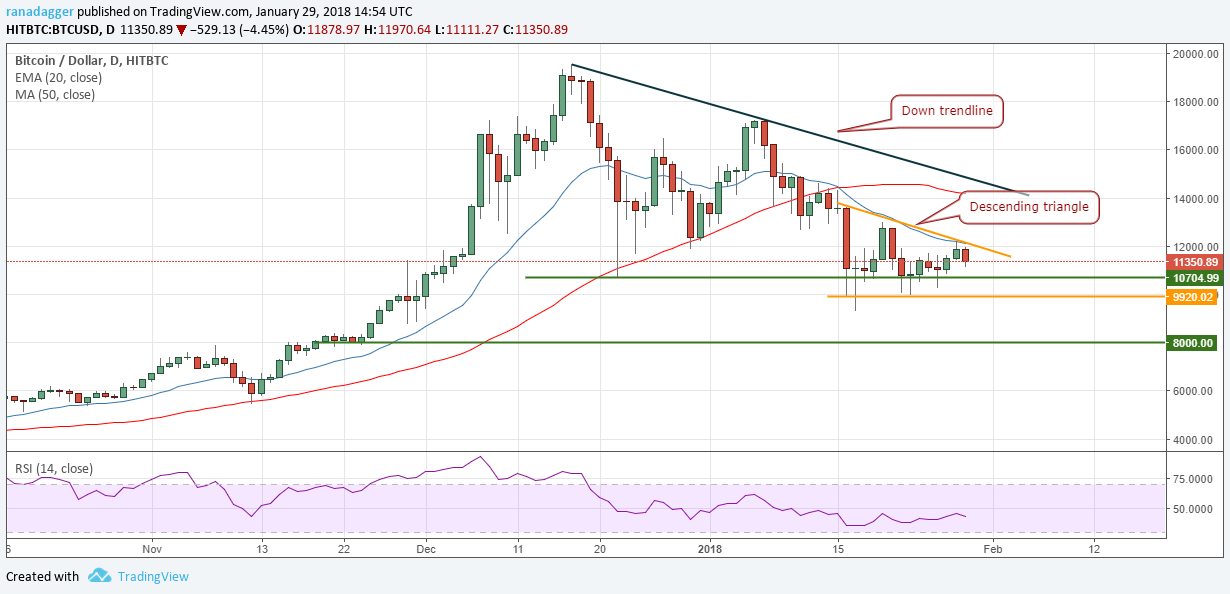

BTC/USD

Bitcoin diverted down from the 20-day EMA on January 28. We had recommended a long position on a nearby above $12,200, which did not trigger. For the time being, we locate another dropping triangle design as appeared in the graph. The example will finish on a breakdown and close beneath $9,920 levels.

For the time being, we locate another dropping triangle design as appeared in the graph. The example will finish on a breakdown and close beneath $9,920 levels.

Underneath this level, we are probably going to see additionally offering weight by the bears and some long liquidation from the forceful bulls who have collected near the $10,000 to $12,000 levels expecting a shoot up.

Frenzy offering can drag the BTC/USD match to $8,000 and possibly significantly additionally down to $6,000 levels. These lower levels look frightening, however please note, we are not attempting to ingrain fear among dealers. We are simply giving the conceivable lower levels creating as indicated by the graph designs.

It is imperative to remember that if Bitcoin breaks out of the $12,000 levels, it will refute a bearish example; and that is a bullish sign.

Consequently, our proposal is a conceivable long position at $12250, with a stop loss of $9,900 and an objective target of $14,000. Inside the scope of $9,900 and $12,200, we don't discover any purchase setups.

ETH/USD

We are holding long positions in Ethereum from $1,000 levels. We had suggested booking fractional benefits at $1,170 levels, in our past investigation

Thanks for the analysis. If this year will be anything like the last ones, we are good to go now... ;)