Daimler's €100 Million Ethereum Bond Is Bigger Than Mercedes-Benz

When the manufacturing company behind Mercedes-Benz issued its first blockchain bond last month, it did something that impacts much more than just a single automobile brand.

When the manufacturing company behind Mercedes-Benz issued its first blockchain bond last month, it did something that impacts much more than just a single automobile brand.

As revealed to CoinDesk, the €100m bond, issued on a private version of the ethereum blockchain signals the first step in a much larger plan by Daimler AG to explore the technology. But it's the type of bond – called a Schuldschein – that gives the project a truly global scale.

Since the financial crisis of 2008, this German version of a private placement has seen an explosion of use around the world, now totaling more than €20bn annually.

But while Daimler itself says large-scale use of an ethereum-based Schuldschein isn't likely anytime in the near future, its success is already encouraging the German firm to test even more use cases.

According to Daimler AG's senior manager of treasury process management, Eva-Marie Scholz, multiple business departments in the firm are now exploring use cases as a result.

More specifically, the Schuldschein is a way for corporations to borrow money from a small group of private investors with only minimal disclosure and regulatory requirements, typically for between 3–10 years and in amounts as high as €500m.

For Daimler’s first blockchain-based bond, which was designed to simplify the lending process, the automaker partnered with Landesbank Baden-Württemberg (LBBW) to sell a relatively short-term one-year bond to savings banks Esslingen-Nürtingen, Ludwigsburg and Ostalb.

But for a firm that generated €153bn in revenue last year, the bond signals just a drop in the bucket of the total number of Schuldscheins sold in a typical year.

"Daimler issues around 50 to 70 bonds annually," said Orhan Oezcelik from Daimler's capital markets division. "While we don't expect blockchain to impact the total volume of issuances, the technology could allow a greater number of transactions which would then be smaller in size."

Streamlined Schuldscheins

While Scholz said the single test wasn't enough to determine the efficiencies gained from ethereum-based bond issuance, there's plenty room for improvement on the standard process.

In March 2016, German bank NORD/LB co-published a fixed income research report along with Bloomberg-Kurzel laying out the legal framework and spreads for a Schuldschein bond.

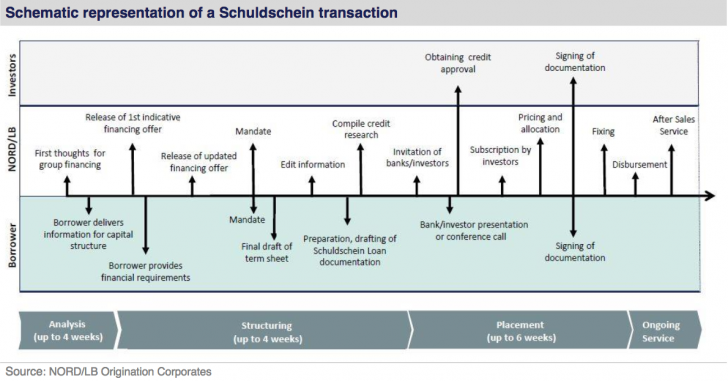

In spite of being widely considered a streamlined version of borrowing, a typical Schuldschein transaction still requires 20 pages of documentation and takes as long as 14 weeks to close, not counting ongoing administrative services.

Schuldschein schematic

In spite of the already simplified regulatory requirements typically associated with the bond, using a shared, distributed ledger has the potential to even further streamline the process, while also decreasing what credit rating agency Moody's last year described as an "increased risk for investors" resulting from lack of transparency.

To give an idea of what's at stake should blockchain-based Schuldscheines become the norm, between 2014 and 2015, the issuance of the bonds increased by 67 percent to €20.2bn, according to a BNP Paribas report.

And Moody's has predicted a record level of issuances this year.

Beyond bonds

With the World Bank also getting into the issuance of bonds on a blockchain earlier this year, the asset class is ripe for disruption. But Daimler's work doesn't stop there.

Currently, there are several business departments looking at use cases, including in sales, engineering, securities trade, the cross-border shipment of goods and – perhaps most promising – the payment of transactions.

While the actual blockchain solutions that might eventually be employed have yet to be settled – several of Hyperledger's open-source solutions are still on the table – the next step forward is a bit more certain.

Congratulations @mohameddz! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @mohameddz! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP