Markets Update: Bitcoin’s Value Climbs After Cboe Opens XBT Trading

Bitcoin’s value has been climbing since the recent opening of Cboe’s futures markets. The spot price of BTC had dipped a good 3 percent an hour prior to Cboe’s Sunday evening trading sessions, but volume immediately spiked at precisely 6 pm ET when the futures trading opened. At the moment bitcoin is hovering around the $15,700-15,950 range on Bitstamp, and Cboe’s bitcoin futures markets have been going wild.

Bitcoin’s Price Kicked Into High Gear At the Start of Cboe’s Opening Trading Sessions

Lately, bitcoin markets have been an astonishing observation as the price has been moving at warp speed towards record highs for over a week. Many people believe that Cboe and CME Group’s bitcoin-based futures products have been injecting markets with optimism. The price slumped this past weekend after coming awfully close to the $17K territory reaching a low of $13,000. However, on December 10 bitcoin’s value kicked into high gear during the morning trading sessions reaching $15,300. Following this, the price had rapid swings ranging from $500-900 and markets were down just before Cboe opened its futures markets.

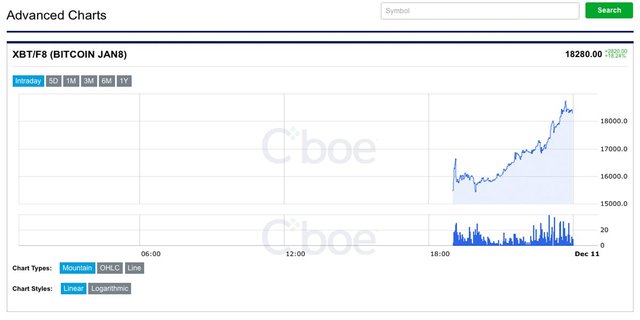

Cboe’s January Contracts Reach a High of $18,280

Cboe’s market contract bids started at $15,000, and they expire on January 8. At press time the firm’s bitcoin futures have surged over 15 percent reaching a high of $18,300. So far a few thousand contracts have been traded on Cboe’s derivatives exchange. Further according to the Wall Street Journal a spokeswoman from Cboe said trading stopped for 2 minutes due to volatile price swings. If the price moves during a massive swing, the exchange can impose a halt on trading. Additionally, Cboe’s website and XBT futures charts suffered from severe traffic, and the site was unavailable for a period of time. Cboe’s website states;

Due to heavy traffic on our website, visitors to www.cboe.com may find that it is performing slower than usual and may at times be temporarily unavailable.

Bitcoin Markets See Massive Volume and High Energy

Bitcoin’s global trade volume is through the roof, averaging over $14.6Bn worth of BTC swaps in the last 24-hours. The Japanese yen is still leading the market share by 42 percent, but the U.S. dollar has picked up by 29 percent. The volume, by currency, behind the dollar is the won, tether (USDT) and the euro, according to Crypto Compare statistics. Right now Bithumb is dominating the top five exchanges followed by Bitfinex, GDAX, Bitflyer, and Coinone.

Technical Indicators

Charts show a fairly bullish trend forming after the previous dips during the afternoon and into the early evening. The two short and long-term Simple Moving Averages (SMA) had crossed earlier in the day which indicated signs of buyer exhaustion. At the moment the long term 200 SMA is above the 100 SMA, indicating another correction could be in the cards at any time. Stochastic and the Relative Strength Index (RSI) have been showing oversold conditions for quite some time. Even so, bitcoin’s price could easily reach the $17,000 range or more this week after Cboe’s first day and before CME Group’s introduction. There is heavy resistance above the $17K range and even more so above $17,600 region. Order books show thin foundations on the buy side, showing prices could slide back quite easily with very little breaks until $14,000 again.

The Verdict

Overall the bitcoiners are still optimistic about the spot market value as many believe the mainstream enthusiasm is good for bitcoin. For the moment trading arena participants agree as the price is reflecting a favorable upswing that seems to also reflect Cboe’s contract predictions.

Bear Scenario: As stated above, order books show fragile buy walls in the backdrop, indicating prices could slip backward easily. Prices could dip back in the $15,300 to $14,800 regions if market optimism became reasonably negative. For now, the only bears making off will be intra-range players and day traders for the time being.

Bull Scenario: Bitcoin could easily break $17-20K in the short term due to market optimism, speculation, and bull market emotion. Markets have been bullish for weeks on end, and the quick dips have been eaten up quite quickly. Bulls should expect resistance around $16,500, $17,000, $17,600, for short-term strategies.

Where do you see the price of bitcoin heading from here? Let us know in the comments below.

Disclaimer: Bitcoin price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Cboe, Twitter, and Bitstamp.